Market Definition

The market comprise resins used to bond different layers of materials, particularly in multilayered structures such as packaging, automotive, and electronics.

These resins enhance adhesion between dissimilar polymers, ensuring better durability and performance. Key applications include food packaging, automotive fuel tanks, wire and cable coatings, and medical devices, driving demand for high-performance, versatile resins.

Tie Layer Resin Market Overview

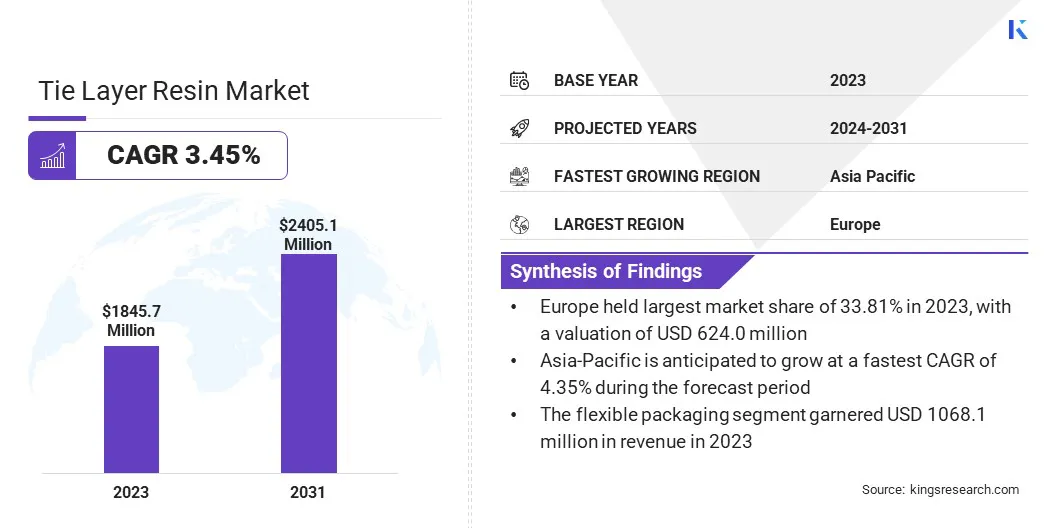

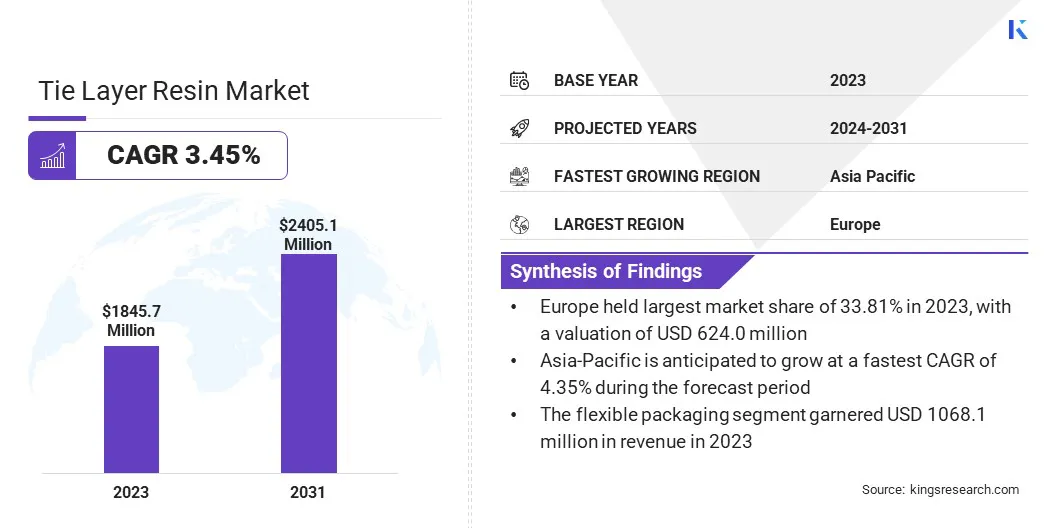

According to Kings Research, global tie layer resin market size was USD 1845.7 million in 2023, which is estimated to be valued at USD 1896.2 million in 2024 and reach USD 2405.1 million by 2031, growing at a CAGR of 3.45% from 2024 to 2031.

This growth is fueled by the expanding automotive sector, where these resins are increasingly used in bonding materials for fuel tanks, composites, and lightweight parts, improving durability, safety, and fuel efficiency.

Key Market Highlights:

- The tie layer resin industry size was recorded at USD 1845.7 million in 2023.

- The market is projected to grow at a CAGR of 3.45% from 2024 to 2031.

- Europe held a share of 33.81% in 2023, valued at USD 624.0 million.

- The LLDPE segment garnered USD 551.9 million in revenue in 2023.

- The reactive segment is expected to reach USD 1332.9 million by 2031.

- The rigid packaging segment is anticipated to witness a CAGR of 3.48% over the forecast period.

- The food & beverages segment is expected to capture a share of 26.80% by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 4.35% through the projection period.

Major companies operating in the tie layer resin industry are LyondellBasell Industries Holdings B.V, The Compound Company, Mitsubishi Chemical Group Corporation, Polyram Plastic Industries LTD, Allnex GMBH, Westlake Corporation, Zeus Company LLC, Mitsui & Co. Italia S.p.A., Dow, Arkema, and others.

The increasing demand for advanced materials and complex product designs has made tie layer resins essential for enhancing the stability and durability of layered structures, facilitating innovation across various sectors.

- In February 2023, Mitsubishi Chemical Group announced plans to enhance production capacity for its specialty polyvinyl alcohol resins, GOHSENX and Nichigo G-Polymer, at its Okayama Plant. This expansion to meet growing demand, particularly in sustainable packaging.

Growth of Automotive Sector

The growth of the automotive sector is contributing significantly to the progress of the tie layer resin market, as manufacturers increasingly rely on multi-layer composites for lightweight, durable components. These advanced materials enhance fuel efficiency and performance by reducing vehicle weight.

Tie layer resins ensure strong bonding between various materials such as plastics, metals, and composites, maintaining structural integrity and safety. With rising demand for fuel-efficient and sustainable vehicles, the adoption of multi-layer composites powered by tie layer resins is expanding.

- In June 2024, Teijin Limited announced the commencement of a new production line for its polycarbonate resin Panlite sheet and film and multi-layer sheet and film of Panlite and acrylic resins at Matsuyama plant in Ehime Prefecture. These advanced materials are designed for automotive and electronics applications.

Fluctuations in Supply of Key Raw Materials

Fluctuations in the supply of key raw materials, such as specific resins and chemicals used in the production, pose a significant challenge to the growth of the tie layer resin market. These supply chain disruptions can lead to instability in production schedules and price volatility, limiting widespread adoption.

To address this challenge, companies can diversify their supplier base, implement strategic sourcing practices, and explore alternative, more sustainable materials to reduce dependency on volatile resources. Additionally, investing in more efficient production methods can help mitigate the impact of raw material shortages.

Advancements in Resin Technology

Advancements in resin technology is emerging as a significant trend in the tie layer resin market, with a focus on improving bonding properties and performance across various applications. Manufacturers are developing resins that offer stronger adhesion, better durability, and enhanced compatibility with diverse materials such as plastics, metals, and glass.

These innovations allow for more efficient production processes and enable tie layer resins to meet the increasing demands of industries such as automotive, packaging, and electronics, supporting more complex and high-performance multi-layer structures.

- In June 2024, Univation Technologies launched the UNIGILITY Tubular High Pressure PE Process, enabling the production of LDPE and EVA resins. This advanced platform offers efficient, low-energy manufacturing, supporting applications in films, packaging, footwear, and photovoltaics with enhanced performance and product flexibility.

Tie Layer Resin Market Report Snapshot

|

Segmentation

|

Details

|

|

By Material

|

LLDPE, LDPE, HDPE, EVA, PP, Others

|

|

By Type

|

Reactive, Non-reactive

|

|

By Application

|

Flexible Packaging, Rigid Packaging

|

|

By End Use Industry

|

Food & Beverages, Automotive, Healthcare, Construction, Electronics, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Material (LLDPE, LDPE, HDPE, EVA, PP, and Others): The LLDPE segment earned USD 551.9 million in 2023, due to its superior flexibility, impact resistance, and suitability for various bonding applications in multilayer structures.

- By Type (Reactive and Non-reactive): The reactive segment held a share of 55.57% in 2023, fueled by its strong adhesion properties, which enhance durability and performance in multilayer material applications.

- By Application (Flexible Packaging and Rigid Packaging): The flexible packaging segment is projected to reach USD 1390.2 million by 2031, owing to increasing demand for lightweight, durable, and cost-effective packaging solutions in food and consumer goods.

- By End Use Industry (Food & Beverages, Automotive, Healthcare, Construction, Electronics, and Others): The construction segment is anticipated to grow at a CAGR of 3.73% over the forecast period, propelled by the rising demand for multi-layer materials with enhanced bonding properties in building applications.

Tie Layer Resin Market Regional Analysis

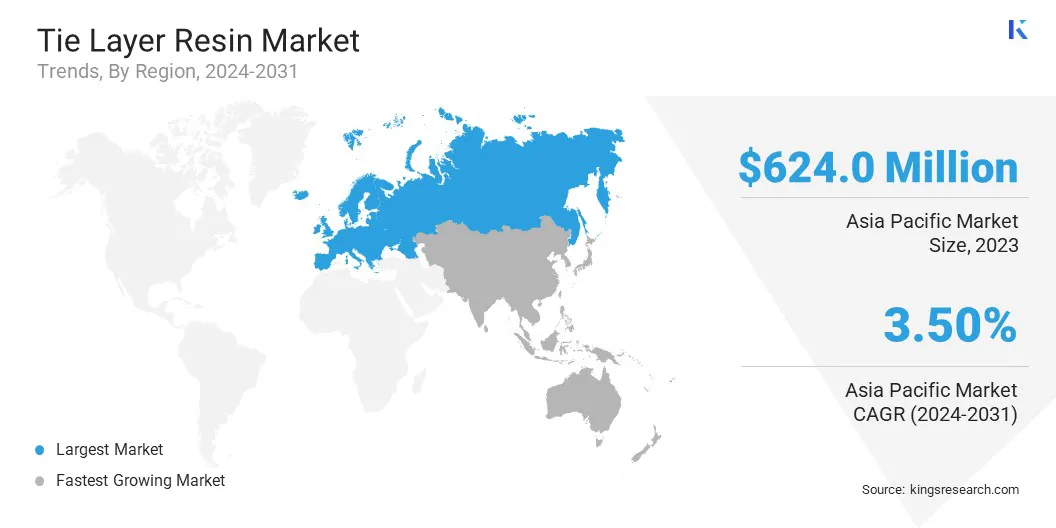

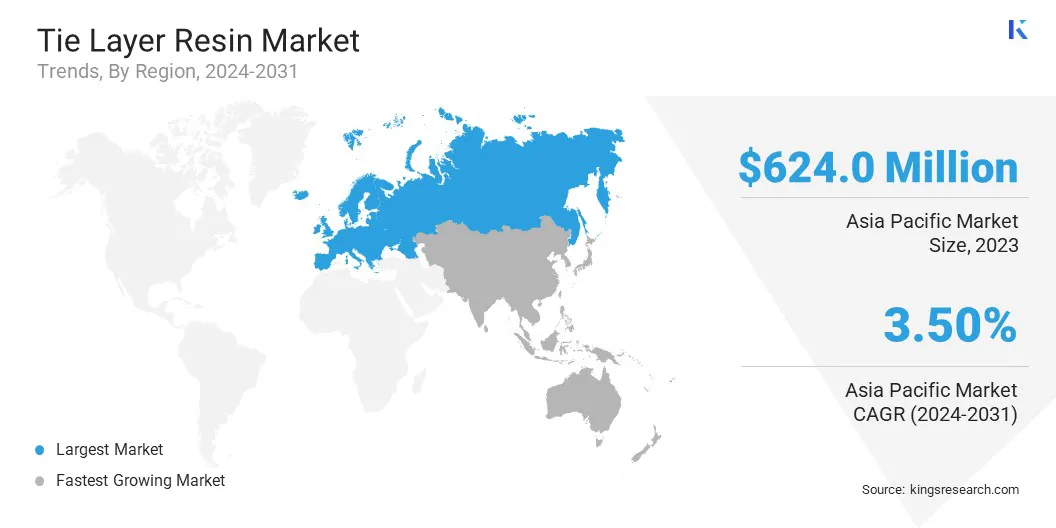

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Europe tie layer resin market share stood at around 33.81% in 2023, valued at USD 624.0 million. This dominance is reinforced by the region's well-established automotive, packaging, and electronics industries.

The demand for high-performance resins in multilayer structures is aided by major focus on technological advancements and stringent regulations for product durability and safety.

Key countries such as Germany, France, and the UK have a robust manufacturing base for automotive and packaging applications, fostering regional market growth. Europe's emphasis on sustainability further supports the use of these resins in eco-friendly packaging solutions.

- In February 2025, The Compound Company, a Netherland-based firm, announced the rebranding of its Exxelor product line to Yparex, a globally recognized brand. This transition will not affect product formulas, quality, or specifications, ensuring continuity for customers.

Asia Pacific tie layer resin industry is set to grow at a CAGR of 4.35% over the forecast period. This growth is fueled by rapid industrialization, expanding automotive production, and increasing consumer demand for packaged goods.

Countries such as China, India, and Japan are experiencing a strong demand for tie layer resins, particularly in automotive fuel tanks, packaging, and electronics. The region’s growing infrastructure projects and rising disposable incomes are highlighting the need for durable and efficient bonding materials in construction and consumer electronics applications.

Regulatory Frameworks:

- The Registration, Evaluation, Authorisation and Restriction (REACH) is the main EU law to protect human health and the environment from the risks that can be posed by chemicals.

- In the EU, the RoHS Directive aims to prevent the risks associated with electronic and electrical waste.

- In the U.S., under the Toxic Substances Control Act (TSCA), the EPA evaluates potential risks from new and existing chemicals and a addresses potential chemical hazards.

Competitive Landscape

In the tie layer resin market, companies often form strategic partnerships to enhance product offerings and expand market reach. These collaborations typically focus on leveraging complementary technologies, such as innovative resin formulations or advanced manufacturing capabilities, to meet growing demand in industries like packaging, automotive, and electronics. Such alliances drive innovation, improve performance, and cater to regional market needs more effectively.

- In January 2024, LyondellBasell and MSI Technology formed a strategic partnership to introduce LyondellBasell’s Polybutene-1 (PB-1) resins. This collaboration aims to enhance packaging solutions with improved seal performance, addressing growing demands in consumer packaging.

Key Companies in Tie Layer Resin Market:

- LyondellBasell Industries Holdings B.V

- The Compound Company

- Mitsubishi Chemical Group Corporation

- Polyram Plastic Industries LTD

- Allnex GMBH

- Westlake Corporation

- Zeus Company LLC

- Mitsui & Co. Italia S.p.A.

- Dow

- Arkema

Recent Developments (Partnership/Approval)

- In June 2024, Bharat Petroleum Corporation Ltd. selected Univation's UNIPOL PE Process for two world-scale polyethylene production lines at its Bina Refinery in India. This move aims to enhance production flexibility and meet the growing demand for HDPE and LLDPE products.

- In October 2023, Revolution received FDA approval for its food-grade PCR-LLDPE resin from recycled stretch film, advancing sustainable packaging in the food industry.