Market Definition

Thermal interface materials (TIMs) are specialized compounds designed to enhance heat transfer between heat-generating components and heat-dissipating devices. They fill microscopic air gaps and irregularities on surfaces to improve thermal conductivity and reduce thermal resistance. TIMs are widely used in electronic devices, power modules, LEDs, and automotive systems to maintain optimal temperatures and ensure reliable performance.

Thermal Interface Materials Market Overview

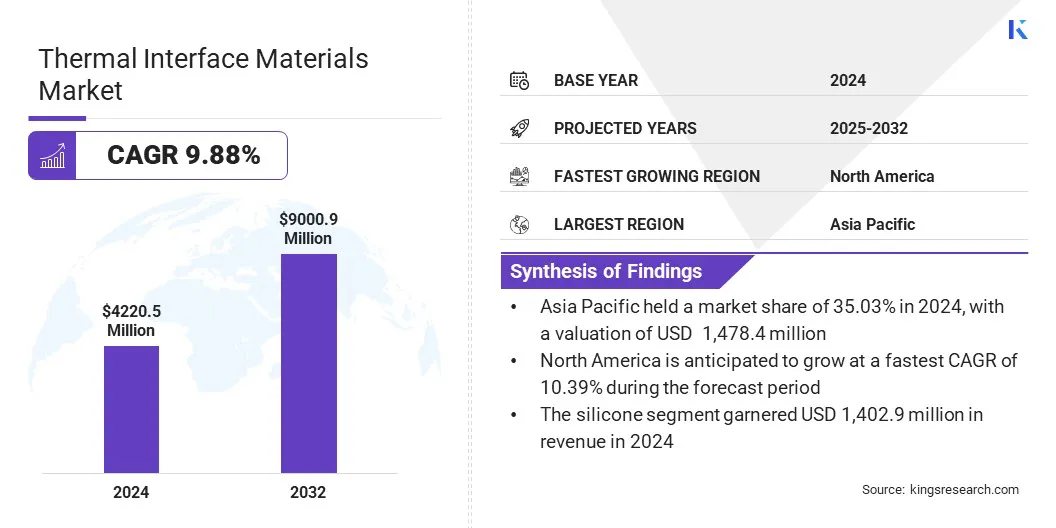

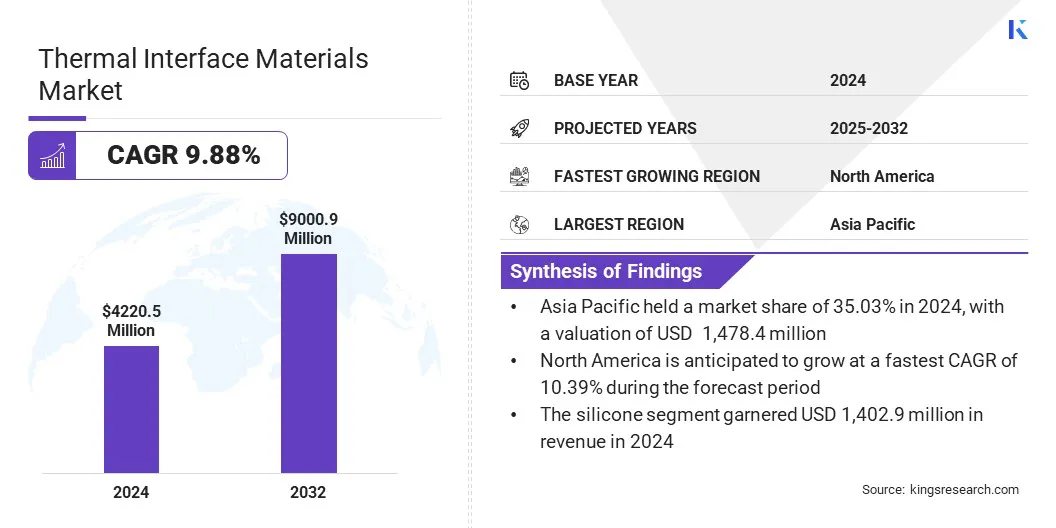

The global thermal interface materials market size was valued at USD 4,220.5 million in 2024 and is projected to grow from USD 4,627.8 million in 2025 to USD 9,000.9 million by 2032, exhibiting a CAGR of 9.88% during the forecast period.

Market growth is driven by the increasing power densities in semiconductor devices, which require advanced thermal interface materials to efficiently dissipate heat and maintain performance in compact designs. Additionally, the rising adoption of miniaturized and high-performance electronics is fueling demand for reliable thermal management solutions to enhance longevity and prevent overheating in compact designs.

Key Highlights:

- The global thermal interface materials market was recorded at USD 4,220.5 million in 2024.

- The market is projected to grow at a CAGR of 9.88% from 2025 to 2032.

- Asia Pacific held a share of 35.03% in 2024, valued at USD 1,478.4 million.

- The silicone segment garnered USD 1,402.9 million in revenue in 2024.

- The grease & adhesives segment is expected to reach USD 2,186.4 million by 2032.

- The automotive segment is anticipated to witness the fastest CAGR of 10.24% through the projection period.

- North America is anticipated to grow at a CAGR of 10.39% over the forecast period.

Major companies operating in the global thermal interface materials market are Henkel Corporation, Honeywell International Inc, Dow, Laird Technologies, Inc., Momentive, 3M, Parker Hannifin Corp, Shin-Etsu Chemical Co., Ltd, Fujipoly America, Indium Corporation, Boyd, Electrolube, Wakefield Thermal, Inc, MG Chemicals, and Dycotec Materials Ltd.

Rising investments in advanced cooling technologies are propelling market expansion by fostering innovation in thermal management solutions. This is prompting manufacturers to develop more efficient materials that improve heat dissipation, reduce energy consumption, and enhance the reliability of data centers and electronic devices.

- In May 2023, the U.S. Department of Energy announced USD 40 million in funding to develop advanced cooling systems for data centers. The initiative aims to support the growing demand for advanced thermal management solutions to lower carbon emissions and address climate change.

Market Driver

Increasing Power Densities in Semiconductor Devices

A major factor boosting the expansion of the thermal interface materials market is the increasing power densities in semiconductor devices. Semiconductor chips are becoming more powerful and compact, generating higher heat within smaller surfaces.

The increasing heat generation is prompting manufacturers to design and implement advanced thermal interface materials that improve heat dissipation. These materials help maintain device performance and reliability by efficiently managing thermal loads, supporting the ongoing demand for high-performance and miniaturized electronics.

- According to the 2023 Microelectronics Roadmap for High-Performance Integrated Electronics Packaging (MRHIEP) report, the thermal density for logic strata is expected to increase from 1 W/mm² in 2023 to 5 W/mm² by 2035, reflecting the growing demand for advanced thermal management in semiconductor devices.

Market Challenge

High Cost of Advanced TIM Formulations and Materials

A key challenge impeding the progress of the thermal interface materials market is the high cost of advanced formulations and materials. Electronics manufacturers often face budget constraints, making it difficult to absorb expenses associated with premium fillers such as graphene, silver, and nanomaterials.

Complex manufacturing processes and stringent quality requirements further raise purchase and maintenance expenses. This financial burden delays adoption and prompts companies to opt for lower-performance alternatives, which impacts device reliability, heat management efficiency, and long-term operational performance.

To address this challenge, market players are investing in R&D to develop cost-effective formulations using alternative fillers and hybrid materials that balance performance with affordability.

They are optimizing manufacturing processes to reduce waste and improve yield, leveraging economies of scale through larger production volumes. Additionally, companies are introducing tiered product ranges, allowing customers to choose TIM solutions aligned with performance needs and budget constraints.

Market Trend

Rising Adoption of High-elasticity TIMs

A key trend influencing the thermal interface materials market is the rising adoption of high-elasticity TIMs. These materials maintain stable thermal contact under vibration, pressure, and temperature fluctuations, making them ideal for automotive electronics and other demanding applications. Their elasticity minimizes stress on sensitive components, preventing contact degradation and ensuring long-term performance.

Additionally, their compatibility with automated dispensing processes supports efficient, high-volume manufacturing. This growing demand for durable and reliable heat management is making high-elasticity TIMs a preferred choice in next-generation electronic systems.

- In March 2025, T-Global Technology launched TG-ASD35AB thermal gel for automotive electronic systems, offering 3.5 W/mK conductivity, low impedance, high elasticity, rapid curing, and compatibility with automated dispensing, ensuring reliable heat management and efficient high-volume production in demanding environments.

Thermal Interface Materials Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Silicone , Epoxy, Polyimide, Others

|

|

By Product

|

Grease & Adhesives, Tapes & Films, Elastomeric Pads, Gap Fillers, Metal-based, Phase change materials, Others

|

|

By Application

|

Electronics, Telecommunications, Automotive, Healthcare, Industrial Machinery, Aerospace & Defense, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Silicone, Epoxy, Polyimide, and Others): The silicone segment earned USD 1,402.9 million in 2024, largely due to its superior thermal conductivity and flexibility in various applications.

- By Product (Grease & Adhesives, Tapes & Films, Elastomeric Pads, Gap Fillers, Metal-based, Phase change materials, and Others): The grease & adhesives segment held a share of 24.20% in 2024, mainly attributed to its effective heat transfer and easy application in electronics.

- By Application (Electronics, Telecommunications, Automotive, Healthcare, Industrial Machinery, Aerospace & Defense, and Others): The electronics segment is projected to reach USD 2,251.4 million by 2032, owing to increasing demand for efficient thermal management in consumer and industrial devices.

Thermal Interface Materials Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific thermal interface materials market share stood at 35.03% in 2024, valued at USD 1,478.4 million. This dominance is reinforced by strong presence of electronics manufacturing, including smartphones, semiconductors, data centers, and 5G infrastructure, which require efficient heat dissipation solutions.

The rapid adoption of electric vehicles and increasing deployment of renewable energy technologies are creating significant demand for advanced thermal management in batteries and power electronics.

Moreover, increased collaboration and consolidation among key players are enhancing innovation, streamlining product development, and improving the availability of thermal interface materials, fueling regional market expansion.

- In February 2025, Shanghai Kleber New Material Technology Co., Ltd. acquired Dongguan Nystein Electronics Material Co., Ltd. to strengthen its capabilities in thermal interface materials. The acquisition is expected to expand the company’s product portfolio, offer advanced technologies, and deliver comprehensive solutions across the electronics, automotive, and industrial equipment sectors.

The North America thermal interface materials market is set to grow at a robust CAGR of 10.39% over the forecast period. This growth is attributed to the increasing adoption of advanced thermal interface materials in satellite manufacturing.

Regional market growth is further supported by aerospace programs incorporating high-performance materials that operate effectively in extreme temperatures and radiation. Manufacturers are deploying solutions that ensure efficient heat dissipation and consistent contact, maintaining long-term operational stability in space applications.

Domestic market expansion is boosted by the efforts to reduce material waste during assembly and improve production efficiency in spacecraft systems. Regional companies are utilizing predictive performance tools for accurate design validation, reducing testing requirements. These advancements help meet stringent performance standards in critical satellite operations, contributing to regional market growth.

- In January 2024, Carbice partnered with RTX’s Blue Canyon Technologies to provide aligned carbon nanotube (CNT) thermal interface materials for critical satellite programs, including MethaneSAT. The partnership integrates Carbice Space Pad across Blue Canyon's satellite solutions, offering enhanced heat dissipation, sustainability benefits, and predictive performance tools that enhance spacecraft reliability in harsh space environments.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) regulates thermal interface materials by overseeing the use of chemicals, additives, and manufacturing emissions under laws such as the Toxic Substances Control Act (TSCA). It monitors environmental impact, ensures safe handling and disposal of hazardous substances, and enforces compliance to protect human health and the environment.

- In the UK, the Health and Safety Executive (HSE) regulates thermal interface materials by managing workplace safety, chemical hazards, and exposure limits under regulations such as COSHH. It oversees risk assessments, enforces safe handling, and ensures manufacturers comply with environmental and occupational health standards, protecting workers and the public from hazardous material exposure.

- In China, the Ministry of Ecology and Environment regulates thermal interface materials. It oversees environmental assessments, approves chemical registrations, and enforces national standards for pollution control. The MEE ensures TIM production aligns with sustainability goals, workplace safety, and environmental protection regulations across industries.

- In India, the Central Pollution Control Board governs thermal interface materials. It sets environmental quality standards, monitors manufacturing compliance, and enforces rules under the Environment Protection Act. The CPCB ensures that TIM producers minimize ecological impact while adhering to product safety and sustainability norms.

Competitive Landscape

Major players in the thermal interface materials market are forming strategic partnerships to integrate material science expertise with advanced technologies such as aligned carbon nanotubes. They are focusing on developing solutions that enhance heat dissipation performance and ensure reliability across diverse applications.

Manufacturers are prioritizing products that combine high thermal conductivity with cost efficiency while offering customization to address specific design and operational needs in mobility, industrial electronics, consumer electronics, and semiconductor sectors.

-

In December 2024, Dow partnered with Carbice to co-develop next-generation thermal interface materials by integrating Dow’s silicone expertise with Carbice’s aligned carbon nanotube technology. The collaboration is aimed at delivering customizable, scalable, and cost-efficient thermal management solutions tailored for high-performance sectors such as mobility, industrial electronics, consumer electronics, and semiconductors.

Key Companies in Thermal Interface Materials Market:

- Henkel Corporation

- Honeywell International Inc

- Dow

- Laird Technologies, Inc.

- Momentive

- 3M

- Parker Hannifin Corp

- Shin-Etsu Chemical Co., Ltd

- Fujipoly America

- Indium Corporation

- Boyd

- Electrolube

- Wakefield Thermal, Inc

- MG Chemicals

- Dycotec Materials Ltd.

Recent Developments (M&A/New Product Launch)

- In December 2024, T-Global Technology introduced its TG-AD Series Ultra Soft Thermal Pads, offering high thermal conductivity with exceptionally low hardness for improved heat transfer. These pads are applied in consumer electronics, industrial equipment, mobility systems, and semiconductor devices.

- In October 2024, Momentive Technologies acquired Sibelco’s spherical alumina and spherical silica businesses from Sibelco, expanding its ceramics powder portfolio for thermal management. This acquisition aims to enhance its production of thermal fillers used in thermal interface.