Automotive Services Market Size

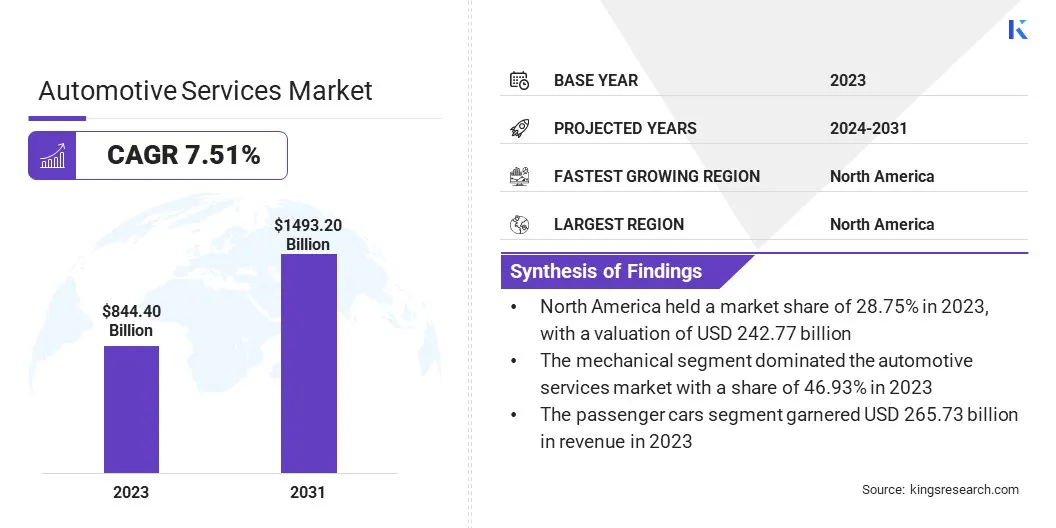

The global Automotive Services Market size was valued at USD 844.40 billion in 2023 and is projected to reach USD 1,493.20 billion by 2031, growing at a CAGR of 7.51% from 2024 to 2031. The automotive services market is witnessing significant growth globally, driven by various factors such as increasing vehicle parking, technological advancements, and changing consumer preferences. In the scope of work, the report includes products offered by companies such as Firestone Complete Auto Care, Robert Bosch Ltd, CarMax Enterprise Services, LLC, Midas International, LLC, Wrench, Inc., Safelite Group, Jiffy Lube International, Inc., M&M Automotive, SUN AUTO SERVICE, MEKO, and others.

In the current market scenario, the demand for automotive services is steadily rising, fueled by the growing need for vehicle maintenance, repair, and aftermarket solutions. With the automotive industry evolving rapidly, particularly with the advent of electric and connected vehicles, the outlook for the automotive services market remains promising. The market is expected to witness continued expansion in the forecast years, supported by the adoption of digitalization, the integration of advanced technologies, and the emergence of new service offerings catering to the evolving needs of consumers and vehicle manufacturers.

Analyst’s Review

The adoption of digitalization and integration of advanced technologies are playing a vital role in shaping the future of the automotive services market. The market outlook for the upcoming years is strongly influenced by the increasing integration of technologies such as artificial intelligence, machine learning, and IoT into automotive service processes.

Digital platforms and mobile applications are expected to become increasingly prevalent, offering seamless service experiences for customers and enabling service providers to optimize their operations. Additionally, the emergence of predictive maintenance solutions empowered by data analytics and connected vehicle technologies is poised to revolutionize the way automotive services are delivered, enhancing efficiency, and reducing downtime for vehicle owners.

Market Definition

Automotive services encompass a wide range of offerings aimed at maintaining, repairing, and enhancing vehicle performance and functionality. Key applications of automotive services include vehicle maintenance and repair, aftermarket parts and accessories, vehicle customization, insurance, financing, and leasing services. These services leverage various technologies and algorithms to identify vehicle issues, perform repairs, and provide personalized solutions tailored to customers' needs. Advanced diagnostic tools, computerized systems, and digital platforms are increasingly utilized to streamline service operations, enhance accuracy, and improve customer satisfaction.

Market Dynamics

Increasing demand for passenger vehicles is expected to foster the growth of the automotive services market. This driver is primarily fueled by several factors such as rising disposable incomes, urbanization, and improving living standards, particularly in emerging economies. As the number of consumers purchasing passenger vehicles rises, the demand for related automotive services, including maintenance, repair, and aftermarket solutions, is projected to increase correspondingly. Moreover, the ongoing technological advancements in passenger vehicles, such as advanced safety features and connectivity solutions, are expected to drive the need for specialized automotive services, thereby contributing to market growth.

Higher charges for vehicle subscription services could potentially hinder the development of the automotive services market. Vehicle subscription models, which offer customers access to vehicles for a fixed monthly fee inclusive of maintenance and other services, may result in higher costs compared to traditional ownership or leasing models. This could deter price-sensitive consumers from opting for automotive services, particularly in regions where affordability is a significant concern. Moreover, the complex pricing structures associated with vehicle subscriptions may pose challenges for service providers in terms of pricing transparency and customer retention.

Segmentation Analysis

The global automotive services market is segmented based on product, age group, distribution channel, and geography.

By Type

Based on type, the market is categorized into maintenance services, mechanical, exterior, and structural. The mechanical segment dominated the automotive services market with a share of 46.93% in 2023 owing to the widespread demand for routine maintenance and repair services for vehicles' mechanical components. This includes services such as oil changes, brake replacements, engine tune-ups, and suspension repairs, which are essential for ensuring the optimal performance and longevity of vehicles. The mechanical segment is characterized by a wide range of service providers, including independent repair shops, dealership service centers, and specialty automotive service chains, catering to diverse customer needs across various vehicle makes and models.

By Service Provider

Based on lifting capacity, the market is divided into franchise general repairs, OEM authorized service centers, local garage, tire stores & repair chains, and others. The local garage segment is expected to witness the fastest growth in the market, depicting a CAGR of 8.33% over the forecast period, mainly attributed to the increasing preference for personalized and convenient vehicle maintenance solutions. Local garages offer proximity and convenience to customers, often providing quick turnaround times and personalized service experiences.

Moreover, local garages are known for their expertise in servicing a wide range of vehicle makes and models, making them a preferred choice for customers seeking specialized or niche automotive services. Additionally, the growing trend towards digitalization and online booking platforms is expected to fuel the growth of local garage businesses, enhancing their visibility and accessibility to customers.

By Vehicle Type

Based on vehicle type, the market is segmented into passenger cars, light commercial vehicles, heavy commercial vehicles, and two wheelers. The passenger cars segment garnered the highest valuation of USD 265.73 billion in 2023 on account of the significant volume of passenger car sales worldwide. Passenger cars represent a substantial portion of global vehicle parking, thereby driving the demand for automotive services such as maintenance, repair, and aftermarket solutions.

Moreover, passenger cars are often used for personal transportation purposes, leading to higher utilization rates, and consequently, a greater need for ongoing maintenance and servicing. The passenger cars segment encompasses a wide range of vehicle types, including sedans, hatchbacks, SUVs, and luxury vehicles, each with distinct service requirements tailored to their respective features and specifications.

Automotive Services Market Regional Analysis

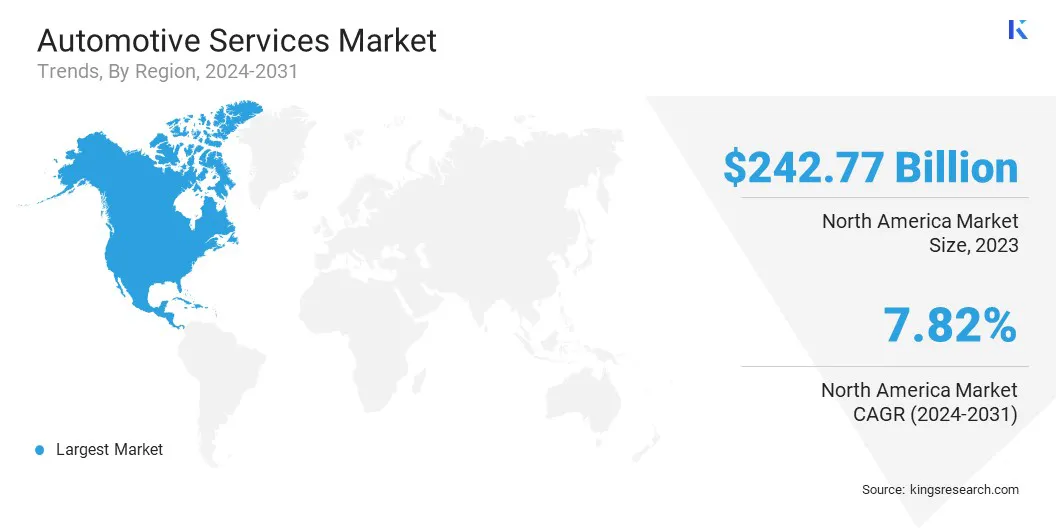

Based on region, the global automotive services market is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

The North America Automotive Services Market share stood around 28.75% in 2023 in the global market, with a valuation of USD 242.77 billion, driven by various factors such as the region's robust aftermarket industry and technological advancements in automotive service solutions. The presence of key automotive manufacturers, service providers, and aftermarket suppliers in North America contributes to the region's market dominance.

Additionally, favorable economic conditions, high disposable incomes, and a strong automotive culture support the demand for automotive services in the region. North America's leading position in automotive innovation and technology adoption positions it as a key market for advanced automotive service offerings, including digitalization, connected vehicle solutions, and electric vehicle services.

Competitive Landscape

The global automotive services market study will provide valuable insights with an emphasis on the fragmented nature of the industry. Major players are focusing on a few strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions. Expansion & investments are the major strategic initiatives adopted by companies in this sector. Industry players are investing heavily in R&D activities, building new manufacturing facilities, and supply chain optimization.

List of Key Companies in Automotive Services Market

Key Industry Developments

- January 2024 (Partnership): Safelite Group acquired Thompson Auto Glass to expand its geographical presence and customer base by offering customers vehicle glass repair services.

- December 2023 (Initiative): MEKO implemented strategic operational enhancements in Norway to drive efficiency gains and elevate service standards. This initiative aimed to streamline processes, enhance productivity, and deliver superior customer service across all operational facets.

The Global Automotive Services Market is Segmented as:

By Type

- Maintenance Services

- Mechanical

- Exterior & Structural

By Service Provider

- Franchise General Repairs

- OEM Authorized Service Centers

- Local Garage

- Tire Stores & Repair Chains

- Others

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Two Wheelers

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America.