Market Definition

Sustainable food refers to products produced, processed, and distributed with minimal environmental impact, efficient resource use, and social and economic benefits. The market encompasses organic food, plant-based alternatives, sustainably sourced seafood, functional foods, and items produced using eco-friendly practices.

The market includes producers, processors, distributors, and retailers committed to environmentally responsible sourcing, ethical production methods, and transparent supply chains to meet growing consumer demand for sustainable consumption.

Sustainable Food Market Overview

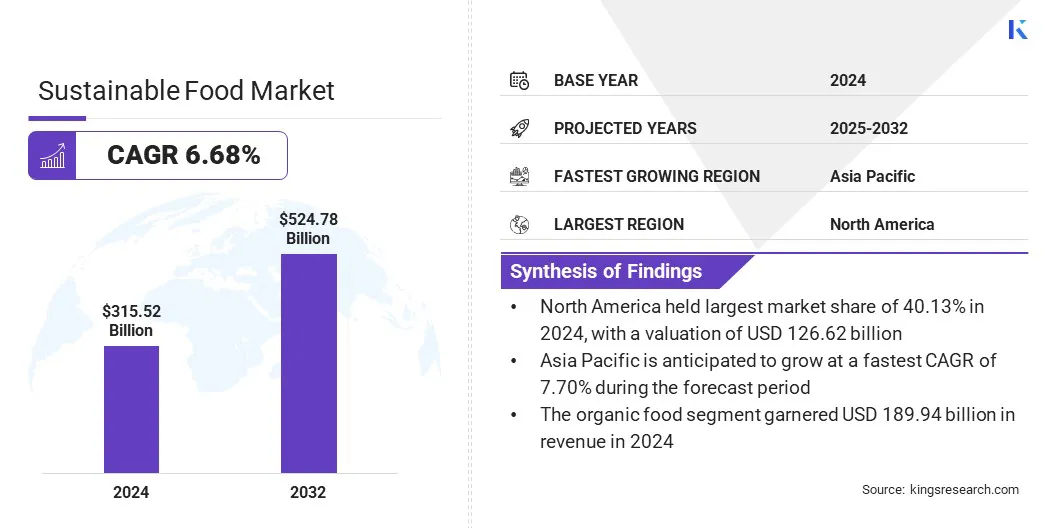

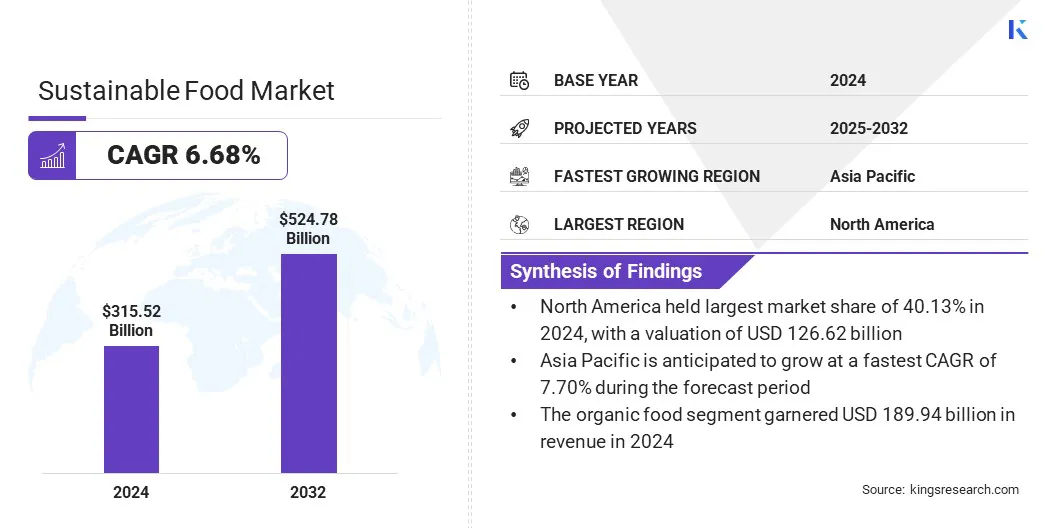

According to Kings Research, the global sustainable food market size was valued at USD 315.52 billion in 2024 and is projected to grow from USD 333.73 billion in 2025 to USD 524.78 billion by 2032, exhibiting a CAGR of 6.68% during the forecast period. The market grows steadily as consumers prioritize products that support health, environmental preservation, and social responsibility.

Rising awareness of carbon footprint, biodiversity impact, and sustainable agriculture practices is driving strong demand for organic, plant-based, and responsibly sourced foods.

In response, companies are leveraging innovations in functional ingredients, eco-friendly processing, and transparent supply chains to meet evolving consumer preferences and expand their global presence.

Key Market Highlights:

- The sustainable food industry size was USD 315.52 billion in 2024.

- The market is projected to grow at a CAGR of 6.68% from 2025 to 2032.

- North America held a share of 40.13% in 2024, valued at USD 126.62 billion.

- The organic food segment garnered USD 189.94 billion in revenue in 2024.

- The supermarkets & hypermarkets segment is expected to reach USD 312.02 billion by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 7.70% over the forecast period.

Major companies operating in the sustainable food market are Nestlé, Unilever, Danone, General Mills Inc., PepsiCo, Cargill, Incorporated, Mars, Incorporated, Tyson Foods, Inc., Arla Foods amba, McCormick & Company, Inc., Bunge, AB InBev, Kerry Group plc., FrieslandCampina, and Conagra Brands, Inc.

Companies are increasingly emphasizing the use of sustainably sourced ingredients to strengthen their supply chains and demonstrate environmental responsibility. They are investing in practices such as regenerative agriculture, reforestation, and climate-smart farming to reduce carbon emissions and improve soil health. These efforts support long-term resilience while aligning with consumer demand for ethical products.

- In April 2025, Nestlé and ofi launched their largest joint cocoa agroforestry initiative, supporting farmers across Brazil, Côte d’Ivoire, and Nigeria. The project targets 72,000 hectares of agroforestry, 2.8 million tree plantings, adoption of regenerative agriculture practices, and a 1.5 million-ton carbon reduction over 30 years.

Surging Demand for Sustainable Products and Strong Policy Support

The growth of the sustainable food market is driven by rising consumer demand for eco-friendly products and strong policy support. Growing awareness of environmental impacts and resource limitations is boosting preference for products with lower ecological footprints.

Governments and regulatory bodies are implementing policies to promote circular economy practices, reduce waste, and improve resource efficiency across the food value chain.

Aligned with the UN's Sustainable Development Goal 12, which targets halving global food waste and reducing supply chain losses by 2030, many countries have adopted supportive measures. This combination of policy support and changing consumer behavior is significantly propelling market growth.

Higher Pricing Compared to Conventional Products

A key challenge impeding the progress of the sustainable food market is its higher production and pricing compared to conventional products.

Organic, plant-based, and sustainably sourced foods often involve costly raw materials, labor-intensive practices, and stringent certifications. These costs are passed on to consumers, limiting adoption among price-sensitive groups and slowing overall market penetration.

Government incentives, subsidies, and supportive policies are helping reduce production and retail costs, making sustainable food more affordable and accessible. Additionally, awareness campaigns emphasizing long-term health and environmental benefits support consumer acceptance of premium pricing.

- In December 2024, the European Commission allocated USD 138 million to promote sustainable and high-quality EU agri-food products in domestic and international markets. It supports campaigns on organic and sustainable products, quality schemes, fresh fruit and vegetables, trade fairs, and exporter initiatives.

Growing Consumer Shift Toward Vegan Diets and Plant-Based Food Alternatives

The sustainable food market is witnessing notable growth as consumers shift toward healthier and more environmentally responsible diets. Rising demand for vegan diets, supported by greater awareness of health benefits, ethical considerations, and reduced environmental impact, is further aiding this shift.

Consumers increasingly seek plant-based proteins, dairy alternatives, and clean-label products that align with their values. In response, manufacturers are expanding portfolios with innovative, nutritionally balanced offerings. The trend is expected to strengthen as plant-based diets gain broader acceptance globally.

- In September 2024, Ferrero launched Nutella Plant-Based, a vegan-certified spread that replaces milk with chickpeas and rice syrup, while maintaining Nutella’s signature hazelnut and cocoa taste.

Sustainable Food Market Report Snapshot

|

Segmentation

|

Details

|

|

By Food Type

|

Organic Food, Plant-Based Food, Sustainable Seafood, Sustainable Functional Food, Sustainable Processed Food, Others

|

|

By Distribution Channel

|

Supermarkets & Hypermarkets, Specialty Organic & Health Stores, Online Retail & E-commerce Platforms, Foodservice & Restaurants, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Food Type (Organic Food, Plant-Based Food, Sustainable Seafood, Sustainable Functional Food, Sustainable Processed Food, and Others): The organic food segment earned USD 189.94 billion in 2024, mainly due to strong consumer preference for chemical-free, nutrient-rich products and increasing awareness of health benefits.

- By Distribution Channel (Supermarkets & Hypermarkets, Specialty Organic & Health Stores, Online Retail & E-commerce Platforms, Foodservice & Restaurants, and Others): The supermarkets & hypermarkets segment held a share of 59.50% in 2024, supported by wide product availability, competitive pricing, and convenient access.

Sustainable Food Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America sustainable food market accounted for a substantial share of 40.13% in 2024, valued at USD 126.62 billion. This dominance is reinforced by the rising adoption of advanced sustainable packaging technologies that enhance product safety, extend shelf life, and reduce environmental impact.

Companies across the region are investing in biodegradable materials, recyclable solutions, and smart packaging systems to track freshness and reduce waste. These innovations align with consumer demand for eco-friendly products and regulatory measures aimed at reducing plastic usage, strengthening North America’s position as a key market for sustainable food.

- In July 2025, Sappi North America launched Project Elevate, a USD 500 million upgrade of its Paper Machine at Somerset Mill, doubling capacity to 520,000 short tons per year. The investment supports high-quality SBS paperboard production for food, beverage, and consumer packaging amid growing demand.

The Asia-Pacific sustainable food Industry is expected to register the fastest CAGR of 7.70% over the forecast period. This growth is propelled by increasing consumer demand for sustainable seafood, supported by rising awareness of health benefits, environmental impact, and ethical sourcing.

This region is a major producer of fish, shellfish, and aquaculture products and is attracting significant investments from seafood producers and agribusiness firms in disease management, climate-resilient farming, and digital traceability systems.

Government initiatives, such as India’s National Fisheries Development Board programs, China’s Sustainable Aquaculture Development Plans, and Vietnam’s Aquaculture Certification Schemes, further promote responsible production and export standards. Adoption of innovative farming techniques and enhanced supply chain practices is strengthening Asia Pacific’s position as a key region for sustainable seafood.

- In September 2024, WorldFish and Universiti Sains Malaysia launched a USD 3 million WAVES project to promote sustainable mollusc farming in Southeast Asia. The initiative targets disease, climate stressors, and production risks to develop resilient aquaculture systems for oysters, mussels, and clams across diverse environmental conditions.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) and the United States Department of Agriculture (USDA) regulate food safety, labeling, and organic certification, including standards for sustainable and plant-based ingredients.

- In Europe, the European Food Safety Authority (EFSA) and the European Commission oversee food safety, traceability, and sustainability claims, ensuring compliance with EU regulations.

- In China, the State Administration for Market Regulation (SAMR) monitors food quality, labeling, and safety standards.

- In Japan, the Ministry of Health, Labour and Welfare (MHLW) enforces food safety, nutrition labeling, and functional food regulations.

- In India, the Food Safety and Standards Authority of India (FSSAI) governs food safety, labeling, and certification, including organic and sustainably produced foods, ensuring supply chain compliance.

Competitive Landscape

Key players in the sustainable food industry are implementing sustainability strategies, including climate-aligned targets, regenerative agriculture, and eco-friendly packaging, to enhance operational resilience and demonstrate strong ESG performance.

They are also focusing on product innovation, developing new plant-based, functional, and sustainably sourced food products to meet evolving consumer preferences and regulatory requirements.

Companies are investing in research and development to improve product quality and sustainability. These strategies are allowing companies to differentiate their offerings, build brand credibility, and maintain a competitive market position.

- In May 2025, PepsiCo refined its pep+ (PepsiCo Positive) sustainability goals, aiming to expand regenerative agriculture to 10 million acres by 2030, target packaging improvements in key markets, and maintain its 2030 net water positive goal to reinforce long-term sustainable growth.

Key Companies in Sustainable Food Market:

- Nestlé

- Unilever

- Danone

- General Mills Inc.

- PepsiCo

- Cargill, Incorporated

- Mars, Incorporated

- Tyson Foods, Inc.

- Arla Foods amba

- McCormick & Company, Inc.

- Bunge

- AB InBev

- Kerry Group plc.

- FrieslandCampina

- Conagra Brands, Inc.

Recent Developments

- In June 2025, Roquette expanded its NUTRALYS plant protein portfolio with the launch of NUTRALYS T WHEAT textured wheat protein and NUTRALYS T PEA textured pea protein. The new ingredients are specifically tailored for plant-based and hybrid meat applications, offering high protein content, sustainability, versatility, and improved processing for food manufacturers.

- In May 2025, Metsä Group and Amcor entered a strategic collaboration to develop recyclable three-dimensional moulded fibre food packaging with lidding and liner. The partnership combines Metsä’s Muoto fibre technology with Amcor’s high-barrier film to provide sustainable, renewable, and recyclable packaging for perishable food products.