Market Definition

The market encompasses non-destructive testing technologies that utilize high-frequency sound waves to detect internal flaws, measure thickness, and evaluate material properties.

It includes equipment such as flaw detectors, transducers, and phased array systems, as well as related services across industries like aerospace, oil & gas, manufacturing, and infrastructure, supporting safety, compliance, and asset integrity.

Ultrasonic Testing Market Overview

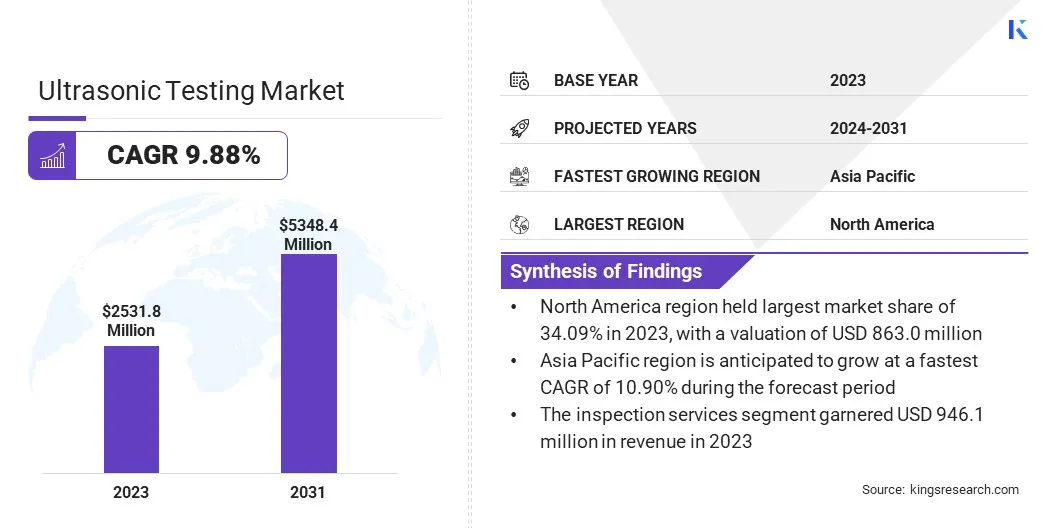

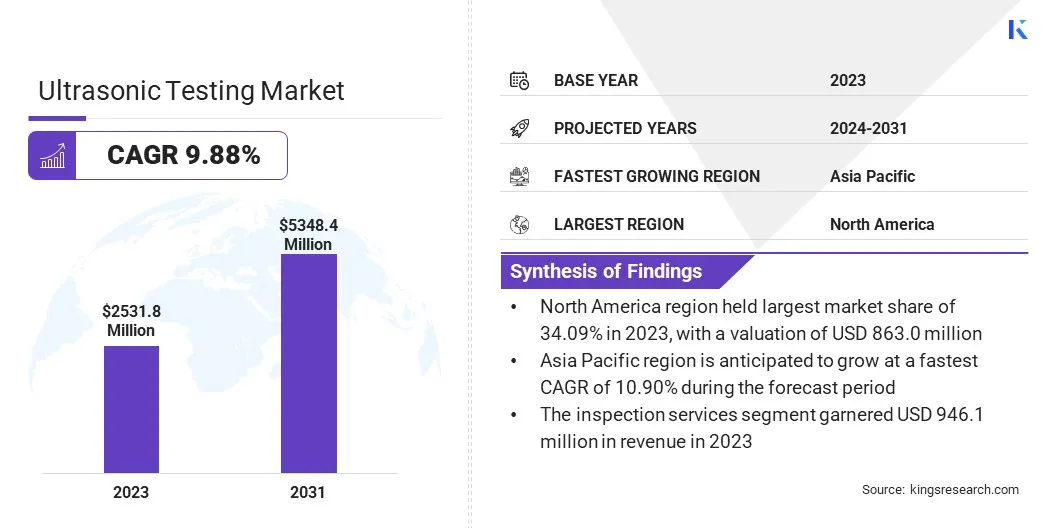

The global ultrasonic testing market size was valued at USD 2531.8 million in 2023 and is projected to grow from USD 2765.7 million in 2024 to USD 5348.4 million by 2031, exhibiting a CAGR of 9.88% during the forecast period.

The market is driven by the rising demand for ultrasonic testing in high-risk energy sectors and accelerated by technological advancements that enhance inspection accuracy, efficiency, and compliance across aerospace, oil & gas, and manufacturing industries.

Major companies operating in the ultrasonic testing industry are Baker Hughes Company, Sonatest, NDT Systems Inc, MISTRAS Group, ACS-Solutions GmbH, Modsonic Instruments Mfg. Co. (P) Ltd., SONOTEC GmbH, Guided Ultrasonics Ltd., EVIDENT, Magnaflux, Hitachi, Ltd, Eddyfi, TecScan.ca, T.D. Williamson, Inc., and TEAM, Inc.

Continuous increase in infrastructure development and industrial expansion, particularly across emerging economies, are driving the market. Substantial capital investments from both government bodies and private enterprises are being directed toward the modernization of transportation networks, energy systems, and manufacturing facilities, thereby elevating the demand for advanced non-destructive testing solutions.

- In March 2024, Schneider Electric announced a USD 140 million investment to expand its manufacturing operations in the U.S., aimed at supporting critical infrastructure and key industrial sectors.

Key Highlights:

- The ultrasonic testing market size was valued at USD 2531.8 million in 2023.

- The market is projected to grow at a CAGR of 9.88% from 2024 to 2031.

- North America held a market share of 34.09% in 2023, with a valuation of USD 863.0 million.

- The time-of-flight diffraction segment garnered USD 757.0 million in revenue in 2023.

- The flaw detectors segment is expected to reach USD 1193.2 million by 2031.

- The inspection services segment secured the largest revenue share of 37.37% in 2023.

- The aerospace segment is poised for a robust CAGR of 10.03% through the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 10.90% during the forecast period.

Market Driver

Growth in Energy Sector Applications

The global market is registering significant growth, driven by the increasing need for advanced non-destructive testing solutions in the energy sector.

High-risk, asset-intensive segments such as oil & gas, nuclear, and renewables rely on ultrasonic testing for the precise inspection of pipelines, turbines, and storage tanks, ensuring preventive maintenance, operational efficiency, and adherence to regulatory standards.

- In April 2025, the India Brand Equity Foundation (IBEF) reported that oil demand in India is projected to double, reaching 11 million barrels per day by 2045. Additionally, natural gas consumption is expected to increase by 25 billion cubic metres (BCM), reflecting an average annual growth rate of 9% through 2024, driven by expanding industrial and energy requirements.

Market Challenge

High Costs and Implementation Complexity in Ultrasonic Testing

A significant challenge in the ultrasonic testing market is the high cost of advanced equipment and the complexity of implementation, particularly for small and medium-sized enterprises (SMEs).

The initial investment in ultrasonic testing systems, such as phased array and automated devices, can be prohibitive for these companies, limiting their adoption. Additionally, the integration of these systems into existing workflows requires specialized training and technical expertise.

Manufacturers are focusing on developing more cost-effective solutions, offering modular systems that are easier to integrate, and providing comprehensive training & support programs to help businesses maximize their investment and reduce operational barriers.

Market Trend

Innovation in Advanced Ultrasonic Testing Technologies

A major trend shaping the market is the increasing integration of advanced ultrasonic technologies that enhance testing precision, speed, and data analysis capabilities.

These innovations are driving the demand for more efficient, reliable, and cost-effective solutions, particularly in critical sectors such as aerospace, oil & gas, and manufacturing. The adoption of these technologies is expected to accelerate as industries focus on improving operational efficiency and asset integrity.

- In April 2024, Baker Hughes introduced the Waygate Technologies Ultrasonic Precision Thickness Gauge Krautkrämer CL Go+, a versatile inspection tool designed for the automotive and aerospace industries. This device efficiently measures cast and stamped metal components made from materials like aluminum, steel, copper, and bronze, as well as machined workpieces, tubes, chemically milled parts, metal plates, plastics, composites, and glass. Additionally, it can be upgraded to a 3-in-1 platform, serving as both a corrosion thickness gauge and a flaw detector.

Ultrasonic Testing Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Time-Of-Flight Diffraction, Phased Array, Immersion Testing, Guided-Wave Testing, Acoustography, Others

|

|

By Equipment

|

Flaw Detectors, Thickness Gauges, Transducers & Probes, Industrial Scanners, Tube Inspection Systems, Bond Testers, Imaging Systems, Others

|

|

By Service

|

Inspection Services, Equipment Rental Services, Calibration Services, Calibration Services

|

|

By Vertical

|

Manufacturing, Oil & Gas, Aerospace, Public Infrastructure, Automotive, Power Generation, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Time-Of-Flight Diffraction, Phased Array, Immersion Testing, Guided-Wave Testing, and Acoustography): The time-of-flight diffraction segment earned USD 757.0 million in 2023, due to its superior ability to detect critical defects with high precision and reliability, particularly in weld inspection and other complex structural applications, offering increased inspection speed and enhanced accuracy over traditional methods.

- By Equipment (Flaw Detectors, Thickness Gauges, Transducers & Probes, and Industrial Scanners): The flaw detectors segment held 22.42% share of the market in 2023, due to their widespread use in identifying internal defects and ensuring structural integrity across industries like aerospace, oil & gas, and manufacturing, providing cost-effective, reliable, and real-time inspection capabilities.

- By Service (Inspection Services, Equipment Rental Services, Calibration Services, Calibration Services): The inspection services segment is projected to reach USD 1979.7 million by 2031, owing to the growing demand for specialized, on-site non-destructive testing services that ensure compliance with safety regulations, improve operational efficiency, and minimize downtime in critical industries such as energy, aerospace, and manufacturing.

- By Vertical (Manufacturing, Oil & Gas, Aerospace, Public Infrastructure, Automotive, Power Generation, Others): The aerospace segment is poised for significant growth at a CAGR of 10.03% through the forecast period, due to the industry's stringent safety and quality standards, where ultrasonic testing is essential for ensuring the integrity of critical components, such as turbine blades and airframes, and maintaining compliance with regulatory requirements.

Ultrasonic Testing Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America accounted for 34.09% share of the ultrasonic testing market in 2023, with a valuation of USD 863.0 million. This market dominance is attributed to the significant growth of the aerospace and defense sector in the U.S.

The rising need for non-destructive testing in essential applications, such as aircraft component inspections and military asset maintenance, has notably led to the market expansion. Additionally, stringent safety regulations and the widespread adoption of advanced ultrasonic technologies further strengthen North America's position as the market leader.

- In September 2024, the Aerospace Industries Association (AIA) highlighted the strength of the aerospace and defense (A&D) sector and its substantial contribution to the U.S. economy, both at the national and state levels. The study evaluated the A&D industry's economic impact, including employment, GDP contribution, sales, labor income, and taxes. It revealed that the U.S. aerospace and defense industry continues to drive economic growth, exceeding national averages in job creation and wages, while significantly contributing to global trade, national security, and technological leadership.

The ultrasonic testing industry in Asia Pacific is poised for significant growth at a robust CAGR of 10.90% over the forecast period. This is attributed to rapid industrialization, infrastructure development, and increasing demand for non-destructive testing solutions across key sectors such as manufacturing, automotive, and energy.

Countries like China and India are registering significant growth in aerospace, automotive, and energy industries, where ultrasonic testing plays a critical role in ensuring quality, safety, and regulatory compliance, further accelerating the market demand in the region.

Regulatory Frameworks

- In the U.S., the American Society for Nondestructive Testing (ASNT) establishes comprehensive certification standards and operational guidelines for both professionals and companies engaged in ultrasonic testing. These standards ensure that individuals meet the necessary qualifications to perform accurate, reliable, and safe inspections across various industries.

- In Asia Pacific, the Japanese Society for Non-Destructive Testing (JSNDT) plays a key role in establishing comprehensive standards and guidelines for non-destructive testing methods, including ultrasonic testing. These regulations ensure the accuracy, safety, and reliability of testing practices within Japan’s industries.

Competitive Landscape

The competitive landscape of the ultrasonic testing market is characterized by strategic acquisitions aimed at enhancing technological capabilities, expanding service portfolios, and strengthening geographic presence. Key market participants are actively acquiring specialized non-destructive testing firms to gain access to advanced ultrasonic technologies and industry-specific expertise.

These acquisitions support vertical integration, improve customer offerings, and enable companies to address evolving demands across sectors such as aerospace, energy, and manufacturing, reinforcing their market positions globally.

- In December 2024, Apave announced the successful acquisition of IRISNDT, a company specializing in non-destructive testing and inspection services. Through this acquisition, Apave gains access to the expertise of IRISNDT’s 2,400 employees, significantly enhancing its global presence across key markets. The integration strengthens Apave’s position in critical industrial sectors such as energy (including renewables), chemicals, petrochemicals, mining, and agriculture, reinforcing its capabilities in non-destructive testing and inspection services.

List of Key Companies in Ultrasonic Testing Market:

- Baker Hughes Company

- Sonatest

- NDT Systems Inc

- MISTRAS Group

- ACS-Solutions GmbH

- Modsonic Instruments Mfg. Co. (P) Ltd.

- SONOTEC GmbH

- Guided Ultrasonics Ltd.

- EVIDENT

- Magnaflux

- Hitachi, Ltd

- Eddyfi

- TecScan.ca

- D. Williamson, Inc.

- TEAM, Inc.

Recent Developments (Product Launches)

- In May 2024, Phoenix Inspection Systems Limited introduced a new automated ultrasonic testing (AUT) weld scanner at the 20th World Conference on Non-Destructive Testing. The advanced scanner features an automated carriage with adaptable tracks that securely attach to various inspection surfaces using full-surface tension, magnets, or vacuum across all orientations. Its configurable probe pan accommodates a range of inspection needs and supports between one and twelve ultrasonic probes, depending on probe diameter.