Market Definition

The global market involves the production, distribution, and use of wires made from superconducting materials. These materials, which exhibit zero electrical resistance at very low temperatures, are used in a wide range of applications across various sectors. The report provides insights into key market growth drivers, emerging trends, and regulatory landscape shaping the industry.

Superconducting Wire Market Overview

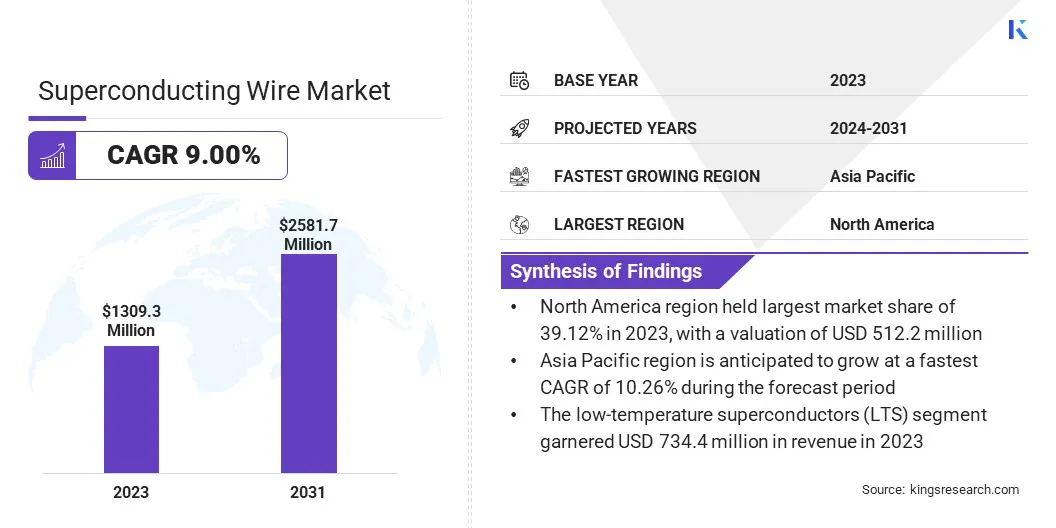

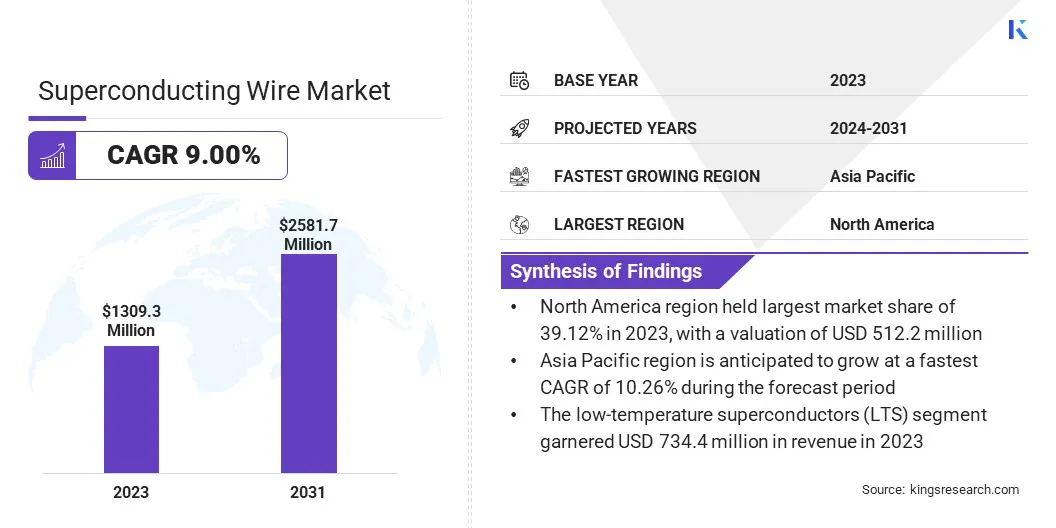

The global superconducting wire market size was valued at USD 1,309.3 million in 2023 and is projected to grow from USD 1,412.2 million in 2024 to USD 2,581.7 million by 2031, exhibiting a CAGR of 9.00% during the forecast period.

Market growth is driven by the rising use of superconducting wire in medical applications, particularly in MRI systems, where it enables strong, stable magnetic fields essential for high-resolution imaging. Rising global demand for advanced diagnostic technologies is further highlighting the need for high-performance superconducting components.

Major companies operating in the superconducting wire industry are SuNam Co., Ltd, Cutting Edge Superconductors, Inc., Bruker, Hyper Tech Research, Inc., Hitachi, Ltd., American Superconductor, THEVA Dünnschichttechnik GmbH, Kiswire Advanced Technology Co., Ltd., Mitsubishi Materials, Furukawa Electric Co., Ltd., JEOL GROUP, Fujikura Ltd., SuperOx, MetOx International, Sumitomo Electric Industries, Ltd., and others

Additionally, significant advancements in superconducting materials, particularly high-temperature superconductors (HTS), are enhancing performance while reducing operational costs. These innovations are expanding the application of superconducting wires across next-generation power systems, scientific research, and emerging technologies.

- In April 2023, SuperNode and CERN collaborated to advance insulation technology for superconducting cables. The partnership focuses on developing innovative insulation solutions to enhance the performance and efficiency of superconducting transmission systems, supporting large-scale renewable energy integration. SuperNode contributes expertise in superconducting energy transmission, while CERN offers advanced knowledge of vacuum and thermal insulation from its work with superconducting magnets, supporting the deployment of next-generation grid infrastructure.

Key Highlights:

- The superconducting wire industry size was recorded at USD 1,309.3 million in 2023.

- The market is projected to grow at a CAGR of 9.00% from 2024 to 2031.

- North America held a share of 39.12% in 2023, valued at USD 512.2 million.

- The niobium-based segment garnered USD 446.3 million in revenue in 2023.

- The low-temperature superconductors (LTS) segment is expected to reach USD 1,534.54 million by 2031.

- The medical segment is likely to reach USD 854.30 million by 2031.

- The Healthcare segment is estimated to generate a revenue of USD 957.8 million by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 10.26% over the forecast period.

Market Driver

Extensive Use of Superconducting Wire in MRI Systems

The rising demand for MRI systems in the healthcare sector is bolatering the expansion of the market. Superconducting wires are essential components in MRI machines, enabling high-strength magnetic fields with zero electrical resistance, crucial for accurate imaging.

Rising chronic disease prevalence, aging populations, and focus on early diagnosis are boosting global MRI demand. This growth is prominent in both developed regions with advanced healthcare infrastructure and emerging markets enhancing medical infrastructure.

Consequently, the need for reliable and efficient superconducting wires continues to surge, reinforcing their critical role in modern medical imaging technologies.

- In April 2024, CEA unveiled Iseult, a MRI machine operating at 11.7 teslas and powered by 182 km of superconducting wire. Cooled to -271.35 °C, the wire generates a stable magnetic field, enabling ultra-high-resolution brain imaging. This breakthrough significantly enhances diagnostic precision for neurological disorders and highlights the growing role of superconducting wire in medical imaging.

Market Challenge

High Cost of Manufacturing and Maintenance

A major barrier to the expansion of the superconducting wire market is the high cost of manufacturing and maintenance, particularly for low-temperature superconductors (LTS) that require complex cryogenic cooling systems using liquid helium.

These systems elevate operational costs and limit the widespread adoption of superconducting wires in commercial and industrial applications. Additionally, the fabrication of high-performance superconducting wires involves expensive raw materials and intricate production processes, making large-scale deployment economically challenging.

To mitigate this challenge, market participants are developing high-temperature superconductors (HTS), which operate at higher temperatures and can be cooled using cost-effective options such as liquid nitrogen. This advancement is expected to reduce production and operational costs, enhancing the viability of superconduting technologies across the power, healthcare, and transportation sectors.

Market Trend

Advancements in Superconducting Materials

A key trend influencing the market is the continuous advancement in superconducting materials, particularly high-temperature superconductors (HTS). Innovations in material composition and wire fabrication techniques are enabling the development of more cost-effective, durable, and efficient superconducting wires.

These improvements are expanding the feasibility of HTS wires in a wider range of applications, including power transmission, medical imaging, and transportation systems. Compared to traditional low-temperature superconductors, HTS wires operate at relatively higher temperatures, reducing cooling costs and simplifying system designs.

This trend is enhancing performance capabilities while increasing the accessibility of superconducting technologies for commercial and industrial applications, thereby accelerating adoption across multiple sectors.

- In March 2025, researchers from the National University of Singapore (NUS) developed a copper-free high-temperature superconducting oxide that operates at around 40 Kelvin under ambient pressure. This breakthrough marks a significant advancement in superconducting materials, expanding the scope beyond traditional copper-based compounds and supporting the progress of next-generation high-temperature superconductors.

Superconducting Wire Market Report Snapshot

|

Segmentation

|

Details

|

|

By Material

|

Niobium-Based, Bismuth-Based, Yttrium-Based, Magnesium Diboride

|

|

By Type

|

Low-Temperature Superconductors (LTS), High-Temperature Superconductors (HTS)

|

|

By Application

|

Medical, Energy, Industrial, Scientific Research

|

|

By End-User Industry

|

Healthcare, Energy & Power, Electronics, Transportation, Defense & Aerospace, Research Institutes & Laboratories

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Material (Niobium-Based, Bismuth-Based, Yttrium-Based, and Magnesium Diboride): The niobium-based segment earned USD 446.3 million in 2023 due to its widespread use in high-performance superconducting wires for MRI machines and particle accelerators.

- By Type (Low-Temperature Superconductors (LTS) and High-Temperature Superconductors (HTS)): The low-temperature superconductors (LTS) held a share of 56.09% in 2023, fueled by their proven reliability in critical applications such as MRI systems and scientific research.

- By Application (Medical, Energy, Industrial, and Scientific Research): The medical segment is projected to reach USD 854.30 million by 2031, fueled by the increasing demand for MRI machines and advancements in diagnostic technologies.

- By End-User Industry (Healthcare, Energy & Power, Electronics, and Transportation): The healthcare segment is projected to reach USD 957.8 million by 2031, propelled by the growing adoption of superconducting materials in medical imaging systems and cancer treatment technologies.

Superconducting Wire Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America superconducting wire market share stood at around 39.12% in 2023, valued at USD 512.2 million. This dominance is attributed to the region's advanced technological infrastructure, strong R&D efforts, and high demand for superconducting wires in critical applications such as medical imaging (MRI), scientific research, and energy storage.

The presence of major industry players and continuous investments in energy-efficient technologies further strengthens North America's leading position. Additionally, government support for clean energy and innovation in power transmission continues to spur regional market expansion.

Asia Pacific superconducting wire industry is poised to grow at a CAGR of 10.26% over the forecast period. This expansion is stimulated by rapid industrialization and technological advancements in countries such as China, Japan, and South Korea.

The increasing demand for energy-efficient solutions, particularly in the power sector, coupled with the expansion of healthcare infrastructure and advancements in scientific research, is fueling regional market growth. Additionally, favorable government policies and significant investments in infrastructure in countries such as China and India are expected to boost the adoption of superconducting wires, positioning Asia Pacific as a key market.

- In February 2024, the Government of India, through the Interim Budget 2024–25, announced an 11.1% increase in infrastructure spending, totaling approximately USD 156 million or 3.4% of GDP. Key initiatives include railway corridor projects under PM Gati Shakti, accelerated airport expansion, and the promotion of metro rail and Namo Bharat to foster urban development.

Regulatory Frameworks

- In the U.S., superconducting wires are governed by the National Electrical Code (NEC) and standards from the National Institute of Standards and Technology (NIST), ensuring compliance with safety, performance, and environmental standards.

- In India, the Bureau of Indian Standards (BIS) oversees the formulation and enforcement of standards related to superconducting wire. Although specific Indian standards are still inunder development, BIS aligns with international frameworks, particularly those of the International Electrotechnical Commission (IEC TC90).

Competitive Landscape

The superconducting wire market is highly competitive and innovation-driven, with key players leveraging strategic alliances with academic institutions, government research bodies, and large-scale scientific initiatives.

These partnerships accelerate innovation, provide access to advanced infrastructure and public funding,and support the co-development of specialized applications. Robust R&D investments remains critical to maintaining competitiveness.

Market participants are enhancing the performance of high-temperature superconducting (HTS) wires focusing on critical current density, thermal stability, and cost-efficiency while driving the commercialization of second-generation (2G) technologies.

To expand their global footprint, companies are adopting geographic diversification and localized manufacturing, establishing production hubs and service networks in key regions, along with engaging local regulators to ensure compliance and accelerate time-to-market.

- In April 2024, High Temperature Superconductors, Inc. (HTSI) launched an advanced manufacturing technologies initiative under the U.S. Department of Energy’s Advanced Research Projects Agency for Energy (ARPA-E) superconducting tape program. HTSI secured USD 5 million, half of the total USD 10 million funding, to enhance production throughput and lower manufacturing costs of high-temperature superconducting (HTS) tape.

List of Key Companies in Superconducting Wire Market:

- SuNam Co.,Ltd

- Cutting Edge Superconductors, Inc.

- Bruker

- Hyper Tech Research, Inc.

- Hitachi, Ltd.

- American Superconductor

- THEVA Dünnschichttechnik GmbH

- Kiswire Advanced Technology Co., Ltd.

- Mitsubishi Materials

- Furukawa Electric Co., Ltd.

- JEOL GROUP

- Fujikura Ltd.

- SuperOx

- MetOx International

- Sumitomo Electric Industries, Ltd.

Recent Developments (Partnerships)

- In October 2024, THEVA, in partnership with Stadtwerke München (SWM), commissioned the world’s first superconducting 110 kV high-voltage cable at the Menzing main substation. Developed under the “SuperLink” project, the system is the first to transmit over 500 MW across more than 10 km at the distribution grid level. The milestone enhances grid efficiency and supports the energy transition, with commercial deployment expected after successful testing.