Market Definition

The market encompasses the development, production, and deployment of autonomous and remotely operated vessels designed to operate on the water's surface. These vehicles are engineered through advanced marine robotics, integrated sensors, and sophisticated navigation systems for a wide range of mission capabilities.

USVs are widely adopted by naval forces, coast guards, research institutions, and offshore industries, as they offer reliable, cost-effective solutions for complex and repetitive maritime tasks.

This report outlines the primary drivers of market growth, along with an in-depth analysis of emerging trends and evolving regulatory frameworks shaping the global USV market.

Unmanned Surface Vehicle Market Overview

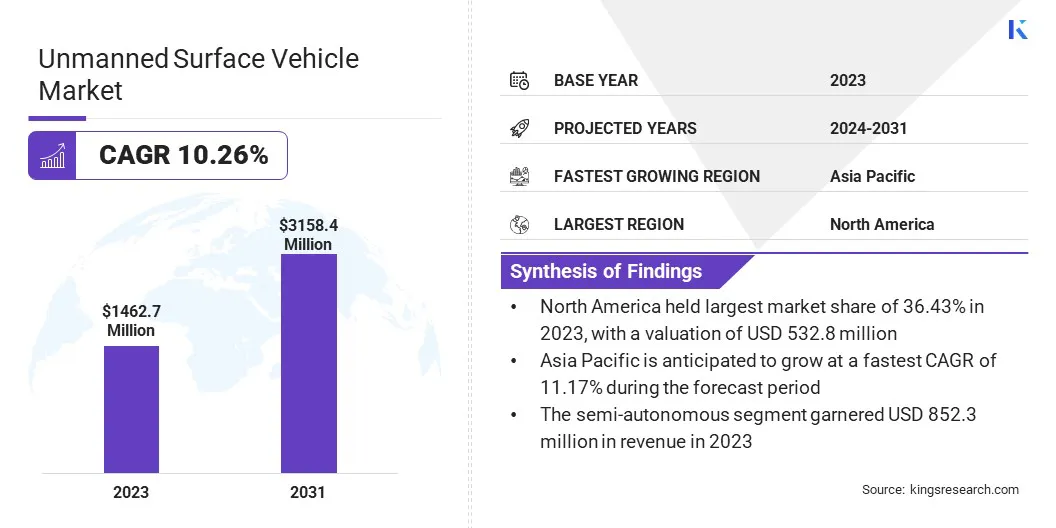

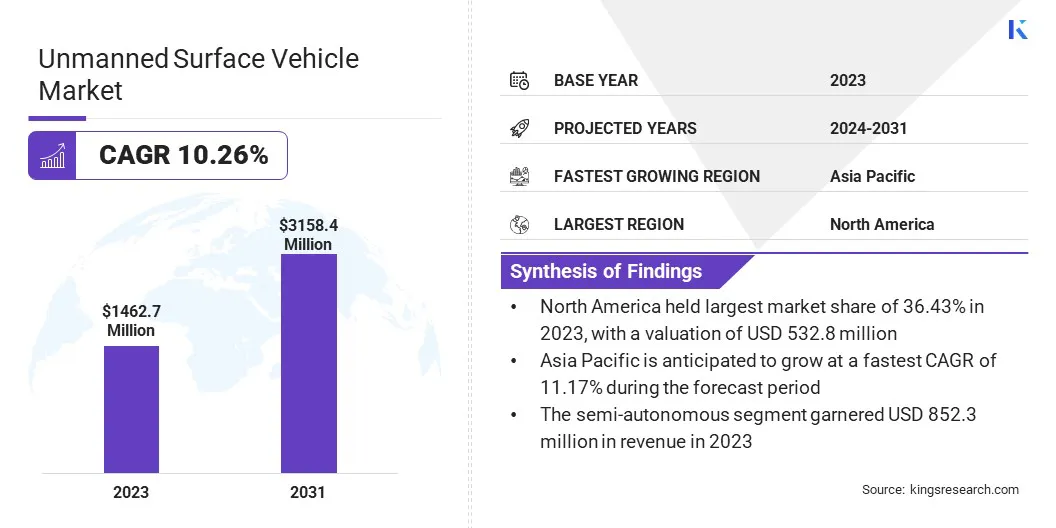

The global unmanned surface vehicle market size was valued at USD 1,462.7 million in 2023 and is projected to grow from USD 1,594.7 million in 2024 to USD 3,158.4 million by 2031, at a CAGR of 10.26% during the forecast period.

Increasing deployment of USVs in naval and defense operations due to the rising demand for cost-effective, low-risk maritime surveillance and reconnaissance is driving the growth of the market.

Advancements in autonomous navigation and remote sensing technologies are further fueling USV adoption across defense and commercial sectors by enhancing operational efficiency.

Major companies operating in the unmanned surface vehicle industry are Kongsberg Gruppen ASA, L3Harris Technologies, Inc., Saab AB, Textron Systems Corporation, Thales, Fugro, Elbit Systems Ltd., Teledyne Technologies Incorporated, Liquid Robotics, Atlas Elektronik GmbH, Maritime Robotics, Ocean Aero, AutoNaut Ltd., Saildrone Inc., and Unmanned Survey Solutions.

Incrasing adoption of USVs for pipeline inspection, asset monitoring, and oceanographic data collection across oil, gas, and renewable energy sector is driving market growth. Moreover, the market is gaining momentum due to reduced reliance on onboard crew, lower fuel consumption, and simplified maintenance schedules.

- In January 2025, Textron Systems introduced the TSUNAMI family of autonomous maritime surface vessels, developed in collaboration with Brunswick Corporation. These vessels are designed for rapid deployment and scalability, offering modular open systems architecture (MOSA) to support a wide range of maritime missions.

Key Highlights

- The unmanned surface vehicle industry size was recorded at USD 1,462.7 million in 2023.

- The market is projected to grow at a CAGR of 10.26% from 2024 to 2031.

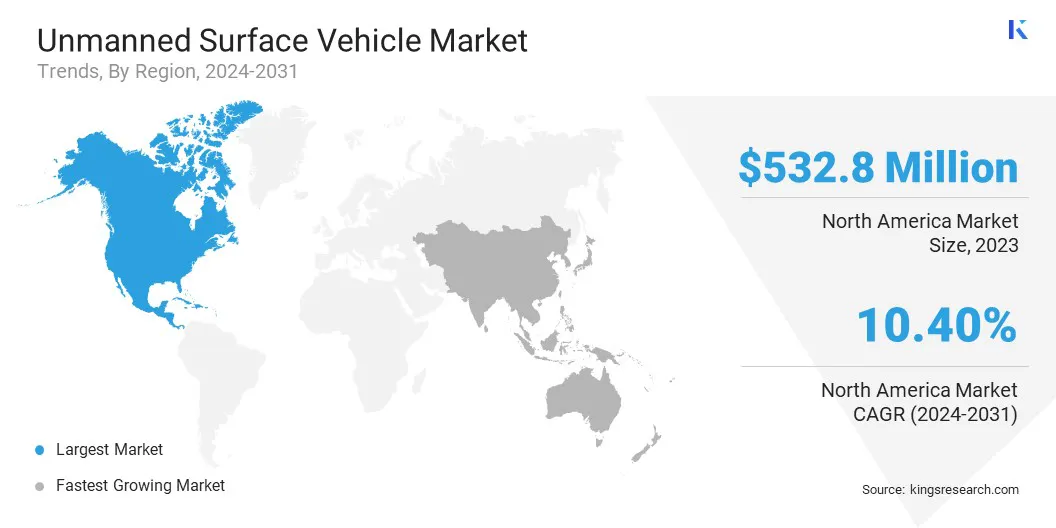

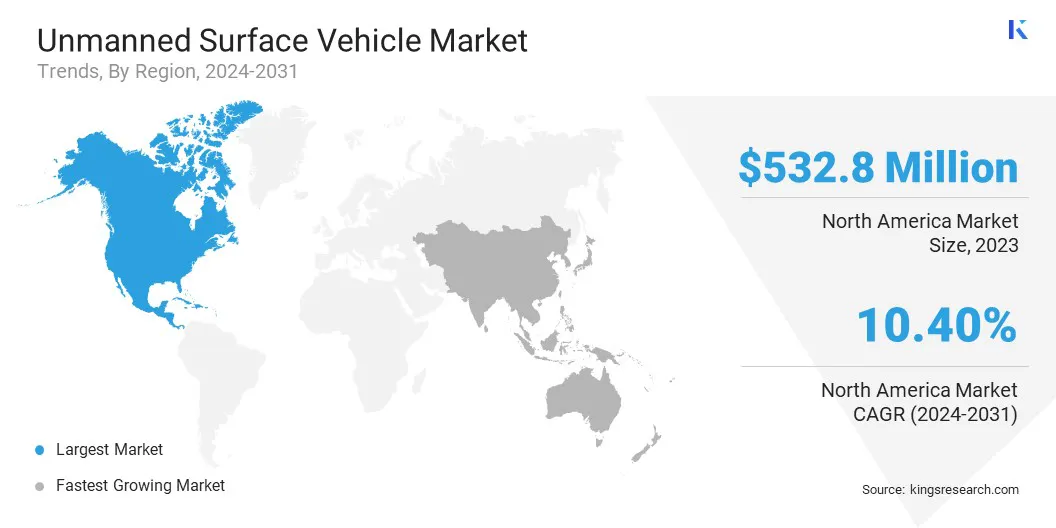

- North America held a market share of 36.43% in 2023, with a valuation of USD 532.8 million.

- The semi-autonomous segment garnered USD 852.3 million in revenue in 2023.

- The medium USV segment is expected to reach USD 1,802.1 million by 2031.

- The surveillance and reconnaissance segment secured the largest revenue share of 31.98% in 2023.

- Asia Pacific is anticipated to grow at a CAGR of 11.17% during the forecast period.

Market Driver

"Increased Deployment in Naval and Defense Operations"

Growing investment in maritime security and modern naval capabilities is driving the growth of the unmanned surface vehicle market. Naval forces are integrating USVs into fleet operations to perform mine countermeasure missions, intelligence gathering, anti-submarine warfare, and coastal surveillance.

These vehicles reduce risks to personnel and improve operational efficiency during high-risk missions. Countries are accelerating procurement programs involving USVs to enhance maritime situational awareness due to the rising geopolitical tensions and expanding defense budgets.

- In March 2025, Thales completed the delivery of its first fully autonomous maritime mine-hunting system to the Royal Navy. This milestone was achieved under the Joint Armament Cooperation Organization (OCCAr) and the Franco-British Maritime Mine Counter Measures (MMCM) program.

Market Challenge

"Regulatory Uncertainty and Operational Restrictions"

A significant challenge affecting the growth of the unmanned surface vehicle market is the absence of standardized regulatory frameworks governing their deployment in international and territorial waters.

Differing maritime laws, navigation safety protocols, and limited clarity on autonomous vessel operation create legal and operational barriers for manufacturers and operators.

To address this, companies are actively engaging with regulatory bodies, participating in pilot programs, and contributing to policy development initiatives. They are also investing in advanced situational awareness systems, geofencing technology, and fail-safe navigation protocols to ensure compliance and safe integration within existing maritime traffic systems.

Market Trend

"Advancements in Autonomous Navigation and Remote Sensing Technologies"

Technological innovation in USVs are a key trend influencing the global unmanned surface vehicle market. Advancements in autonomous control systems, remote sensing modules, collision avoidance, and onboard data processing are making USVs more capable and reliable.

These advancements are enabling long-duration missions with minimal supervision, which increases the commercial viability of USVs across various sectors. Additionally, continuous development in AI-driven navigation and real-time data analytics is strengthening the value proposition of unmanned surface operations.

- In January 2025, Kongsberg Maritime delivered Reach Remote 1, a 79-foot unmanned surface vessel (USV) built to support offshore operations. The vessel successfully completed sea trials under the supervision of Det Norske Veritas (DNV) and the Norwegian Maritime Authority. This new USV can be remotely monitored and operated from a Remote Operations Centre (ROC).

Unmanned Surface Vehicle Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Autonomous, Semi-Autonomous

|

|

By Size

|

Small USVs, Medium USVs, Large USVs

|

|

By Application

|

Surveillance and Reconnaissance, Patrol and Security, Hydrographic Surveys, Environmental Monitoring, Search and Rescue, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Autonomous, Semi-Autonomous): The semi-autonomous segment earned USD 1,462.7 million in 2023 due to its operational flexibility, combining autonomous functionalities with remote human supervision to enable cost-effective and safer maritime missions.

- By Size (Small USVs, Medium USVs, Large USVs): The medium USVs segment held 54.44% of the market in 2023, due to its optimal balance of payload capacity, operational range, and versatility, making it well-suited for multi-mission naval and commercial applications.

- By Application (Surveillance and Reconnaissance, Patrol and Security, Hydrographic Surveys, Environmental Monitoring, Search and Rescue, Others): The surveillance and reconnaissance segment is projected to reach USD 1,123.9 million by 2031, owing to the rising defense investments in persistent maritime monitoring and intelligence-gathering capabilities across contested and high-risk coastal regions.

Unmanned Surface Vehicle Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The North America unmanned surface vehicle market share stood around 36.43% in 2023 in the global market, with a valuation of USD 532.8 million. The U.S. Navy is prioritizing the integration of unmanned surface vehicles into its fleet under initiatives like the Unmanned Campaign Framework and Distributed Maritime Operations.

Moreover, defense programs such as the Large and Medium Unmanned Surface Vessel (LUSV/MUSV) development are further fueling domestic demand. These platforms are adopted to conduct long-endurance missions, electronic warfare, and strike operations, which is accelerating the expansion of the market in the region.

- In March 2025, the U.S. Defense Advanced Research Projects Agency (DARPA) introduced the USX-1 Defiant, a medium unmanned surface vessel (USV) engineered for autonomous maritime operations.

Additionally, the U.S. Department of Homeland Security is increasingly adopting USVs for port surveillance, drug interdiction, and unauthorized vessel detection.

Coastal agencies such as the Gulf of Mexico and Pacific Northwest, are integrating autonomous maritime systems into layered border defense strategies. This operational shift is resulting in procurement contracts with commercial USV manufacturers across the region, thereby expanding the market.

Asia Pacific unmanned surface vehicle industry is poised for significant growth at a robust CAGR of 11.17% over the forecast period. Geopolitical tensions and territorial disputes in the South China Sea are leading countries, such as Japan, India, Australia, and Taiwan to enhance maritime domain awareness.

USVs are being adopted for persistent surveillance and patrol missions in contested waters. These platforms offer real-time intelligence without endangering human operators, aligning with the region’s focus on low-risk, high-endurance maritime solutions to monitor unauthorized naval and fishing activities.

- In March 2025, CSBC Corp unveiled Taiwan’s first domestically developed unmanned surface vehicle (USV), the Endeavour Manta. It is designed to align with Taiwan’s asymmetric warfare strategy and features autonomous navigation and a stealth-optimized hull to address growing security challenges posed by neighboring countries.

Regulatory Frameworks

- The U.S. Coast Guard (USCG) has developed an Unmanned Systems Strategic Plan, emphasizing the integration of unmanned systems into maritime operations. This plan outlines objectives for employing, defending against, and regulating unmanned systems within the maritime domain.

- The European Maritime Safety Agency (EMSA) initiated the SAFEMASS study to identify emerging risks and regulatory gaps associated with Maritime Autonomous Surface Ships (MASS).The study aims to provide insights to EU Member States and the European Commission regarding autonomous shipping.

- The UK's Maritime and Coastguard Agency (MCA) has issued Marine Guidance Note MGN 705 (M), which provides guidance on Remotely Operated Unmanned Vessels (ROUVs) ranging from 2.5 to less than 4.5 meters in length. This document outlines compliance requirements and the MCA's authority to inspect such vessels.

- The Indian Register of Shipping (IRClass) has published guidelines on Remotely Operated Vessels and Autonomous Surface Vessels. These guidelines cover design philosophy, risk assessment, system requirements including cyber resilience, and requirements for Remote Control Centres.

Competitive Landscape

Market players are increasingly adopting strategic partnerships and collaborative ventures to enhance their technological capabilities and expand their regional footprint in the market.

These alliances allow companies to integrate advanced control systems with locally manufactured platforms, streamlining operational efficiency while catering to specific defense and commercial requirements.

- In April 2024, L3Harris Technologies partnered with Performance Marine to demonstrate the capabilities of an Unmanned Surface Vehicle (USV) at the eighth edition of the Doha International Maritime Defense Exhibition and Conference (DIMDEX). The 39-foot USV, named Suhail, was custom-designed and manufactured locally by Performance Marine, featuring the integration of L3Harris’ advanced ASView control system technology.

List of Key Companies in Unmanned Surface Vehicle Market:

- Kongsberg Gruppen ASA

- L3Harris Technologies, Inc.

- Saab AB

- Textron Systems Corporation

- Thales

- Fugro

- Elbit Systems Ltd.

- Teledyne Technologies Incorporated

- Liquid Robotics

- Atlas Elektronik GmbH

- Maritime Robotics

- Ocean Aero

- AutoNaut Ltd.

- Saildrone Inc.

- Unmanned Survey Solutions

Recent Developments (Partnerships/Agreements/Collaborations)

- In April 2025, Saildrone and Thales announced the successful integration of an autonomous payload with the Saildrone Surveyor USV during the Sea-Air-Space conference in the U.S.. The integration demonstrated the system’s ability to detect and classify both underwater and surface threats, enabling real-time reporting of critical information to decision-makers.

- In June 2024, L3Harris Technologies collaborated with maritime startup Seasats to evaluate the advanced capabilities of an autonomous surface vessel (ASV) in the Pacific Ocean. The two firms successfully demonstrated the ASV's operational reliability, resilience, and performance in real-world maritime conditions off the coast of Hawaii.

- In February 2024, the Italian Ministry of Defense awarded a contract to Norwegian naval vessel manufacturer Kongsberg Maritime for the delivery of an unmanned submersible vehicle designed for shallow water surveying. Valued at approximately USD 11 million, the vehicle is lightweight and engineered to perform effectively in confined and shallow maritime environments, supporting a range of underwater operational needs.