Market Definition

The market involves the design, construction, and installation of swimming pools for residential, commercial, and public use. This report examines critical factors fueling market development, while also offering a detailed regional analysis and an overview of the competitive landscape shaping future opportunities.

Swimming Pool Construction Market Overview

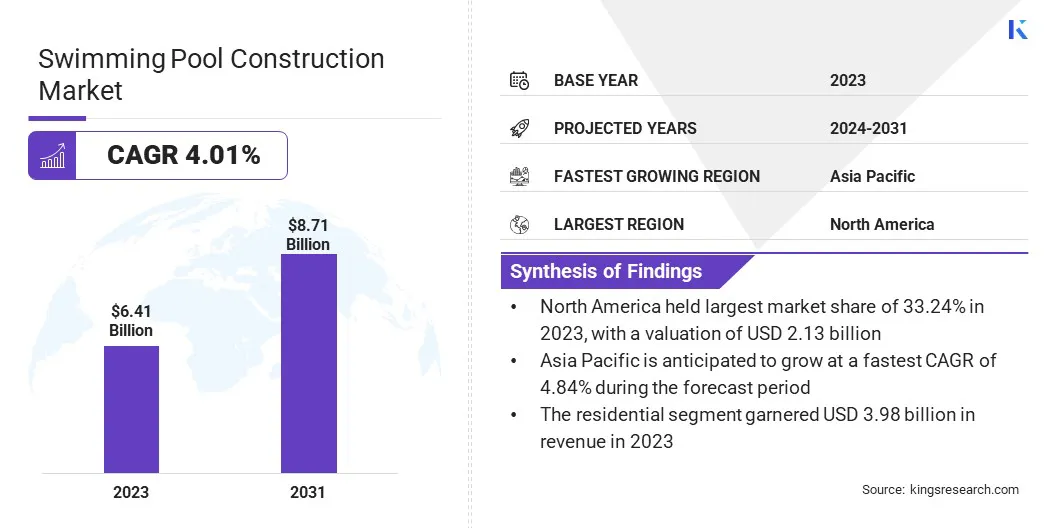

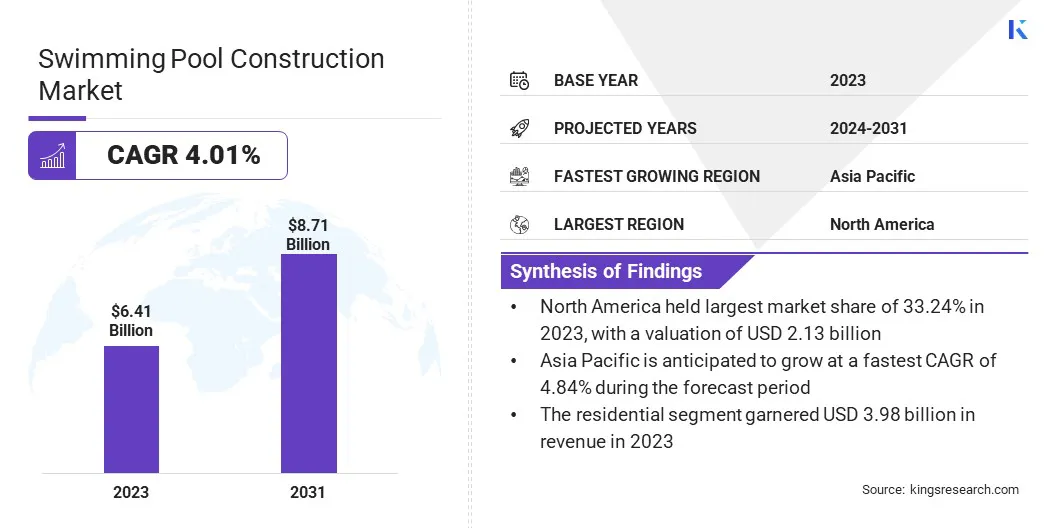

Global swimming pool construction Market size was valued at USD 6.41 billion in 2023, which is estimated to be valued at USD 6.61 billion in 2024 and reach USD 8.71 billion by 2031, growing at a CAGR of 4.01% from 2024 to 2031.

The expansion of the tourism and hospitality industry is leading to a robust demand for swimming pools in hotels, resorts, and water parks, creating significant growth opportunities.

Major companies operating in the swimming pool construction industry are ALOHA POOLS LTD., Aquamarine Pool Construction, Concord Pools & Spas. , Leisure Pools, millennium pools pvt limited, A&T Europe Spa, Natare Corporation, Platinum Pools, Presidential Pools & Spas, Apram Swimming Pool, Swimming Pool & Spa, Arrdev Prefab Pvt. Ltd, Southern Poolscapes, Crystal Swimming Pools India Private Limited., Swimwell Pools India Pvt. Ltd., and others.

The market is expanding, propelled by rising temperatures and extended summer seasons in various regions, which are boosting demand for both residential and public pools.

- According to the National Center for Environmental Information's 2023 Annual Report, every month of 2023 ranked among the seven warmest on record for that month. Notably, June to December were the hottest ever recorded for their respective periods, with global temperatures in July, August, and September exceeding the long-term average by more than 1.0°C (1.8°F).

This surge in demand is fueled by factors such as urbanization, rising disposable income, and growing interest in leisure and wellness facilities. Additionally, expansion of the tourism and hospitality sectors is creating a demand for pool construction in hotels, resorts, and recreational facilities.

Key Highlights:

- The swimming pool construction industry size was recorded at USD 6.41 billion in 2023.

- The market is projected to grow at a CAGR of 4.01% from 2024 to 2031.

- North America held a share of 33.24% in 2023, valued at USD 2.13 billion.

- The concrete segment garnered USD 2.28 billion in revenue in 2023.

- The above-ground segment is expected to reach USD 4.82 billion by 2031.

- The commercial segment is anticipated to witness the fastest CAGR of 4.22% over the forecast period

- Asia Pacific is anticipated to grow at a CAGR of 4.84% through the projection period.

Market Driver

"Expansion of Tourism and Hospitality Industry"

The growth of the tourism and hospitality sectors is stimulating the expansion of the swimming pool construction market, as hotels, resorts, and water parks increasingly incorporate pools to attract guests.

- According to the Indian Brand Equity Foundation, India's hospitality industry is expected to grow at a compound annual growth rate (CAGR) of 4.73% from 2024 to 2029.

Pools are seen as essential amenities that enhance the guest experience, boosting demand for new pool installations. The global expansion of the tourism industry expands globally, particularly in high-traffic destinations, is increasing the need for large, luxurious, and distinctive pool designs. This leads to increased construction projects and benefit pool builders.

- In March 2025, Imagicaaworld Entertainment Limited proudly launched Aqua Imagicaa Water Park in Indore, Madhya Pradesh. This expansion marks a significant step in their growth, following the success of Aqua Imagicaa Surat. The 18-acre park with 20 thrilling rides aligns with the growing demand for high-quality swimming pool and water park constructions across India, strengthening the brand's presence in central India.

Market Challenge

"High Initial Investment"

A significant challenge limiting the expansion of the swimming pool construction market is the high initial investment , including costs for materials, labor, and specialized equipment. This often deters potential customers, particularly in price-sensitive regions.

To address this challenge, companies are offering financing options, flexible payment plans, and cost-effective solutions such as modular or fiberglass pools. Additionally, focusing on long-term value, energy efficiency, and low maintenance can help justify the upfront cost.

Market Trend

"Emphasis of Sustainability"

Sustainability is emerging as a significant trend in the swimming pool construction market, supported by an increasing focus on environmentally friendly materials and energy-efficient technologies. Builders are increasingly adopting recycled materials, such as eco-friendly membranes and sustainable pool finishes, to reduce environmental impact.

Additionally, innovations in water management systems, energy-efficient pumps, and solar heating systems are gaining traction. These practices help minimize ecological footprints while meeting growing consumer demand for green, environmentally-conscious solutions.

- In February 2025, Myrtha Pools unveiled the R-Evolution membrane, a major advancement in sustainable pool technology. Comprising 60% recycled materials, it sets new benchmarks for sustainability and material reuse.

Swimming Pool Construction Market Report Snapshot

|

Segmentation

|

Details

|

|

By Material

|

Concrete, Fiberglass, Vinyl Liner, Steel Frame

|

|

By Type

|

Above-ground, In-ground

|

|

By End User

|

Residential, Commercial

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Material (Concrete, Fiberglass, Vinyl Liner, and Steel Frame): The concrete segment earned USD 2.28 billion in 2023 due to its durability, versatility, and high demand in both residential and commercial pool projects.

- By Type (Above-ground, In-ground): The above-ground segment held a share of 54.42% in 2023, attributed to its cost-effectiveness, ease of installation, and growing preference among budget-conscious consumers.

- By End User (Residential and Commercial): The residential segment is projected to reach USD 5.36 billion by 2031, fueled by increasing disposable incomes and the rising trend of home leisure amenities.

Swimming Pool Construction Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America swimming pool construction market share stood at around 33.24% in 2023, valued at USD 2.13 billion. This dominance is reinforced by the robust demand for both residential and commercial pools. The regional market benefits from a high standard of living, increasing disposable income, and a strong tourism and hospitality sector.

Additionally, a rising trend of luxury pools, renovations, and upgrades is propelling domestic market expansion. Favorable climatic conditions and the highconcentrations of pool installations in hotels, resorts, and residences further reinforce North America's leading position.

- In February 2025, Pool Service Partners (PSP) expanded its presence in the Northeast and Mid-Atlantic regions of the United States by acquiring USA Pools. This acquisition enhances PSP's service capabilities and supports its continued growth.

Asia Pacific swimming pool construction industry is likely to grow at a CAGR of 4.84% over the forecast period. This growth is propelled by rapid urbanization, rising disposable incomes, and a growing middle-class population.

Increasing investments in tourism, hospitality, and residential sectors further boost demand for pools in hotels, resorts, and homes. Additionally, favorable weather conditions in many areas of Asia promote outdoor recreational activities, undercsoring the need for swimming pools.

With expanding infrastructure projects and a shift toward luxury living, the regional market is estimated to witness substantial expansion in the foreseeable future.

Regulatory Frameworks

- In India, the National Building Code of India (NBC) 2016 outlines guidelines for regulating building construction activities, including the safe design and construction of swimming pools in buildings.

- In the U.S., the Virginia Graeme Baker Pool and Spa Safety Act (VGBA) mandates safety standards for pool construction, design, and equipment to prevent accidents in public and private pools.

Competitive Landscape

Companies in the swimming pool construction industry are focusing on expanding their services, enhancing product offerings, and integrating advanced technologies. They are investing in sustainable materials, adopting eco-friendly construction methods, and improving efficiency.

Additionally, businesses are capitalizing on the rising demand for residential and commercial pools, offering customized solutions, and focusing on customer-centric services to gain competitive edge.

- In October 2024, Easton Select Group announced the acquisition of Christman Pool, a Maine-based pool service and construction company. This acquisition accelerates Easton Select’s US expansion, enabling them to meet growing demand for premium pool services and plunge pool solutions in Northern New England.

List of Key Companies in Swimming Pool Construction Market:

- ALOHA POOLS LTD.

- Aquamarine Pool Construction

- Concord Pools & Spas.

- Leisure Pools

- millennium pools pvt limited

- A&T Europe Spa

- Natare Corporation

- Platinum Pools

- Presidential Pools & Spas

- Apram Swimming Pool

- Swimming Pool & Spa

- Arrdev Prefab Pvt. Ltd

- Southern Poolscapes

- Crystal Swimming Pools India Private Limited.

- Swimwell Pools India Pvt. Ltd.

Recent Developments (M&A/Partnerships)

- In March 2025, Myrtha Pools inaugurated Italy’s largest urban thermal park, De Montel Terme Milano. The facility features 10 innovative pools that integrate historical architecture with modern wellness design, emphasizing sustainability and functionality.

- In February 2025, Easton Select Group acquired Environmental Pools to expand its presence in New England. This acquisition enhances its premium pool design, construction, and maintenance capabilities, reinforcing its regional market position..

- In November 2024, Fluidra acquired BAC Pool Systems to strenghthen its portfolio of sustainable pool covers. This strategic move supports Fluidra’s growth in Central Europe and highlights commitment to energy-efficient solutions.