Market Definition

System integrators design and implement complex IT solutions by combining hardware, software, networking, and storage components into a unified system. Their expertise ensures seamless interoperability and optimized performance across various technologies and platforms.

The market covers a wide range of services, including consulting, infrastructure integration, application integration, and data management. These solutions are used across manufacturing, energy, defense, healthcare, and telecommunications industries to streamline operations, improve efficiency, and support digital transformation initiatives.

System Integrator Market Overview

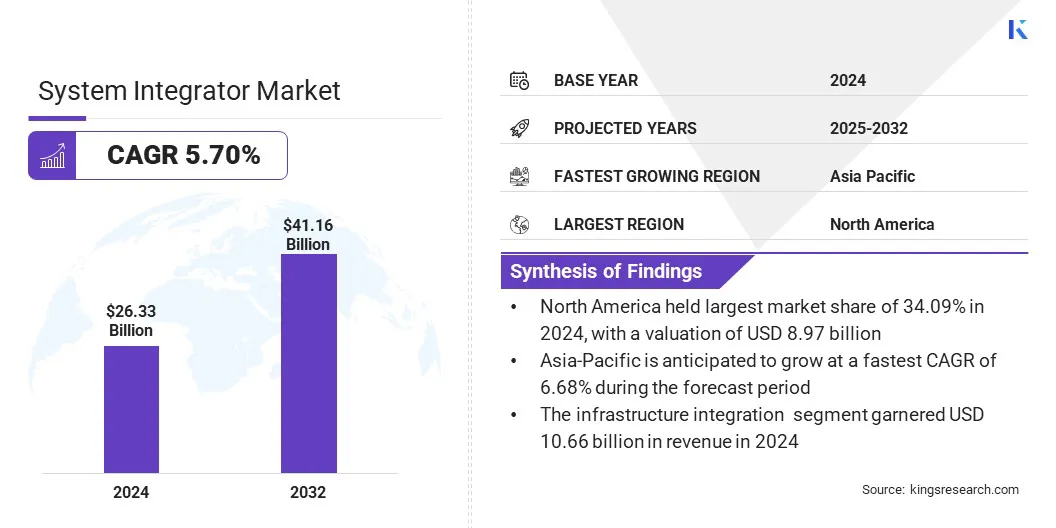

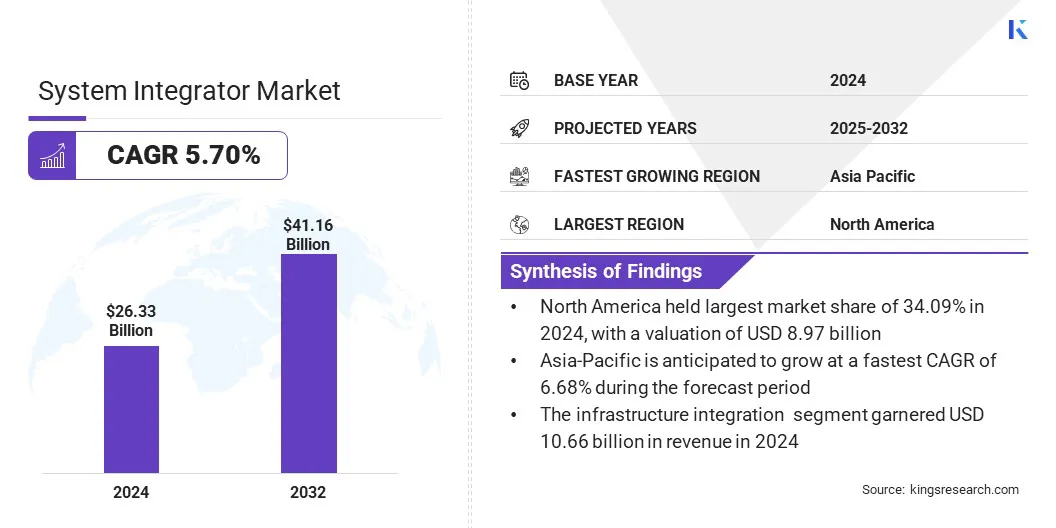

The global system integrator market size was valued at USD 26.33 billion in 2024 and is projected to grow from USD 27.78 billion in 2025 to USD 41.16 billion by 2032, exhibiting a CAGR of 5.70% during the forecast period.

Market growth is fueled by the increasing need for cohesive information technology ecosystems across industries such as manufacturing, healthcare, energy, and telecommunications. Increasing enterprise focus on optimizing operational efficiency, enhancing interoperability, and enabling seamless data flow is driving the adoption of system integration services.

Key Highlights

- The system integrator industry size was valued at USD 26.33 billion in 2024.

- The market is projected to grow at a CAGR of 5.70% from 2025 to 2032.

- North America held a market share of 34.09% in 2024, with a valuation of USD 8.97 billion.

- The infrastructure integration segment garnered USD 10.66 billion in revenue in 2024.

- The oil & gas segment is expected to reach USD 10.00 billion by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 6.68% through the projection period.

Major companies operating in the system integrator market are Accenture, NTT DATA Group Corporation, The RoviSys Company, Prime Controls, LP, Deloitte, TATA Consultancy Services Limited, Quad Plus, Infosys Limited, IBM, ANDRITZ, Wunderlich-Malec Engineering, Inc., John Wood Group PLC, ATS Corporation, Tesco Controls, and Capgemini.

The growing emphasis on digital transformation, automation, and real-time data analytics is supporting market expansion. Continuous advancements in cloud computing, industrial Internet of Things (IoT), artificial intelligence, and increasing investments in smart infrastructure projects are also accelerating market development.

The growing emphasis on digital transformation, automation, and real-time data analytics is supporting market expansion. Continuous advancements in cloud computing, industrial Internet of Things (IoT), artificial intelligence, and increasing investments in smart infrastructure projects are also accelerating market development.

- In September 2023, EPAM expanded its partnership with Microsoft by becoming a Globally Managed Enterprise Systems Integrator, enhancing its capability to deliver large-scale cloud-native and AI-powered solutions. The partnership focuses on accelerating digital transformation and platform modernization through Microsoft Azure technologies.

Market Driver

Increasing Complexity of Enterprise IT Environments

The progress of the system integrator market is propelled by the growing complexity of enterprise IT environments across industries. Organizations manage and expand a mix of applications, platforms, and infrastructures that span on-premises systems, cloud services, and hybrid models. They also coordinate with multiple vendors, technologies, and data sources to maintain seamless operations and support business agility.

This shift is further supported by the rising need for real-time data accessibility, enhanced cybersecurity, and compliance. The increasing complexity of technology ecosystems is compelling organizations to engage system integrators that can deliver comprehensive, secure, and scalable integration solutions, thereby accelerating market expansion.

Market Challenge

Complexities in Ensuring Seamless Integration Across Multiple Vendors

The system integrator market is influenced by the complexities involved in achieving seamless integration across multiple vendors. Organizations often operate diverse technology stacks sourced from various hardware, software, and service providers, each with unique compatibility and interoperability requirements.

Inconsistencies in protocols, frequent vendor-specific updates, and differing architectural frameworks contribute to integration difficulties. These complications can disrupt system performance, increase project timelines, and elevate operational risks.

To manage these complexities, system integrators are developing standardized integration frameworks and employing advanced middleware solutions. They are also enhancing cross-platform expertise, adopting automation tools, and establishing strong vendor partnerships to ensure alignment across systems.

Additionally, continuous monitoring, proactive maintenance, and adaptive integration strategies are being utilized to sustain long-term interoperability and system efficiency.

Market Trend

Proliferation of IoT/IIoT & Edge Computing Integration

The market is being shaped by the proliferation of Internet of Things (IoT) and Industrial Internet of Things (IIoT) technologies that enable real-time monitoring, automation, and data-driven decision-making. Industries such as manufacturing, healthcare, and energy are adopting edge computing to process data closer to devices, reduce latency, and improve responsiveness.

Enterprises are integrating large networks of sensors and connected equipment, creating complex data flows that demand seamless and secure system coordination. In response, system integrators are delivering advanced integration solutions that combine IoT platforms, edge infrastructure, and centralized systems into scalable architectures to meet evolving business needs.

- In May 2025, Qualcomm partnered with Advantech to accelerate Edge AI innovation by integrating Qualcomm’s Dragonwing AI platforms into Advantech’s edge computing solutions. The partnership aims to simplify and speed up the deployment of intelligent IoT applications across industries.

System Integrator Market Report Snapshot

|

Segmentation

|

Details

|

|

By Service

|

Infrastructure Integration, Application Integration, and Consulting

|

|

By End User

|

Oil & Gas, Automotive, Aerospace & Defense, Healthcare, Energy & Power, Chemical, and Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Service (Infrastructure Integration, Application Integration, and Consulting): The infrastructure integration segment earned USD 10.66 billion in 2024, due to the rising demand for unified and efficient IT infrastructures that connect hardware, software, and network systems.

- By End User (Oil & Gas, Automotive, Aerospace & Defense, Healthcare, Energy & Power, Chemical, and Others): The oil & gas segment held a share of 24.20% in 2024, attributed to the increasing need for integrated automation, real-time monitoring, and advanced control systems to optimize complex exploration and production operations.

System Integrator Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

.webp) The North America system integrator market share stood at 34.09% in 2024, valued at USD 8.97 billion. This dominance is attributed to the region’s advanced technology infrastructure, strong adoption of digital transformation initiatives, and substantial investments in automation and smart industry solutions.

The North America system integrator market share stood at 34.09% in 2024, valued at USD 8.97 billion. This dominance is attributed to the region’s advanced technology infrastructure, strong adoption of digital transformation initiatives, and substantial investments in automation and smart industry solutions.

The presence of major system integrators and a well-established network of technology providers enhance the delivery of comprehensive integration services. Regulatory standards supporting data security, interoperability, and system reliability further strengthen market activity.

Furthermore, the growing focus on cybersecurity, cloud integration, and real-time data analytics drives innovation and adoption of system integration solutions across industries.

- In March 2025, Convergint acquired Delco Security to strengthen its systems integration capabilities across Canada, expanding services in healthcare, education, utilities, real estate, and government sectors. The acquisition adds over 70 Delco employees, enhancing Convergint’s expertise in delivering integrated security, communication, and location-based solutions for complex facilities.

The Asia-Pacific system integrator industry is set to grow at a CAGR of 6.68% over the forecast period. This growth is attributed to rapid industrialization, expanding manufacturing capabilities, and the increasing adoption of automation technologies across key sectors.

The rising demand for digital infrastructure driven by growing small and medium-sized enterprises and emerging technology hubs is further accelerating market development. Government initiatives aimed at modernizing industries, enhancing energy efficiency, and promoting smart city projects are creating a strong demand for system integration services.

Collaborations between global technology providers, local system integrators, and research institutions, along with advancements in IoT and edge computing technologies are strengthening integration capabilities and supporting regional market growth.

Regulatory Frameworks

- In the European Union, the General Data Protection Regulation (GDPR) regulates personal data processing by system integrators. It mandates strict data protection and privacy requirements for integrators handling personal data within and outside the EU.

- In the U.S., the National Institute of Standards and Technology Cybersecurity Framework (NIST CSF) regulates cybersecurity practices for system integrators. It provides guidelines for managing and reducing cybersecurity risks in integrated systems.

- In Australia, the Privacy Act 1988 regulates personal information handling by system integrators. It includes the Australian Privacy Principles (APPs), which govern how integrators collect, use, disclose, and secure personal data.

Competitive Landscape

The system integrator industry consists of a broad range of established multinational companies and specialized regional players. These players are actively working to broaden their service offerings and expand their global presence through innovation, diversification, and strategic acquisitions.

Leading companies are heavily investing in research and development to enhance integration capabilities across emerging technologies such as cloud computing, artificial intelligence, industrial Internet of Things (IIoT), and cybersecurity. They are also developing industry-specific solutions tailored to sectors like manufacturing, healthcare, energy, and automotive to address complex integration needs and regulatory requirements.

Moreover, firms are forming partnerships with technology providers, software vendors, and consulting firms to strengthen service offerings, improve operational efficiency, and accelerate market expansion.

- In November 2024, AVI Systems acquired CCS Southeast, a regional audiovisual systems integrator, to expand its services across the U.S. Southeast. The addition strengthens AVI’s systems integration capabilities for corporate, education, and government clients, with CCS operations integrating into AVI’s structure.

Key Companies in System Integrator Market:

- Accenture

- NTT DATA Group Corporation

- The RoviSys Company

- Prime Controls, LP

- Deloitte

- TATA Consultancy Services Limited

- Quad Plus

- Infosys Limited

- IBM

- ANDRITZ

- Wunderlich-Malec Engineering, Inc.

- John Wood Group PLC

- ATS Corporation

- Tesco Controls

- Capgemini

Recent Developments (M&A/Partnerships/Agreements/Product Launch)

- In March 2025, OIP Insurtech joined the Insurity LLC System Integrator Partner program to enhance cloud software implementations for insurers. OIP will use its expertise with Insurity solutions to streamline deployments and improve operational efficiency for property and casualty carriers, brokers, and managing general agents.

- In May 2024, AGENA3000 acquired SRC System Integrators to strengthen its European presence and expand its expertise in product information management, product data management, and electronic data interchange. The acquisition enhances AGENA3000’s data management solutions for clients across Europe and North America.

- In January 2024, Omron Corporation designated Odecopack as a System Integrator Partner, acknowledging its capabilities in automation and packaging solutions. The partnership aims to enhance customer support and improve automation project outcomes across North America.

- In January 2024, NetNordic acquired Swedish consultant EdgeGuide to enhance its role as a Microsoft Cloud–focused system integrator across the Nordics. The acquisition reinforces NetNordic’s cloud and security capabilities, positioning it to meet the growing demand for enterprise Microsoft Cloud and AI solutions in the region.

- In October 2023, Xceptor partnered with Delta Capita to simplify post-trade operations ahead of the T+1 settlement mandate. The partnership combines Xceptor’s data automation platform with Delta Capita’s implementation expertise to enhance processing speed, accuracy, and regulatory compliance for financial institutions.

.webp) The North America system integrator market share stood at 34.09% in 2024, valued at USD 8.97 billion. This dominance is attributed to the region’s advanced technology infrastructure, strong adoption of

The North America system integrator market share stood at 34.09% in 2024, valued at USD 8.97 billion. This dominance is attributed to the region’s advanced technology infrastructure, strong adoption of