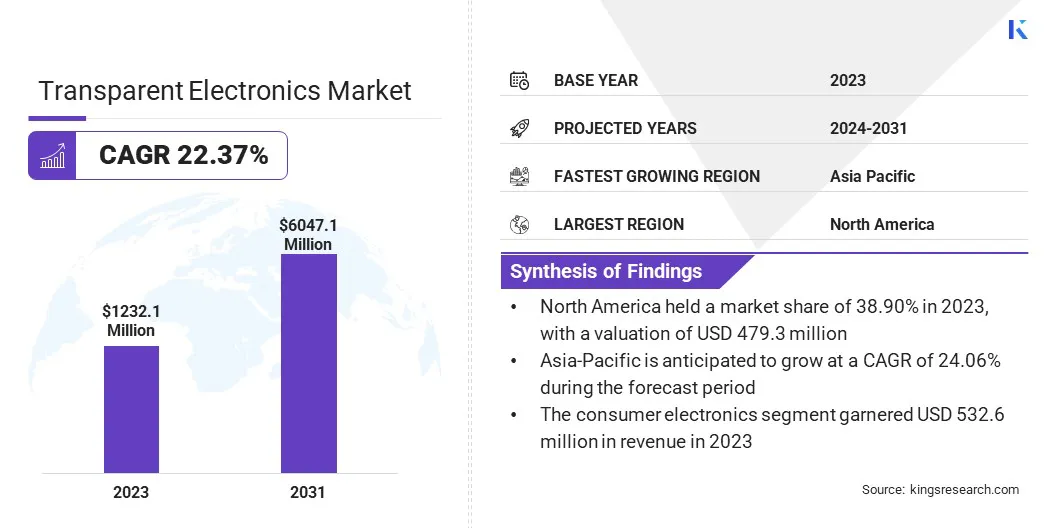

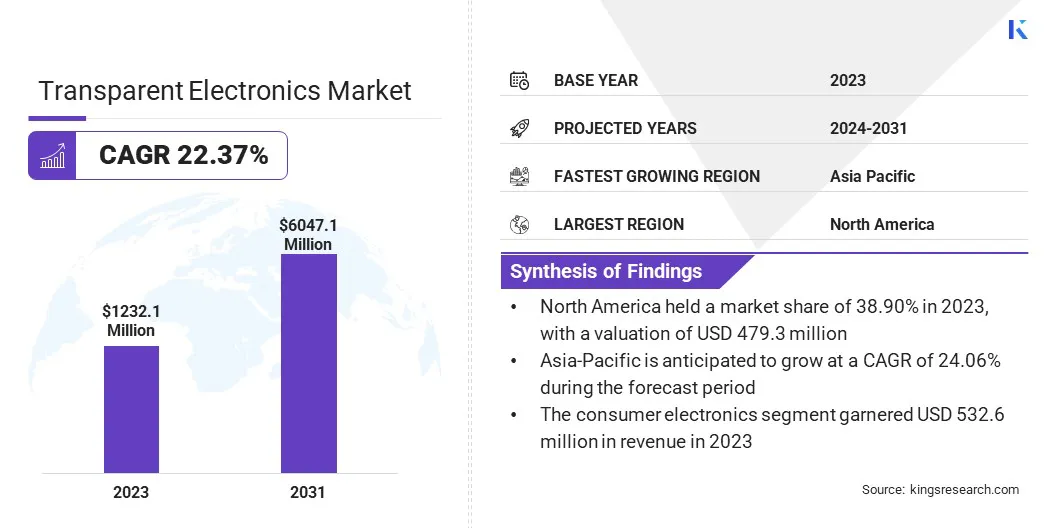

Transparent Electronics Market Size

The global Transparent Electronics Market size was valued at USD 1,232.1 million in 2023 and is projected to grow from USD 1,471.6 million in 2024 to USD 6,047.1 million by 2031, exhibiting a CAGR of 22.37% during the forecast period.The market is rapidly evolving, driven by the rising need for innovative solutions in smart devices and interactive surfaces.

Advances in materials, such as flexible transparent conductors, along with new applications in smart windows and touch-sensitive interfaces, are contributing to the expansion of the market. Increased investments in R&D are enhancing the functionality and affordability of transparent electronics, thereby supporting market growth.

In the scope of work, the report includes solutions offered by companies such as BOE Technology Group Co., Ltd., BRITESOLAR, ClearLED, Inc., Corning Incorporated, LG Electronics Inc., AuroLED, Nexnovo, STREET CO, UbiQD, Inc., Panasonic Corporation, and others.

The increasing demand for seamless integration of technology with visibility, coupled with advancements in materials science, is fueling market expansion. Furthermore, a surge in demand for advanced display technologies across diverse sectors, including consumer electronics, automotive, and advertising, is propelling the growth of the transparent electronics market.

- For instance, in January 2024, LG Electronics introduced the world’s first wireless transparent OLED TV at CES 2024. The LG SIGNATURE OLED represents a a significant technological breakthrough, featuring a transparent 4K OLED screen paired with LG’s wireless video and audio transmission technology, thereby enhancing the viewing experience to new heights.

This innovation highlights the potential of transparent electronics to transform various applications, fueling market growth and facilitating advancements and adoption in the coming years.

Transparent electronics refer to electronic devices and components that incorporate materials allowing light to pass through while simultaneously performing electrical functions. These devices use advanced materials such as transparent conductive oxides and flexible polymers to create screens, sensors, and circuits that are both see-through and functional.

Transparent electronics enable the development of innovative applications, including transparent displays, smart windows, and augmented reality interfaces, by combining visibility with technological capabilities. This innovative approach enhances user interaction and integration with various environments, offering versatile solutions for consumer electronics, automotive, and architectural applications. The development of transparent electronics aims to seamlessly integrate functionality with aesthetics.

Analyst’s Review

Advancements in material science are supporting the development of the transparent electronics market. Companies and researchers are continuously improving materials that offer both transparency and high electrical conductivity.

- For instance, in December 2023, LG Electronics showcased its transparent antenna for vehicles at CES 2024. This innovation, developed in collaboration with the esteemed French glass manufacturer Saint-Gobain Sekurit, features LG’s transparent film and Tina, which adheres directly to glass. This cutting-edge telematics technology is poised to revolutionize the mobility sector and reinforce LG’s presence in the automotive solutions market.

These advancements by key industry players, such as innovative materials and cutting-edge technologies, are set to bolster market growth in the forthcoming years. By enhancing functionality and expanding applications, these developments are likely to position the market for significant expansion in the coming years.

Transparent Electronics Market Growth Factors

The surge in demand for advanced display technologies, such as heads-up displays and transparent screens, is fostering the growth of the market. As industries such as consumer electronics and automotive increasingly require these innovative solutions for enhanced functionality and unobstructed visibility, manufacturers are prioritizing the development of high-performance transparent components.

This increased demand stimulates further investment in research and development, which leads to technological advancements and cost reductions. The expansion of application areas and continuous innovation in transparent electronics contribute to robust market growth. A major challenge hampering the growth of the transparent electronics market is the high production cost associated with advanced materials and manufacturing technologies. These costs limit market growth by making transparent displays less accessible and affordable for a wide range of applications.

This price barrier particularly affects consumer electronics and other price-sensitive sectors. To mitigate these challenges, key players are focusing on research and development to develop cost-effective materials and improve manufacturing processes. Strategic collaborations aim to enhance production efficiency and reduce costs, while technological advancements and economies of scale are expected to gradually make transparent electronics more affordable.

Transparent Electronics Market Trends

Innovations in transparent conductive materials, such as enhanced transparent conductive oxides and flexible polymers, are aiding the growth of the transparent electronics market. These advancements are improving the performance, durability, and scalability of transparent electronics, making them increasingly viable for a range of applications.

Enhanced conductive materials offer improved electrical performance while maintaining transparency Additionally, flexible polymers enable new design possibilities and facilitate integration into various surfaces. These technological improvements reduce production costs and enhance the feasibility of transparent electronics, thereby increasing their appeal and applicability across diverse sectors such as consumer electronics, automotive, and building-integrated photovoltaics.

The rising trend toward integrating AMOLED (Active Matrix Organic Light Emitting Diode) panels in smartphones is influencing the market. With AMOLED being a prominent subset due to its superior attributes, including reduced thickness and enhanced brightness. Mobile manufacturers are increasingly adopting AMOLED technology to create transparent displays, leveraging its ability to deliver high-quality visuals while maintaining a slim design.

- For instance, in January 2023, Samsung Electronics introduced its latest Neo QLED, MICRO LED, and Samsung OLED series, along with new lifestyle products and accessories, ahead of CES 2023. This collection showcased cutting-edge technology and emphasized improvements in connectivity and personalized user experiences.

This shift reflects the industry's growing focus on innovating user interfaces and expanding the functionality of smartphones, positioning AMOLED as a key technology in the evolving landscape of transparent display solutions.

Segmentation Analysis

The global market is segmented based on application, product, and geography.

By Application

Based on application, the market is categorized into consumer electronics, automotive, architectural, healthcare, retail, and others. The consumer electronics segment led the transparent electronics market in 2023, reaching a valuation of USD 532.6 million.

Increasing consumer demand for advanced, aesthetically pleasing devices is prompting manufacturers to integrate transparent electronics into smartphones, tablets, and wearables. Transparent displays offer unique features such as enhanced interactivity and design flexibility, which are particularly appealing to tech-savvy consumers.

Moreover, the integration of transparent electronics in consumer devices enables new applications, such as augmented reality and immersive user experiences. As companies continue to innovate and develop more cost-effective solutions, the consumer electronics segment is expected to witness substantial expansion in the forthcoming years.

By Product

Based on product, the market is categorized into transparent display, transparent solar panels, smart windows, and other products. The transparent display segment captured the largest transparent electronics market share of 45.89% in 2023.

Transparent displays, which offer unique features such as enhanced visual appeal and interactivity, are gaining immense traction in consumer electronics, automotive, and advertising industries. Innovations in transparent conductive materials and flexible display technologies are improving performance and reducing costs, making these displays more accessible and versatile.

- For instance, in September 2023, Meta Materials Inc. and Panasonic Industry announced a strategic collaboration to advance transparent conductive materials. This partnership aims to enhance the supply of NANOWEB films and boost the growth of the transparent electronics market. Their joint effort is expected to introduce new applications, including transparent film antennas and heaters, to the automotive and consumer electronics sectors.

As the technology continues to advance and become more cost-effective, the range of its applications is expanding, which in turn boosts market growth. The increasing integration of transparent displays into products such as smartphones, smart windows, and digital signage is expected to bolster segmental growth.

Transparent Electronics Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America transparent electronics market share stood around 38.90% in 2023 in the global market, with a valuation of USD 479.3 million. The region's strong focus on research and development, leading to significant advancements in transparent conductive materials and display technologies, is expected to propel regional market growth.

The presence of major technology companies and research institutions fuels innovation, while growing applications in consumer electronics, automotive, and smart technologies boost domestic market growth.

- For instance, in August 2022, Andersen Corporation and Ubiquitous Energy announced a collaboration to develop innovative energy-generating windows and doors. This partnership aims to revolutionize solar technology for residential and light commercial buildings, marking a significant advancement in transparent electronics. The joint effort is expected to support the expansion of the North American market by integrating cutting-edge transparent solar technology into everyday building products, thereby enhancing energy efficiency and sustainability in the region.

Additionally, rising consumer interest in interactive and aesthetically advanced devices is propelling the growth of the regional market.

Asia Pacific is anticipated to witness robust growth at a staggering CAGR of 24.06% over the forecast period, mainly due to rapid technological advancements and growing industrial applications.

Countries such as China, Japan, and South Korea are at the forefront of developing innovative transparent display technologies, supported by substantial investment in R&D and manufacturing capabilities. Increasing adoption of transparent electronics in consumer electronics, automotive, and smart infrastructure is further fueling regional market growth.

- For instance, in November 2023, BOE Technology Group, a leading Chinese panel supplier, announced its plans to invest USD 8.84 billion in constructing a advanced production facility for advanced OLED screens. This significant investment underscores the rapid technological advancements in the Asia-Pacific region and highlights the growing focus on transparent electronics.

Additionally, government initiatives that promote green technologies and sustainable solutions are enhancing market potential. Thi rising demand for advanced, functional displays and smart window applications is fostering regional market expansion.

Competitive Landscape

The global transparent electronics market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Transparent Electronics Market

Key Industry Development

- January 2024 (Product launch): Samsung unveiled its Transparent MICRO LED display at the Samsung First Look event preceding CES 2024 in Las Vegas. This advanced display, the result of six years of research and development, which gained indiciduals attention due to its crystal-clear, glass-like screen and innovative design. The reveal garnered significant global attention, showcasing a revolutionary advancement in the market.

The global transparent electronics market is segmented as:

By Application

- Consumer Electronics

- Automotive

- Architectural

- Healthcare

- Retail

- Others

By Product

- Transparent Display

- Transparent Solar Panels

- Smart Windows

- Other Products

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America