Market Definition

The market encompasses devices designed to safeguard electrical equipment and appliances from overheating by interrupting the circuit when temperatures exceed safe limits.

These protectors operate through bimetallic strips, temperature-sensitive polymers, or advanced thermistors that trigger a response based on thermal fluctuations. They are formulated to ensure precise thermal cutoffs, enhancing safety and preventing damage to motors, transformers, batteries, and heating elements.

Thermal protectors are widely applied in household appliances, industrial machinery, automotive systems, and HVAC units to prevent fire hazards and system failures across various temperature-sensitive applications.

Thermal Protector Market Overview

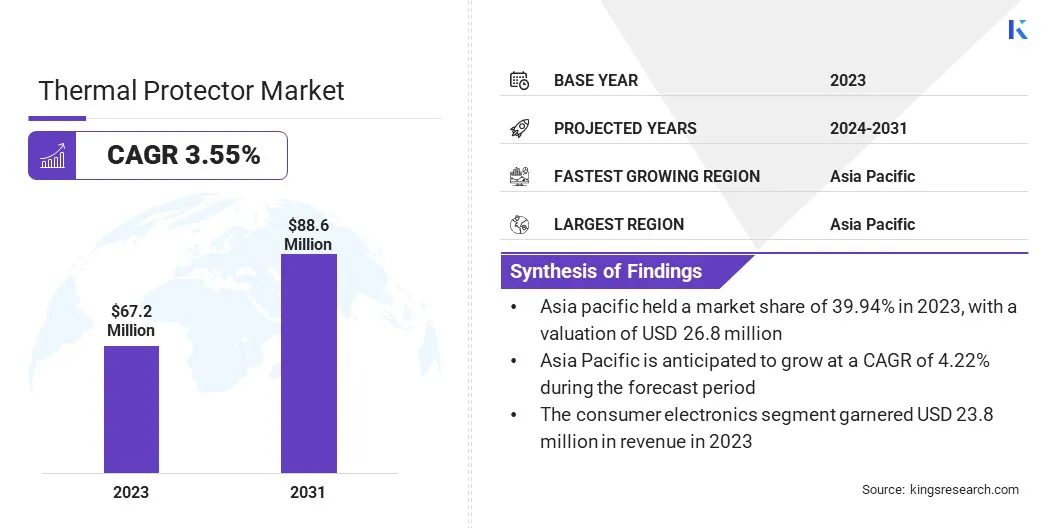

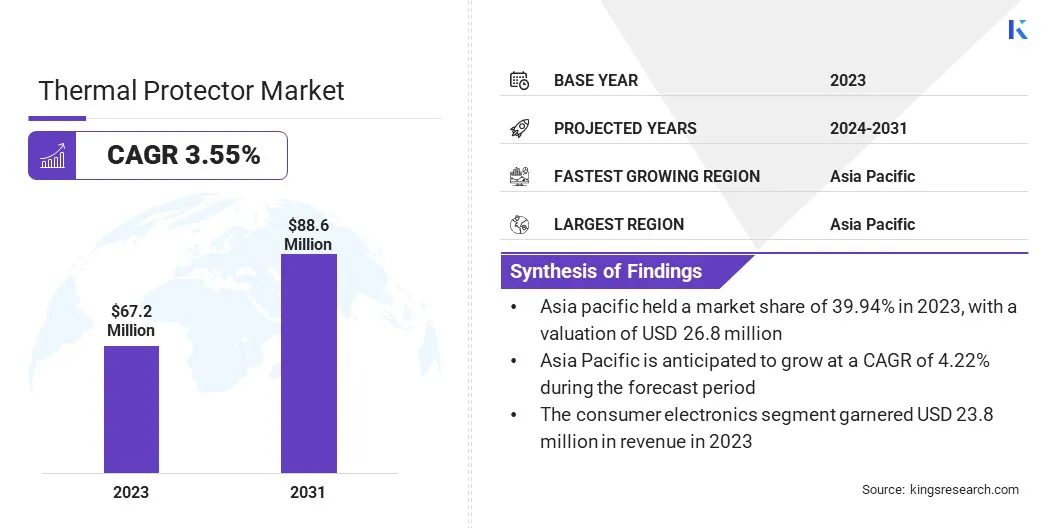

The global thermal protector market size was valued at USD 67.2 million in 2023 and is projected to grow from USD 69.4 million in 2024 to USD 88.6 million by 2031, exhibiting a CAGR of 3.55% during the forecast period.

The growing dependence on electrical and electronic devices is increasing the demand for thermal protectors to prevent overheating and ensure operational safety across industrial and consumer applications.

The rapid adoption of electric vehicles (EVs) is further increasing the need for advanced thermal protection solutions to safeguard battery systems and power electronics.

Additionally, the expansion of data centers and telecommunications infrastructure is driving the demand for reliable thermal management to maintain system efficiency and prevent equipment failures, in turn driving the growth of the market.

Major companies operating in the thermal protector industry are Sensata Technologies, Xiamen SET Electronics Co., Ltd., SAFTTY Technologies, Calco Electric, Tex Tech Industries, BSTFLEX, Portage Electric Products, Inc., Thermik Gerätebau GmbH, AUPO, Focus Sensing and Control Technology Co., Ltd., SEKI Controls Co., Ltd., Kangrong Electronic Co., Ltd., Dongguan Heng Hao Electric Co., Ltd., Uchihashi Estec Co., Ltd., and Sensience.

The increasing reliance on electrical and electronic devices is driving the demand for thermal protectors to ensure safety and prevent failures caused by overheating. Household appliances, including refrigerators, washing machines, and air conditioners, require advanced thermal protection to enhance durability and operational efficiency.

Industrial equipment such as motors, transformers, and power tools also rely on thermal protectors to prevent system malfunctions and reduce fire hazards. As industries shift toward automation and high-performance machinery, the demand for precision-engineered thermal protection solutions continues to strengthen, contributing to the sustained growth of the market.

Key Highlights:

- The thermal protector industry size was recorded at USD 67.2 million in 2023.

- The market is projected to grow at a CAGR of 3.55% from 2024 to 2031.

- Asia Pacific held a market share of 39.94% in 2023, with a valuation of USD 26.8 million.

- The bimetallic switches segment garnered USD 28.0 million in revenue in 2023.

- The consumer electronics segment is poised for a robust CAGR of 4.03% through the forecast period.

- The market in North America is anticipated to grow at a CAGR of 4.00% during the forecast period.

How are EVs contributing to the market growth?

The automotive industry is experiencing a rapid shift toward electric vehicles (EVs), creating a heightened demand for thermal protection solutions. EV batteries, charging systems, and power electronics generate significant heat during operation, requiring advanced thermal protectors to prevent overheating and ensure optimal performance.

Battery management systems (BMS) in EVs incorporate thermal protection mechanisms to maintain safe temperature levels and enhance battery life. Global initiatives promoting EV adoption are driving automakers to invest in high-performance thermal protectors to improve vehicle safety and reliability. The expansion of the EV industry continues to strengthen the growth of the thermal protector market.

- According to a report by the International Energy Agency, approximately 14 million new electric cars were registered worldwide in 2023. Moreover, EV sales in 2023 surpassed the previous year by 3.5 million, reflecting a 35% year-over-year increase.

What are the major obstacles for this market?

The increasing complexity of modern electronic and industrial systems presents a significant challenge for the thermal protector market. Manufacturers are required to develop solutions that meet diverse operational requirements while ensuring reliability and efficiency.

Additionally, there is growing pressure to create cost-effective solutions that can be integrated seamlessly into a wide range of applications, including high-performance systems, without compromising safety or performance. This challenge is further compounded by the need to comply with stringent regulatory standards across different regions.

To address these challenges, companies are investing in advanced materials and sensor-based thermal protection. Moreover, AI-driven monitoring systems are used to enhance real-time temperature management.

Additionally, partnerships with OEMs are facilitating the co-development of customized solutions that seamlessly integrate with next-generation electronics, improving performance and ensuring compliance with evolving safety standards.

Which application trends are shaping the market?

The growing reliance on cloud computing, artificial intelligence (AI), and 5G technology has led to a significant increase in data center and telecommunications infrastructure development.

The International Energy Agency's 2024 report highlights a significant surge in investments in new data centers over the past two years, driven by increasing digitalization and the rapid adoption of artificial intelligence (AI).

High-performance servers, networking equipment, and power distribution units generate excess heat, necessitating advanced thermal protection to prevent overheating and maintain system stability. Telecom base stations and fiber-optic transmission systems also require reliable thermal management to ensure continuous operation.

With the rapid expansion of digital infrastructure, the demand for precision-engineered thermal protectors continues to rise, strengthening the growth of the thermal protector market in the data and communication sectors.

Thermal Protector Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Temperature-Sensitive Resistors, Bimetallic Switches, Thermal Fuses, Others

|

|

By Application

|

Consumer Electronics, Automotive, Industrial Equipment, Residential, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Temperature-Sensitive Resistors, Bimetallic Switches, Thermal Fuses, and Others): The bimetallic switches segment earned USD 28.0 million in 2023 due to its high reliability, cost-effectiveness, and ability to provide precise temperature control across industries.

- By Application (Consumer Electronics, Automotive, Industrial Equipment, Residential, and Others): The consumer electronics segment is poised for significant growth at a CAGR of 4.03% through the forecast period, attributed to the increasing demand for compact, high-performance devices that require efficient thermal management solutions to prevent overheating, enhance operational safety, and extend product lifespan.

What is the market scenario in Asia-Pacific and North America region?

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The Asia Pacific thermal protector market share stood around 39.94% in 2023 in the global market, with a valuation of USD 26.8 million. Asia-Pacific is home to some of the world's largest semiconductor and consumer electronics manufacturers, including Taiwan Semiconductor Manufacturing Company (TSMC), Samsung, and Sony.

The increasing production of high-performance microprocessors, sensors, and power management chips requires efficient thermal protection to prevent overheating and ensure device reliability. The rising demand for compact thermal protectors in smartphones, laptops, and IoT-enabled devices is significantly contributing to the expansion of the market in the region.

- According to the National Bureau of Statistics, China's home appliance industry generated revenue of approximately USD 255 billion USD in 2023, reflecting a 7% year-over-year increase.

Additionally, Several Asia-Pacific economies, including China, India, and Japan, are investing heavily in industrial automation as part of their smart manufacturing initiatives.

Programs like "Made in China 2025" and Japan’s Society 5.0 emphasize the adoption of automated machinery, robotics, and AI-driven production lines, which require advanced thermal protection.

Industrial motors, variable frequency drives (VFDs), and precision control systems generate significant heat during continuous operation, necessitating reliable thermal management solutions. These factors are driving the market in this region.

North America is poised for significant growth at a robust CAGR of 4.00% over the forecast period. North America's industrial sector is rapidly adopting automation, robotics, and smart factory technologies to enhance productivity.

The U.S. and Canada are leading investments in Industry 4.0, integrating high-performance machinery that requires advanced thermal protection for motors, sensors, and control systems.

Companies in aerospace, automotive, and electronics manufacturing are increasingly using thermal protectors to ensure the safe operation of automated production lines. The shift toward energy-efficient industrial equipment, supported by government initiatives such as the U.S. Advanced Manufacturing Plan, is further boosting demand for thermal protection solutions.

Regulatory Frameworks

- The U.S. enforces stringent safety standards for electrical components, including thermal protectors. The Underwriters Laboratories (UL) sets widely recognized standards, such as UL 60730-1, which covers automatic electrical controls for household and similar use. Compliance with UL standards is often a prerequisite for market entry and consumer trust.

- The EU mandates compliance with the Low Voltage Directive (LVD) 2014/35/EU, which ensures that electrical equipment within certain voltage limits provides a high level of protection for European citizens. Thermal protectors must also meet the CE marking requirements, indicating conformity with health, safety, and environmental protection standards.

- China's Compulsory Certification (CCC) system requires that electrical products, including thermal protectors, obtain certification before entering the market. This process involves rigorous testing to ensure compliance with national safety standards.

Competitive Landscape:

The thermal protector industry is characterized by several market players that are focusing on material innovation to enhance thermal protection capabilities, addressing the growing demand for solutions that withstand extreme temperature conditions.

Key players are improving performance across aerospace, industrial, and energy sectors by developing advanced materials with superior insulating properties. These innovations expand application possibilities and strengthen competitive positioning, in turn driving market growth.

- In March 2025, Blueshift introduced AeroZero Tapes, a versatile range of lightweight and user-friendly tapes engineered to provide superior protection across extreme temperature conditions, ranging from -200°C to over 2,000°C. These tapes are designed for applications where weight and space limitations restrict design flexibility. Additionally, AeroZero Tapes offers extensive customization options, allowing customers to develop tailored solutions that meet their specific requirements.

List of Key Companies in Thermal Protector Market:

- Sensata Technologies

- Xiamen SET Electronics Co., Ltd.

- SAFTTY Technologies.

- Calco Electric

- Tex Tech Industries

- BSTFLEX

- Portage Electric Products, Inc.

- Thermik Gerätebau GmbH

- AUPO

- Focus Sensing and Control Technology Co., Ltd.

- SEKI Controls Co., Ltd.

- Kangrong Electronic Co., Ltd.

- Dongguan Heng Hao Electric Co., Ltd.

- Uchihashi Estec Co., Ltd.

- Sensience

Recent Developments (Product Launch)

- In January 2024, L&T introduced the LRD13 thermal overload relay, engineered to enhance safety and protection in industrial applications. LRD13 is designed for reliable overload and phase loss protection in motors and helps prevent damage caused by excessive current or electrical faults. This development is set to influence industrial safety practices by encouraging the adoption of advanced protection technologies.