Unified Threat Management Market Size

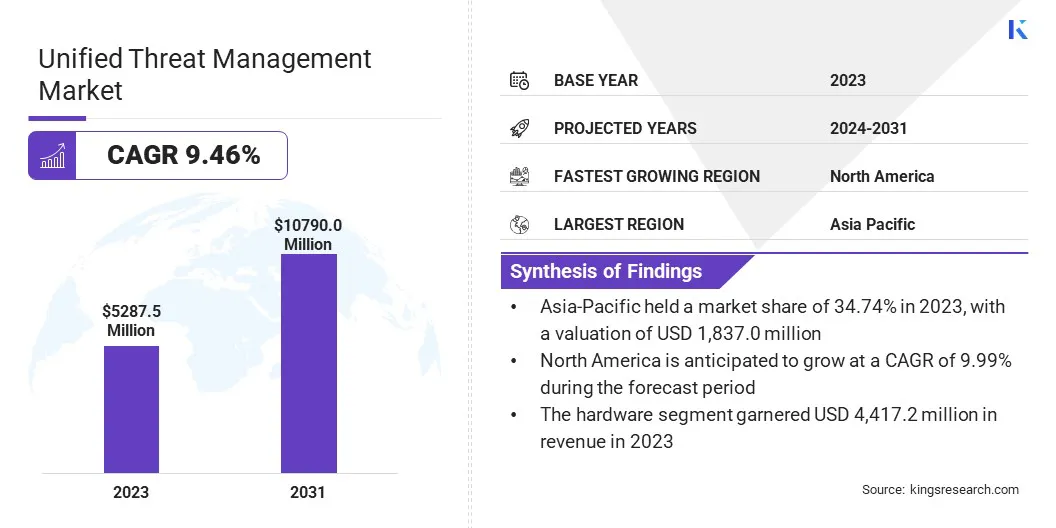

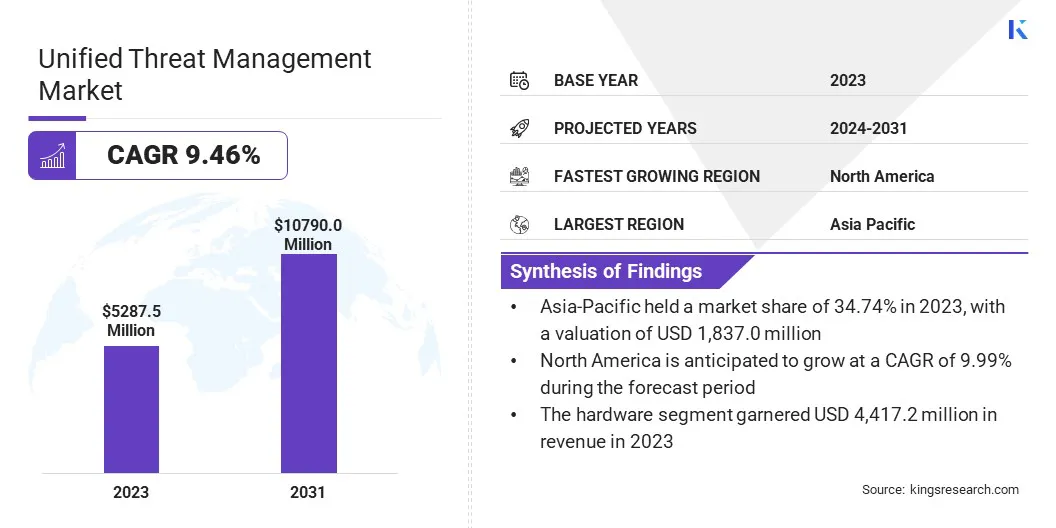

The global Unified Threat Management Market size was valued at USD 5,287.5 million in 2023 and is projected to grow from USD 5,729.5 million in 2024 to USD 10,790.0 million by 2031, exhibiting a CAGR of 9.46% during the forecast period. The expansion of the market is driven by the increasing need for comprehensive cybersecurity solutions to address rising cyber threats, the growing complexity of IT environments, and the surging demand for integrated, cost-effective security measures.

In the scope of work, the report includes solutions offered by companies such as Barracuda Networks, Inc., Check Point Software Technologies Ltd., Cisco, Cyberoam, Dell Inc., Fortinet, Inc., Hewlett Packard Enterprise Development LP, Sophos Ltd., WatchGuard Technologies, Inc., IBM, and others.

The growth of the unified threat management market is fueled by the increasing need for robust cybersecurity measures in response to rising cyber threats. Organizations are prioritizing comprehensive security solutions to protect sensitive data and comply with regulatory requirements.

The proliferation of remote work and cloud services has led to increased demand for integrated security platforms that offer simplicity and efficiency. Additionally, advancements in technology, such as AI and machine learning, are enhancing threat detection and response capabilities.

- For instance, in June 2024, WatchGuard Technologies launched ThreatSync+ NDR and WatchGuard Compliance Reporting, which feature an AI-driven tool for continuous threat monitoring and remediation. Designed for businesses with limited IT resources, ThreatSync+ NDR automated threat detection and simplified management. Utilizing AI technology from WatchGuard’s CyGlass acquisition, this solution provides detailed visibility into network traffic and efficiently identified risks, including sophisticated attacks such as ransomware and supply chain threats.

Growing investments in IT infrastructure by small and medium-sized enterprises (SMEs) are further contributing to market growth. The rising emphasis on reducing operational costs while maintaining high security standards further propels the adoption of UTM solutions.

The UTM market encompasses a range of solutions that integrate multiple security functions into a single platform, thereby streamlining management and reducing complexity. Key components include firewalls, intrusion detection and prevention systems, antivirus, and content filtering.

North America leads the market due to high cybersecurity awareness and significant IT infrastructure investments. The Asia-Pacific region is experiencing rapid growth, supported by rising digital transformation initiatives. Market players are increasingly focusing on product innovation and strategic partnerships to enhance their offerings and expand their global footprint.

Unified threat management refers to a comprehensive security solution that combines multiple security functions into a single appliance or platform. This approach streamlines the management of various security tools, by providing centralized control and monitoring. UTM solutions typically include features such as network firewalls, intrusion detection and prevention, gateway antivirus, and web content filtering.

They are designed to protect networks from a wide array of threats, including malware, phishing attacks, and unauthorized access. By integrating these functionalities, UTM solutions offer a cohesive and efficient way to manage security across an organization's IT environment, thereby reducing complexity and operational costs while enhancing overall protection.

Analyst’s Review

The market is witnessing key efforts by manufacturers to innovate and expand their product portfolios. Companies are integrating advanced technologies including artificial intelligence and machine learning to enhance threat detection and response capabilities.

- For instance, in May 2024, Palo Alto Networks introduced new security solutions designed to address AI-generated attacks and secure AI systems. The company integrated Precision AI into its Prisma, Strata, and Cortex platforms, thereby enhancing real-time threat protection. The launch featured the Precision AI Security Bundle with advanced URL filtering, threat prevention, and DNS security, while AI Access Security and AI Runtime Security improved the protection and compliance of AI applications.

New products are designed to offer scalable and flexible solutions that cater to the growing demand for cloud-based security. Furthermore, manufacturers are emphasizing user-friendly interfaces and automation to simplify security management. It is recommended that businesses prioritize UTM solutions that offer comprehensive protection and adaptability to evolving threats.

Investing in continuous employee training and adopting a proactive security approach is anticipated to enhance organizational resilience against cyber threats, thereby ensuring robust cybersecurity in an increasingly digital landscape.

Unified Threat Management Industry Growth Factors

The rising frequency of cyberattacks is a major factor propelling the expansion of the unified threat management (UTM) market. Businesses are increasingly facing sophisticated threats, underscoring the imperative to adopt comprehensive security measures. UTM solutions are providing an all-in-one approach, combining firewalls, intrusion prevention systems, antivirus, and content filtering. This integration is streamlining security management, making it more efficient and cost-effective.

As organizations increasingly transition to cloud environments and support remote work, the need for robust and scalable security solutions is becoming critical. The unified threat management market is responding to this rising demand by evolving its capabilities to offer enhanced protection, thereby attracting a wider range of customers across various industries.

A major challenge impeding the development of the market is the complexity of managing integrated security systems. Organizations often find it difficult to effectively configure and monitor all components, leading to potential vulnerabilities. To overcome this, vendors are focusing on developing user-friendly interfaces and automated features that simplify management tasks.

Implementing machine learning and AI technologies is contributing to improved threat detection and response times, thereby reducing the need for manual intervention. By providing comprehensive training and support services, vendors are enabling their clients to effectively utilize UTM solutions. This approach mitigates the complexity challenge and improves overall security efficiency for businesses.

Unified Threat Management Market Trends

A notable trend in the market is the rising integration of artificial intelligence (AI) and machine learning (ML) technologies. These advancements are enhancing the ability to detect and respond to threats in real-time. AI-driven analytics are continuously monitoring network traffic and identifying patterns that indicate potential security breaches. Machine learning algorithms are improving the accuracy of threat detection by analyzing and learning from past incidents.

This trend is leading to the implementation of more proactive and adaptive security measures, thereby reducing the risk of successful cyberattacks. As cyber threats grow increasingly sophisticated, the incorporation of AI and ML in UTM solutions is becoming essential for maintaining robust cybersecurity.

Another significant trend in the unified threat management market is the growing shift toward cloud-based solutions. Organizations are increasingly adopting cloud-based UTM due to its scalability, flexibility, and cost-efficiency. Cloud-based UTM solutions provide easier deployment and management, especially for businesses with multiple locations or remote workforces.

This trend is further supported by the rising need for seamless security integration across various environments, including on-premise, cloud, and hybrid setups. The growing preference for Software-as-a-Service (SaaS) models is influencing this shift, offering subscription-based pricing and continuous updates. As cloud adoption continues to rise, cloud-based UTM solutions are emerging as a fundamental component of modern cybersecurity strategies.

Segmentation Analysis

The global market is segmented based on component, deployment, enterprise size, end use, and geography.

By Component

Based on component, the market is categorized into hardware, software, and virtual. The hardware segment led the unified threat management market in 2023, reaching a valuation of USD 4,417.2 million. Hardware-based UTM solutions offer comprehensive protection by integrating multiple security functions into a single appliance.

This is particularly appealing to enterprises seeking reliable, high-performance security. The ease of installation and lower risk of software conflicts are additional benefits. Hardware solutions are often preferred in environments with stringent regulatory requirements, due to their ability to provide dedicated, tamper-proof security measures, thereby boosting the expansion of the hardware segment.

By Deployment

Based on deployment, the market is classified into cloud and on-premises. The cloud segment is poised to witness significant growth at a robust CAGR of 9.85% through the forecast period (2024-2031). This expansion is fueled by the increasing adoption of cloud services across various industries. Cloud-based UTM solutions offer scalability, flexibility, and cost-efficiency, making them highly attractive to organizations of all sizes.

They enable seamless integration with existing cloud infrastructures and support remote management, which is crucial for businesses with distributed workforces. The shift toward digital transformation and the growing preference for subscription-based models are further propelling the adoption of cloud-based UTM solutions.

By Enterprise Size

Based on end user, the market is segmented into large enterprise and small & medium size enterprise. The large enterprise segment secured the largest unified threat management market share of 64.87% in 2023. This dominance is attributed to the extensive cybersecurity needs of large enterprises, which require comprehensive and scalable security solutions to protect vast amounts of sensitive data. Large enterprises often face complex security challenges due to their expansive IT infrastructures and higher risk profiles.

UTM solutions are providing these organizations with integrated, efficient, and centralized security management. Additionally, the financial capability of large enterprises to invest in advanced security technologies is influencing their preference for UTM solutions, thereby contributing to the expansion of the segment.

Unified Threat Management Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia-Pacific unified threat management market held a significant share of around 34.74% in 2023, with a valuation of USD 1,837.0 million. This dominance is fostered by the rapid digital transformation and increasing adoption of advanced technologies across various industries. Countries such as China, India, and Japan are experiencing significant growth in their IT sectors, which is fueling the demand for comprehensive cybersecurity solutions.

Additionally, the rise in cyberattacks and stringent regulatory requirements are compelling businesses to invest in UTM solutions. The presence of numerous small and medium-sized enterprises (SMEs) seeking cost-effective and integrated security solutions is further contributing to the region's leading market position.

North America is poised to experience significant growth at a robust CAGR of 9.99% over the forecast period. This rapid expansion is bolstered by the growing awareness of cybersecurity threats and the strong presence of key players in the region. The increasing adoption of cloud services and remote work arrangements is boosting the demand for scalable and flexible security solutions.

Furthermore, stringent government regulations and compliance requirements are compelling organizations to enhance their cybersecurity measures. The region's robust IT infrastructure and substantial investments in advanced security technologies are further propelling the growth of the North America market.

Competitive Landscape

The global unified threat management market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Expansion & investments are the major strategic initiatives adopted by companies in this sector. Industry players are investing extensively in R&D activities, building new manufacturing facilities, and supply chain optimization.

List of Key Companies in Unified Threat Management Market

- Barracuda Networks, Inc.

- Check Point Software Technologies Ltd.

- Cisco

- Cyberoam

- Dell Inc.

- Fortinet, Inc.

- Hewlett Packard Enterprise Development LP

- Sophos Ltd.

- WatchGuard Technologies, Inc.

- IBM

Key Industry Developments

- June 2024 (Partnership): Fortinet acquired Lacework, a cloud security company renowned for its AI-powered platform. The acquisition aimed to integrate Lacework’s cloud-native security solutions into Fortinet's portfolio, thereby enhancing its AI-driven security capabilities. This strategic move, scheduled for completion in the latter half of 2024, aligns with Fortinet’s goal of expanding its comprehensive cybersecurity offerings.

- April 2024 (Launch): CelerityX launched OneX, a comprehensive network management solution, and partnered with the Maharashtra State Cooperative Credit Societies Federation. This partnership improved connectivity and security for over 40,000 bank branches across Maharashtra.

The global unified threat management market is segmented as:

By Component

- Hardware

- Software

- Virtual

By Deployment

By Enterprise Size

- Large Enterprise

- Small & Medium Size Enterprise

By End Use

- BFSI

- Government

- Healthcare

- Manufacturing

- Retail

- Telecom & IT

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America