Market Definition

The thermal barrier coatings (TBC) market involves the production and use of coatings that are applied to materials (typically metal surfaces) to protect them from high temperatures.

These coatings are primarily used to improve the performance, durability, and efficiency of components in high-temperature environments such as gas turbines, jet engines, power plants, and industrial applications. TBCs are designed to insulate surfaces from heat, reduce thermal stresses, and prevent oxidation and corrosion.

The growth of the TBC market is driven by factors such as technological advancements, rising demand for more energy-efficient and durable systems, and increased investments in high-temperature applications.

Thermal Barrier Coatings Market Overview

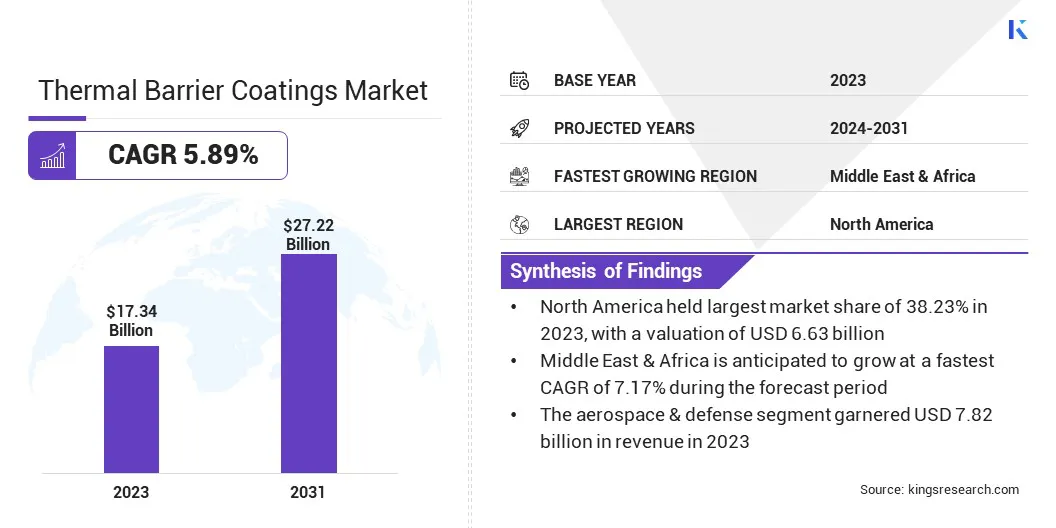

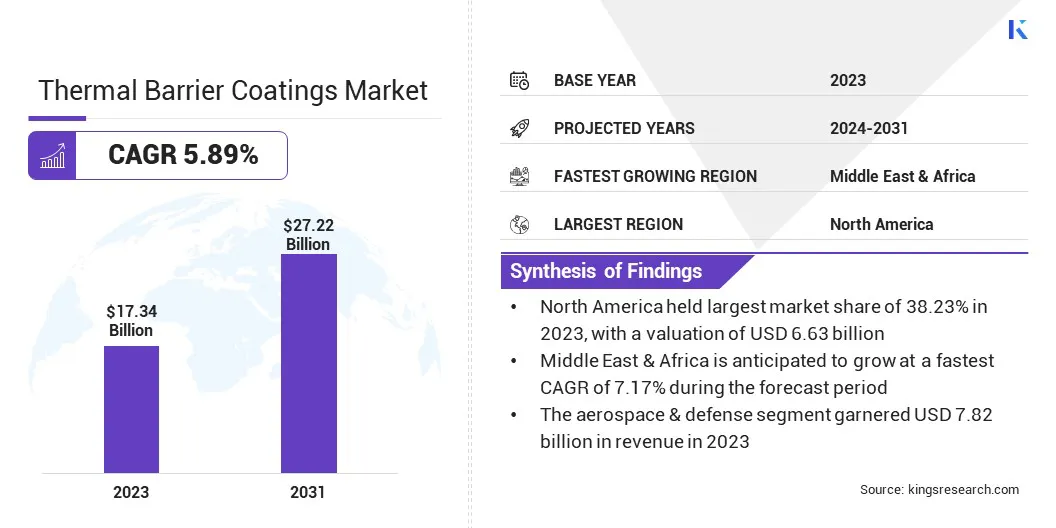

Global thermal barrier coatings market size was USD 17.34 billion in 2023, which is estimated to be valued at USD 18.23 billion in 2024 and reach USD 27.22 billion by 2031, growing at a CAGR of 5.89% from 2024 to 2031.

The increasing demand for high-performance engines in the aerospace and automotive industries is highlighting the need for thermal barrier coatings. These coatings enhance engine durability and efficiency, enabling components to withstand extreme temperatures and improving overall performance and reliability.

Major companies operating in the thermal barrier coatings industry are Metallisation Limited, Flame Spray Inc., Precision Coatings, Inc., Cincinnati Thermal Spray, Inc., Hannecard Roller Coatings, Inc - ASB Industries, Thermion, A&A Thermal Spray Coatings, TWI Ltd, Metallizing Equipment Co. Pvt. Ltd., Fisher Barton, Honeywell International Inc., Parat Tech (senata GmbH), Hayden Corporation, MITSUBISHI HEAVY INDUSTRIES, LTD., Saint-Gobain, and others.

The market is characterized by a strong emphasis on innovation and performance. Industry players are focusing on developing advanced coating materials that offer superior heat resistance, durability, and efficiency. The market is highly competitive, with continuous advancements in coating technologies, application techniques, and material formulations.

- In December 2024, Zircotec introduced a next-generation formulation of its ThermoHold for Composites, a plasma-applied ceramic coating that is 69% lighter than its predecessor. This breakthrough reduces weight while maintaining thermal protection, offering a competitive advantage for motorsport teams.

As industries seek to improve operational reliability and performance in extreme conditions, the demand for high-quality thermal barrier coatings continues to grow.

- In September 2024, Zircotec unveiled its ElectroHold range, featuring coatings for dielectric, flameproofing, and EMI shielding. These high-performance coatings, including the all-in-one OMNI SHIELD, provide essential protection for EV battery enclosures and cooling plates, enhancing safety and efficiency.

Key Highlights:

- The thermal barrier coatings industry size was recorded at USD 17.34 billion in 2023.

- The market is projected to grow at a CAGR of 5.89% from 2024 to 2031.

- North America held a share of 38.23% in 2023, valued at USD 6.63 billion.

- The air plasma segment garnered USD 6.24 billion in revenue in 2023.

- The ceramic-based coatings segment is expected to reach USD 10.11 billion by 2031.

- The power generation segment is anticipated to witness fastest CAGR of 8.40% during the forecast period

- Middle East & Africa is estimated to grow at a CAGR of 7.17% through the projection period.

Market Driver

"Increasing Demand for High-Performance Engines"

The increasing demand for high-performance engines in the automotive industry is propelling the growth of the thermal barrier coatings (TBC) market. As manufacturers strive for more efficient and durable engines, TBCs are becoming essential in protecting engine components from extreme temperatures, improving longevity, and optimizing performance.

- In May 2023, Cabot Corporation launched its ENTERA aerogel particles, designed for use in thermal barriers for lithium-ion batteries in electric vehicles. These aerogel particles provide lightweight, low thermal conductivity solutions, supporting battery safety, efficiency, and extended driving range for EVs.

This need for advanced thermal management solutions to enhance engine efficiency and reliability is fueling the demand for TBCs, particularly in high-performance vehicles and those seeking better fuel economy and reduced emissions.

- In June 2023, Zircotec introduced Diamond Black, a highly durable ceramic coating developed using their ThermoHold technology. This ultra-hard-wearing coating resists abrasion and high temperatures up to 450°C, making it ideal for automotive applications requiring both performance and aesthetic appeal.

Market Challenge

"Rising Durability Concerns"

Rising durability concerns are presenting a significant challenge to the expansion of the thermal barrier coatings market, as these coatings can degrade over time due to thermal cycling, erosion, and mechanical stress, reducing their long-term effectiveness.

To address this challenge, continuous advancements in material science and coating technologies are essential. Researchers and companies are focusing on developing more resilient materials to enhance the coatings' lifespan.

- In November 2024, researchers from the University of Virginia and Harvard University found that substituting iron into yttria-stabilized zirconia (YSZ) improves heat absorption properties, enhancing the efficiency and durability of thermal barrier coatings, particularly in turbines, benefiting the market.

Market Trend

"Notable Shift Toward Customized Solutions"

A prominent trend in the thermal barrier coatings market is the rise of customized solutions. Manufacturers are increasingly providing tailored coatings designed to meet the unique thermal management needs of various industries, including aerospace, automotive, and energy.

These bespoke coatings are formulated to address specific challenges, such as extreme temperature resistance, durability, and performance under unique conditions. By offering application-specific solutions, companies can optimize thermal protection, improve efficiency, and enhance the longevity of critical components in demanding environments.

- In January 2024, Arkema introduced the Foranext Gaseous Thermal Barrier (GTB), an advanced material designed to prevent thermal runaway in EV batteries. This innovative solution enhances immersion cooling systems, improving battery safety and reducing ignition risks during thermal events.

Thermal Barrier Coatings Market Report Snapshot

| Segmentation |

Details |

| By Technology |

Air Plasma, High Velocity Oxy Fuel, Electron Beam-Physical Vapor Deposition, Chemical Vapor Deposition, Others. |

| By Combination |

Ceramic-based Coatings, Al2O3, Mullite-based, MCrAiY, Others. |

| By End-User Industry |

Aerospace & Defense, Automotive, Power Generation, Industrial. |

| By Region |

North America: U.S., Canada, Mexico |

| Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe |

| Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Technology (Air Plasma, High Velocity Oxy Fuel, Electron Beam-Physical Vapor Deposition, Chemical Vapor Deposition, and Others): The air plasma segment earned USD 6.24 billion in 2023 due to its ability to provide high-temperature protection with precision and growing use in aerospace and automotive industries for superior durability.

- By Combination (Ceramic-based Coatings, Al2O3, Mullite-based, MCrAiY, Others): The ceramic-based coatings held a share of 39.51% in 2023, fueled by their superior thermal insulation properties, making them essential in industries requiring high thermal stability such as aerospace and automotive.

- By End-User Industry (Aerospace & Defense, Automotive, Power Generation, and Industrial): The power generation segment is projected to reach USD 11.14 billion by 2031, propelled by the increasing demand for efficient energy systems and advanced turbine technologies requiring high-performance thermal barrier coatings for extreme conditions.

Thermal Barrier Coatings Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America thermal barrier coatings market accounted for a notable share of around 38.23% in 2023, valued at USD 6.63 billion. This dominance is reinforced by its strong aerospace, automotive, and power generation industries, along with advanced manufacturing capabilities and rising demand for high-performance engines.

Increasing investments in renewable energy projects further support regional market growth. Additionally, onging technological advancements, stringent regulations, and the presence of key players boosts the adoption of innovative thermal barrier coatings for enhanced performance, durability, and energy efficiency.

- In June 2023, Aspen Aerogels established the Advanced Thermal Barrier Center (ATBC) in Marlborough, Massachusetts , to enhance thermal barriers solutions, including PyroThin, for EV battery safety. This facility reinforces North America's leadership in thermal barrier innovation ands market dominance.

Middle East & Africa thermal barrier coatings industry is poised to grow at a CAGR of 7.17% over the forecast period. This rapid growth is stimulated by rapid industrialization, infrastructure development, and increased demand for energy efficiency. The region's expanding automotive and aerospace sectors are increasingly adopting TBCs to enhance performance and durability under extreme conditions.

Additionally, the region’s growing focus on sustainable energy solutions and power generation technologies is boosting the demand for advanced thermal protection, positioning MEA as a key region in the global TBC market.

Region’s Regulatory Framework Also Plays a Significant Role in Shaping the Market

- In the U.S., the Environmental Protection Agency (EPA) sets guidelines for emission control that influence materials used in thermal barrier coatings to safeguard human health and the environment.

- The Occupational Safety and Health Administration (OSHA) ensures safe and healthful working conditions, protecting workers from hazardous environments and unlawful retaliation

- In the U.S., the Federal Aviation Administration (FAA) regulates aerospace coatings for engine components, ensuring safety and efficiency in the aviation sector.

- In the EU, the Regulation on Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) protects human health and the environment from chemical risks.

- The European Union Aviation Safety Agency (EASA) ensures enhanced aviation safety by developing regulations, certifying aircraft and components, and overseeing organizations globally.

Competitive Landscape:

The thermal barrier coatings industry is characterized by a large number of participants, including both established corporations and emerging players. Several market participants are emphasizing innovative product introductions aimed at improving heat resistance, durability, and efficiency.

These new launches focus on enhancing performance for industries such as aerospace, automotive, and power generation, catering to evolving customer needs for advanced thermal protection solutions.

- In August 2024, PPG introduced PITT-THERM 909, a silicone-based spray-on insulation coating. Designed for high-heat environments in industries such as oil, gas, and petrochemicals, it enhances safety, asset protection, and operational efficiency while addressing temperature resistance and corrosion challenges.

List of Key Companies in Thermal Barrier Coatings Market:

- Metallisation Limited

- Flame Spray Inc.

- Precision Coatings, Inc.

- Cincinnati Thermal Spray, Inc.

- Hannecard Roller Coatings, Inc - ASB Industries

- Thermion

- A&A Thermal Spray Coatings

- TWI Ltd

- Metallizing Equipment Co. Pvt. Ltd.

- Fisher Barton

- Honeywell International Inc.

- Parat Tech (senata GmbH)

- Hayden Corporation

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- Saint-Gobain

Recent Developments (Launch/Expansion/Acquisition)

- In March 2023, Zircotec enhanced its ThermoHold ceramic coating technology by refining its powder deposition process to reduce heat transfer. This technology, used in automotive and motorsport industries, improves performance by lowering exhaust surface temperatures by up to 33% while retaining lightweight and heat retention properties for composite materials.

- In February 2024, Flame Spray North America announced a USD 2.5 million expansion in Laurens County, creating 40 jobs. The investments aims to advance the company’s thermal spray coating technologies for industrial gas turbine and aerospace markets.

- In October 2024, Hannecard – ASB Industries upgraded its equipment with the K2 HVOF System from GTV. This third-generation kerosene fuel system provides higher combustion pressure, improved coating quality, and enhanced production stability, enabling consistent, high-performance HVOF coatings for customers.

- In February 2024, Hannecard acquired Revamo, a Netherlands-based thermal spray service company, expanding its capabilities in combustion flame, wire, HVOF, plasma, and cold spray technologies. This acquisition strengthens Hannecard's presence in diverse industrial markets globally.