Market Definition

Swarm robots are groups of robots that coordinate through local interactions to collectively perform tasks without centralized control. The market encompasses hardware platforms, software, and communication systems that enable distributed coordination across diverse applications.

It includes defense, agriculture, logistics, healthcare, and environmental monitoring, where multiple robots operate together to improve efficiency and scalability. The market further covers research and commercial deployments that focus on autonomous collaboration, adaptability, and integration with advanced sensing and computing technologies for multi-robot systems.

Swarm Robotics Market Overview

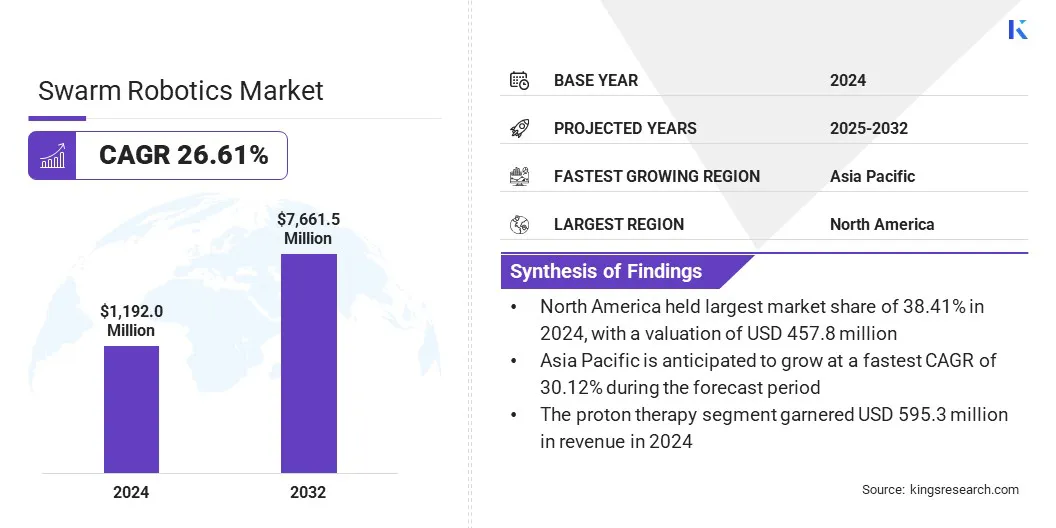

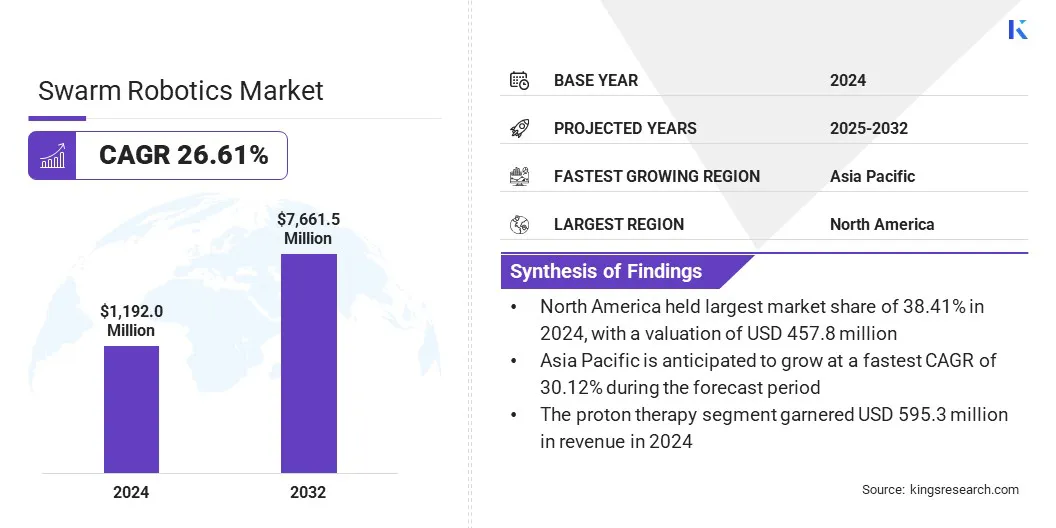

According to Kings Research, the global swarm robotics market size was valued at USD 1,192.0 million in 2024 and is projected to grow from USD 1,468.9 million in 2025 to USD 7,661.5 million by 2032, exhibiting a CAGR of 26.61% over the forecast period. The market is expanding as industries deploy autonomous multi-robot systems in defense, agriculture, logistics, and environmental monitoring.

This expansion is supported by advancements in artificial intelligence, miniaturized sensors, and cost-efficient robotic platforms. These innovations create scalable and adaptable systems with higher efficiency and wider adoption in commercial and research domains.

Key Market Highlights:

- The swarm robotics industry size was valued at USD 1,192.0 million in 2024.

- The market is projected to grow at a CAGR of 26.61% from 2025 to 2032.

- North America held a market share of 38.41% in 2024, with a valuation of USD 457.8 million.

- The unmanned ground vehicles (UGV) segment garnered USD 595.3 million in revenue in 2024.

- The inspection & monitoring segment is expected to reach USD 1,857.2 million by 2032.

- The military & defense segment is expected to reach USD 2,072.4 million by 2032.

- The market in Asia Pacific is anticipated to grow at a CAGR of 30.12% over the forecast period.

Major companies operating in the swarm robotics market are Swarmbotics AI, SwarmFarm, Sentien Robotics, Hydromea, Berkeley Marine Robotics Inc., FARobot, Inc., KION GROUP AG, Swarm Robotics, Unbox Robotics Pvt. Ltd., SWARM Biotactics, tmsuk co., ltd., Auterion LLC, and Swarmer.

Companies in the defense and robotics sector are securing significant investments to advance autonomous and AI-enabled systems. These investments support the development of UAV technology and drone swarms, enhancing coordination, scalability, efficiency, and real-time tactical decision-making in defense applications.

- In September 2025, Swarmer secured USD 15 million in a Series A round for advancing AI-based drone swarms. This funding will enable coordinated operations of UAVs, USVs, UGVs, and stationary launchers with real-time autonomous decision-making based on combat mission data for enhanced tactical precision.

Market Driver

Growing Demand for Coordinated Robotic Units to Enhance Operational Capabilities

The market is growing due to the rising demand for coordinated robotic units that improve operational capabilities. Defense, logistics, agriculture, and infrastructure sectors are adopting swarms because they can complete tasks more systematically compared to individual robots.

Coordinated swarms provide wider coverage, better regulation, and higher resilience, which make them valuable in large-scale and high-risk operations. As organizations prioritize scalable and cost-effective systems for higher mission success and lower operational risks, the strengthening demand is expected to drive the swarm robotics market.

- In March 2025, UBTECH Robotics conducted the world’s first multi-humanoid robot collaborative training at ZEEKR’s 5G Intelligent Factory. The initiative showcased swarm intelligence through multi-task coordination of humanoid robots across diverse industrial scenarios. UBTECH introduced its BrainNet software framework and Internet of Humanoids (IoH) control hub to support large-scale collaboration, advanced decision-making and flexible task execution.

Market Challenge

Advanced Counter-Swarm Technologies

The swarm robotics market faces a major challenge from the increasing deployment of advanced counter-swarm systems. These systems use detection, tracking, and neutralization technologies to monitor and disable multiple autonomous drones simultaneously.

- In September 2024, Honeywell launched its Stationary and Mobile UAS Reveal and Intercept system to counter swarm drones. The multi-layered system integrates advanced detection, tracking, and defensive technologies to protect high-value assets in military operations.

This reduces the operational effectiveness of swarm robotics in defense, security, and other high-value applications, raising the risk of mission failure. To solve this, manufacturers are creating swarm AI algorithms that make robots more adaptable, agile, and better at working together.

These improved systems help drones and robots stay efficient even when facing anti-swarm defenses, so they can finish their tasks reliably in difficult or protected environments.

Market Trend

Rising Adoption of Interoperable Drone Systems

The market is witnessing the adoption of interoperable drone systems for improved coordination across multiple platforms. Companies are integrating artificial intelligence and computer vision to enable autonomous decision-making and accurate execution of complex, multi-target missions.

This approach has enhanced performance and minimized human involvement while supporting large-scale deployment of coordinated robotic units.

Continuous improvements in AI algorithms, sensor technology, and communication frameworks are facilitating scalable, intelligent swarms, capable of real-time task allocation and adaptive responses in dynamic environments. These trends are fueling the market in terms of technological capabilities and competitive positioning.

- In September 2025, Auterion launched Nemyx, a cross-platform drone swarm strike engine. The system enables drones from different manufacturers to operate as a coordinated unit, using AI and computer vision to engage multiple targets simultaneously, thereby improving efficiency and precision in defense operations.

Swarm Robotics Market Report Snapshot

|

Segmentation

|

Details

|

|

By Platform

|

Unmanned Ground Vehicles (UGV), Unmanned Aerial Vehicles (UAV), Others

|

|

By Application

|

Inspection & Monitoring, Supply Chain and Warehouse Management, Mapping & Surveying, Security, Search & Rescue, Others

|

|

By End Use Industry

|

Military & Defense, Retail, Automotive, Healthcare, Agriculture, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Platform (Unmanned Ground Vehicles (UGV), Unmanned Aerial Vehicles (UAV), Others): The unmanned ground vehicles (UGV) segment earned USD 595.3 million in 2024 due to increasing use in border surveillance and autonomous patrolling.

- By Application (Inspection & Monitoring, Supply Chain and Warehouse Management, Mapping & Surveying, Security, Search & Rescue, Others): The inspection & monitoring segment held 24.82% of the market in 2024, due to rising adoption in infrastructure inspection and environmental monitoring.

- By End Use Industry (Military & Defense, Retail, Automotive, Healthcare, Agriculture, Others): The military & defense segment is projected to reach USD 2,072.4 million by 2032, growing demand for autonomous systems in combat support and reconnaissance.

Swarm Robotics Market Regional Analysis

Based on region, the swarm robotics market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America accounted for a substantial market share of 38.41% in 2024, with a valuation of USD 457.8 million in the global market.

This share is supported by a strong military presence and continuous investments in advanced defense technologies. The U.S. and other countries are focusing on unmanned systems and multi-robot coordination to improve their performance, surveillance, and tactical capabilities.

Rising demand for autonomous drone swarming in defense, security, and emergency response is driving market adoption. Government funding, research initiatives, and collaborations between defense contractors and robotics companies are accelerating the development and deployment of swarm robotics solutions.

- In April 2024, Red Cat Holdings partnered with Sentien Robotics to integrate Teal Drones into the Hive UAS management platform. The collaboration enables autonomous drone swarming across land, air, and sea, enhancing defense, security, and tactical operations through scalable, multi-domain fleet coordination.

The swarm robotics industry in Asia Pacific is expected to register the fastest growth at a projected CAGR of 30.12% over the forecast period. This growth is supported by the region’s expanding industrial base and high labor demand across construction, manufacturing, and logistics sectors.

Rapid urbanization and large-scale infrastructure projects increase the need for efficient and precise operations. The presence of numerous manufacturing plants further intensifies demand for scalable automation.

Swarm robotics enhances productivity, ensures accuracy, and accelerates project timelines in labor-intensive sectors. Government support and strategic investments in robotics are also promoting the adoption of multi-robot systems in Asia-Pacific.

- In July 2023, tmsuk Co., Ltd., in collaboration with Kajima Corporation, introduced the world’s first AI-powered swarm robots for suspended ceiling construction. The system uses edge AI and multi-robot coordination to automate ceiling installation tasks, improving precision, scalability, safety, and productivity in office interiors.

Regulatory Frameworks

- In the U.S., the Federal Aviation Administration (FAA) governs unmanned aerial systems, including drone swarms, and sets safety and operational standards for autonomous aerial robotics.

- In Europe, the European Union Aviation Safety Agency (EASA) regulates unmanned aircraft operations, ensuring compliance with safety, security, and operational rules for autonomous drones and robotics.

- In China, the Civil Aviation Administration of China (CAAC) oversees drone operations, including multi-drone systems, with regulations for safety, registration, and airspace management.

- In Japan, the Ministry of Land, Infrastructure, Transport and Tourism (MLIT) manages unmanned aircraft and robotics deployment standards, covering safety and operational protocols.

- In India, the Directorate General of Civil Aviation (DGCA) regulates unmanned aircraft, including drone swarms, through the Digital Sky Platform, defining operational, safety, and licensing requirements.

Competitive Landscape

Key players in the swarm robotics market are strengthening their positions by investing in technological advancements. Companies are increasing investments in research and product development to enhance autonomous coordination, improve multi-robot collaboration, and expand applications across industrial, defense, and intralogistics operations.

Companies are forming strategic partnerships with robotics and AI solution providers to integrate advanced systems, helping market leaders maintain a competitive edge and drive innovation in next-generation swarm robotics.

- In June 2025, SWARM Biotactics, secured USD 15 million in seed funding to advance its insect-based bio-robotic systems toward field deployment. The technology uses controllable cockroaches equipped with sensors and communication interfaces for missions in inaccessible environments, signaling a shift toward biologically integrated swarm systems in defense and disaster response.

Key Companies in Swarm Robotics Market: