Market Definition

The market is focused on the production of transmission fluids and specialized lubricants essential for the smooth operation of vehicle transmission systems. These systems can be automatic, manual, or dual-clutch, and are responsible for transferring power from the engine to the wheels by regulating gear shifts.

Transmission fluids play a critical role in cooling, lubricating, and protecting internal components. They ensure optimal performance, efficiency, and longevity of the transmission system. The report highlights key market drivers, major trends, regulatory frameworks, and the competitive landscape shaping the industry’s growth.

Transmission Fluid Market Overview

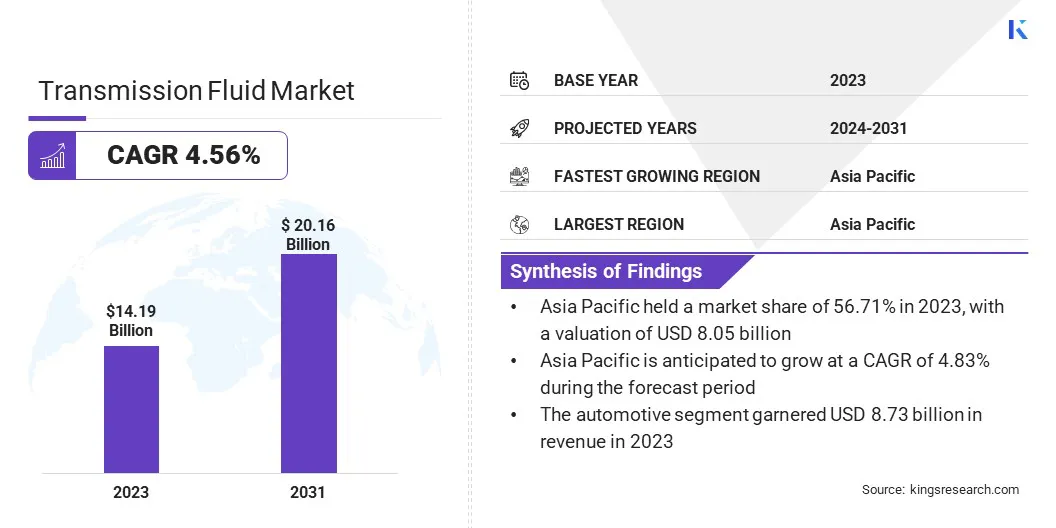

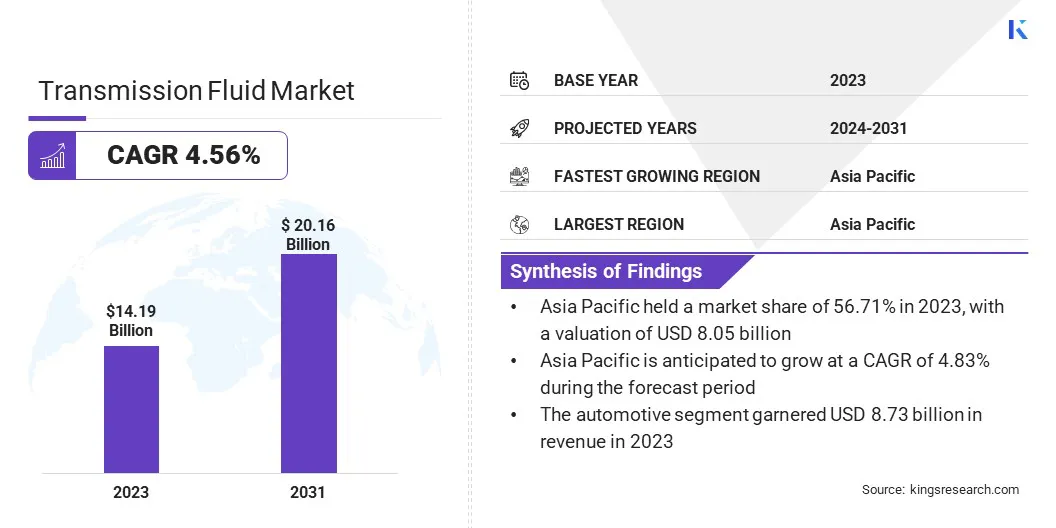

The global transmission fluid market size was valued at USD 14.19 billion in 2023, which is estimated to be valued at USD 14.76 billion in 2024 and reach USD 20.16 billion by 2031, growing at a CAGR of 4.56% from 2024 to 2031.

Rising demand for enhanced vehicle performance and fuel efficiency is driving the adoption of premium transmission fluids. OEMs and end-users are increasingly opting for advanced formulations that ensure smoother gear shifts and contribute to better mileage and durability.

Major companies operating in the transmission fluid industry are Exxon Mobil Corporation, Shell International B.V., BP, TotalEnergies, Chevron Corporation, FUCHS, Valvoline Global Operations, LUKOIL, MOTUL S.A., BASF, Barat Lubricants, Nexton Lubricants, Castrol Limited, Gulf Oil International Ltd and Manak Petro Chem.

The market is driven by the rising demand for efficient vehicle performance, durability, and smooth gear shifting across various types of transmissions, such as automatic, manual, and continuously variable systems.

Increasing global vehicle production, technological advancements in drivetrain systems, and growing awareness about preventive vehicle maintenance are key factors fueling market growth. The market also benefits from the shift toward synthetic fluids. These fluids offer better thermal stability, wear protection, and fuel efficiency, which support longer transmission life and improved performance.

- In November 2024, AMSOIL expanded its product lineup by introducing two new drivetrain products: Signature Series Ultra-Low Viscosity 100% Synthetic Automatic Transmission Fluid (ATF) and the SEVERE GEAR 75W-85 100% Synthetic Extreme-Pressure Gear Lube.These products are designed for high-performance and severe-duty vehicle applications, offering superior protection against heat, pressure, and wear.

Key Highlights:

- The global transmission fluid industry size was valued at USD 14.19 billion in 2023.

- The market is projected to grow at a CAGR of 4.56% from 2024 to 2031.

- Asia Pacific held a market share of 56.71% in 2023, with a valuation of USD 8.05 billion.

- The manual transmission fluids segment garnered USD 5.70 billion in revenue in 2023.

- The automotive segment is expected to reach USD 12.61 billion by 2031.

- North America is anticipated to grow at a CAGR of 4.65% during the forecast period.

Market Driver

Performance & Fuel Efficiency Needs

In today’s automotive landscape, performance and efficiency are priorities for vehicle manufacturers and consumers. As a result, there is a growing preference for high-quality transmission fluids that offer superior thermal stability, reduced friction, and smoother gear transitions.

These fluids not only improve the driving experience but also support fuel economy by minimizing energy losses within the transmission system. With OEMs focused on meeting stringent efficiency standards, and drivers expecting longer vehicle life, this trend is significantly fueling growth in the market.

- In June 2024, Granville Oil & Chemicals launched four fully synthetic variants, MTF FS 70W, MTF FS 75W/85, EP 75W/85, and MTF FS 75W/90, designed for enhanced gear protection, thermal stability, and fuel efficiency across a wide range of vehicle transmissions.

Market Challenge

Lack of Standardization

The market faces challenges due to the lack of standardization across different regions and vehicle specifications. A wide range of fluid requirements from automakers and markets lead to complexities in product development, production costs, and global distribution.

To tackle this, manufacturers in the transmission fluid market should focus on fluid formulations that can meet multiple standards. Additionally, investing in research and collaborating with OEMs and global standard-setting bodies can help streamline product development, ensuring compatibility and market access worldwide.

Market Trend

Ultra-Low Viscosity Fluids

The market is focused on the demand for ultra-low viscosity fluids. These fluids are crucial for supporting the latest generation of automatic transmissions, which require lower viscosity for enhanced fuel efficiency, smoother shifting, and improved overall performance.

The market is growing as modern transmission systems become more complex, especially in vehicles with multiple gears or hybrid/electric models. Ultra-low viscosity fluids are key in this evolution. They ensure optimal lubrication by reducing friction, leading to smoother driving experiences. At the same time, these fluids meet the technical requirements of advanced automotive technologies, supporting the market's growth..

- In June 2023, MPM Oil Company introduced an ultra-low viscosity automatic transmission fluid, the 16000ULV ATF. Designed for modern and high-performance transmissions, like those in the Ford Mustang Mach-E and hybrid models, this fluid is ideal for vehicles requiring advanced Automatic Transmission Fluids (ATFs) with lower viscosity, ensuring smoother performance and better fuel efficiency.

Transmission Fluid Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Automatic Transmission Fluids, Manual Transmission Fluids, Dual Clutch Transmission Fluids, Continuously Variable Transmission Fluids

|

|

By Application

|

Automotive, Off-Road Vehicles

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product (Automatic Transmission Fluids, Manual Transmission Fluids, Dual Clutch Transmission Fluids, Continuously Variable Transmission Fluids): The manual transmission fluids segment earned USD 5.70 billion in 2023, due to the increased demand for fuel-efficient vehicles and advancements in transmission technologies.

- By Application (Automotive, Off-Road Vehicles): The automotive segment held 61.51% of the market in 2023, due to the growing need for advanced transmission fluids in modern vehicles and the expansion of electric vehicle production.

Transmission Fluid Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The Asia Pacific transmission fluid market share stood at around 56.71% in 2023 in the global market, valued at USD 8.05 billion. Asia Pacific has emerged as the dominant region in the market due to the rapidly expanding automotive industry, particularly in China, Japan, and India.

The region’s high vehicle production rates, increasing demand for commercial and passenger vehicles, and a growing preference for advanced transmission technologies contribute to its leadership. Additionally, the rise of electric and hybrid vehicles in Asia Pacific boosts the need for specialized transmission fluids, reinforcing the region's significant market share and growth potential.

The North America market is poised for significant growth at a CAGR of 4.65% over the forecast period. North America is experiencing rapid growth in the transmission fluid industry, driven by an increase in vehicle production and the adoption of advanced transmission technologies.

The demand for high-performance and energy-efficient fluids is rising as automakers are focusing on improving fuel economy and transmission durability.The growth of hybrid and electric vehicles is further expanding the market for specialized transmission fluids, creating significant opportunities for manufacturers. The region's evolving automotive landscape is expected to continue fueling the market's growth in the coming years.

- In June 2024, ENEOS USA Inc. partnered with Mighty Auto Parts to expand its distribution of high-quality motor oils and transmission fluids across the U.S. and Ontario. This collaboration makes ENEOS's premium products, including 0W-8 Motor Oil and ECO CVT Fluid, available for more customers, enhancing their vehicle service offerings.

Regulatory Frameworks

- In India, the Bureau of Indian Standards (BIS) prescribes requirements, sampling methods, and testing for gear lubricants used in worm gear drives, specifying eleven viscosity grades based on the prescribed viscosity limits.

- In the U.S., the American Petroleum Institute (API) sets lubricant service designations for automotive manual transmissions, transaxles, and axles. These designations, such as API GL-4 and API GL-5, specify performance requirements for various gear lubricants based on their operating conditions like speed, load, and torque.

Competitive Landscape:

Companies in the transmission fluid market are focusing on developing advanced fluids to meet the growing demands for the latest vehicle technologies, such as electric vehicles and automated transmissions. Investments in research and development are being made to enhance fluid performance, ensure improved fuel efficiency, durability, and smoother operation.

Additionally, companies are adapting to stricter environmental standards by formulating products with reduced environmental impact and increasing compatibility with diverse transmission systems.

- In August 2024, LUKOIL started the production of specialized transmission fluids for electric vehicles, marking a significant step as the first national producer in Russia. Their E-FLUID 301 ensures optimal performance for electric cars with direct motor-transmission contact, meeting international standards and meeting global automotive manufacturers’ needs.

List of Key Companies in Transmission Fluid Market:

- Exxon Mobil Corporation

- Shell International B.V.

- BP

- TotalEnergies

- Chevron Corporation

- FUCHS

- Valvoline Global Operations

- LUKOIL

- MOTUL S.A.

- BASF

- Barat Lubricants

- Nexton Lubricants

- Castrol Limited

- Gulf Oil International Ltd

- Manak Petro Chem

Recent Developments (Product Launch)

- In November 2024, TotalEnergies launched Fluidsyn ATF/CVT, a fully synthetic transmission fluid, designed for automatic and continuously variable transmission systems. This fluid enhances fuel economy, extends lifespan, and provides optimal protection. It simplifies inventory management by covering over 95% of light vehicles,ensuring high performance under harsh conditions..

overall