Technical Ceramics Market Size

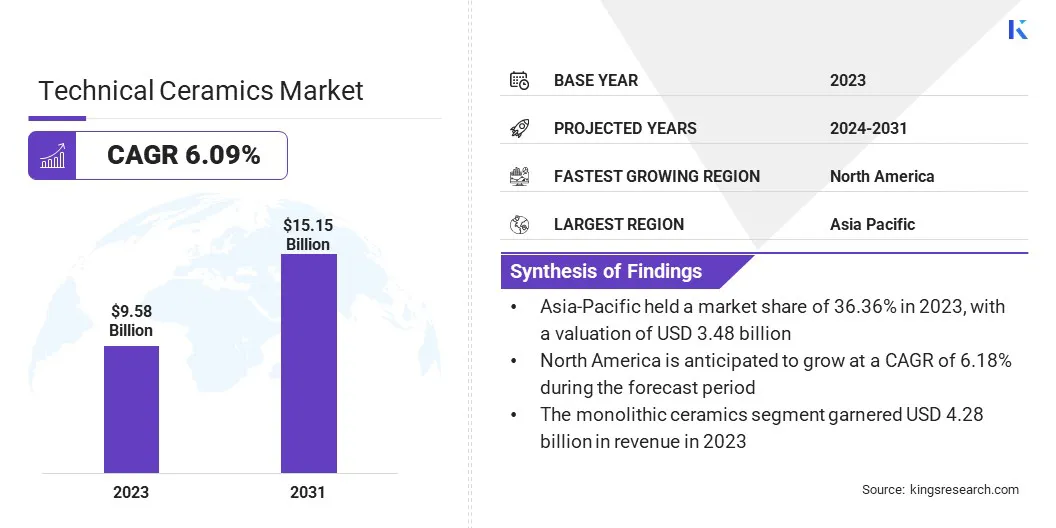

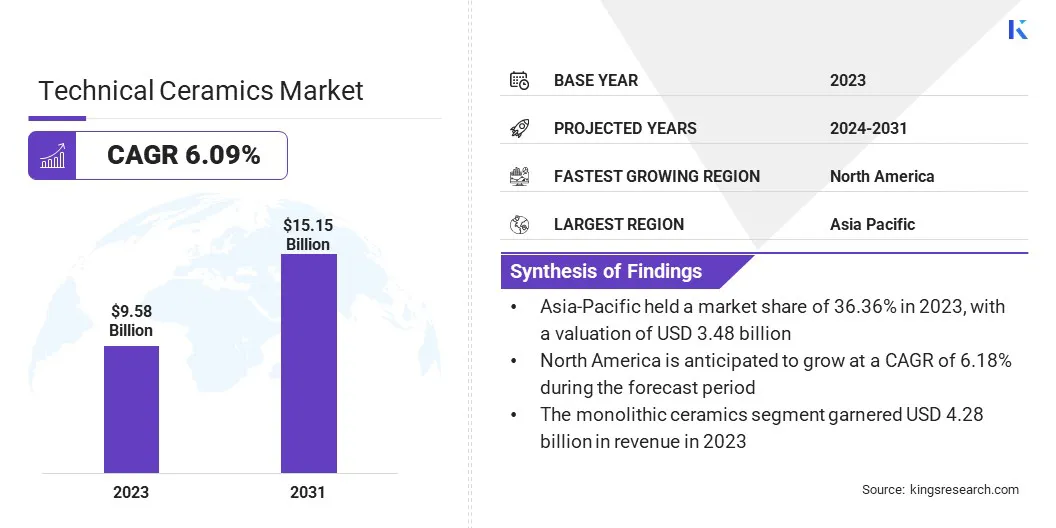

The global Technical Ceramics Market size was valued at USD 9.58 billion in 2023 and is projected to grow from USD 10.02 billion in 2024 to USD 15.15 billion by 2031, exhibiting a CAGR of 6.09% during the forecast period. The growth of the market is driven by the rising demand for high-performance materials in electronics, automotive, aerospace, and medical applications, coupled with advancements in processing technologies and a growing focus on sustainability.

In the scope of work, the report includes solutions offered by companies such as 3M, CeramTec GmbH, CoorsTek Inc., Elan Technology, Elster GmbH, Morgan Advanced Materials, Ortech, inc., Saint-Gobain, KYOCERA Corporation, OC Oerlikon Management AG, and others.

The expansion of the technical ceramics market is supported by the increasing demand for advanced materials across various industries. Key factors supporting market growth include rising demand in electronics and electrical applications, where high-performance ceramics are essential for components such as insulators and substrates.

Additionally, advancements in the automotive sector are boosting the need for ceramics in components such as sensors and catalyst supports. The growing emphasis on renewable energy and medical devices further contributes to market expansion, as ceramics are essential in manufacturing high-efficiency components.

Environmental regulations aimed at promoting sustainable materials further propel the adoption of technical ceramics, given their durability and efficiency. Innovation in ceramic processing technologies additionally plays a critical role in meeting evolving industry demands.

- For instance, in November 2023, Roca Group made a significant stride in the integration of innovative processing technologies by investing in the world’s first electric tunnel kiln for sanitaryware. This kiln, developed in collaboration with Keramischer OFENBAU, marked a major advancement in reducing carbon emissions and energy consumption in ceramic production. The new kiln, which began operations at Roca’s Laufen plant in Austria, served as a key development in achieving decarbonization goals and demonstrated innovation to incorporate sustainable ceramic manufacturing.

The technical ceramics market is experiencing robust growth, fueled by ongoing technological advancements and increased adoption across various sectors. The market is characterized by the integration of high-performance ceramics in electronic, automotive, aerospace, and medical applications. Emerging economies are contributing to this growth by investing in infrastructure and technology, which in turn is increasing the demand for ceramics.

Competitive dynamics are influenced by leading players who are focusing on research and development to enhance product performance and expand their application scope. The market is expected to continue its upward trajectory as industries increasingly seek high-quality, reliable materials.

Technical ceramics refer to advanced ceramic materials engineered for specialized applications that require superior properties compared to traditional ceramics. These materials are designed to withstand extreme conditions, including high temperatures, corrosive environments, and mechanical stresses.

Technical ceramics include a range of materials such as alumina, zirconia, and silicon carbide, each offering unique characteristics tailored to specific uses. They are utilized in a variety of high-tech applications, including electronic devices, medical implants, and industrial machinery.

The term encompasses both traditional ceramics with enhanced properties and innovative ceramics designed for cutting-edge applications. Technical ceramics are distinguished by their performance attributes, including high hardness, electrical insulation, and thermal stability.

Analyst’s Review

The technical ceramics market is undergoing significant transformation, propelled by key initiatives from manufacturers and the introduction of emerging product innovations. Companies are focusing on enhancing product performance through advanced manufacturing techniques and developing new ceramic materials to meet evolving industry needs. Notable advancements include the integration of smart technologies into ceramics and the expansion of eco-friendly production methods.

- For instance, in August 2023, SINTX Technologies, Inc., a producer of advanced ceramics for biomedical and technical applications, and 3DCERAM Sinto, Inc., a provider of additive manufacturing solutions for advanced ceramics, announced a partnership to create new resins and processes for 3D printing ceramic products. This collaboration aims to develop high-value resins, 3D print ceramic components, and use advanced thermal processing,with a particular emphasis on the biomedical and investment casting sectors.

It is recommended that stakeholders prioritize investments in research and development to leverage these technological advancements and address evolving market demands. Additionally, exploring strategic partnerships and collaborations is likely to facilitate the development of innovative solutions and expand market reach. Companies are further advised to increase their focus on sustainability in response to growing environmental concerns and evolving regulatory requirements.

Technical Ceramics Market Growth Factors

The increasing demand for high-performance electronic devices is boosting the growth of the technical ceramics market. As electronic devices advance, they require materials that offer excellent thermal and electrical insulation. Technical ceramics, such as alumina and zirconia, provide the necessary properties to meet these requirements. The rapid advancement in consumer electronics, including smartphones, tablets, and wearables, is increasing the need for reliable ceramic components.

Additionally, the increasing adoption of electric vehicles and advancements in renewable energy technologies are contributing to surging demand. Technical ceramics are being increasingly utilized due to their ability to improve device efficiency, reliability, and longevity, supporting the ongoing trend toward miniaturization and higher performance in electronic applications.

A significant challenge hampering the development of the technical ceramics market is the high cost associated with raw materials and processing. These costs limit the accessibility and affordability of advanced ceramics, thereby impeding market growth. To overcome this challenge, companies are focusing on developing cost-effective manufacturing processes and exploring alternative materials.

Innovations such as advanced manufacturing techniques, including additive manufacturing and automated production, are being implemented to reduce production costs. Additionally, research into more cost-effective raw materials and recycling methods are contributing to the reduction of cost. By improving production efficiency and material sourcing, industry players are aiming to make technical ceramics more affordable and accessible for a broader range of applications.

Technical Ceramics Market Trends

The integration of smart technologies into technical ceramics is influencing the landscape of the market. As industries shift toward automation and intelligent systems, technical ceramics are being developed with embedded sensors and actuators. These smart ceramics are enhancing performance by providing real-time data on environmental conditions, such as temperature and pressure, while also enabling self-regulation.

The trend is particularly evident in aerospace and automotive applications, where precise control and monitoring are critical. Companies are focusing on incorporating advanced materials and technologies into ceramics to create multifunctional components. This trend is fostering innovation and expanding the application scope of technical ceramics, aligning with the broader shift toward smart, interconnected systems.

Sustainability is becoming a major trend in the technical ceramics market. The industry is increasingly focusing on developing eco-friendly materials and processes to meet environmental regulations and rising consumer demands for greener products. Manufacturers are investing heavily in research to enhance the recyclability of ceramic materials and reduce waste during production. Innovations in using renewable energy sources and minimizing carbon footprints are gaining traction.

This trend is addressing environmental concerns while also aligning with global sustainability goals. Companies are emphasizing the development of sustainable ceramics that offer both high performance and reduced environmental impact, reflecting the growing importance of eco-conscious practices in the market.

Segmentation Analysis

The global market is segmented based on product, material, end user, and geography.

By Product

Based on product, the market is categorized into monolithic ceramics, ceramic matrix composites, ceramic coatings, and others. The monolithic ceramics segment led the technical ceramics market in 2023, reaching a valuation of USD 4.28 billion. This expansion is propelled by their widespread use and established advantages across various applications.

Monolithic ceramics, known for their uniform structure, offer superior mechanical strength, high thermal resistance, and electrical insulation. These properties make them suitable for use in demanding environments across industries such as aerospace, automotive, and electronics.

Their ability to maintain performance under extreme conditions and their cost-effectiveness contribute to their leading position in the market. The considerable growth reflects the increasing adoption of monolithic ceramics due to advancements in manufacturing processes and the growing demand for reliable, high-performance materials in critical applications.

By Material

Based on material, the market is classified into oxide and non-oxide. The non-oxide segment is poised to witness significant growth at a CAGR of 6.66% through the forecast period (2024-2031). This notable growth is attributed to their advanced properties and expanding applications. Non-oxide ceramics, including materials such as silicon carbide and boron carbide, offer exceptional hardness, thermal stability, and resistance to wear and corrosion.

These characteristics are making them highly suitable for high-performance applications in aerospace, defense, and industrial machinery. Innovations in processing and the increasing demand for high-strength, lightweight materials are further propelling the expansion of the segment.

By End User

Based on end user, the market is segmented into electronics & semiconductor, automotive, energy & power, healthcare, military & defense, and others. The electronics & semiconductor segment secured the largest technical ceramics market share of 35.18% in 2023, largely due to the increasing demand for advanced electronic devices and components.

Technical ceramics are crucial for producing reliable insulators, substrates, and components in electronics, offering high performance in electrical insulation and thermal management. The dominance of the segment reflects the growing integration of ceramics in consumer electronics, telecommunications, and computing technologies.

The ongoing advancements in electronic devices, including miniaturization and higher performance requirements, are boosting the demand for specialized ceramic materials. This trend underscores the critical role of ceramics in meeting the evolving needs of the electronics and semiconductor industries.

Technical Ceramics Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia-Pacific technical ceramics market accounted for a share of around 36.36% in 2023, with a valuation of USD 3.48 billion. This dominance is fueled by the region's rapid industrialization, significant investments in infrastructure, and a growing manufacturing base. Key countries such as China and India are at the forefront of the production and consumption of technical ceramics due to their expanding electronics, automotive, and aerospace sectors.

The region's robust supply chain, cost-effective manufacturing capabilities, and increasing demand for high-performance materials further solidify its leading position. Additionally, supportive government policies and a favorable business environment are contributing to the sustained growth of Asia-Pacific market expansion.

North America is poised to experience considerable growth at a CAGR of 6.18% over the forecast period. This growth is fueled by ongoing advancements in technology and increasing demand for high-performance ceramics across key industries such as aerospace, defense, and electronics. The region's focus on innovation and research and development is boosting the adoption of advanced ceramic materials.

Additionally, North America's strong economic framework, coupled with substantial investments in technological advancements and infrastructure, supports the expansion of the regional market. The presence of leading market players and a growing emphasis on upgrading manufacturing processes are further bolstering domestic market development.

Competitive Landscape

The global technical ceramics market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Technical Ceramics Market

- 3M

- CeramTec GmbH

- CoorsTek Inc.

- Elan Technology

- Elster GmbH

- Morgan Advanced Materials

- Ortech, inc.

- Saint-Gobain

- KYOCERA Corporation

- OC Oerlikon Management AG

Key Industry Developments

- April 2024 (Expansion): Kyocera Fineceramics Europe established KYOCERA Fineceramics Medical GmbH to broaden its operations. As a part of KYOCERA Fineceramics Europe GmbH, this new entity focuses on the manufacturing of high-quality ceramic ball heads for hip prostheses. They established a new production facility in the greater Stuttgart area.

- November 2023 (Expansion): Watlow announced the opening of its new Ceramic Technology Center to develop advanced material solutions, with a major focus on thermal management systems for critical industries such as medical devices and semiconductors. The facility was developed at a cost of approximately USD 6 million and covers an area of 12,000-square-feet. It received funding of USD 740,000 from the Jordan Valley Innovation Center and additional support from the Missouri Works program and Missouri One Start for recruitment and training.

The global technical ceramics market is segmented as:

By Product

- Monolithic Ceramics

- Ceramic Matrix Composites

- Ceramic Coatings

- Others

By Material

By End User

- Electronics & Semiconductor

- Automotive

- Energy & Power

- Healthcare

- Military & Defense

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America