Market Definition

The market covers the ecosystem of technologies, solutions, and services involved in producing printed materials using heat-sensitive methods. This market includes a range of components such as printer hardware, printing supplies, and associated software and services.

It spans various thermal printing technologies, including direct thermal (DT), thermal transfer (TT), and dye diffusion thermal transfer (D2T2). The market addresses diverse printing formats such as barcode labels, receipts, tags and tickets, and RFID labels.

The report presents an overview of the primary market drivers, supported by regional analysis and regulatory frameworks expected to impact market development over the forecast period.

Thermal Printing Market Overview

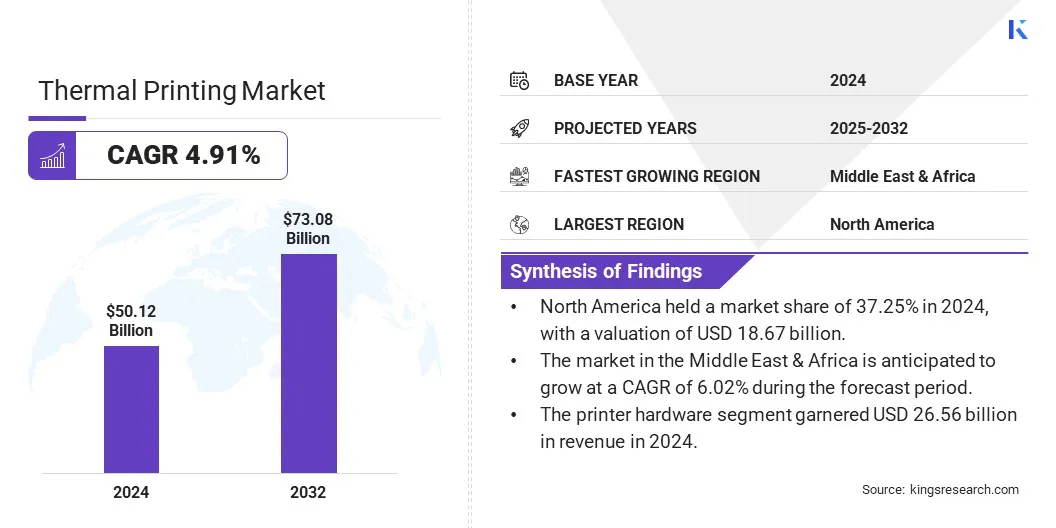

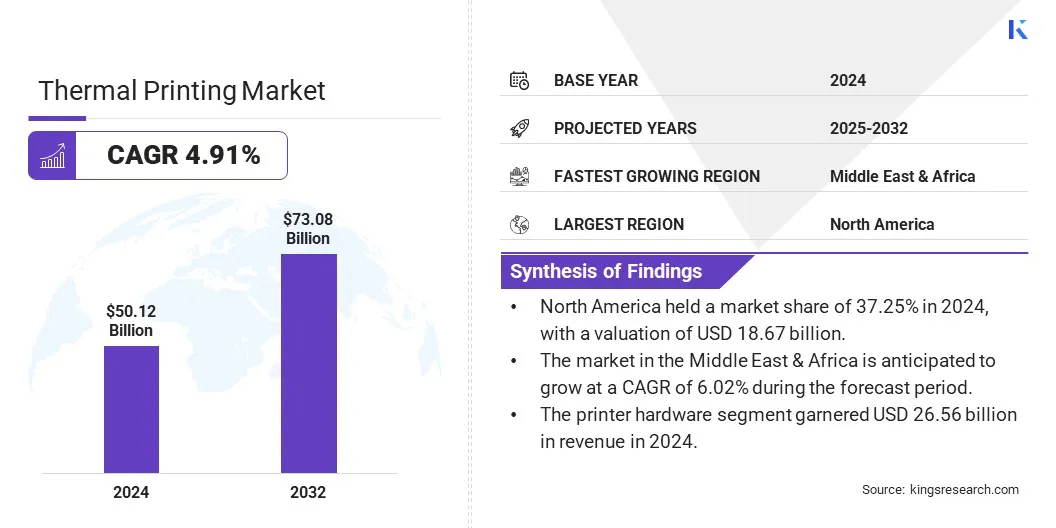

The global thermal printing market size was valued at USD 50.12 billion in 2024 and is projected to grow from USD 52.26 billion in 2025 to USD 73.08 billion by 2032, exhibiting a CAGR of 4.91% during the forecast period. This is attributed to the increasing demand for fast, reliable, and cost-effective printing solutions across multiple industries.

Expansion in e-commerce and retail sectors is fueling the need for barcode and receipt printing to support inventory tracking and transaction processing. Additionally, thermal printers enable efficient labeling and shipment tracking, contributing to the growth of logistics and transportation, and consequently, the market.

Major companies operating in the thermal printing industry are Star Micronics, Toshiba Tec, Avery Dennison Corporation, The Axiohm company, SATO Argox India Pvt. Ltd., HP Development Company, L.P., Dai Nippon Printing Co., Ltd., Zebra Technologies Corp., Domino Printing Sciences plc, BIXOLON CO., LTD., Citizen Systems Europe GmbH, Honeywell International Inc, Rongta Technology (Xiamen) Group Co., Ltd., BIPL, and TSC Auto ID.

Rising adoption of thermal printing in healthcare for patient identification, prescription labeling, and medical records is boosting the market. Advancements in printer technology, including improved print speeds and wireless connectivity, are further supporting the market expansion by enhancing operational efficiency and flexibility.

- In June 2024, Domino Printing Sciences launched a new thermal Inkjet (TIJ) solution designed for flexible packaging lines, including food applications. The solution, integrated with the Domino Gx-Series range, offers a cost-effective alternative to traditional thermal transfer overprinting (TTO), providing efficient 1-, 2-, or 4-line printed text codes and small-sized 2D codes.

Key Highlights:

- Th thermal printing industry size was valued at USD 50.12 billion in 2024.

- The market is projected to grow at a CAGR of 4.91% from 2025 to 2032.

- North America held a market share of 37.25% in 2024, with a valuation of USD 18.67 billion.

- The printer hardware segment garnered USD 26.56 billion in revenue in 2024.

- The direct thermal (DT) segment is expected to reach USD 34.31 billion by 2032.

- The barcode labels segment is expected to reach USD 25.97 billion by 2032.

- The desktop printer segment is expected to reach USD 26.53 billion by 2032.

- The market in the Middle East & Africa is anticipated to grow at a CAGR of 6.02% during the forecast period.

Market Driver

"Rising Demand for Efficient Labeling & Tracking Solutions"

The thermal printing market is primarily driven by the rising demand for efficient labeling & tracking solutions across the logistics, healthcare, and pharmaceutical sectors. In logistics, thermal printers enable high-speed production of barcode labels and shipping tags, supporting real-time tracking and inventory accuracy.

In healthcare, they are used for patient wristbands and specimen labels to ensure correct identification and safety. In the pharmaceutical industry, thermal printing is critical for labeling medications with batch numbers, expiry dates, and barcodes to meet regulatory requirements and ensure traceability throughout the supply chain.

- In September 2024, Dai Nippon Printing Co., Ltd. announced the launch of two new thermal transfer ink ribbons, R380 and V670. These ribbons cater to the printing needs of manufacturers in electronics, food, medical products, and pharmaceuticals.

Market Challenge

"Environmental Concerns Over BPA Use"

Environmental concerns related to the use of Bisphenol A (BPA) in thermal paper pose challenges to the market growth. BPA is a chemical coating commonly used in thermal paper to develop images during printing; however, it has been linked to health and environmental risks.

A potential solution is the development and adoption of BPA-free thermal papers using alternative coatings such as Bisphenol S (BPS) or phenol-free materials. These alternatives offer safer options while maintaining printing quality, helping manufacturers stay compliant and meet sustainability goals.

Market Trend

"Integration of Wireless Connectivity Features"

The trend of integrating wireless connectivity features in printing systems is growing. This shift is driven by the need for flexible, cable-free operations across dynamic work environments such as warehouses, retail stores, and healthcare facilities.

Wireless-enabled thermal printers allow for easy relocation, faster setup, and smoother integration with mobile devices and handheld scanners. This enhances productivity by enabling real-time printing at the point of use, reducing delays and improving workflow efficiency in high-demand settings.

- In November 2024, Jadens announced the upcoming launch of its Wireless Tattoo Printer. The new thermal printer, equipped with Bluetooth connectivity and proprietary software, is designed to enhance printing efficiency for a wide range of applications, including shipping labels, documents, and tattoo printing.

Thermal Printing Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Printer Hardware, Printing Supplies, Software & Services

|

|

By Technology

|

Direct Thermal (DT), Thermal Transfer (TT), Dye Diffusion (D2T2)

|

|

By Printing Format

|

Barcode Labels, Receipts, Tags & Tickets, RFID Labels

|

|

By Printer Type

|

Desktop Printer, Industrial Printer, Mobile Printer, Kiosk Printer

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Component (Printer Hardware, Printing Supplies, Software & Services): The printer hardware segment earned USD 26.56 billion in 2024, due to the rising demand for high-performance printing equipment across logistics and retail sectors.

- By Technology (Direct Thermal (DT), Thermal Transfer (TT), Dye Diffusion (D2T2)): The direct thermal (DT) segment held 45.12% share of the market in 2024, due to its cost-effectiveness and widespread use in short-life labeling applications.

- By Printing Format (Barcode Labels, Receipts, Tags & Tickets, and RFID Labels): The barcode labels segment is projected to reach USD 25.97 billion by 2032, owing to their increasing adoption in inventory tracking and supply chain management.

- By Printer Type (Desktop Printer, Industrial Printer, Mobile Printer, and Kiosk Printer): The desktop printer segment is projected to reach USD 26.53 billion by 2032, owing to its compact design and growing deployment in office & retail environments.

Thermal Printing Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America thermal printing market share stood at around 37.25% in 2024, with a valuation of USD 18.67 billion. The market dominance of this region is attributed to the widespread adoption of thermal printers across retail, logistics, healthcare, and transportation sectors.

Strong investments in automation, along with advanced infrastructure and a high concentration of leading thermal printing manufacturers, support the market expansion. Growth in e-commerce and the increasing need for efficient labeling and tracking systems have further boosted the demand for thermal printing.

The thermal printing industry in Asia Pacific is poised to grow at a significant CAGR of 5.90% over the forecast period. This is attributed to the expanding industrialization, rising retail activity, and rapid development of logistics networks in emerging economies.

Countries like China, India, and Southeast Asian nations are registering high demand for barcode and receipt printing in manufacturing and warehousing. Increasing digitalization, coupled with growing investments in smart supply chain solutions, is expected to support sustained market growth in the region.

- In September 2024, Roland DG Corporation launched the TY-300 Direct-to-Film (DTF) production transfer printer. The printer is designed for custom apparel printing, offering high image quality, productivity, and cost performance with advanced features like new print heads and the True Rich Color 3 print setting.

Regulatory Frameworks

- In the U.S., thermal printing equipment and supplies are subject to regulations under the Occupational Safety and Health Administration (OSHA), which mandates the safe handling of chemicals used in thermal papers, particularly Bisphenol A (BPA).

- In the European Union (EU), thermal papers are regulated under Regulation (EC) No 1907/2006 (REACH), which restricts the use of hazardous substances such as BPA in thermal paper.

- In India, thermal printing materials are regulated under the Bureau of Indian Standards (BIS) and Hazardous and Other Wastes (Management and Transboundary Movement) Rules, 2016, which oversee the chemical content and waste management practices related to thermal printing processes.

Competitive Landscape

Key players in the thermal printing industry are focusing on expanding their product portfolios by introducing advanced thermal printers with enhanced speed, connectivity, and durability. Many are investing in R&D to develop eco-friendly printing solutions and reduce reliance on BPA-based thermal paper.

Strategic collaborations with software vendors and supply chain partners are being pursued to offer integrated printing solutions tailored for retail, logistics, and healthcare applications.

Additionally, firms are expanding their geographic footprint through distribution agreements and establishing local manufacturing units to enhance market access and reduce operational costs. Mergers and acquisitions are also being used to acquire technological capabilities and enter untapped regional markets.

- In March 2025, Hangzhou Todaytec Digital Co., Ltd. acquiredthe CALOR Group . This acquisition strengthens Todaytec’s presence in Europe and enhances its competitiveness in the market.

List of Key Companies in Thermal Printing Market:

- Star Micronics

- Toshiba Tec

- Avery Dennison Corporation

- The Axiohm company

- SATO Argox India Pvt. Ltd.

- HP Development Company, L.P.

- Dai Nippon Printing Co., Ltd.

- Zebra Technologies Corp.

- Domino Printing Sciences plc

- BIXOLON CO., LTD.

- Citizen Systems Europe GmbH

- Honeywell International Inc

- Rongta Technology (Xiamen) Group Co., Ltd.

- BIPL

- TSC Auto ID

Recent Developments (Product Launches)

- In July 2024, Star Micronics launched the SK5-31 Thermal Kiosk Printer, introducing a high-speed, fully-housed solution with advanced features such as anti-paper jam technology, paper eject assistance, and an innovative inner looping mechanism. Designed for diverse applications like parking, self-payment, and gaming, the printer supports various media types and offers versatile connectivity with USB, LAN, and serial options.

- In January 2024, HP Inc. launched its HP Thermal Inkjet (TIJ) 108mm Bulk Printing Solution, designed to enhance efficiency and versatility in packaging production. The new solution enables high-speed, high-resolution printing with longer throw distances and reduced downtime, supporting a wide range of applications such as secondary coding, mail addressing, and specialty packaging.