Market Definition

The testing, inspection, and certification (TIC) market provides third-party services aimed at ensuring product, service, and system quality, safety, and compliance across diverse industries such as manufacturing, healthcare, automotive, energy, and food and beverage. The growth of this market is driven by increasing demand for quality assurance, regulatory adherence, and environmental sustainability globally.

Testing, Inspection, and Certification Market Overview

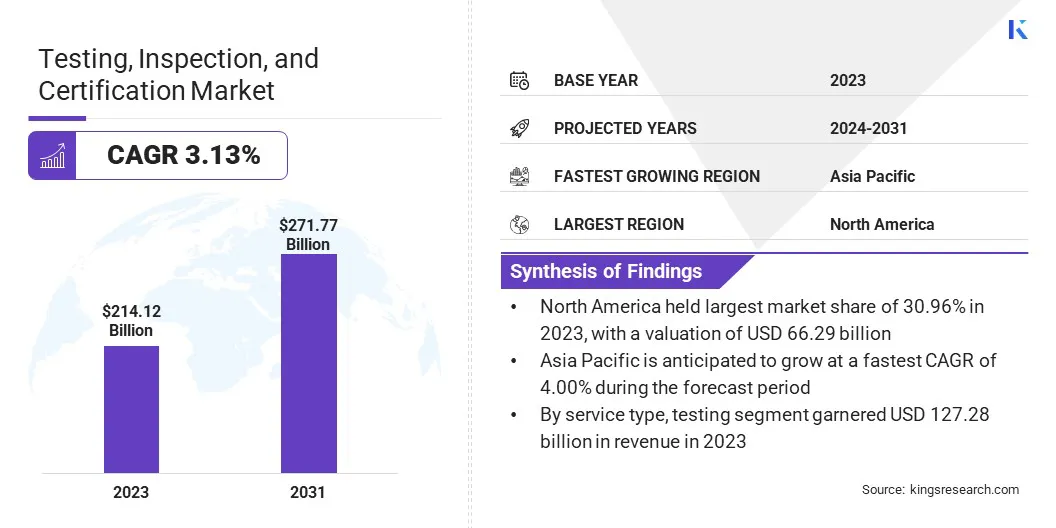

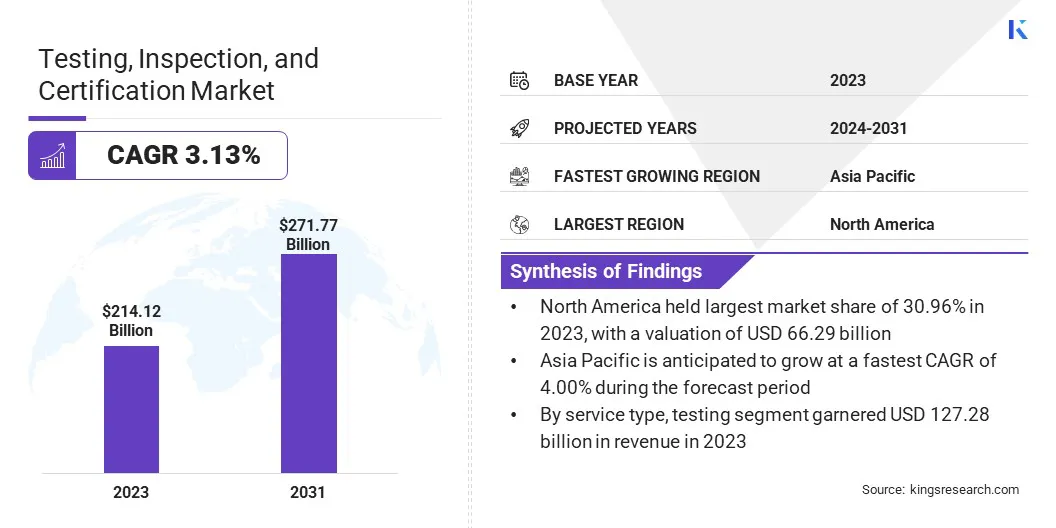

The testing, inspection, and certification market size was valued at USD 214.12 billion in 2023 and is projected to grow from USD 219.05 billion in 2024 to USD 271.77 billion by 2031, exhibiting a CAGR of 3.13% during the forecast period.

The TIC market is expanding due to stringent regulatory requirements, growing consumer demand for quality and safety, expanding global supply chains, and technological advancements improving efficiency and accuracy. Innovations such as automation, AI, and real-time data analytics are streamlining testing, inspection, and certification processes, reducing costs and time while improving accuracy.

Major companies operating in the testing, inspection, and certification market are Intertek Group plc, DEKRA IN, Element Materials Technology, MISTRAS Group, TÜV NORD GROUP, ASTM, SGS Société Générale de Surveillance SA, Applus+, UL LLC, TÜV SÜD, Bureau Veritas, DNV AS, Eurofins Scientific, ALS, Lloyd's Register Group Services Limited, and Others.

The growth of the TIC market is further fueled by expansion into emerging markets, where the demand for compliance and certification services is rising. Advancements in artificial intelligence (AI), machine learning, automation, and IoT are enhancing efficiency, accuracy, and scalability, streamlining testing and inspection while minimizing human error.

Additionally, digital platforms and cloud-based solutions enable seamless data sharing, remote inspections, and enhanced collaboration across global supply chains.

In April 2024, Intertek expanded its services to include auditing for the ISO/IEC 42001:2023 Artificial Intelligence Management System (AIMS). This new offering helps organizations manage AI technologies in accordance with governance, ethical, and risk management standards.

It supports businesses in achieving transparent and responsible AI implementation, addressing the growing need for compliance and accountability in AI applications.

Key Highlights

- The testing, inspection, and certification market size was recorded at USD 214.12 billion in 2023.

- The market is projected to grow at a CAGR of 3.13% from 2024 to 2031.

- North America held a share of 30.96% in 2023, valued at USD 66.29 billion.

- The infrastructure segment garnered USD 41.55 billion in revenue in 2023.

- The testing segment is expected to reach USD 127.28 billion by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 4.00% over the forecast period.

Market Driver

"Rising Emphasis on Sustainability and Digital Innovation"

Growing environmental concerns are prompting businesses to prioritize Environmental, Social, and Governance (ESG) compliance to meet regulatory requirements and align with consumer expectations, boosting the growth of the testing, inspection, and certification market. This has led to increased demand for TIC services to ensure adherence to sustainability standards.

Moreover, advancements in digital technologies, including AI, automation, and IoT, are transforming the TIC industry by enhancing the efficiency, accuracy, and scalability of testing, inspection, and certification processes.

- According to the TIC Council's 2023 annual report, the past year saw the global adoption of various Environmental, Social, and Governance (ESG) policies. The TIC Council's Summit on Carbon Removals, featuring contributions from global stakeholders, reinforced sustainability as a key priority. In September 2023, the Council introduced the TIC Index of Trust, a survey measuring public confidence in the sustainability efforts of governments, international institutions, and corporations.

The focus on ESG policies and digital transformation has created a robust demand for testing, inspection, and certification services as businesses prioritize sustainability and regulatory compliance. Initiatives such as the TIC Index of Trust reflect growing public interest in credible sustainability efforts.

Meanwhile, advancements in AI and the establishment of the Digitalisation Working Group are improving efficiency and accuracy in testing processes, strengthening the sector's role in supporting sustainability and digital trust.

Market Challenge

"Complex Regulatory Compliance"

The testing, inspection, and certificationmarket encounters significant challenges due to complex regulatory compliance, requiring navigation of diverse standards across regions, industries, and jurisdictions.

This complexity increases costs, delays product launches, and demands specialized expertise to ensure adherence to the evolving regulations. Stricter overnment enforcement of safety, quality, and environmental standards intensifies compliance pressure on businesses.

This has led to an increased demand for third-party testing, inspection, and certification services, which enable companies to meet evolving standards, mitigate risks, and avoid potential penalties or reputational harm.

To address these challenges, key players are developing innovative solutions, such as advanced testing technologies, digital platforms for streamlined compliance management, and automated inspection processes. Additionally, companies are investing in specialized expertise to stay ahead of evolving regulations and ensure their services meet the diverse needs of global markets.

Market Trend

"Surging Demand for Quality Assurance"

The demand for product quality and safety is increasing, particularly within industries such as pharmaceuticals, food, and electronics. Stricter regulatory requirements and increased consumer awareness are highlighting the need for comprehensive inspections and certifications to ensure compliance with quality standards.

- In January 2025, Bureau Veritas announced an agreement to acquire Contec AQS and its subsidiaries, Exenet and PMPI. Aligned with its LEAP | 28 strategy, this acquisition reinforces its leadership in the Buildings and Infrastructure market, strengthens its presence in Italy, and enhances its construction and infrastructure capabilities to meet the rising demand for sustainable solutions.

The increasing demand for quality assurance is propelled by stricter regulatory compliance, higher consumer expectations for product safety and reliability, and the growing need for competitive advantages through superior quality standards.

Industries such as pharmaceuticals, food, and electronics face increasingly stringent regulations and evolving market expectations, compelling businesses to invest in comprehensive testing, inspections, and certifications to ensure product integrity and compliance.

Testing, Inspection, and Certification Market Report Snapshot

| Segmentation |

Details |

| By Service Type |

Testing, Inspection and Certification, Accreditation and Approval, Others |

| By Sourcing Type |

In-house Services, Outsourced Services |

| By End-Users |

Infrastructure, Automotive, Aerospace and Defense, Consumer Goods and Retail, Agriculture and Food, Chemicals, Healthcare, Energy and Power, Others |

| By Region |

North America: U.S., Canada, Mexico |

| Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe |

| Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Service Type (Testing, Inspection and Certification, Accreditation and Approval, and Others): The testing segment earned USD 97.33 billion in 2023 due to its critical role in ensuring product safety, quality, and compliance with regulatory standards across various industries.

- By Sourcing Type (In-house Services and Outsourced Services): The in-house services segment held a share of 61.63% in 2023, attributed to to companies’ preference for greater control over quality, security, and compliance.

- By End-Users (Infrastructure, Automotive, Aerospace and Defense, Consumer Goods and Retail, Agriculture and Food, Chemicals, Healthcare, Energy and Power, and Others): The infrastructure segment earned USD 41.55 billion in 2023 and is projected to grow at a CAGR of 4.62%, primarily fueled by the increasing construction activities.

Testing, Inspection, and Certification Market Regional Analysis

North-America testing, inspection, and certification market accounted for a significant share of around 30.96% in 2023, valued at USD 66.29 billion. This dominance is reinforced by the region's stringent regulatory environment, high demand for product safety and quality assurance, and continuous technological advancements.

The region's well-established infrastructure across industries such as manufacturing, healthcare, and automotive, along with a growing focus on digital trust and security, further accelerates regional market expansion.

- In January 2025, SGS announced the acquisition of RTI Laboratories, a leading provider of environmental and materials testing services. This strategic move strengthens SGS’s capabilities, particularly in PFAS analysis and expands its environmental testing services in North America. With the acquisition, SGS adds metallurgical testing and failure analysis to its Midwest network, enhancing local testing options and increasing support for clients, including those in the Department of Defense sector.

Asia-Pacific testing, inspection, and certification industry is set to grow at a CAGR of 4.00% through the projection period. This growth is largely propelled by the increasing demand for global market access, enhanced safety standards, environmental sustainability, and expanding supply chains.

China, India, and Japan are the fastest-growing markets for TIC solutions. The TIC Council recognizes China's growing TIC industry in China and maintains onging dialogues with local authorities. The establishment of its Shanghai office enhances collaboration between members and public authorities.

Regulatory Framework

- The International Electro Technical Commission (IEC) publishes around 10,000 international standards, providing the technical framework for governments to build quality infrastructures and facilitating global trade in safe, reliable products. These standards are crucial for risk and quality management, as well as for ensuring compliance through testing and certification.

- The International Organization for Standardization (ISO) 14001 is a key regulatory framework in the TIC market, guiding organizations in environmental management. It supports compliance, sustainability, and operational efficiency by addressing resource usage, waste management, and stakeholder engagement, ultimately enhancing global competitiveness.

- The U.S. Food and Drug Administration (FDA) protects public health by ensuring the safety, efficacy, and security of drugs, biological products, medical devices, food, cosmetics, and radiation-emitting products. It also regulates tobacco products to reduce use, particularly among minors. The FDA advances public health by fostering medical innovations, providing science-based information, and securing the food supplyagainst health threats.

- The Federal Communications Commission (FCC) regulates radio frequency (RF) devices in electronic products that emit RF energy, ensuring they meet compliance requirements to prevent interference within the 9 kHz to 3000 GHz range. Most electronic devices with RF circuitry must undergo testing and obtain authorization, such as Supplier's Declaration of Conformity (SDoC) or Certification, before being marketed or imported into the U.S.

- The China National Accreditation Service for Conformity Assessment (CNAS) develops and enforces accreditation standards for conformity assessment bodies (CABs), including certification bodies, laboratories, and inspection entities in china. It ensures competence, impartiality, and regulatory compliance while promoting global recognition of China’s accreditation system through memberships in international accreditation organizations, supporting trade and market access.

Competitive Landscape

The testing, inspection, and certification industry is characterized by a number of participants, including both established corporations and emerging players. To gain a competitive edge in the market, key participants are focusing on technological innovation, service expansion, operational efficiency, regulatory compliance, and global reach.

Leveraging automation, AI, and data analytics improves accuracy, reduces costs, and accelerates certification. Additionally, specialized expertise in emerging industries anda commitment to quality and reliability are crucial for maintaining customer trust and market leadership.

- In January 2023 TÜV Rheinland acquired ABB’s functional safety business, expanding its expertise in industrial safety and compliance services. This acquisition strengthens it's position in safety assessments for automation, control systems, and electrical installations, expanding its offerings in energy, automation, and electrification while reinforcing its commitment to high safety and performance standards.

Additionally, strategic partnerships, geographic expansion, and a customer-centric approach can help players tap into new markets, particularly in regions such as Asia-Pacific. By collaborating with local businesses and adapting services to meet regional regulatory requirements, companies can enhance their market presence.

Expanding into emerging markets allows TIC providers to leverage the rising demand for quality assurance, safety, and compliance services, contributing to industry growth and sustainability.

List of Key Companies in Testing, Inspection, and Certification Market:

- Intertek Group plc

- DEKRA IN

- Element Materials Technology

- MISTRAS Group

- TÜV NORD GROUP

- ASTM

- SGS Société Générale de Surveillance SA

- Applus+

- UL LLC

- TÜV SÜD

- Bureau Veritas

- DNV AS

- Eurofins Scientifi

- ALS

- Lloyd's Register Group Services Limited

Recent Developments

- In March 2024, Intertek strengthened its global minerals offering by acquiring a leading provider of metallurgical testing services. This acquisition enhances Intertek's ability to serve the mining, mineral processing, and materials testing sectors, improving its testing and certification services for clients in industries such as mining, energy, and manufacturing. The move helps expand Intertek’s service capabilities globally.

- In June 2023, DEKRA launched its first generation of AI testing and certification services, focusing on ensuring that AI systems comply with safety, regulatory, and performance standards. This offering is aimed at industries looking to certify AI-driven technologies, ensuring their reliability and ethical compliance. This service demonstrates DEKRA's commitment to addressing the rising demand for AI governance across various sectors.

- In December 2024, TÜV Rheinland partnered with Crif D&B to enhance ESG (Environmental, Social, and Governance) practices and support compliance with CBAM (Carbon Border Adjustment Mechanism). Their collaboration introduces the Synesgy platform, offering businesses ESG self-assessment tools, supply chain monitoring, and CO₂ emission calculations. This platform provides companies with the resources to improve sustainability and ensure alignment with global standards, helping them navigate regulatory changes like CBAM

- In February 2023, TÜV Rheinland expanded its partnership with Alibaba.com, focusing on B2B trade growth in Europe. TÜV Rheinland will independently audit suppliers on Alibaba's platform, ensuring compliance and providing quality assessments. This expansion, initially targeting Germany, Austria, Switzerland, and Italy, aims to support SMEs with transparent verification, promoting safe and efficient digital trade across these regions.