Market Definition

Thermal imaging captures infrared radiation emitted by objects to produce thermal images, revealing temperature variations. It operates across various wavelengths, including shortwave, mid-wave, and long-wave infrared. It is widely used in sectors such as defense, healthcare, automotive, and industrial.

Users employ thermal imaging for tasks, including surveillance, medical diagnostics, predictive maintenance, and energy audits, enhancing safety, efficiency, and operational effectiveness.

Thermal Imaging Market Overview

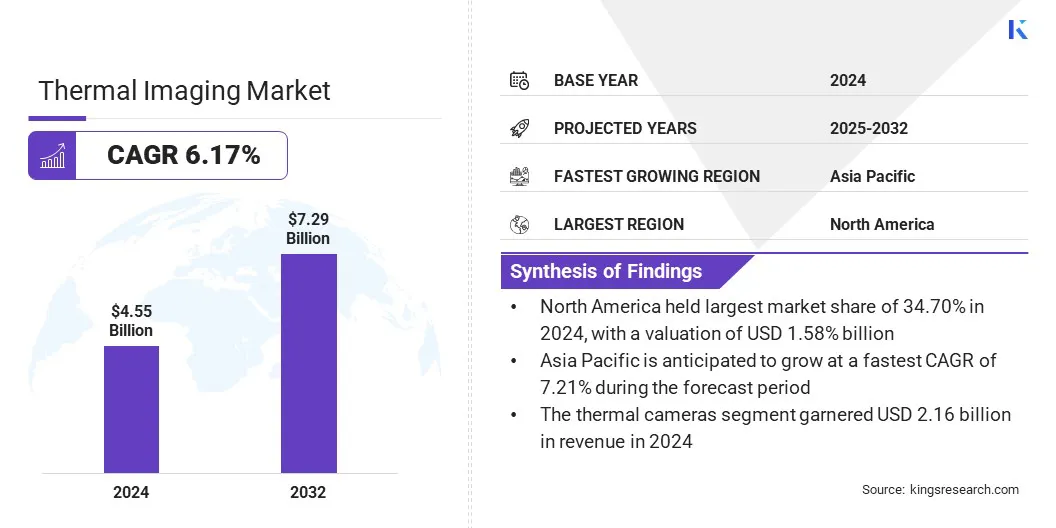

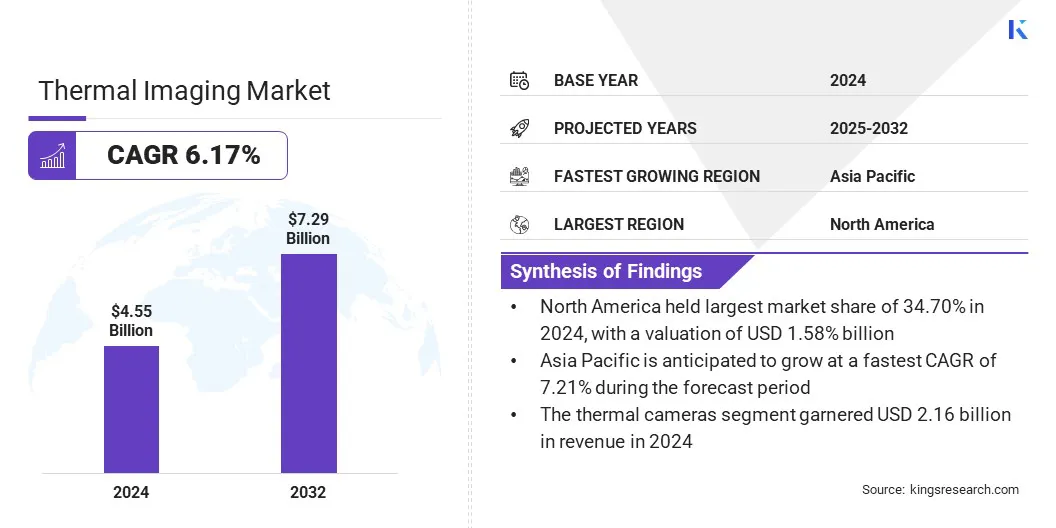

The global thermal imaging market size was USD 4.55 billion in 2024 and is projected to grow from USD 4.79 billion in 2025 to USD 7.29 billion by 2032, exhibiting a CAGR of 5.92% during the forecast period. This growth is primarily fueled by rising adoption in industrial and predictive maintenance for early fault detection and reduced downtime.

Additionally, advancing accuracy through AI-linked and surface-enhanced imaging techniques is making thermal systems more precise and reliable, expanding their use in critical monitoring and inspection applications.

Key Highlights

- The thermal imaging industry size was valued at USD 4.55 billion in 2024.

- The market is projected to grow at a CAGR of 5.92% from 2025 to 2032.

- North America held a share of 34.70% in 2024, valued at USD 1.58 billion.

- The thermal cameras segment garnered USD 2.16 billion in revenue in 2024.

- The uncooled thermal imaging segment is expected to reach USD 5.19 billion by 2032.

- The long-wave infrared (LWIR) segment secured the largest revenue share of 67.90% in 2024.

- The security & surveillance segment is set to grow at a CAGR of 6.70% through the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 7.21% through the projection period.

Major companies operating in the thermal imaging market are Teledyne FLIR LLC, Fluke Corporation, Axis Communications AB, RTX, Leonardo S.p.A., L3Harris Technologies, Opgal Ltd., Seek Thermal, Inc., Testo SE & Co. KGaA, Thermoteknix Systems Ltd., Hangzhou Hikvision Digital Technology Co., Ltd., InfiRay Technologies Co., Ltd, BAE Systems, Exosens, and InfraTec GmbH.

The increasing use of thermal imaging technologies in security and defense is boosting adoption across government and military sectors. Thermal imaging is being widely used for surveillance, border control, night vision, and target acquisition in low-visibility conditions.

Defense agencies are deploying thermal systems to detect heat signatures from threats, vehicles, and personnel in darkness, smoke, or adverse weather conditions. These technologies are enhancing situational awareness, mission accuracy, and perimeter security. Integration with drones, vehicles, and handheld devices is further extending the reach and versatility of thermal imaging solutions.

- In November 2024, Poland signed a contract worth approximately USD 25 million to procure 52 FlyEye drones from WB Electronics. The drones are equipped with day-and-night thermal imaging capability and will be used by the Polish Armed Forces and Ukraine. This reflects a commitment to enhancing surveillance effectiveness in mission-critical environments.

Market Driver

Rising Adoption in Industrial & Predictive Maintenance

The growing use of thermal imaging in industrial and predictive maintenance is driving its adoption across manufacturing, utilities, and construction sectors. Thermal cameras are being extensively used to inspect equipment and identify early signs of failure such as hotspots in motors, bearings, and electrical panels. These non-contact tools are allowing technicians to detect anomalies without interrupting operations, improving safety, and minimizing unplanned downtime.

Energy audits conducted using thermal imaging are helping facilities identify insulation gaps, air leaks, and heat loss, enhancing efficiency. In response, businesses are integrating thermal imaging into routine maintenance for data-driven asset management.

- In June 2024, Teledyne FLIR launched the A6301 thermal camera, a cooled mid-wave infrared system with 640 × 512 resolution and a 30 Hz frame rate. Engineered for inspection and predictive maintenance in manufacturing, it enables early anomaly detection without disrupting operations. Its rugged design and compatibility with standard GigE Vision and REST APIs support seamless integration into automated maintenance workflows.

Market Challenge

High Cost of Equipment

A key challenge impeding the progress of the thermal imaging market is the high upfront cost associated with premium devices, particularly those with cooled detectors. While these systems offer superior sensitivity and resolution, their pricing remains prohibitive for small and medium enterprises and individual consumers. This cost barrier is limiting the adoption of thermal imaging applications beyond specialized industrial and defense sectors.

To address this challenge, market players are developing uncooled and compact thermal imaging solutions that offer adequate performance at lower costs. Companies are also introducing scalable product lines and collaborating with component suppliers to reduce manufacturing expenses and improve affordability.

Market Trend

Advancement in AI-Linked and Surface-Enhanced Imaging

A key trend influencing the thermal imaging market is the development of surface-enhanced and AI-linked imaging technologies. Researchers are focusing on emissivity-aware neural imaging techniques that account for surface variations to improve measurement precision. These approaches are enhancing calibration accuracy, particularly in industrial environments with diverse surface materials.

AI enables real-time adjustments and interpretation of thermal data, leading to more precise diagnostics. Key applications such as predictive maintenance, quality control, and process monitoring are seeing improved detection sensitivity and reduced error rates, aiding the shift toward more reliable and intelligent thermal imaging solutions.

- In June 2025, researchers from Ningbo Institute of Digital Twin and Hangzhou Dianzi University introduced a physically guided neural framework combining temperature correction and image enhancement. Using a symmetric skip-CNN architecture and an emissivity-aware attention module, the model dynamically integrates thermal radiation features with spatial context, reducing emissivity artifacts and recovering structural details. The method was validated on an industrial blower system under varying conditions, demonstrating accurate calibration results across different industrial settings.

Thermal Imaging Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Thermal Cameras, Thermal Modules, Thermal Scopes & Binoculars

|

|

By Technology

|

Uncooled Thermal Imaging, Cooled Thermal Imaging

|

|

By Wavelength

|

Short-Wave Infrared (SWIR), Mid-Wave Infrared (MWIR), Long-Wave Infrared (LWIR)

|

|

By Application

|

Security & Surveillance, Industrial Inspection, Automotive, Healthcare & Life Sciences, Research & Development, Firefighting & Public Safety, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product Type (Thermal Cameras, Thermal Modules, and Thermal Scopes & Binoculars): The thermal cameras segment earned USD 2.16 billion in 2024, mainly due to its widespread use across industrial maintenance, defense, security, and surveillance applications.

- By Technology (Uncooled Thermal Imaging and Cooled Thermal Imaging): The uncooled thermal imaging segment held a notable share of 73.20% in 2024, largely attributed to its lower cost, compact design, and suitability for high-volume applications in industrial, commercial, and security sectors.

- By Wavelength (Short-Wave Infrared (SWIR), Mid-Wave Infrared (MWIR), and Long-Wave Infrared (LWIR)): The long-wave infrared (LWIR) segment is projected to reach USD 5.02 billion by 2032, owing to its cost-effective uncooled sensor technology and strong performance in detecting thermal signatures in low-visibility and ambient temperature conditions.

- By Application (Security & Surveillance, Industrial Inspection, Automotive, Healthcare & Life Sciences, Research & Development, Firefighting & Public Safety, and Others): The security & surveillance segment is estimated to grow at a CAGR of 6.70% through the forecast period, mainly attributed to continued investments in border control, critical infrastructure protection, and 24/7 perimeter monitoring.

Thermal Imaging Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America thermal imaging market share stood at 34.70% in 2024, valued at USD 1.58 billion. This dominance is primarily reinforced by the widespread use of thermal imaging systems for round-the-clock surveillance along North America's vast land and coastal borders.

Government agencies are deploying fixed and mobile thermal cameras to detect unauthorized crossings, particularly in low-visibility conditions. Investments in unmanned platforms with thermal payloads are further bolstering demand in the defense and public safety sectors.

- In November 2024, U.S. Customs and Border Protection (CBP) deployed two solar-powered Autonomous Surveillance Towers (ASTs) with thermal cameras in the Big Bend Sector, Texas. These towers enable continuous monitoring in low-visibility conditions. Real-time thermal imaging detected over 1,600 instances of border activity in FY 2024, improving detection of unauthorized crossings while aligning with labor and safety protocols by reducing the need for constant human patrols.

The Asia-Pacific thermal imaging industry is estimated to grow at a CAGR of 7.21% over the forecast period. This growth is stimulated by the region's rapidly expanding base of manufacturing, chemical, and power generation industries, where thermal imaging is increasingly used for preventive maintenance.

Companies rely on these systems to detect overheating in electrical equipment, machinery, and pipelines, reducing downtime, preventing accidents, and ensuring operational efficiency in facilities with continuous processes.

- In May 2025, Adani Electricity implemented mobile thermal imaging in its Mumbai service area to enhance preventive maintenance of electrical infrastructure. Field teams are equipped with handheld thermal cameras to identify overheating in transformers, cables, and switchgear, allowing early fault identification and timely resolution.

Moreover, thermal imaging is being increasingly integrated into urban infrastructure, particularly for surveillance and traffic monitoring in newly developed or expanding cities. Smart city projects are adopting thermal cameras for perimeter security, low-light vehicle detection, and crowd management, contributing to regional market expansion.

Regulatory Frameworks

- In the U.S., thermal imaging systems are regulated under the Export Administration Regulations (EAR) and International Traffic in Arms Regulations (ITAR), particularly for military or dual-use applications. High-resolution or high-frame-rate systems require export licenses. Domestically, the use of thermal cameras for surveillance is restricted by the Fourth Amendment, as established in the Kyllo v. United States.

- In the EU, thermal imaging devices are governed by the Dual-Use Regulation (Regulation (EU) 2021/821), which requires licensing for exports of high-resolution or dual-use systems. The General Data Protection Regulation (GDPR) applies to any data collection using thermal cameras in public or commercial settings. Additional compliance is required with technical directives such as Electromagnetic Compatibility (EMC), Restriction of Hazardous Substances (RoHS), and Low Voltage Directive (LVD).

- China regulates thermal imaging exports under its dual-use export control system, aligned with the national Export Control Law. Export approval is required for devices used in surveillance, border control, or critical infrastructure protection. Domestic use is subject to strict oversight under cybersecurity and public security regulations.

- Japan enforces thermal imaging controls under the Foreign Exchange and Foreign Trade Act, in line with the Wassenaar Arrangement. Export of sensitive thermal imaging equipment, specifically those with military or surveillance applications, requires government licensing. Domestically, usage in public areas must comply with the Act on the Protection of Personal Information (APPI), which mandates transparency, consent, and data protection measures in public and workplace settings.

Competitive Landscape

Major players in the thermal imaging industry are adopting strategies such as advanced product development, investment in proprietary packaging technologies, and integration of high-efficiency sensors to strengthen their position.

They are focusing on research and development to reduce power consumption, improve sensitivity, and enable compact, robust thermal imaging solutions for large-scale manufacturing. Strategic collaborations and technology licensing are further supporting faster time-to-market and growing demand across industrial, surveillance, and consumer sectors.

- In June 2025, Raytron Microelectronics launched the OHLE 3123, the world’s first SWLP-based uncooled LWIR thermal sensor based on Super Wafer-Level Packaging. Designed for compact, dust-resistant applications, it supports mass production via SMT2 mounting and delivers 384 × 288 resolution, <40 mK NETD, and <65 mW power consumption, making i suitable for outdoor night vision, industrial measurement, and security monitoring.

Key Companies in Thermal Imaging Market

- Teledyne FLIR LLC

- Fluke Corporation

- Axis Communications AB

- RTX

- Leonardo S.p.A.

- L3Harris Technologies

- Opgal Ltd.

- Seek Thermal, Inc.

- Testo SE & Co. KGaA

- Thermoteknix Systems Ltd.

- Hangzhou Hikvision Digital Technology Co., Ltd.

- InfiRay Technologies Co., Ltd

- BAE Systems

- Exosens

- InfraTec GmbH

Recent Developments (Product Launches)

- In February 2025, Raythink showcased its thermal imaging solutions for the oil and petrochemical industry at EYGPEs 2025. Products on display included handheld thermometers, PTZ network cameras, and panoramic infrared systems featuring RS1280, CX200+, PC4S4A1, and U655 models at Hall 1, Booth 1E49. These non-contact thermal devices are tailored for industrial safety and maintenance.

- In April 2025, FLIR launched FLIR MIX, a multispectral imaging system synchronizing thermal and visible-light data for research applications. The platform supports capture rates up to 1,004 frames per second and offers spatial-temporal alignment of dual datasets. The system is available in X-Series and A-Series hardware kits, along with a software toolkit for post-processing.

- In August 2024, Leonardo launched the SLX‑Hawk, a compact, high-performance thermal imaging camera for OEMs and system integrators. The new model offers passive infrared imaging with high resolution for both day and night operations.

- In January 2024, Teledyne FLIR introduced the FLIR E5 Pro, a ruggedized point-and-shoot thermal camera designed for building surveys, HVAC diagnostics, and electrical inspections. The device features enhanced thermal sensitivity and ergonomic design for improved field usability.