Market Definition

The UHV (Ultra High Voltage) switches market involves the design, production, and deployment of switching devices capable of handling voltages exceeding 800 kV.

These switches are critical components in the transmission and distribution of electrical power, particularly in long-distance power transmission networks and large-scale electrical grids. UHV switches are meticulously engineered to withstand extreme electrical stresses, ensuring operational safety, reliability, and efficiency within power systems.

UHV Switches Market Overview

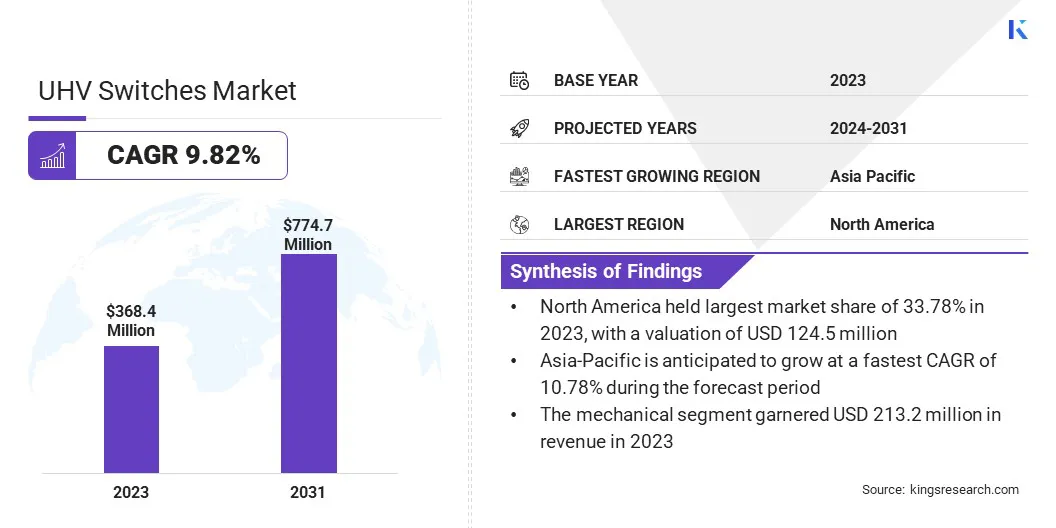

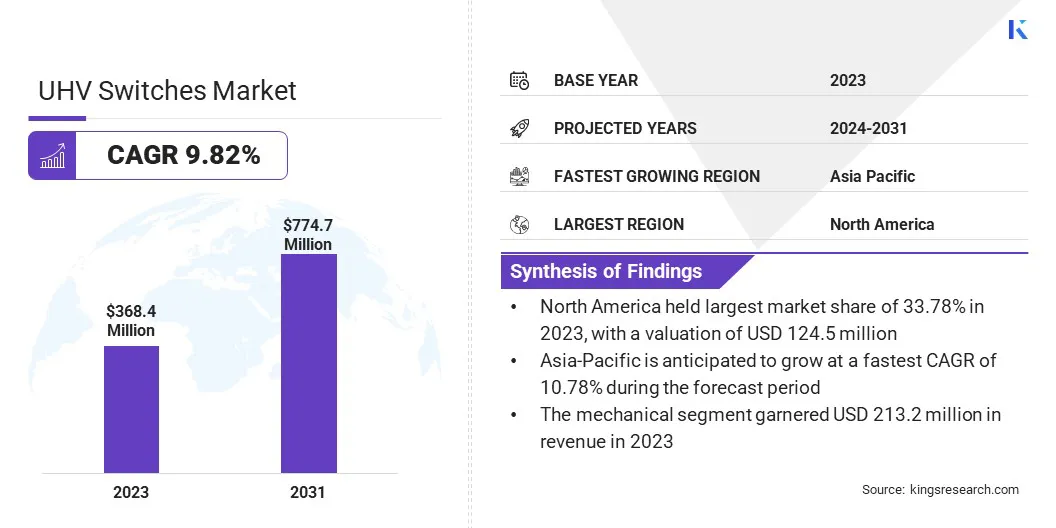

The global UHV switches market size was valued at USD 368.4 million in 2023 and is projected to grow from USD 402.1 million in 2024 to USD 774.7 million by 2031, exhibiting a CAGR of 9.82% during the forecast period. This growth is driven by the rising demand for long-distance electricity transmission, expansion of renewable energy sources, and the growing need for efficient grid management.

UHV switches are integral to ensuring the reliable and secure operation of electrical grids by facilitating the control of high-voltage power transmission, which is essential to meet the increasing energy demands in both developed and emerging economies.

Major companies operating in the global UHV switches industry are GE Grid Solutions LLC, CG Power & Industrial Solutions Ltd., TOSHIBA CORPORATION, PowerSources GmbH, Henan pinggao Electric Co.,Ltd, CHINA XD GROUP, Eaton, NEW NORTHEAST ELECTRIC INDIA, Siemens, Hitachi Energy Ltd., ALCEN, Anarghya Innovations and Technology, Nano Vacuum Pty Ltd, LCSC.COM, and Thyracont Vacuum Instruments GmbH.

Advancements in UHV switch technology, particularly in the development of more durable and efficient materials, are expected to further fuel the market. The integration of smart grid technologies and increased infrastructure investments for power grid modernization will also contribute significantly to market growth.

- In November 2024, the U.S. Energy Information Administration highlighted that the annual electricity production and delivery expenditures of major utilities grew by 12%, from USD 287 billion in 2003 to USD 320 billion in 2023, as per FERC financial reports. Capital investment in distribution infrastructure surged by USD 31.4 billion, marking a 160% increase over the two-decade period, reflecting sustained industry modernization efforts.

Key Highlights

- The global UHV switches market size was valued at USD 368.4 million in 2023.

- The market is projected to grow at a CAGR of 9.82% from 2024 to 2031.

- North America held a market share of 33.78% in 2023, with a valuation of USD 124.5 million.

- The vacuum switches segment garnered USD 117.4 million in revenue in 2023.

- The mechanical segment is expected to reach USD 447.8 million by 2031.

- The transportation segment is anticipated to register the fastest CAGR of 9.90% during the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 10.78% during the forecast period.

Market Driver

"Expansion of Renewable Energy Infrastructure"

The expansion of renewable energy infrastructure significantly drives the demand for UHV switches, as increasing amounts of electricity are generated from renewable sources such as sun, wind, and water. UHV switches are critical for efficiently transmitting high-voltage power over long distances with minimal loss.

They play a vital role in maintaining grid stability, particularly in managing the intermittent nature of renewable energy. As nations invest in cleaner energy solutions, UHV switches are essential for integrating renewable energy into existing power grids, facilitating the transition to a more sustainable energy system.

- In January 2024, the International Energy Agency (IEA) stated that global renewable energy capacity expansion surged by 50% in 2023, reaching nearly 510 GW, driven primarily by solar PV, which accounted for 75% of additions, per the IEA’s Renewables 2023 report. China led growth, installing as much solar PV as the world did in 2022, while wind power rose 66%. Europe, the U.S., and Brazil also registered record increases.

Market Challenge

"Technological Complexity"

Technological complexity represents a significant challenge in the UHV switches market, due to the advanced materials and precise engineering required to ensure safe and efficient operation at voltages exceeding 800 kV.

These switches demand specialized insulating materials, which are both costly and difficult to source, and their intricate design necessitates high levels of precision to prevent performance failures.

The switching mechanisms must be capable of handling large currents and voltages without causing electrical arcing or damage to the components, all while maintaining reliability under extreme environmental conditions. This technological complexity results in higher production costs, requires a highly skilled workforce, and slows down the widespread adoption of UHV switch technology.

The technological complexity in the market requires focused investment in Research and Development (R&D) to enhance materials and manufacturing processes. Innovations in insulation technology and precision engineering can help reduce costs and improve performance.

Collaborative efforts between manufacturers, utilities, and regulatory bodies will facilitate the exchange of knowledge, promote innovation, and standardize designs. Additionally, establishing comprehensive training programs will ensure a skilled workforce capable of effectively managing the intricacies of UHV switch technologies.

Market Trend

"Integration of Digital Technologies and Rise of Smart Grids"

A key trend in the UHV switches market is the integration of digital technologies and the rise of smart grids. As grids become more automated, UHV switches are being equipped with advanced digital monitoring, real-time data collection, and predictive maintenance capabilities.

This trend enhances efficiency, reliability, and flexibility in managing high-voltage power flows. Smart grids, which use sensors, communication networks, and analytics, rely on these intelligent UHV switches to optimize performance, integrate renewable energy, and respond swiftly to changes in demand or faults, improving overall grid stability and management.

- In March 2024, Siemens introduced one of the world’s most innovative circuit protection devices, the SENTRON Electronic Circuit Protection Device (ECPD), which utilizes advanced electronic switching technology.

UHV Switches Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Vacuum Switches, Air-insulated Switches, Hybrid Switches, Others

|

|

By Technology

|

Mechanical, Electronic

|

|

By End Use

|

Industrial, Utilities, Transportation

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Vacuum Switches, Air-insulated Switches, Hybrid Switches, Others): The vacuum switches segment earned USD 117.4 million in 2023, due to their superior performance, reliability, and ability to operate efficiently at high voltages.

- By Technology (Mechanical, Electronic): The mechanical segment held 57.87% share of the market in 2023, due to its established reliability, cost-effectiveness, and ability to handle high-voltage operations in UHV applications.

- By End Use (Industrial, Utilities, Transportation): The utilities segment is projected to reach USD 298.3 million by 2031, owing to the increasing demand for reliable and efficient power transmission infrastructure, driven by the growth of renewable energy sources and the need for grid modernization.

UHV Switches Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for a UHV switches market share of around 33.78% in 2023, with a valuation of USD 124.5 million. This substantial market share can be attributed to the well-established energy infrastructure, ongoing initiatives in grid modernization, and the increasing integration of renewable energy sources in the region.

The demand for UHV switches in North America is further bolstered by a heightened emphasis on enhancing grid resilience, improving power transmission efficiency, and the adoption of advanced smart grid technologies. The presence of key manufacturers and continuous technological advancements in UHV switch design further contribute to the market growth in the region.

- In August 2023, XConn Technologies announced the introduction of the industry's first hybrid CXL 2.0 and PCIe Gen 5 switch. This innovative product integrates both Compute Express Link (CXL) technology and Peripheral Component Interconnect Express (PCIe) Gen 5 interconnect technology on a single 256-lane System on Chip (SoC).

The UHV switches industry in Asia Pacific is poised for significant growth at a robust CAGR of 10.78% over the forecast period, driven by rapid industrialization, urbanization, and rising electricity demand in key markets such as China and India. Increased investments in renewable energy and the modernization of power grids are further boosting the demand for UHV switches.

Large-scale transmission projects and a growing focus on sustainable energy solutions are expected to support continued market expansion in the region. The growing adoption of electric vehicles (EVs) and the need for robust charging infrastructure are also expected to drive the demand for efficient and reliable power transmission solutions in the region.

Regulatory Frameworks

- The International Electrotechnical Commission (IEC) establishes global standards for UHV switches, particularly through the IEC 62271 series, which outlines specifications for high-voltage switchgear and controlgear.

- The Federal Energy Regulatory Commission (FERC) regulates the transmission and wholesale sale of electricity in the U.S., ensuring the reliability and safety of the nation’s power grid.

- The U.S. Department of Energy (DOE) regulates and supports the development of electrical transmission systems, through initiatives aimed at enhancing grid reliability and resilience.

- The National Fire Protection Association (NFPA) governs the National Electrical Code (NEC), which sets the minimum safety requirements for electrical installations to prevent electrical hazards.

Competitive Landscape

Industry leaders capitalize on their experience, extensive networks, and established market presence, while new entrants focus on innovative solutions and advanced technologies.

The increasing demand for smart grids, renewable energy integration, and grid modernization has intensified competition, driving investment in R&D to improve product performance and sustainability. Strategic partnerships, mergers, and acquisitions are also common, as companies seek to expand their market reach and explore growth opportunities.

- In October 2023, Menlo Microsystems launched the MM1205, a 6x SPST relay solution featuring an integrated relay driver and charge pump. This single-component solution combines the high isolation of mechanical relays with semiconductor reliability, enhancing DC, analog, and RF performance through Menlo Micro’s advanced design and manufacturing expertise in signal relay technology.

List of Key Companies in UHV Switches Market:

- GE Grid Solutions, LLC

- CG Power & Industrial Solutions Ltd.

- TOSHIBA CORPORATION

- PowerSources GmbH

- Henan pinggao Electric Co.,Ltd

- CHINA XD GROUP

- Eaton

- NEW NORTHEAST ELECTRIC INDIA

- Siemens

- Hitachi Energy Ltd.

- ALCEN

- Anarghya Innovations and Technology

- Nano Vacuum Pty Ltd

- LCSC.COM

- Thyracont Vacuum Instruments GmbH

Recent Developments (M&A)

- In August 2023, Frontgrade Technologies announced the successful completion of its acquisition of Aethercomm ,. By merging Aethercomm's expertise in active RF amplifiers, switches, and hardware with Frontgrade's existing antenna solutions, the newly expanded company will deliver a broader range of advanced technologies tailored to meet the complex needs of space and national security missions.