Market Definition

The market involves technologies and systems designed to store heat or cold for later use. These systems capture excess thermal energy, typically from renewable sources, and release it when required. This process helps enhance energy efficiency, support grid stability, and facilitate sustainable energy management.

Thermal Energy Storage Market Overview

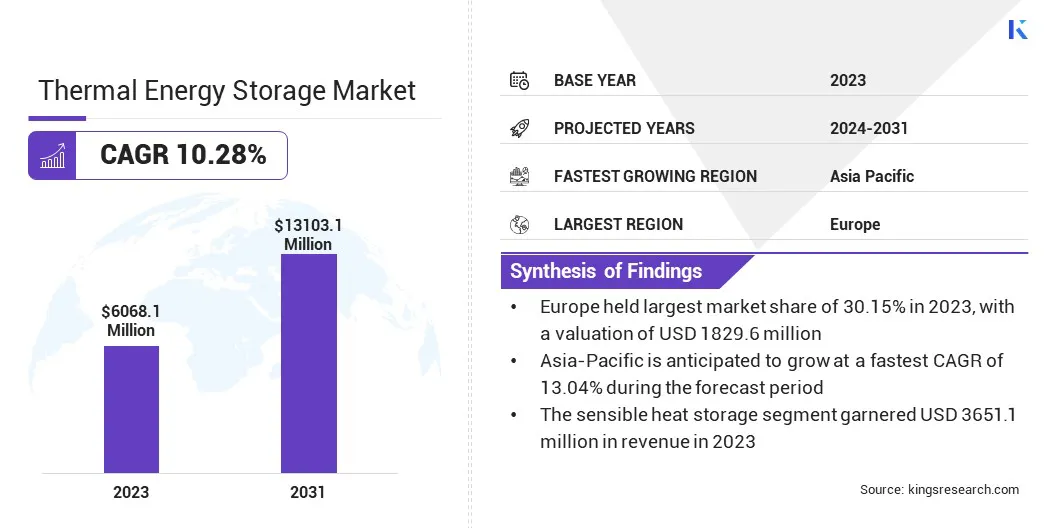

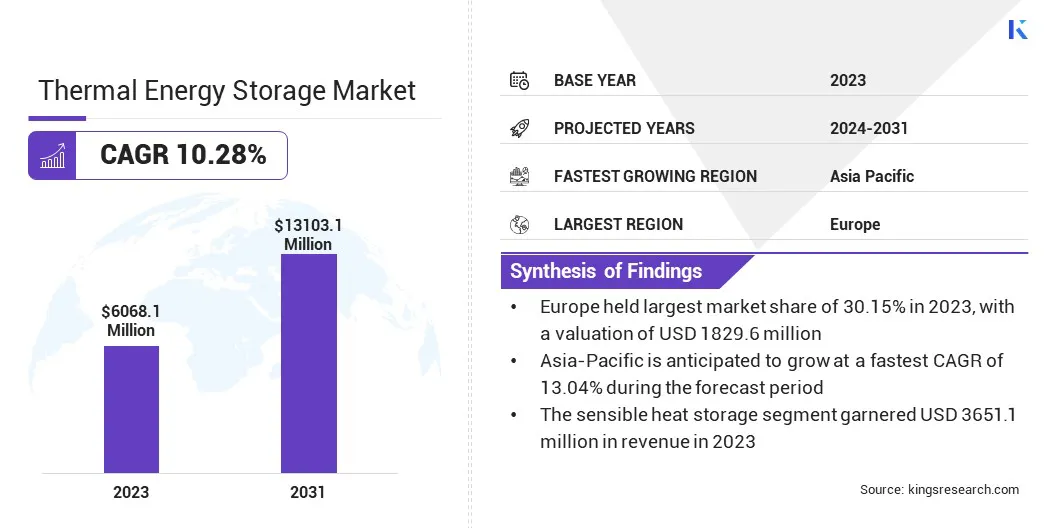

According to Kings Research, the global thermal energy storage market size was valued at USD 6,068.1 million in 2023, which is estimated to be valued at USD 6,603.8 million in 2024 and reach USD 13,103.1 million by 2031, growing at a CAGR of 10.28% during the forecast period.

The growing demand for renewable energy, especially solar and wind power, is a key driver for the market. These energy sources are intermittent, hence, thermal storage solutions help manage energy generation and ensure a reliable power supply.

Key Market Highlights:

- The thermal energy storage industry size was valued at USD 6,068.1 million in 2023.

- The market is projected to grow at a CAGR of 10.28% from 2024 to 2031.

- Europe held a market share of 30.15% in 2023, with a valuation of USD 1,829.6 million.

- The molten salt technology segment garnered USD 1,840.7 million in revenue in 2023.

- The district heating & cooling segment is expected to reach USD 4,256.0 million by 2031.

- The thermochemical heat storage segment is anticipated to register a CAGR of 12.95% during the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 13.04% during the forecast period.

Major companies operating in the global thermal energy storage industry are Abengoa, Burns & McDonnell, ENERGYNEST AS, CALMAC, MAN Energy Solutions Group, Baltimore Aircoil Company, Inc, Thermofin , Caldwell Tanks, Dunham Bush , Goss Engineering, Steffes, LLC, DN Tanks, Terrafore Technologies LLC, Siemens AG (Siemens Gamesa Renewable Energy), and Fafco.

The market is focused on storing excess non-renewable and renewable energy in the form of heat for later use, offering an effective solution to balance energy supply and demand.

- As per the European Environment Agency article published in January 2025, renewable energy sources accounted for 24.5% of the European Union’s (EU) final energy consumption in 2023.

With advancements in materials and technology, thermal storage systems are increasingly being integrated into both industrial and residential applications. This technology is essential in managing energy fluctuations, providing a stable, sustainable solution for energy storage. As energy management becomes more crucial, the market is registering steady growth across various regions.

Rising Demand for Renewable Energy

The rising demand for renewable energy, particularly solar and wind power, is a significant driver for the thermal energy storage market.

- As per Press Information Bureau (PIB) on January 2025, the Union Minister of India highlighted India’s renewable energy leadership, targeting 500 GW by 2030. Key developments were emphasized, including Rajasthan’s solar projects and PM KUSUM Scheme, driving the nation’s sustainable energy transition.

Thermal Energy Storage (TES) helps manage fluctuations in energy generation, allowing excess energy to be stored and used when production is low. This need for efficient energy storage is crucial to optimize the use of renewable energy and support grid stability.

- In September 2024, National Renewable Energy Laboratory (NREL's) sand-based 100-hour thermal energy storage technology moved to the demonstration phase, achieving a 10-hour discharge. This innovation uses sand’s high thermal stability and low cost to offer long-duration, efficient energy storage at USD 0.05/kWh.

Energy Loss During Storage

A significant challenge faced by the thermal energy storage market is energy loss during storage, as systems tend to lose heat over time, which reduces their efficiency and overall storage potential. This issue can be mitigated by improving insulation technologies and using advanced materials or high-density storage media.

These materials are designed to minimize heat loss and enhance energy retention, ensuring longer storage durations and improving the overall effectiveness of thermal energy storage systems.

- In July 2024, the NewHeatIntegrated project, a collaboration between VSB-TUO, Fraunhofer-Gesellschaft, and other partners, aims to develop innovative TES solutions using phase change materials, focusing on high-density heat storage and efficient heat transfer for buildings.

District Heating and Cooling Expansion

The thermal energy storage market is registering significant growth, due to the expansion of district heating and cooling systems. Urban areas increasingly demand energy-efficient solutions to address rising energy consumption and environmental concerns.

TES systems play a crucial role by storing thermal energy for use during peak demand, ensuring consistent heating and cooling services while reducing reliance on conventional energy sources. This trend aligns with global sustainability goals, promoting cleaner energy utilization and improved energy management in urban infrastructures.

- In March 2024, Polar Night Energy and Loviisan Lämpö agreed to construct a 1 MW Sand Battery in Pornainen. Integrated with the district heating network, this innovative TES system will cut emissions by 70%, aligning with carbon-neutral goals.

Thermal Energy Storage Market Report Snapshot

| Segmentation |

Details |

| By Application |

Process Heating & Cooling, District Heating & Cooling, Power Generation, Ice storage airconditioning, Others |

| By Storage Material |

Molten Salt, Phase Change Material, Water, Others |

| By Type |

Sensible Heat Storage, Latent Heat Storage, Thermochemical Heat Storage |

| By Technology |

Molten Salt Technology, Electric Thermal Storage Heaters, Solar Energy Storage, Ice-based Technology, Miscibility Gap Alloy Technology (MGA), Others |

| By Region |

North America: U.S., Canada, Mexico |

| Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

| Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Technology (Molten Salt Technology, Electric Thermal Storage Heaters, Solar Energy Storage, Ice-Based Technology, Miscibility Gap Alloy Technology (MGA), Others): The molten salt technology segment earned USD 1,840.7 million in 2023, due to its high energy density, ability to store heat at high temperatures, and widespread use of solar plants.

- By Application (Process Heating & Cooling, District Heating & Cooling, Power Generation, Ice Storage Airconditioning, Others): The district heating & cooling segment held 31.13% share of the market in 2023, due to the growing demand for efficient energy distribution systems in urban areas.

- By Storage Material (Molten Salt, Phase Change Material, Water, Others): The water segment is projected to reach USD 4,320.8 million by 2031, owing to the abundant availability of water, cost-effectiveness, and ease of integration into thermal energy storage systems for both residential and industrial applications.

- By Type (Sensible Heat Storage, Latent Heat Storage, Thermochemical Heat Storage): The thermochemical heat storage segment is anticipated to register a CAGR of 12.95% during the forecast period, due to its ability to store energy for long periods without significant heat loss, making it ideal for applications requiring seasonal storage and long-duration energy storage.

Thermal Energy Storage Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

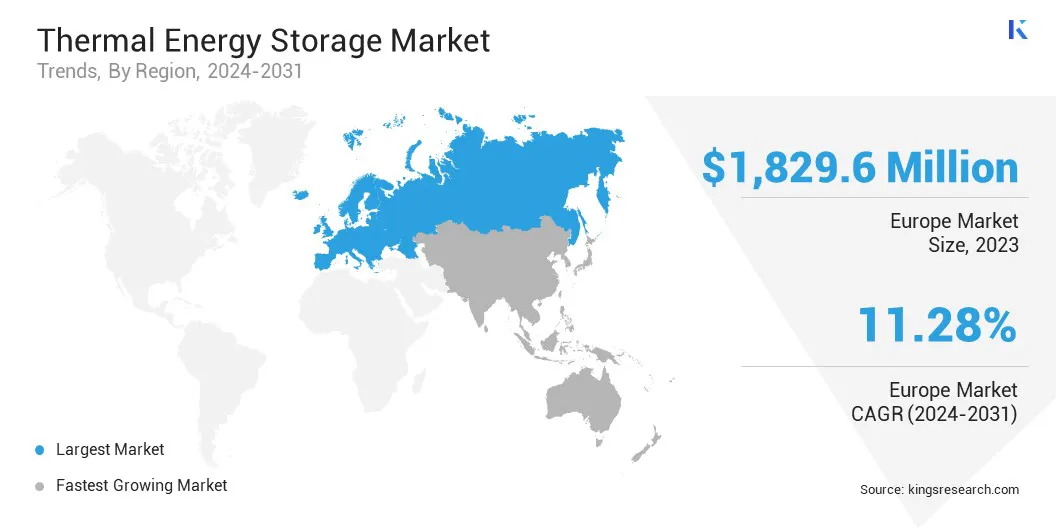

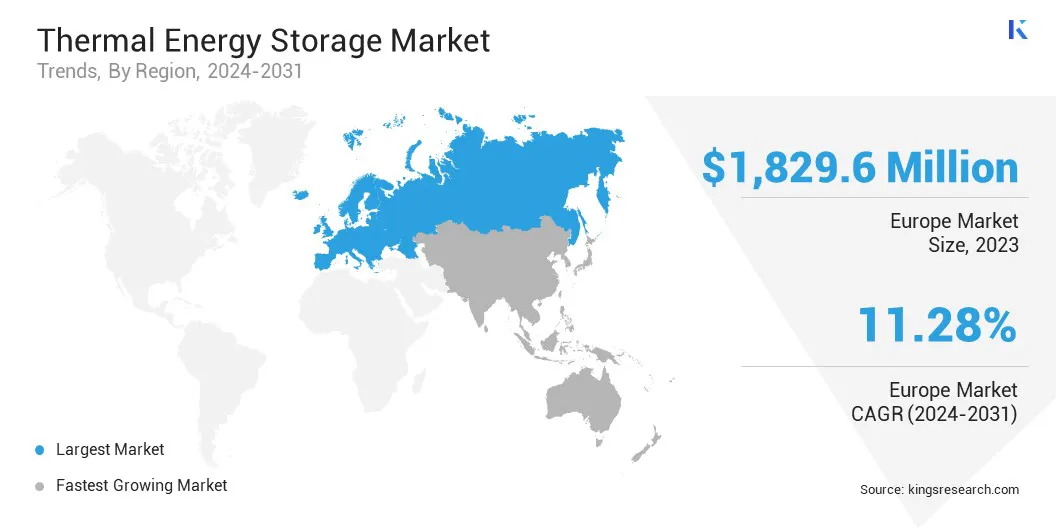

Europe accounted for a market share of around 30.15% in 2023, with a valuation of USD 1,829.6 million. Europe leads the global thermal energy storage market, driven by strong renewable energy adoption, stringent climate policies, and a focus on energy efficiency.

The region's advanced infrastructure and government incentives for sustainable energy solutions have fostered significant growth in TES applications, particularly in district heating and cooling.

Countries in Europe are integrating TES with renewable energy systems, aligning with EU climate goals. Europe’s commitment to carbon neutrality further solidifies its dominance in the market.

- In September 2024, Brenmiller Energy launched Brenmiller Europe S.L., a joint venture with Green Enesys and Viridi RE, to expand bGen thermal energy storage deployment across Europe. This collaboration leverages expertise in renewable projects to drive decarbonization and accelerate clean energy adoption.

The market in Asia Pacific is poised for significant growth over the forecast period at a CAGR of 13.04%. Asia Pacific is the fastest-growing market for thermal energy storage, driven by increasing energy demand, rapid urbanization, and government initiatives to promote renewable energy.

Countries like China, India, and Japan are investing heavily in TES technologies to enhance energy efficiency and reduce reliance on fossil fuels. The rising adoption of TES in industrial processes, district heating, and cooling applications is further boosting the market. Favorable policies and advancements in TES solutions make Asia Pacific a key player in the global market.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- The American Society of Mechanical Engineers (ASME) formed the TES Standards Committee, which oversees the development and maintenance of requirements for the design, construction, installation, inspection, testing, comissioning, maintenance, operation, and decommissioning of thermal energy storage systems for the life cycle of the equipment.

- The Thermal Energy Storage subprogram by the U.S. Department of Energy, aims to accelerate the development and optimization of next-generation TES innovations that enable resilient, flexible, affordable, healthy, and comfortable buildings and a reliable & flexible energy system and supply.

Competitive Landscape:

The thermal energy storage market is characterized by a number of participants, including both established corporations and rising organizations. Companies in the market are increasingly forming strategic partnerships to drive technological advancements, expand their market presence, and leverage complementary expertise.

These collaborations help in enhancing product offerings, improving system integration, accessing new markets, and supporting the large-scale deployment of TES solutions globally.

- In May 2024, Alfa Laval and Hyme Energy announced their partnership to develop specialized steam generators for molten salt TES. This collaboration aims to accelerate the transition to sustainable energy, improve energy efficiency, and advance decarbonization efforts in industries and utilities.

Key Companies in Thermal Energy Storage Market:

- Abengoa

- Burns & McDonnell

- ENERGYNEST AS

- CALMAC

- MAN Energy Solutions Group

- Baltimore Aircoil Company, Inc

- Thermofin

- Caldwell Tanks

- Dunham Bush

- Goss Engineering

- Steffes, LLC

- DN Tanks

- Terrafore Technologies LLC

- Siemens AG (Siemens Gamesa Renewable Energy)

- Fafco,

Recent Developments (Partnerships/New Product Launch/Expansion/Funding)

- In December 2024, Brenmiller Energy achieved a significant milestone in its TES project for Tempo Beverages Ltd., with 40% of the financial commitment secured. System assembly for the 32 MWh bGen ZERO TES system will begin in January 2025, targeting 2025 commissioning.

- In September 2024, HiTHIUM deployed Eastern Europe’s largest battery energy storage system in Razlog, Bulgaria, with a capacity of 55MWh using 16 advanced storage containers. This milestone underscores HiTHIUM’s commitment to accelerating renewable energy transition and fostering European collaboration.

- In April 2024, the world's first molten salt-based TES facility was inaugurated in Esbjerg, Denmark. Developed by Hyme Energy, DIN Forsyning, and partners, it stores green electricity for use during sunless or windless days, crucial for a climate-friendly energy system.

- In November 2024, Mitsubishi Heavy Industries Thermal Systems received an order from Aisan Industry for a large-scale Aquifer Thermal Energy Storage (ATES) system at its new Anjo Plant. This will be the first practical application of ATES in Japan’s Chubu region, supporting eco-friendly operations.

- In May 2024, Aramco signed an MoU with Rondo Energy to explore large-scale deployment of Rondo Heat Batteries for reducing emissions at Aramco facilities. The collaboration aims to advance TES, hydrogen production, and carbon capture technologies.

- In February 2024, Brenmiller Energy announced the completion of its first bGen TES installation at a State University of New York (SUNY) campus. The system will reduce 550 metric tons of emissions annually, financed with support from BIRD Foundation.