Market Definition

The market encompasses the development, manufacturing, and integration of devices that detect angular movement relative to gravity. These sensors operate based on technologies such as electrolytic, capacitive, and MEMS (Micro-Electro-Mechanical Systems), providing output used in real-time positioning and stability monitoring.

Enclosed in durable housings, tilt sensors are formulated to withstand diverse environmental conditions, including vibration, temperature fluctuations, and moisture. The report outlines primary drivers of market growth, along with an in-depth analysis of emerging trends and evolving regulatory frameworks shaping the industry's trajectory.

Tilt Sensor Market Overview

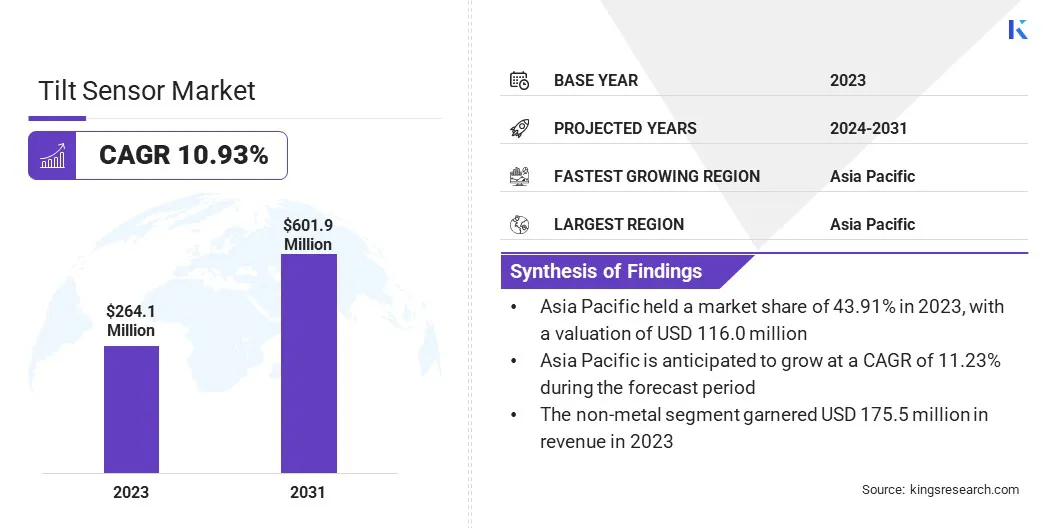

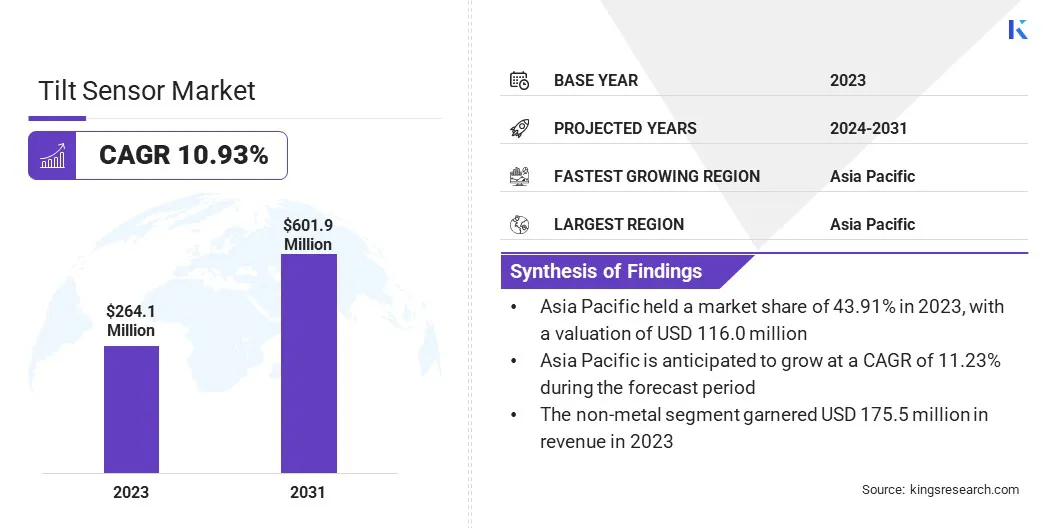

The global tilt sensor market size was valued at USD 264.1 million in 2023 and is projected to grow from USD 291.2 million in 2024 to USD 601.9 million by 2031, exhibiting a CAGR of 10.93% during the forecast period.

Market growth is fueled by rising investments in smart infrastructure and urban development, which require precise monitoring systems for structural health and machinery alignment. Additionally, growing demand for enhanced vehicle safety and stability systems in modern automotive applications is accelerating the adoption of advanced tilt sensing technologies.

Major companies operating in the tilt sensor industry are TE Connectivity, Murata Manufacturing Co., Ltd., Sick AG, Analog Devices, Inc., Bosch Sensortec GmbH, Honeywell International Inc., Curtiss-Wright Corporation, elobau GmbH & Co KG, STMicroelectronics, Texas Instruments Incorporated, Balluff ApS, Level Developments Ltd., Baumer, TDK Corporation, and Pepperl+Fuchs Vertrieb GmbH & Co. Kg.

Infrastructure safety is becoming a priority globally, leading to wider deployment of tilt sensors in buildings, bridges, dams, and tunnels. These sensors provide continuous monitoring of structural alignment and detect early signs of instability or deformation.

Civil engineers are integrating tilt sensors into structural health monitoring systems to reduce risks and improve maintenance planning. With rising investments in smart infrastructure and urban development, the role of tilt sensors in ensuring structural integrity is fostering market expansion.

Key Highlights:

- The tilt sensor industry size was recorded at USD 264.1 million in 2023.

- The market is projected to grow at a CAGR of 10.93% from 2024 to 2031.

- Asia Pacific held a share of 43.91% in 2023, valued at USD 116.0 million.

- The non-metal segment garnered USD 175.5 million in revenue in 2023.

- The MEMS segment is expected to reach USD 371.8 million by 2031.

- The construction & Mining segment secured the largest revenue share of 39.67% in 2023.

- North America is anticipated to grow at a CAGR of 11.05% over the forecast period.

Market Driver

Rising Demand for Enhanced Vehicle Safety and Stability Systems

The growth of the market is fostered by the increasing integration of tilt sensors in modern vehicles to improve safety and ride stability. These sensors assist in rollover prevention, suspension monitoring, and adaptive braking systems.

Automotive manufacturers are deploying tilt sensing technologies across passenger and commercial vehicles to meet evolving safety standards and consumer expectations. With continuous advancements in electric and autonomous vehicles, the need for real-time tilt monitoring is growing.

- In November 2024, Murata Manufacturing Co., Ltd. launched the SCH1633-D01, a Six-Degrees-of-Freedom (6DoF) sensor featuring integrated tilt sensing functions. Engineered specifically for automotive applications, the sensor delivers essential orientation data to support vehicle stability and safety in systems such as autonomous driving and advanced driver-assistance systems (ADAS). Its high-precision capabilities contribute to improved performance in next-generation vehicles.

Market Challenge

Sensor Performance Degradation in Harsh Environments

A significant challenge hindering the growth of the tilt sensor market is performance degradation under extreme environmental conditions, including high humidity, temperature fluctuations, and mechanical vibrations. These factors affect accuracy and long-term reliability, particularly in heavy industrial and off-highway applications.

To address this challenge, companies are focusing on robust sensor designs with enhanced sealing technologies, protective enclosures, and advanced compensation algorithms. Ongoing R&D investments are being directed toward materials and circuit designs that ensure stability and precision in challenging environments, allowing tilt sensors to meet the rigorous demands of modern automotive, construction, and industrial systems.

Market Trend

Industrial Automation and Smart Factory Implementation

The rapid advancement of Industry 4.0 and the adoption of smart manufacturing processes are contributing to the growth of the market. Tilt sensors are essential for machine safety, angular displacement detection, and structural positioning in automated environments.

With factories transitioning to data-driven operations and predictive maintenance models, the incorporation of tilt sensors into industrial systems is rising. This shift is boosting the adoption of sensors across the automotive, packaging, and semiconductor manufacturing sectors.

In January 2024, the World Economic Forum emphasized the growing impact of its Global Lighthouse Network, comprising leading manufacturers advancing Fourth Industrial Revolution technologies. In 2023, 21 new members joined the network, increasing the total to 153 advanced factories.

Notably, a prominent electronics manufacturer in China aims to achieve a zero-carbon operations and double its revenue within three years. Meanwhile, a German pharmaceutical equipment producer has implemented computer vision and Industrial Internet of Things (IIoT) solutions to enhance simulation and predictive capabilities. This expanding use of intelligent factory frameworks is reinforcing sensor integration, supporting market growth.

Tilt Sensor Market Report Snapshot

|

Segmentation

|

Details

|

|

By Housing Material

|

Non-metal, Metal

|

|

By Technology Outlook

|

Fluid-filled, MEMS, Force Balanced

|

|

By Application Outlook

|

Construction & Mining, Automotive & Transportation, Aerospace & Defense, Telecommunications, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Housing Material (Non-metal and Metal): The non-metal segment earned USD 175.5 million in 2023 due to its lightweight, corrosion-resistant properties and cost-effective suitability for integration in compact and sensitive electronic assemblies across industrial and automotive applications.

- By Technology Outlook (Fluid-filled, MEMS, and Force Balanced): The MEMS segment held a share of 61.32% in 2023, fueled by its compact size, low power consumption, and high integration capability, making it ideal for widespread use across automotive, industrial, and consumer electronics applications.

- By Application Outlook (Construction & Mining, Automotive & Transportation, Aerospace & Defense, Telecommunications, and Others): The construction & mining segment is projected to reach USD 237.4 million by 2031, propelled by the critical need for real-time inclination monitoring to ensure operational safety, equipment stability, and precision in high-risk, rugged environments.

Tilt Sensor Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The Asia Pacific tilt sensor market share stood at around 43.91% in 2023, valued at USD 116.0 million. This dominance is reinforced by the rapid development of industrial zones and smart manufacturing clusters, particularly in electronics, semiconductors, and heavy engineering.

The adoption of advanced automation technologies, where sensors are embedded into machinery for position tracking, angular monitoring, and robotic alignment, is fueling regional market growth. Additionally, domestic market is benefiting from large-scale investments in high-speed rail networks and intelligent transportation infrastructure.

Governments across the region are prioritizing railway modernization projects that require high-precision tilt sensors for track monitoring, train stability, and automated control systems.

- In November 2024, Vietnam’s National Assembly approved a high-speed railway project connecting Hanoi and Ho Chi Minh City. Valued at approximately USD 67 billion and spanning 957 miles, the project aims to redefine passenger mobility and regional connectivity. Construction is scheduled to start in 2027, with full operations expected by 2035.

North America tilt sensor industry is poised to grow at a CAGR of 11.05% over the forecast period. This growth is stimulated by increasing integration into military-grade vehicles and surveillance systems. Defense OEMs are incorporating tilt sensors into armored platforms, missile launchers, and stabilization systems for enhanced targeting accuracy and terrain navigation.

Ongoing military technology upgrades and the focus on real-time situational awareness across battlefield platforms are fostering sensor adoption in defense applications across the region. Furthermore, electric utility providers across North America are deploying tilt sensors to monitor the alignment of utility poles, transmission towers, and distribution infrastructure.

With a strong emphasis on grid reliability and storm resilience, utilities are integrating tilt sensing solutions into condition monitoring systems, contributing to steady regional market growth.

Regulatory Frameworks

- The tilt sensor industry in the U.S. is subject to regulations from agencies such as the Federal Communications Commission (FCC) for electromagnetic compatibility and the Occupational Safety and Health Administration (OSHA) for workplace safety standards. Additionally, the National Highway Traffic Safety Administration (NHTSA) imposes regulations on automotive sensors to ensure vehicle safety and performance.

- The EU enforces the Restriction of Hazardous Substances (RoHS) Directive, limiting the use of specific hazardous materials in electrical and electronic equipment, including tilt sensors. The General Product Safety Directive (GPSD) mandates that products must be safe for use, impacting sensor design and manufacturing.

- China's tilt sensor industry is governed by standards set by the Standardization Administration of China (SAC), which oversees compliance with national safety and performance standards. The China Compulsory Certificate (CCC) is required for certain products, ensuring they meet safety and quality standards.

Competitive Landscape

Leading players operating in the tilt sensor market are actively focusing on expanding their product portfolios by introducing advanced product lines tailored to meet evolving application demands. This emphasis on developing new sensor technologies allows companies to address requirements in high-precision automotive systems and compact industrial equipment.

These initiatives are boosting market growth by enhancing performance parameters, improving temperature stability, and supporting integration in space-constrained environments. The ongoing development of advanced sensing technolgoies reflects a broader industry trend toward strengthening competitive positioning and meeting stringent reliability standards across end-use sectors.

- In June 2024, TDK Corporation broadened its tunnel-magnetoresistance (TMR) tilt sensor lineup with the introduction of the TAS8240 sensor, tailored for automotive and industrial applications. Available in compact QFN16 and TSSOP16 packages, it offers four redundant analog single-ended SIN/COS outputs and low power consumption. The sensor ensures accurate angular detection in space-constrained enviroments, maintaining accuracy across temperature variations and over its lifespan. This launch reinforces TDK’s commitment to delivering high-performance sensor solutions for demanding environments.

List of Key Companies in Tilt Sensor Market:

- TE Connectivity

- Murata Manufacturing Co., Ltd.

- Sick AG

- Analog Devices, Inc.

- Bosch Sensortec GmbH

- Honeywell International Inc.

- Curtiss-Wright Corporation

- elobau GmbH & Co KG

- STMicroelectronics

- Texas Instruments Incorporated

- Balluff ApS

- Level Developments Ltd.

- Baumer

- TDK Corporation

- Pepperl+Fuchs Vertrieb GmbH & Co. Kg

Recent Developments (Product Launch)

- In June 2024, elobau introduced its N6 static and N7 dynamic tilt sensors, offering enhanced functionality for manufacturers in the off-highway sector. These sensors are designed to optimize the efficiency and safety of mobile machinery operations. These sensors provide reliable inclination data for precise control and secure equipment movement, supporting safety-critical applications in demanding industrial environments.