Market Definition

Thermoplastic composites are advanced materials that combine a thermoplastic polymer matrix with reinforcing fibers such as glass, carbon, aramid, or natural fibers. These lightweight, high‑strength composites feature a thermoplastic resin that serves as the binding matrix. They offer advantages including re‑moldability, recyclability, and rapid processing.

Known for excellent impact resistance, corrosion resistance, and durability, thermoplastic composites are widely used across aerospace, automotive, transportation, consumer goods, construction, wind energy, electrical and electronics, industrial equipment, and sporting goods for structural and semi‑structural components requiring high performance and reduced weight.

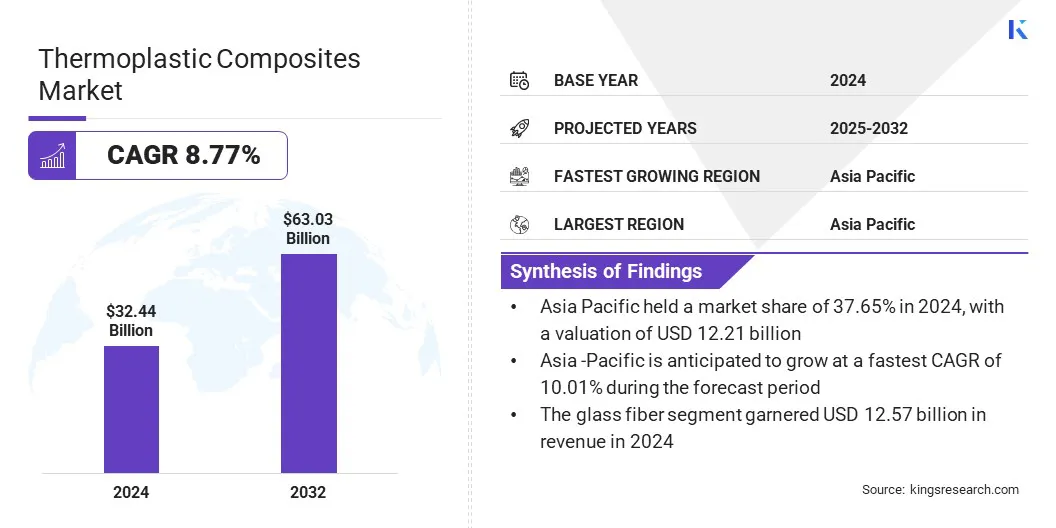

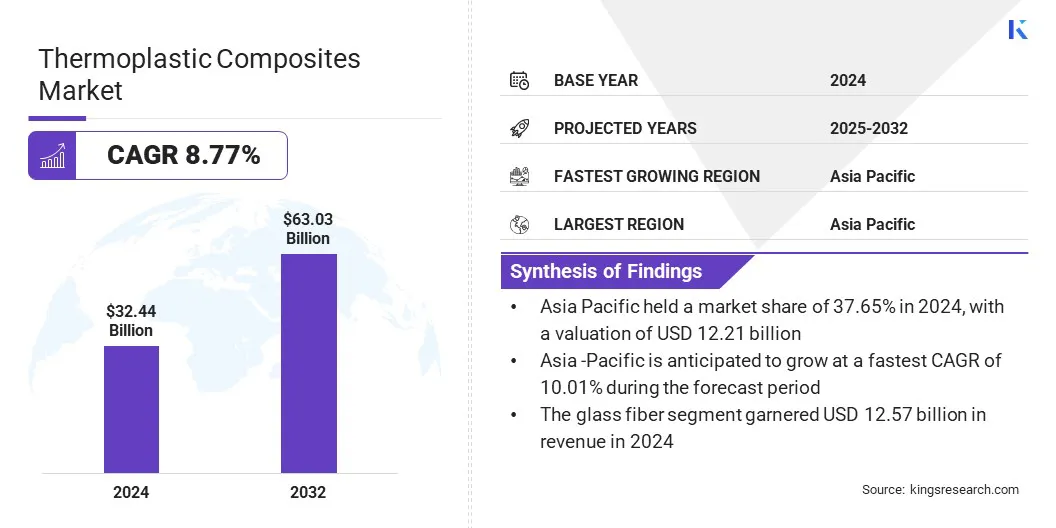

The global thermoplastic composites market size was valued at USD 32.44 billion in 2024 and is projected to grow from USD 34.99 billion in 2025 to USD 63.03 billion by 2032, exhibiting a CAGR of 8.77% during the forecast period. This growth is driven by the rising need for high‑performance components that deliver strength, durability, and resistance to impact and corrosion in critical applications.

This has led to greater adoption of advanced thermoplastic composites that support lightweight structures with improved mechanical properties for automotive, aerospace, and industrial sectors. Additionally, rising preference for recyclable and sustainable materials fuels market expansion by reducing environmental impact and promoting advanced composite use.

Key Highlights:

- The thermoplastic composites industry size was recorded at USD 32.44 billion in 2024.

- The market is projected to grow at a CAGR of 8.77% from 2025 to 2032.

- Asia Pacific held a share of 37.65% in 2024, valued at USD 12.21 billion.

- The polypropylene segment garnered USD 12.21 billion in revenue in 2024.

- The glass fiber segment is expected to reach USD 22.53 billion by 2032.

- The automotive segment secured the largest revenue share of 34.23% in 2024

- North America is anticipated to grow at a CAGR of 8.63% over the forecast period.

Major companies operating in the global thermoplastic composites market are BASF SE, Celanese Corporation, Toray Industries Inc., LANXESS, Arkema, Avient Corporation, Mitsubishi Corporation, SGL Carbon, Solvay S.A., Hexcel Corporation, Teijin Limited, Hanwha Group, Daicel Miraizu Ltd., Syensqo, and RTP Company.

Thermoplastic Composites Market Report Scope

|

Segmentation

|

Details

|

|

By Resin Type

|

Polypropylene, Polyamide, Polyetheretherketone, Polyetherimide, Others

|

|

By Fiber Type

|

Glass Fiber, Carbon Fiber, Natural Fiber, Others

|

|

By End-Use Industry

|

Automotive, Aerospace & Defense, Electrical & Electronics, Construction, Medical, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Thermoplastic Composites Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America .

Asia Pacific accounted for a thermoplastic composites market share of 37.65% in 2024, valued at USD 12.21 billion. This dominance is attributed to the expansion of advanced manufacturing bases across the region. Key players are prioritizing integrated solutions that combine thermoplastic composite materials and automated molding systems to meet the automotive sector's demand fr new energy vehicles for lightweight and durable structures.

Additionally, increased production capacity for PPS and PEEK materials ensures consistent quality and faster delivery, supporting regional market expansion. Moreover, manufacturers are adopting intelligent production technologies to meet the need for large‑scale lightweight components and improve industrial efficiency, thereby contributing to domestic industry expansion.

- In February 2025, Napo New Materials established a thermoplastic composites facility in Xuancheng, Anhui. The site specializes in PPS and PEEK solutions for new energy vehicles and applies integrated molding technology and support from strategic investors to advance lightweight applications.

The North America thermoplastic composites industry is set to grow at a CAGR of 8.63% over the forecast period. This growth is attributed to the expansion of production capacity and facilities across the region.

Key players are enhancing expertise in unidirectional tapes and high‑melting thermoplastic systems to meet rising requirements in sporting goods, oil and gas, and industrial applications. The regional market is witnessing steady investment in advanced technologies to enhance manufacturing capability and broaden material portfolios.

Moreover, regional players are expanding supply networks by acquiring assets and integrating specialized technologies. Manufacturers are focusing on continuous fiber‑reinforced materials to ensure consistent performance across varied applications, boosting regional market expansion.

- In November 2024, Toray Advanced Composites acquired the assets, technology, and intellectual property of Colorado-based Gordon Plastics to expand its continuous fiber-reinforced thermoplastic composites portfolio. The acquisition enhances Toray’s capability in unidirectional tapes and high-melting thermoplastic systems, supporting growth across sporting goods, oil & gas, and industrial sectors.

Thermoplastic Composites Market Overview

Technological advancements in composite forming are propelling the expansion of the market by enhancing efficiency and precision for large component production. This advancement is prompting the use of lightweight and recyclable materials in aerospace and other demanding applications. It is also encouraging broader adoption of advanced composite manufacturing solutions.

- In February 2025, Pinette PEI introduced a large-scale stamping press for thermoplastic composites in Chalon‑sur‑Saô. The press, with 5 m × 2 m platens and 30,000 kN forming force, incorporates rapid material transfer, robotic handling, and optimized energy management to enhance precision, flexibility, and efficiency in manufacturing advanced thermoplastic composite aerospace components.

Market Driver

Growing Need for High‑Performance Components

The thermoplastic composites market is experiencing a notable expansion, propelled by the growing need for high‑performance components that combine strength, impact resistance, and corrosion resistance. Industries such as construction, automotive, and aerospace are adopting thermoplastic composites to replace heavier traditional materials and to ensure durability in demanding conditions.

These materials deliver consistent performance in environments exposed to chemicals, moisture, or mechanical stress. The requirement for advanced components that extend service life and reduce maintenance is promoting the use of thermoplastic composites in structural and functional applications.

- In February 2025, Avient introduced Hammerhead FR flame‑retardant thermoplastic composite panels at the NAHB International Builders’ show. These patent‑pending panels feature an integrated flame‑retardant sandwich structure designed for modular walls, floors, and ceilings. The panels are developed to shorten installation time and lower costs while providing strength, durability, and resistance to moisture and chemicals.

Market Challenge

Complex Manufacturing Processes

A key challenge hindering the progress of the thermoplastic composites market is the complexity of its manufacturing processes. Production requires advanced machinery and skilled labor, with precise control over fiber placement and polymer consolidation. This results in slower operations and higher costs. The technical requirements limit the ability of manufacturers to scale operations and pose barriers to new entrants, thereby reducing flexibility and delaying adoption.

To address this challenge, market players are adopting automated production technologies to reduce errors and improve efficiency. They are setting up dedicated facilities with advanced machinery that supports faster consolidation and molding.

Companies are increasing investment in research programs to simplify material processing and improve compatibility between fibers and polymers. They are also providing training programs to build skilled workforces and developing standardized manufacturing practices.

Market Trend

Development of Recyclable Thermoplastic Composite

A key trend influencing the thermoplastic composites market is the development of recyclable thermoplastic composites to support lightweight structures and circular design goals.

Manufacturers are focusing on mono‑material construction to simplify recycling and reduce processing requirements. This trend is prompting innovation in aerospace interiors by enhancing impact resistance, toughness, and fire safety. These developments help industries lower lifecycle costs, meet sustainability objectives, and expand the applications of thermoplastic composites.

- In September 2024, Toray Advanced Composites launched Toray Cetex TC1130 PESU, a continuous fiber reinforced thermoplastic composite developed for aircraft interior applications. The material enables lightweight mono‑material sandwich structures with improved recyclability, impact resistance, and FST performance, promoting sustainable and high‑performance solutions.

Market Segmentation:

- By Resin Type (Polypropylene, Polyamide, Polyetheretherketone, Polyetherimide, and Others): The polypropylene segment earned USD 12.21 billion in 2024, mainly due to its widespread use in cost‑efficient lightweight components and ease of processing.

- By Fiber Type (Glass Fiber, Carbon Fiber, Natural Fiber, and Others): The glass fiber segment held a share of 38.76% in 2024, attributed to its high strength‑to‑weight ratio and broad applicability across transportation and industrial sectors.

- By End-Use Industry (Automotive, Aerospace & Defense, Electrical & Electronics, Construction, Medical, and Others): The automotive segment is projected to reach USD 20.75 billion by 2032, owing to the rising demand for lightweight materials to improve fuel efficiency and reduce emissions.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) oversees the market by regulating emissions, chemical formulations, and waste handling during production. It ensures compliance with air quality standards, hazardous waste disposal, and sustainability in polymer resin and fiber reinforcement processes.

- In the UK, the Health and Safety Executive regulates thermoplastic composites by enforcing occupational health, chemical safety, and plant safety protocols. It oversees safe handling of polymers and reinforcements, controls exposure to hazardous substances, and promotes compliance with workplace safety protocols during advanced composite manufacturing and processing.

- In China, the Ministry of Ecology and Environment regulates thermoplastic composite manufacturing by enforcing emission controls, resource efficiency, and safe handling of chemical feedstock. It oversees environmental permits and promotes the sustainable use of advanced polymer materials in production.

- In India, the Central Pollution Control Board establishes guidelines for emissions, effluents, and material safety in thermoplastic composites manufacturing. It oversees compliance in resin processing, fiber reinforcement, and recycling, promoting energy-efficient technologies and reducing industrial pollution.

Competitive Landscape

Major players in the thermoplastic composites industry are expanding manufacturing capacity to meet rising demand for lightweight composite materials. They aim to secure a consistent supply of fiber‑reinforced thermoplastic composites for transportation, recreational vehicles, and agricultural sectors.

Organizations are integrating new facilities to enhance production efficiency and broaden their product portfolios. Additionally, market players are working on improving the availability of materials that offer strength, durability, and low weight across various applications.

- In July 2024, Transtex acquired US Liner Company, a producer of fiber‑reinforced thermoplastic composites for transportation, RV, and agricultural sectors. The acquisition enhances manufacturing capacity in North America and ensures a reliable supply of lightweight composite materials.

Key Companies in Thermoplastic Composites Market:

- BASF SE

- Celanese Corporation

- Toray Industries, Inc

- LANXESS

- Arkema

- Avient Corporation

- Mitsubishi Corporation

- SGL Carbon

- Solvay S.A.

- Hexcel Corporation

- TEIJIN LIMITED

- Hanwha Group

- Daicel Miraizu Ltd

- Syensqo

- RTP Company.

Recent Developments (New Product Launch)

- In June 2025, Xenia Materials introduced Xeramic, a new range of ceramic‑reinforced thermoplastic composites featuring bio‑based PPA matrices. The materials combine engineered ceramic fillers and carbon fiber reinforcement to improve thermal conductivity, mechanical strength, and surface quality, targeting applications requiring a balance of high performance and aesthetics.

- In February 2025, Toray Group showcased advanced composite technologies at JEC World 2025, highlighting Cetex thermoplastic composites and carbon fiber materials. The exhibits emphasized lightweight components for mobility and energy sectors, hydrogen storage solutions, and recycled composites, demonstrating ongoing innovation and focus on sustainability.