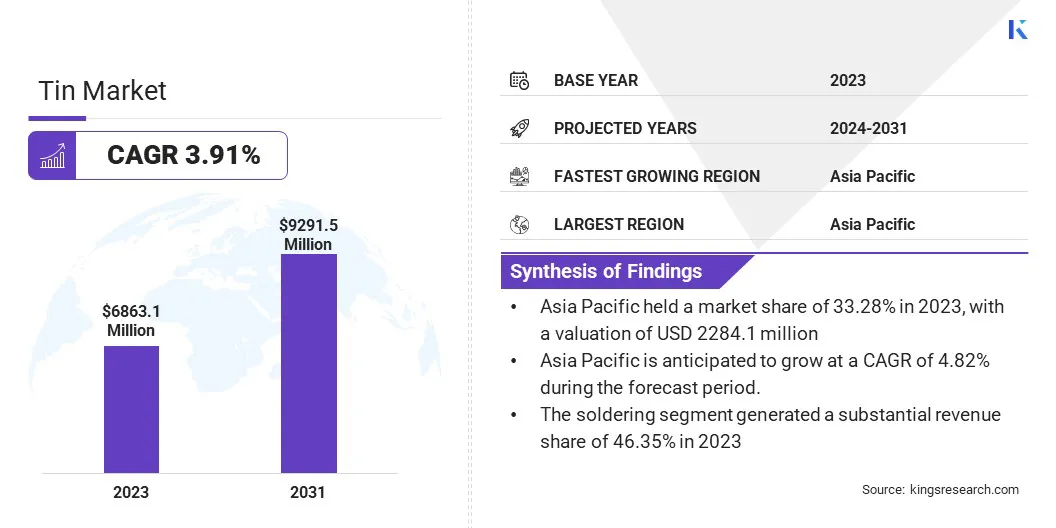

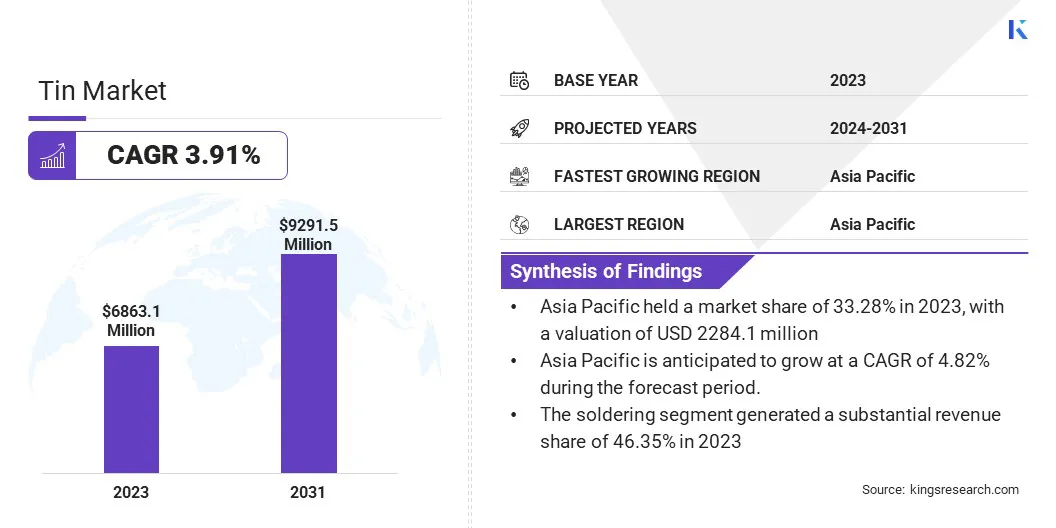

Tin Market Size

The global Tin Market size was valued at USD 6,863.1 million in 2023 and is projected to reach USD 9,291.5 million by 2031, growing at a CAGR of 3.91% from 2024 to 2031. In the scope of work, the report includes products offered by companies such as Yunnan Tin Group, PT Timah, Minsur, Malaysia Smelting Corporation Berhad, Thaisarco, Aurubis AG, Guangxi China Tin, Belmont Metals, Zenith Tins Pvt. Ltd., Swastik Tins Pvt. Ltd. and Others.

The global tin market is primarily supplied by a handful of key producing countries, including Indonesia, China, Myanmar, and Peru, which are among the largest producers. The demand for tin is driven by its diverse applications across industries. In the electronics sector, tin is a critical component in soldering, which is used for joining electronic components in devices ranging from consumer electronics to automotive electronics.

The packaging industry relies heavily on tinplate for food and beverage cans due to its corrosion resistance and ability to preserve contents. Additionally, tin alloys find applications in automotive parts, construction materials, and various consumer goods. Several trends are shaping the tin industry's growth trajectory.

Technological advancements in electronics are impelling the demand for tin in soldering applications, particularly with the proliferation of electronic devices and the growth of sectors such as electric vehicles and renewable energy systems.

Sustainability concerns are prompting companies to explore recycled tin sources and adopt environment friendly mining practices. These trends are leading to increased investments in research and development to improve the efficiency of tin extraction and processing methods. As a result, the tin industry is expected to witness steady growth in the coming years, with a rising focus on sustainable practices and innovation to meet the evolving needs of various sectors.

Analyst’s Review

Technological advancements in tin mining, processing, and recycling are improving efficiency, reducing costs, and minimizing environmental impact. Innovations in extraction methods, ore beneficiation, and metallurgical processes are enhancing tin recovery rates and expanding the resource base.

Additionally, advancements in recycling technologies are enabling the recovery of tin from end-of-life products and scrap materials. These advancements contribute not only to the sustainability of the tin industry but also help alleviate concerns over the depletion of tin reserves. Furthermore, the development of more efficient recycling processes reduces the need for new mining activities, thereby minimizing the overall environmental footprint of the tin industry.

Market Definition

Tin is a metallic chemical element with the symbol Sn and atomic number 50. It belongs to the carbon group of elements on the periodic table. Tin is a soft, malleable, and ductile metal with a silvery-white appearance when freshly cut, but it quickly tarnishes to a dull grayish color when exposed to air.

Tin is distinguished by several significant characteristics, notably its relatively low melting point of 231.93 degrees Celsius (449.47 degrees Fahrenheit). This property has historically rendered tin a popular choice for a range of uses, such as safeguarding against corrosion by applying tin plating on metals, incorporating it as an alloy component, and employing it in soldering applications.

Tin is relatively non-toxic and exhibits low chemical reactivity, making it suitable for use in food packaging and as a component in various consumer products. Additionally, tin's low melting point makes it convenient for casting and shaping into various forms.

Additionally, tin is known for its ability to resist corrosion, which has led to its extensive use in the production of cans for food and beverages. Furthermore, its non-toxic nature makes it an ideal choice for lining food containers, ensuring the safety of the stored products. Overall, tin's unique combination of properties has made it a valuable material across a wide range of industries.

Tin Market Dynamics

The electronics industry heavily relies on tin as a crucial component, mainly in the form of solder. The ever-growing tin market for electronic devices such as smartphones, tablets, laptops, and automotive electronics fuels the necessity for tin solder, which plays a vital role in connecting electronic components.

Advancements in technology, such as the emergence of 5G infrastructure, electric vehicles, and Internet of Things (IoT) devices, are contributing significantly to the expansion of the electronics sector and subsequently increasing the demand for tin.

Moreover, the rising inclination toward making electronics smaller in size has necessitated the utilization of smaller and more intricate components. This, in turn, calls for soldering techniques that are precise and dependable. Tin solder is favored for such purposes due to its low melting point and exceptional ability to spread and adhere to surfaces.

Additionally, the increasing emphasis on embracing environment-friendly manufacturing methods has resulted in the development of solder without lead, thereby increasing the demand for tin as a replacement for lead-containing solder in electronic manufacturing. As a result, the electronics industry is expected to continue playing a significant role in driving the demand for tin in the foreseeable future.

The supply of tin in the market is restricted due to several factors, including the scarcity of primary tin producers and geological limitations affecting tin deposits. Countries such as Indonesia and Myanmar, which are major tin producers, may face supply disruptions due to regulatory changes, political instability, or depletion of resources. Furthermore, difficulties in accessing new reserves and rising production costs contribute to the limited supply of tin.

As a result, the prices of tin have risen, attracting traders and investors who view it as a potentially profitable investment. Furthermore, the increasing need for tin in diverse sectors such as electronics and packaging intensifies the imbalance between supply and demand.

Due to a scarcity of primary tin producers and the difficulties associated with discovering new reserves, it is indispensable for market participants to investigate alternative tin sources, such as recycling and secondary production, in order to address the expanding demand and establish tin market stability.

Segmentation Analysis

The global tin market is segmented based on type, application, end use industry, and geography.

By Type

By type, it is bifurcated into metal, alloy, and compounds. The metal segment registered a significant revenue share of 41.24% in 2023. This segmental growth can be attributed to the high demand for tin metal in various industries such as electronics, automotive, and packaging. Additionally, metal is highly favored for its superior properties of corrosion resistance, malleability, and low toxicity, making it a preferred choice for manufacturers across different sectors.

For instance, in the electronics industry, tin metal is widely used as solder for circuit boards due to its excellent conductivity and ability to form strong bonds. In the automotive industry, tin is used in the production of parts such as bearings and bushings, where its corrosion resistance ensures durability and longevity.

Moreover, in the packaging industry, tin is favored for canning food and beverages as it provides a protective barrier against moisture and oxygen, preserving the quality of the products.

By Application

By application, it is bifurcated into soldering, tinplate, chemicals, and others. The soldering segment generated a substantial revenue share of 46.35% in 2023 due to the increasing demand for soldering materials in the electronics industry, especially with the rise of consumer electronics and the growing adoption of advanced technologies such as IoT and 5G.

The soldering process plays a crucial role in ensuring reliable connections and efficient circuitry assembly, driving the demand for tin in this segment. Additionally, the automotive sector is expected to contribute to the growth of the soldering segment, as tin is widely used in the manufacturing of automotive components and wiring systems.

By End Use Industry

By end use industry, it is bifurcated into electronics, packaging, automotive, and others. The electronic industry accounted for a lion’s share of 41.08% in 2023. This significant in market share is fueled by the growing demand for electronic devices such as smartphones, laptops, and tablets.

With the rapid advancements in technology and the increasing reliance on electronic gadgets, the demand for tin as a key component in electronic circuits and soldering materials is projected to continue its upward trend. For instance, the increasing popularity of smartphones has led to a higher demand for tin in the production of circuit boards and connectors.

Additionally, the rise in remote work and online learning during the COVID-19 pandemic has boosted the sales of laptops and tablets, thereby driving the need for tin in their manufacturing processes. As a result, the electronic industry is expected to remain the dominant consumer of tin in the coming years.

Tin Market Regional Analysis

Based on region, the global tin market is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

The Asia Pacific Tin Market share stood around 33.28% in 2023 in the global market, with a valuation of USD 2284.1 million. This dominance is mainly boosted by the rapid industrialization and infrastructure development in countries such as China and India. Moreover, the increasing demand for tin in the electronics industry and the booming automotive sector have bolstered domestic market growth, solidifying its position as the leading region in the tin market.

However, the region is projected to exhibit a rapid growth rate of 4.82% over the forecast period, fueled by the rising consumption of tin in the packaging industry, along with the increasing use of tin in solar panels and batteries.

Additionally, the implementation of favorable government policies and initiatives to promote sustainable energy sources and reduce carbon emissions is expected to drive the demand for tin in the Asia Pacific region. Given these factors, Asia Pacific is estimated to continue to experience significant growth in the forthcoming years.

Competitive Landscape

The global tin market study will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their tin market shares across different regions.

Expansion & investments are the major strategic initiatives adopted by companies in this sector. Industry players are investing extensively in R&D activities, building new manufacturing facilities, and supply chain optimization.

List of Key Companies in Tin Market

- Yunnan Tin Group

- PT Timah

- Minsur

- Malaysia Smelting Corporation Berhad

- Thaisarco

- Aurubis AG

- Guangxi China Tin

- Belmont Metals

- Zenith Tins Pvt. Ltd.

- Swastik Tins Pvt. Ltd.

Key Industry Developments

- September 2023 (Investment) - Minsur, a Peruvian mining company, outlined its intention to increase copper and tin production in the country by investing a minimum of $2 billion (7.39 billion sol) over the following five-year period.

The Global Tin Market is Segmented as:

By Type

By Application

- Soldering

- Tinplate

- Chemicals

- Others

By End Use Industry

- Electronics

- Packaging

- Automotive

- Others

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America.