Market Definition

Carbon nanotubes (CNTs) are cylindrical nanostructures made of rolled graphene sheets. Known for their exceptional mechanical strength, electrical conductivity, and thermal stability, CNTs are classified into single-walled and multi-walled types. They are widely applied in electronics, energy storage, composite materials, sensors, and biomedical devices due to their unique nanoscale properties.

Carbon Nanotubes Market Overview

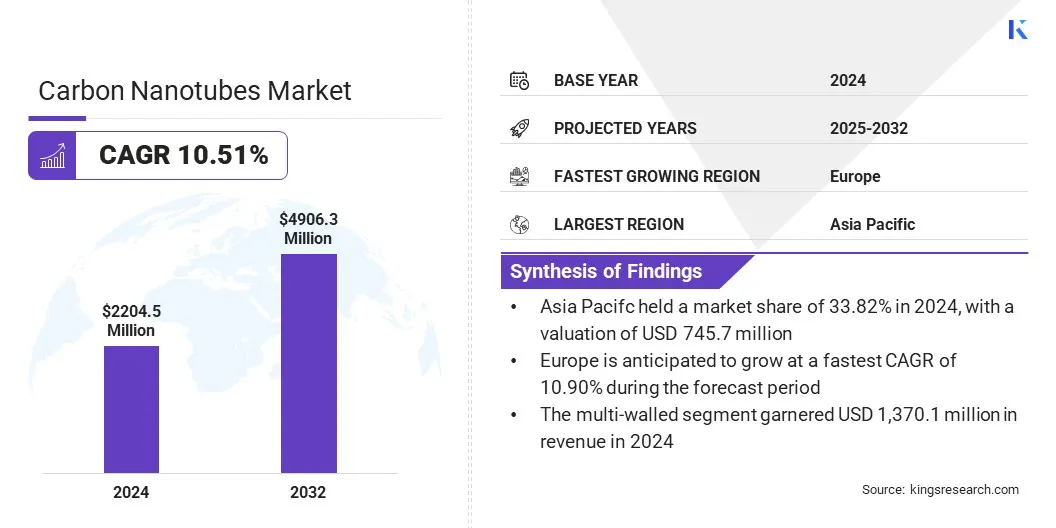

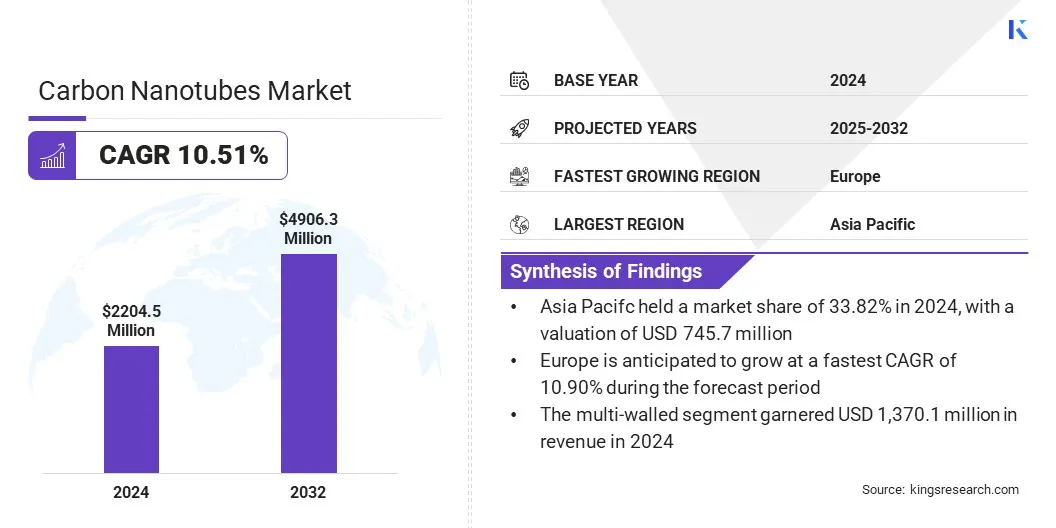

The global carbon nanotubes market size was valued at USD 2,204.5 million in 2024 and is projected to grow from USD 2,435.3 million in 2025 to USD 4,906.3 million by 2032, exhibiting a CAGR of 10.51% during the forecast period.

Market growth is driven by increasing investments in nanotechnology research and development, which are advancing carbon nanotube synthesis and applications. Rising demand for high-performance batteries in electric vehicles and energy storage, along with growing adoption in electronics and automotive sectors, further boosts market growth.

Key Highlights:

- The carbon nanotubes industry was recorded at USD 2,204.5 million in 2024.

- The market is projected to grow at a CAGR of 10.51% from 2025 to 2032.

- Asia Pacific held a share of 33.82% in 2024, valued at USD 745.7 million.

- The multi-walled segment garnered USD 1,370.1 million in revenue in 2024.

- The electronics & semiconductors segment is expected to reach USD 1,379.2 million by 2032.

- Europe is anticipated to grow at a CAGR of 10.90% through the projection period.

Major companies operating in the carbon nanotubes market are Nanocyl SA, Jiangsu Cnano Technology Co., Ltd, OCSiAl, Arkema, Carbon Solutions, Inc, CHASM Advanced Materials, Inc, Nano-C, Cheap Tubes, Canatu Oy, Chengdu Organic Chemicals Co. Ltd, NoPo Nanotechnologies, AdNano Technologies Pvt Ltd, NanoIntegris Inc, Meijo Nano Carbon Co., Ltd, and CARBON FLY, Inc.

Government initiatives to expand domestic production are fueling market growth. Funding and incentives promote the development of local manufacturing facilities, reducing reliance on imports. This enables increased production capacity to meet growing demand from the electric vehicle and energy storage sectors, boosting market expansion.

- In September 2024, the U.S. Department of Energy selected Cabot Corporation for award negotiation to receive up to USD 50 million to develop the first commercial-scale U.S. facility for battery-grade carbon nanotube and conductive additive dispersions.

Market Driver

Increasing Investment in Nanotechnology Research and Development

A major factor propelling the expansion of the carbon nanotubes market is the increasing investment in nanotechnology research and development. Governments, academic institutions, and private companies are funding the advancement of nanomaterial technologies, enabling improved synthesis methods and enhanced material quality. This investment reduces production costs, improves performance, and supports wider adoption of carbon nanotube applications across industries.

- In December 2024, the U.S. government’s National Nanotechnology Initiative (NNI) proposed a record budget of USD 2.2 billion to advance foundational research and application-driven R&D in nanotechnology.

Market Challenge

High Production Costs

A key challenge impeding the progress of the carbon nanotubes market is the high production cost associated with manufacturing processes. Producing CNTs requires advanced equipment and controlled environments, which demand significant capital investment.

Small and medium manufacturers struggle to manage these upfront costs due to limited financial resources. The complex synthesis methods involve expensive raw materials and energy consumption, increasing overall expenses. This financial barrier slows down large-scale production and restricts wider adoption across industries.

To address this challenge, market players are investing in research to develop more efficient and scalable synthesis techniques, including improved chemical vapor deposition methods. Companies are focusing on optimizing raw material use and energy consumption to reduce expenses.

Market players are increasing collaboration with academic institutions and technology partners to accelerate innovation. Additionally, some manufacturers are exploring bulk production and automation to achieve economies of scale.

Market Trend

Rising Adoption of CNTs to Enhance Technology and Promote Sustainability

A key trend influencing the carbon nanotubes market is their surging adoption to advance technology and support sustainability. Companies are integrating CNTs into sensors and conductive films to improve performance and energy efficiency. This trend prompts manufacturers to develop CNT-based solutions that reduce environmental impact and enhance product durability.

These efforts enable industries to meet carbon neutrality goals and fuel innovation in automotive, electronics, and energy sectors. The growing use of CNTs is fostering sustainable growth and technological progress across markets.

- In December 2024, DENSO Corporation signed a Memorandum of Understanding with Canatu of Finland to advance the practical application of carbon nanotube technology. The collaboration focuses on developing CNT-based transparent conductive films and heaters for vehicle cameras and windshields.

Carbon Nanotubes Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Multi-Walled, Single-Walled

|

|

By Industry

|

Electronics & Semiconductors, Automotive, Energy Storage, Industrial, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Multi-Walled and Single-Walled): The multi-walled segment earned USD 1,370.1 million in 2024, largely due to its widespread use in composite materials and energy storage applications.

- By Industry (Electronics & Semiconductors, Automotive, Energy Storage, Industrial, and Others): The electronics & semiconductors segment held a share of 28.08% in 2024, propelled by the increasing demand for miniaturized and high-performance electronic devices.

Carbon Nanotubes Market Regional Analysis

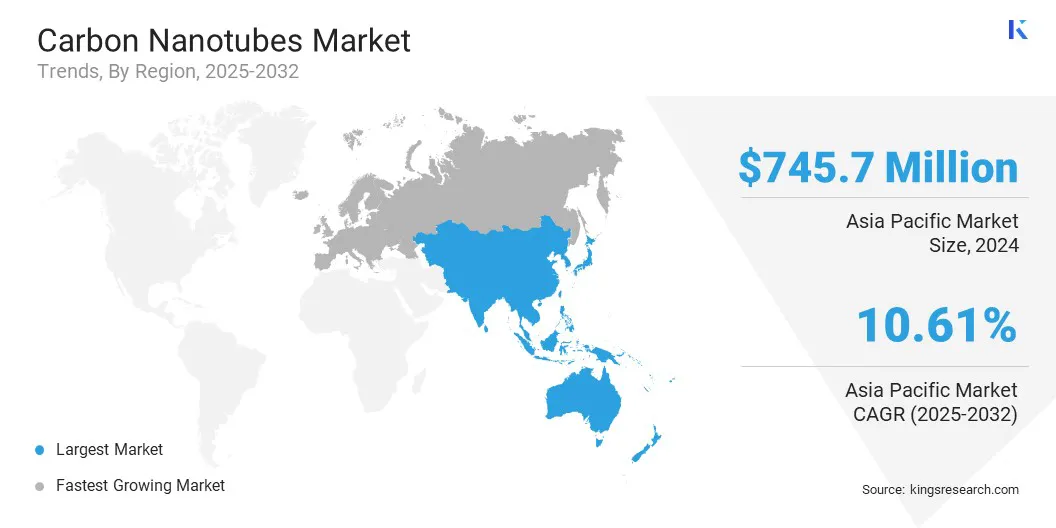

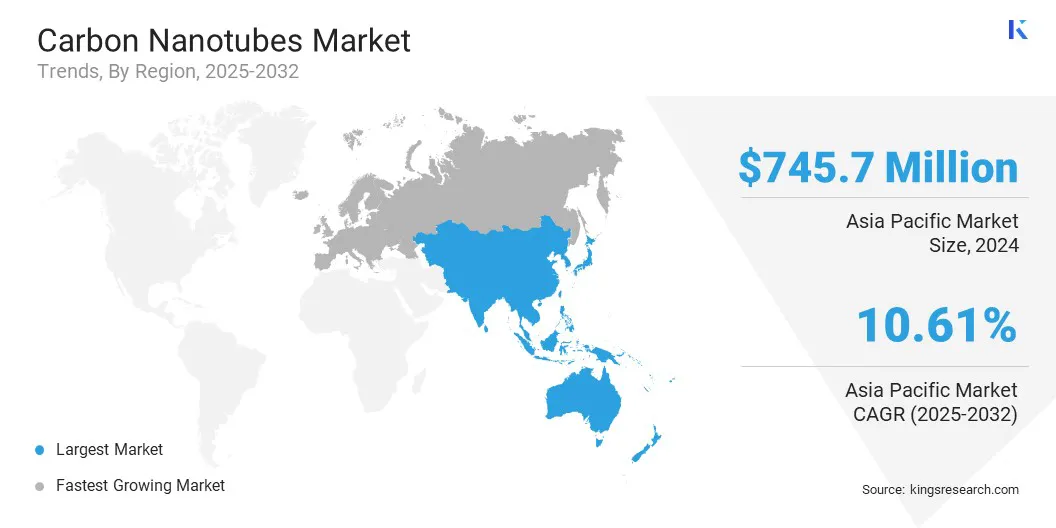

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific carbon nanotubes market share stood at 33.82% in 2024, valued at USD 745.7 million. This dominance is reinforced by a strong focus on developing advanced carbon nanotube technologies that improve battery performance.

The availability of hydrocarbons and catalyst metals, supported by cost-efficient large-scale manufacturing in China, India, South Korea, and Japan, enables large-scale production and widespread industrial adoption of carbon nanotubes. Strong R&D investments and rapid adoption in advanced applications, including electronics, semiconductors, and 3D printing, further support the marekt growth.

Moreover, continuous advancement in research and production capabilities to meet growing requirements in energy storage applications is accelerating the utilization of carbon nanotubes across diverse industries. The market also benefits from partnerships that accelerate the development and commercialization of cutting-edge carbon nanotube products. These efforts are driving market expansion in the region.

- In April 2024, SiAT partnered with Zeon Corporation to launch an innovative single-walled carbon nanotube (SWCNT) conductive paste. This paste serves as a conductive additive in lithium-ion battery cathode and anode formulations, requiring significantly less material than traditional carbon black. The technology enhances battery life, reduces charging time, and increases energy density by allowing a higher proportion of active materials in the battery formulation.

The Europe carbon nanotubes industry is set to grow at a CAGR of 10.90% over the forecast period. This growth is attributed to the establishment of a large-scale nanotube dispersion facility, which enhances production for high-performance lithium-ion batteries used in electric vehicles and consumer electronics. Regional players are expanding manufacturing capabilities to meet the rising demand for advanced battery technologies.

Additionally, the region is experiencing increased investment in emerging applications such as energy-dense, silicon-rich, and fast-charging graphite anodes that improve battery performance and durability. The regional market further benefits from collaboration between production facilities and key industries such as electric vehicles and electronics manufacturing.

- In June 2024, OCSiAl inaugurated a single-wall carbon nanotube (SWCNT) dispersion production facility in Serbia with an annual capacity of 3,000 MT. The upgraded plant delivers 15 times higher output and focuses on high-performance lithium-ion batteries for electric vehicles and consumer electronics, supporting the company's global expansion and collaborations with leading EV and battery manufacturers.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) regulates carbon nanotubes under the Toxic Substances Control Act (TSCA). It oversees their manufacture, import, and use to ensure environmental and human health safety. It enforces risk assessments, exposure limits, and reporting requirements for CNTs to prevent toxic release and manage their impact on air, water, and soil.

- In the UK, the Health and Safety Executive (HSE) governs carbon nanotubes under Control of Substances Hazardous to Health (COSHH) regulations. It oversees workplace exposure limits, risk assessments, and safe handling practices for CNTs to protect workers’ health. The HSE also promotes research and guidance on nanomaterial risks and enforces compliance in manufacturing and industrial use.

- In China, the Ministry of Ecology and Environment (MEE) supervises carbon nanotubes through chemical safety and environmental protection laws. It monitors CNT production emissions, waste management, and occupational exposure limits. The MEE ensures compliance with environmental standards to minimize pollution and health risks associated with nanomaterial manufacturing and application processes.

Competitive Landscape

Major players in the carbon nanotubes industry are forming strategic partnerships to expand supply chains across key regions such as North America and Europe. They are increasing local production capacity to reduce dependency on imports and meet rising demand from the electric vehicle sector. They are also developing cost-effective, scalable CNT additives designed to integrate seamlessly with existing battery manufacturing processes.

Additionally, companies are accelerating the commercialization and qualification of new CNT products for large-scale gigafactory applications to meet industry standards and scale production efficiently.

- In March 2024, CHASM Advanced Materials partnered with Ingevity Corporation. The partnership aims to expand carbon nanotube (CNT) supply for gigafactories in Europe and North America, addressing local production challenges and supporting growing demand from the electric vehicle sector.

Key Companies in Carbon Nanotubes Market:

- Nanocyl SA

- Jiangsu Cnano Technology Co., Ltd

- OCSiAl

- Arkema

- Carbon Solutions, Inc

- CHASM Advanced Materials, Inc

- Nano-C

- Cheap Tubes

- Canatu Oy

- Chengdu Organic Chemicals Co. Ltd

- NoPo Nanotechnologies

- AdNano Technologies Pvt. Ltd

- NanoIntegris Inc

- Meijo Nano Carbon Co. Ltd

- CARBON FLY,Inc.

Recent Developments (Product Launch)

- In January 2024, LG Chem increased its carbon nanotube production at its South Korean plant from 500 tons to 1,700 tons annually to meet the growing demand in the electric vehicle sector.