Market Definition

Surveying and mapping involve collecting, analyzing, and representing spatial data of the Earth’s surface and built environments. Surveying ensures precise measurement of distances, angles, elevations, and positions to determine the exact location of natural and man-made features.

Mapping converts these measurements into visual representations such as maps, charts, or digital geospatial models, which are used for planning, navigation, construction, land management, and resource monitoring.

Surveying and Mapping Market Overview

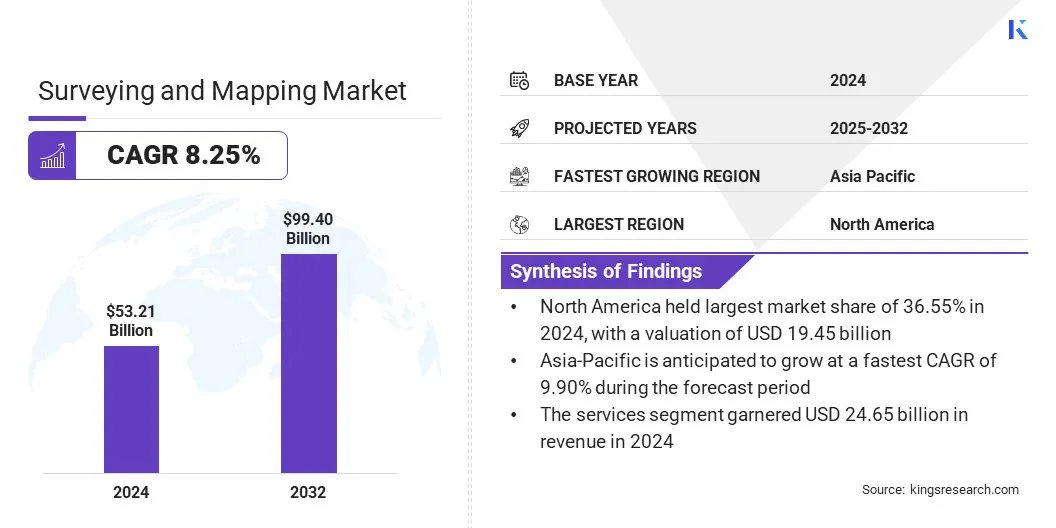

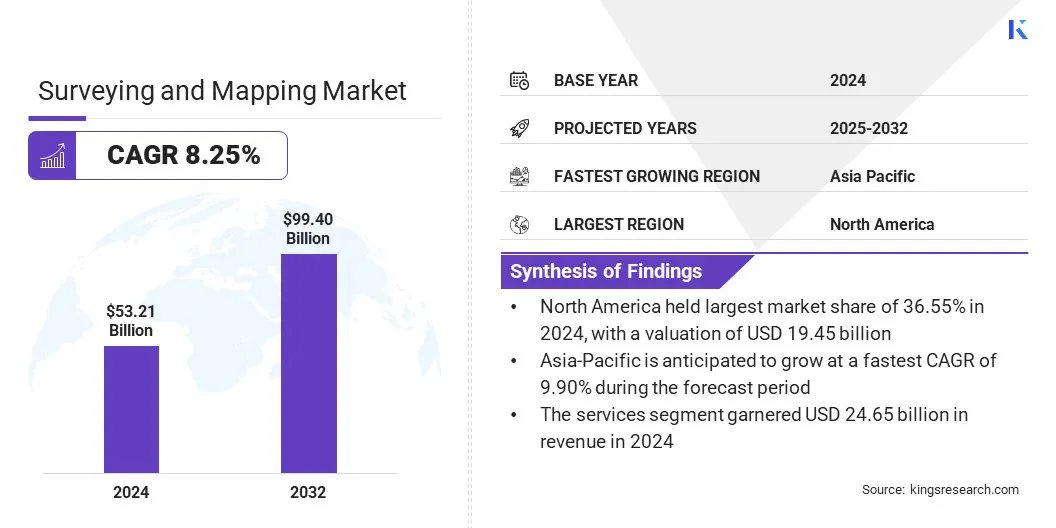

According to Kings Research, the global surveying and mapping market size was valued at USD 53.21 billion in 2024 and is projected to grow from USD 57.07 billion in 2025 to USD 99.40 billion by 2032, exhibiting a CAGR of 8.25% during the forecast period. This growth is driven by rising demand for accurate geospatial data across industries such as construction, oil and gas, agriculture, and transportation.

Advancements in technologies such as LiDAR, GNSS, and remote sensing are enhancing precision, efficiency, and automation, making surveying solutions integral to infrastructure development and resource management. Increasing adoption of digital mapping platforms and integration with AI and IoT are further expanding applications across both developed and emerging economies.

Key Market Highlights:

- The surveying and mapping industry size was recorded at USD 53.21 billion in 2024.

- The market is projected to grow at a CAGR of 8.25% from 2025 to 2032.

- North America held a share of 36.55% in 2024, valued at USD 19.45 billion.

- The services segment garnered USD 24.65 billion in revenue in 2024.

- The GNSS/GPS segment is expected to reach USD 29.76 billion by 2032.

- The construction & infrastructure segment is anticipated to witness the fastest CAGR of 9.48% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 9.90% through the projection period.

Major companies operating in the surveying and mapping market are Trimble Inc., Hexagon AB, Topcon, DJI, FARO, STONEX Srl, Shanghai Huace Navigation Technology Ltd, Robert Bosch Tool Corporation, Teledyne Technologies Inc., Esri, Autodesk Inc., Bentley systems, incorporated, Blue Marble Geographics, Cadcorp Limited., and CartoCanada.

Collaborations between geospatial technology providers, drone manufacturers, and AI analytics companies are boosting market expansion, enabling integrated solutions to improve data accuracy and operational efficiency. Partnerships are helping combine advanced LiDAR, UAV, and satellite technologies with cloud-based mapping platforms, allowing faster project execution and real-time insights.

These collaborations also facilitate knowledge sharing and access to specialized expertise, reducing deployment risks and costs. Surveying firms and infrastructure companies are increasingly leveraging such alliances to enhance service offerings, streamline workflows, and deliver high-precision geospatial solutions for urban planning, construction, and environmental monitoring projects.

- In January 2025, SAM Companies acquired Doucet Survey, a New England-based land surveying and geomatics firm. The acquisition expanded SAM’s presence in the Northeast U.S. and strengthened its ability to deliver technologically advanced surveying and mapping solutions across utilities, transportation, construction, and government sectors.

Growing Adoption of Geospatial Technologies

The increasing integration of geospatial technologies in infrastructure development, urban planning, and environmental monitoring is fueling demand for surveying and mapping solutions.

Governments and private organizations are deploying advanced tools such as LiDAR, drones, and satellite imagery to enable smart city projects, strengthen disaster management systems, and optimize resource planning. This shift toward high-precision mapping is enabling data-driven decision-making in both the public and private sectors, thereby propelling market expansion.

- In April 2025, Bentley Systems launched enhanced asset analytics in its Blyncsy platform, leveraging Google Maps Platform’s Imagery Insights to assess roadway conditions. The AI-powered solution utilized crowdsourced imagery to automate roadway asset detection, streamline maintenance, and support disaster recovery efforts.

High Cost of Advanced Mapping Technologies

A significant challenge restraining the growth of the surveying and mapping market is the high cost associated with advanced technologies such as LiDAR systems, high-resolution drones, and satellite imagery solutions.

These tools require substantial upfront investment, along with ongoing expenses for software licenses, data processing, and skilled personnel training. Smaller surveying firms and organizations in developing regions often struggle to adopt such solutions, limiting widespread adoption.

To overcome this challenge, key players are developing more affordable, scalable, and user-friendly solutions. Many companies are introducing cloud-based platforms that reduce the need for heavy on-premise infrastructure, thereby lowering operational expenses.

Flexible pricing models, such as subscription-based services and pay-per-use options, are also being offered to make advanced mapping technologies accessible to smaller firms and government agencies with limited budgets.

- In June 2025, Eagleview finalized a multi-year transformation project to enhance the value of its aerial imagery, analytics, and insights for customers. The initiative integrated drone and aerial imagery with AI-driven analytics and high-precision 3D models into a unified platform. By streamlining access and adding new workflow tools, Eagleview improved usability and delivered enhanced operational benefits to its clients .

The surveying and mapping market is witnessing a significant shift toward the integration of artificial intelligence (AI) and cloud-based geospatial platforms. AI-driven tools are enabling faster data processing, automated feature extraction, and predictive analytics from complex geospatial datasets, reducing time-intensive manual tasks.

Meanwhile, cloud-based platforms are improving accessibility and collaboration, allowing real-time sharing of high-resolution maps, 3D models, and survey data across project stakeholders. This trend is enhancing operational efficiency in infrastructure projects, disaster response, and environmental monitoring, while also lowering costs associated with large-scale data management.

- In June 2025, Hexagon’s Manufacturing Intelligence division launched the Autonomous Metrology Suite, a cloud-based software on its Nexus platform. The solution eliminated coding from coordinate measuring machine (CMM) workflows, enabling faster R&D and manufacturing.

Surveying and Mapping Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Hardware, Software, Services

|

|

By Technology

|

LiDAR, Photogrammetry, GNSS/GPS, Remote Sensing, Others

|

|

By Application

|

Construction & Infrastructure, Oil & Gas, Agriculture & Forestry, Transportation & Logistics, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Hardware, Software, and Services): The services segment earned USD 24.65 billion in 2024, mainly due to increasing demand for geospatial consulting, data processing, and managed surveying solutions across infrastructure and construction projects.

- By Technology (LiDAR, Photogrammetry, GNSS/GPS, Remote Sensing, and Others): The GNSS/GPS held a share of 32.22% in 2024, fueled by its widespread adoption for high-precision positioning and real-time data collection in surveying, construction, and infrastructure projects.

- By Application (Construction & Infrastructure, Oil & Gas, Agriculture & Forestry, Transportation & Logistics, and Others): The construction & infrastructure segment is projected to reach USD 39.78 billion by 2032, owing to large-scale urban development projects, smart city initiatives, and increasing demand for precise land surveying and mapping solutions.

Surveying and Mapping Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America surveying and mapping market share stood at 36.55% in 2024, valued at USD 19.45 billion. This dominance is reinforced by strong infrastructure development and smart city initiatives. Governments at the federal, state, and local levels are investing heavily in digital land record modernization, urban planning, and transportation network optimization, boosting demand for high-precision mapping solutions.

Advanced technologies such as LiDAR, drones, and AI-powered geospatial platforms are being widely adopted to enhance accuracy, efficiency, and real-time data accessibility. The presence of major market players, coupled with a well-established technology ecosystem and favorable regulatory frameworks, further boosts regional market expansion.

- In October 2024, the U.S. Geological Survey awarded USD 4.8 million, supported by President Biden’s Bipartisan Infrastructure Law, to 36 state geological surveys. The funding aimed to support the preservation of critical geologic and geophysical data and samples through the USGS National Geological and Geophysical Data Preservation Program (NGGDPP).

The Asia-Pacific surveying and mapping industry is poised to grow at a CAGR of 9.90% over the forecast period. This growth is bolstered by strong industrial growth and the rising demand from the energy, mining, and transportation sectors.

Governments are promoting geospatial technology adoption for natural resource management, precision agriculture, and coastal monitoring, creating demand for advanced mapping solutions.

Increasing investments in infrastructure projects such as high-speed rail, smart ports, and renewable energy facilities are highlighting the need for high-accuracy land surveys and 3D modeling. Rapid technological adoption, including UAVs, 3D LiDAR scanners, and AI-based geospatial analytics, is enhancing operational efficiency and data precision.

- In January 2025, Fugro initiated its first Carbon Capture and Storage (CCS) project in India in collaboration with Eco Carbon Engineering Solutions, Visakha Pharma City, and IIT Bombay. Fugro used geotechnical surveying, geological mapping, and geospatial consulting to identify storage sites and monitor subsurface conditions. This project highlights the importance of surveying and mapping technologies in supporting sustainable infrastructure and ensuring precise, safe CCS implementation.

Regulatory Frameworks

- In the U.S., surveying and mapping activities are guided by federal and state regulations, with the Federal Geographic Data Committee (FGDC) overseeing the National Spatial Data Infrastructure (NSDI) to ensure standards for geospatial data quality, sharing, and interoperability. Licensed professional surveyors at the state and local levels enforce accuracy and technical compliance in land surveying practices.

- In the EU, surveying standards and geospatial data usage are regulated under national mapping authorities and geoinformation directives, ensuring consistency, accuracy, and responsible deployment of mapping technologies.

- In APAC, countries such as China and India regulate UAV-based mapping, remote sensing data usage, and geospatial information security, requiring government approvals for certain surveying operations to maintain accuracy, privacy, and safety.

- Internationally, organizations such as the United Nations Committee of Experts on Global Geospatial Information Management (UN-GGIM) are developing frameworks to standardize global surveying and mapping practices, promoting data interoperability, ethical usage, and collaboration across borders.

Competitive Landscape

Key players in the surveying and mapping industry are emphasizing the development of integrated, end-to-end geospatial platforms to streamline workflows and enhance data usability. By combining advanced hardware, cloud-based software, and real-time analytics, companies are enabling faster project execution, more accurate mapping, and seamless data sharing across teams.

Investments in automation, AI-powered analytics, and remote sensing technologies are helping firms reduce operational costs, improve project precision, and deliver actionable insights to clients in infrastructure, agriculture, and environmental management sectors. These strategies position market leaders to meet the growing demand for high-quality, efficient, and scalable surveying and mapping solutions.

- In July 2025, CHC Navigation (CHCNAV) launched the AU20 MMS, a vehicle-mounted mobile mapping system for accurate 3D spatial data collection. The system combined high-performance LiDAR, versatile sensor support, and intelligent data processing, enhancing efficiency in road surveying, asset management, and infrastructure documentation.

Key Companies in Surveying and Mapping Market:

- Trimble Inc.

- Hexagon AB

- Topcon

- DJI

- FARO

- STONEX Srl

- Shanghai Huace Navigation Technology Ltd

- Robert Bosch Tool Corporation

- Teledyne Technologies Inc.

- Esri

- Autodesk Inc.

- Bentley systems, incorporated

- Blue Marble Geographics

- Cadcorp Limited.

- CartoCanada

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In June 2025, NV5 secured a five-year contract worth up to USD 250 million from the National Oceanic and Atmospheric Administration (NOAA) to provide shoreline mapping services for the National Geodetic Survey (NGS). The project emphasized the importance of advanced surveying and mapping technologies in coastal monitoring, infrastructure planning, and environmental management.

- In July 2025, AECOM entered into a strategic partnership with Special Integrated Logistics Zones Company (SILZ) in Saudi Arabia to support the development of integrated logistics zones. The collaboration focused on enhancing infrastructure planning and geospatial mapping capabilities, supporting Saudi Vision 2030’s objectives of economic diversification, sustainable growth, and strengthened global trade networks.

- In July 2025, Fugro entered into a strategic collaboration with Esri to deliver integrated geospatial solutions for climate resilience and sustainable development, combining Fugro’s surveying expertise with Esri’s GIS software.

- In July 2025, Fugro partnered with DTACT and Ubotica to develop a data fusion and intelligence platform. The solution aimed to provide government organizations with actionable insights to enhance national security and protect critical underwater infrastructure.

- In June 2025, Maxar Intelligence secured three multi-year contracts totaling USD 204.7 million to support defense, intelligence, and space capabilities across the Middle East and Africa.