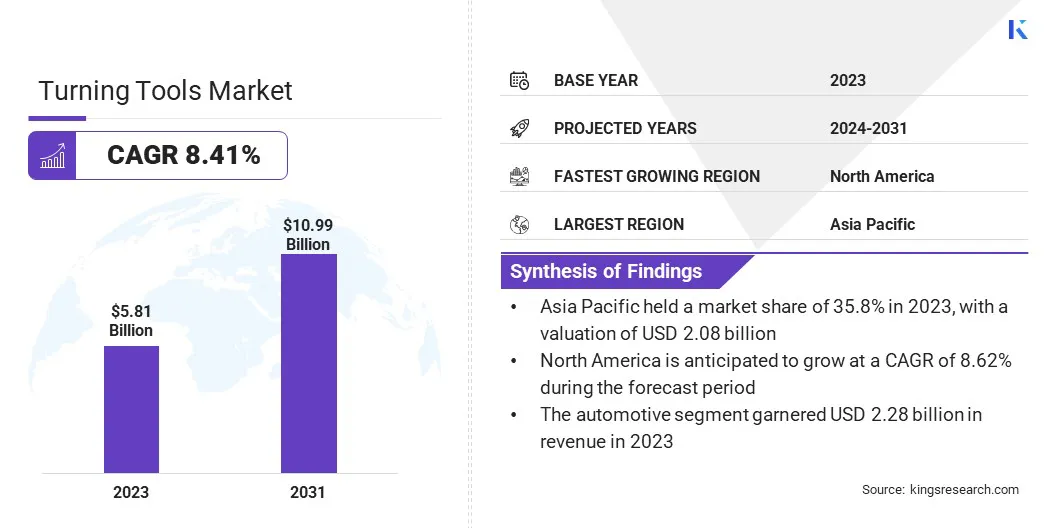

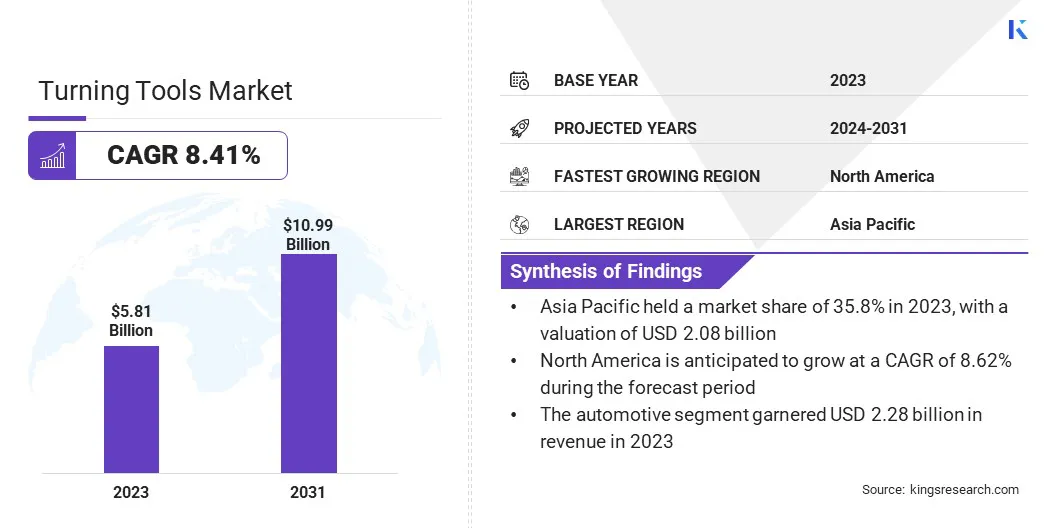

The global Turning Tools Market size was valued at USD 5.81 billion in 2023 and is projected to grow from USD 6.25 billion in 2024 to USD 10.99 billion by 2031, exhibiting a CAGR of 8.41% during the forecast period 2024-2031. The adoption of advanced materials for enhanced performance is a significant trend driving innovation in the market.

In the scope of work, the report includes solutions offered by companies such as Mitsubishi Materials Corporation, KYOCERA Corporation, CERATIZIT S.A., Kennametal Inc., Guhring, Inc., Walter AG, Applitec Moutier SA, Sandvik Coromant, Ingersoll Cutting Tools, SUMITOMO ELECTRIC Hartmetall GmbH, and others.

Traditional materials such as high-speed steel are being increasingly replaced by advanced materials such as carbide, ceramics, and cubic boron nitride (CBN). These materials offer superior hardness, wear resistance, and thermal stability, resulting in longer tool life, improved cutting speeds, and higher machining precision. Carbide inserts, for instance, are renowned for their toughness and versatility, making them ideal for a wide range of machining applications.

Moreover, the development of nanocomposite and nanostructured materials expanding the capabilities of turning tool, enabling manufacturers to achieve unprecedented levels of efficiency and productivity.

As industries demand higher productivity and tighter tolerances, the adoption of advanced materials becomes imperative, prompting manufacturers to invest in research and development to stay competitive in the turning tools market. This trend enhances the performance of turning tools and contributes to overall advancements in manufacturing technology.

Turning tools are essential components in the machining industry, primarily used for shaping and cutting operations on lathe machines. These tools come in various types, including inserts, tool holders, boring bars, and threading tools, each designed for specific applications. Inserts, typically made of carbide or ceramic materials, are replaceable cutting tips mounted on tool holders and are widely used for turning, facing, and grooving operations.

Tool holders secure the inserts and provide stability during machining processes. Boring bars are employed for enlarging existing holes or creating internal features with high precision. Threading tools, on the other hand, are specialized for creating threads on cylindrical work pieces.

Turning tools find applications across a wide range of industries, including automotive, aerospace, construction, medical, and general engineering. In the automotive sector, turning tools are used for manufacturing engine components, transmission parts, and brake systems. Aerospace applications include the production of aircraft components such as landing gear, wing spars, and turbine blades.

In construction, turning tools are utilized for fabricating structural elements and fittings. The medical industry relies heavily on turning tools for producing implants, surgical instruments, and prosthetic devices. Additionally, turning tools play a crucial role in general engineering for producing a diverse array of components used in various machinery and equipment.

Analyst’s Review

The turning tools market is experiencing steady growth due to rapid industrialization, technological advancements, and surging demand from key end-user industries such as automotive, aerospace, and construction. The adoption of advanced materials, integration of IoT and automation, and a notable shift toward sustainable manufacturing practices are shaping the market landscape.

However, challenges such as price volatility of raw materials and intense competition from low-cost manufacturers pose significant hurdles. To navigate these challenges and capitalize on opportunities, key market players are focusing on several strategic imperatives.

Furthermore, an emphasis on after-sales services and customer support is crucial for building long-term relationships and ensuring customer satisfaction. With a proactive approach to innovation and market expansion, key players position themselves to enhance competitiveness and foster sustainable growth in the dynamic market landscape.

The rising adoption of Industry 4.0 technologies is revolutionizing manufacturing processes, including turning operations. Industry 4.0, characterized by the integration of digital technologies with traditional manufacturing processes, offers opportunities for enhanced efficiency, productivity, and flexibility.

In the context of turning processes, the implementation of IoT (Internet of Things) devices and automation systems enables real-time monitoring of machine performance, predictive maintenance, and adaptive machining strategies. IoT sensors collect and transmit data on tool wear, temperature, and vibration, allowing for proactive maintenance and optimization of cutting parameters.

Automation systems, including robotic arms and CNC (Computer Numerical Control) systems, streamline production processes and reduce manual intervention, leading to higher throughput and consistent quality. The price volatility of raw materials presents a significant challenge for companies operating in the market.

Fluctuations in the prices of metals, such as carbide, cobalt, and steel, directly impact manufacturing costs and profit margins. Raw material prices are influenced by various factors, including geopolitical tensions, supply chain disruptions, and currency fluctuations.

Moreover, the growing reliance on imported raw materials adds complexity to pricing strategies and supply chain management. To mitigate the impact of price volatility, companies often engage in forward contracts, hedging strategies, and diversification of suppliers.

Additionally, investments in research and development aimed at alternative materials or process optimization help reduce dependence on volatile raw materials. Despite these challenges, proactive management of raw material costs is essential for maintaining competitiveness and profitability in the market.

The integration of IoT and automation in turning processes is a major trend reshaping the manufacturing landscape. IoT-enabled sensors installed on turning machines collect real-time data on various parameters such as temperature, vibration, and tool wear. This data is then transmitted to centralized systems where it is analyzed using advanced algorithms to optimize cutting parameters, predict maintenance needs, and improve overall process efficiency.

Furthermore, automation technologies, such as robotic arms and CNC systems, automate repetitive tasks by reducing human intervention, minimizing errors, and increasing throughput.

By integrating IoT and automation, manufacturers aim to achieve higher levels of precision, consistency, and productivity in turning processes, leading to improved product quality and reduced production costs. This trend enhances operational efficiency for smart factories where interconnected machines and systems enable agile and responsive manufacturing operations.

Segmentation Analysis

The market is segmented based on type, application, industry, and geography.

By Type

Based on type, the market is categorized into rough turning tools and finish turning tools. The rough turning tools segment captured the largest turning tools market share of 52.28% in 2023.

Rough turning tools are indispensable in initial machining processes, where material removal rates are high, and surface finish requirements are relatively lower compared to finishing operations. Industries such as automotive, aerospace, and heavy machinery rely on rough turning tools for roughing out work pieces before final machining.

Additionally, the increasing adoption of advanced materials such as carbide and ceramic in rough turning inserts has enhanced tool life and machining capabilities, resulting in an increased demand for these tools. Moreover, advancements in cutting tool geometries and coatings have improved cutting performance, thus bolstering the attractiveness of rough turning tools for manufacturers seeking to improve productivity and reduce machining costs.

By Application

Based on application, the market is divided into conventional lathe machines and CNC lathe machines. The CNC lathe machines segment is anticipated to witness the highest growth, depicting a CAGR of 9.07% over the forecast period. The growing demand for precision machining across various industries such as automotive, aerospace, electronics, and medical devices is boosting the adoption of CNC technology.

CNC lathe machines offer superior accuracy, repeatability, and versatility compared to conventional lathe machines, making them ideal for producing complex components with tight tolerances.

Additionally, advancements in CNC technology, such as multi-axis machining and integrated automation features, enhance productivity and operational efficiency. Furthermore, the increasing trend toward digitization and connectivity in manufacturing, often referred to as industry 4.0, is leading to the surging demand for CNC lathe machines equipped with IoT capabilities for real-time monitoring and optimization of machining processes.

By Industry

Based on industry, the turning tools market is classified into automotive, electronics & electrical, aerospace, power & energy, and others. The automotive segment garnered the highest revenue of USD 2.28 billion in 2023. The automotive industry is one of the largest consumers of turning tools, utilizing them for the production of various components such as engine parts, transmission components, brake systems, and chassis components.

The continuous demand for vehicles, attributed to factors such as rapid urbanization, rising disposable incomes, and infrastructure development, fuels the need for machining operations, thereby propelling the demand for turning tools.

Moreover, the automotive industry's increasing focus on lightweight materials, fuel efficiency, and stringent quality standards necessitates advanced machining technologies and high-performance turning tools. Additionally, the adoption of electric vehicles (EVs) and autonomous driving technologies is spurring investment in new manufacturing processes and equipment, thus boosting the demand for turning tools in the automotive sector.

Based on region, the market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia Pacific Turning Tools Market share stood around 35.8% in 2023 in the global market, with a valuation of USD 2.08 billion, primarily fueled by the region's robust industrialization and manufacturing sector. Moreover, the presence of established manufacturing hubs and growing investments in infrastructure projects propelled the demand for machining operations and turning tools.

Additionally, the rapid expansion of end-user industries, coupled with the widespread adoption of advanced manufacturing technologies, contributed to the region's dominance in the market. Furthermore, favorable government policies, initiatives to promote domestic manufacturing, and increasing investments in research and development supported Asia-Pacific market growth.

North America is projected to experience staggering growth at an 8.62% CAGR in the foreseeable future owing to the region's strong presence in industries such as aerospace, automotive, and medical devices, which generate significant demand for turning tools for precision machining applications. Moreover, the increasing adoption of advanced manufacturing technologies, including CNC machining and automation, is fostering the demand for high-performance turning tools in the region.

Additionally, the growing emphasis on reshoring and localization of manufacturing activities, coupled with government incentives to promote domestic manufacturing, is expected to boost domestic market growth. Furthermore, rising focus on innovation, technological advancements, and increased investments in infrastructure contribute to the North America market growth.

Competitive Landscape

The turning tools industry report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

Key Companies in Turning Tools Market

- Mitsubishi Materials Corporation

- KYOCERA Corporation

- CERATIZIT S.A.

- Kennametal Inc.

- Guhring, Inc.

- Walter AG

- Applitec Moutier SA

- Sandvik Coromant

- Ingersoll Cutting Tools

- SUMITOMO ELECTRIC Hartmetall GmbH

The Global Turning Tools Market is Segmented as:

By Type

- Rough Turning Tools

- Finish Turning Tools

By Application

- Conventional Lathe Machines

- CNC Lathe Machines

By Industry

- Automotive

- Electronics & Electrical

- Aerospace

- Power & Energy

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America