Market Definition

The market involves the development, production, and application of fiber optic technology used for high-speed data transmission. This market encompasses a wide range of products and services including fiber optic cables, connectors, transceivers, and installation solutions, which enable high-speed, high-bandwidth communication across various sectors.

The report explores key drivers of market development, offering detailed regional analysis and a comprehensive overview of the competitive landscape shaping future opportunities.

Fiber Optics Market Overview

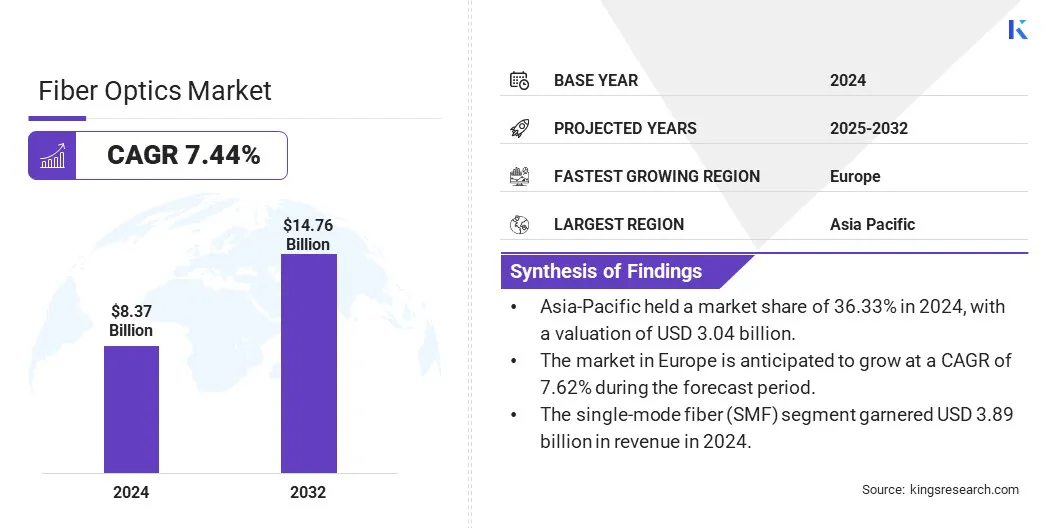

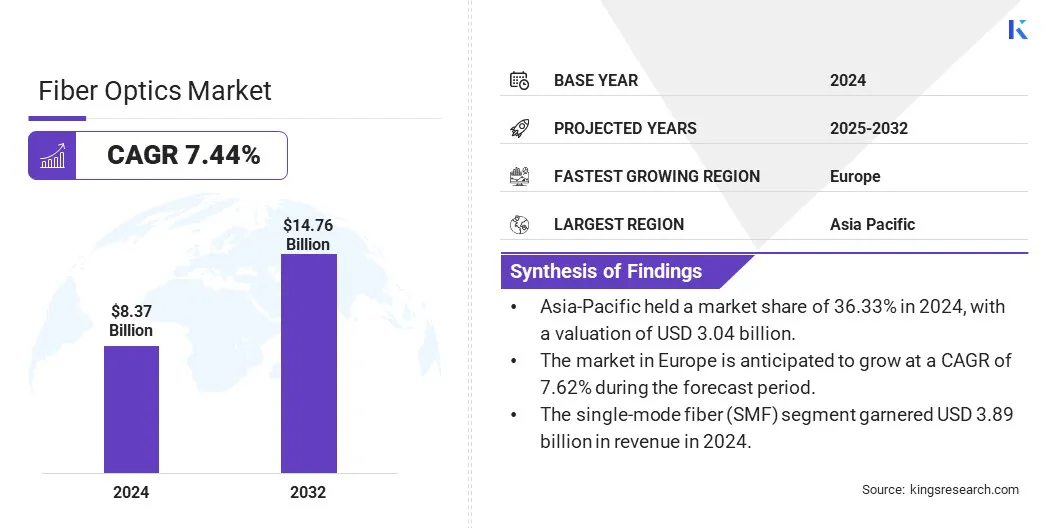

The global fiber optics market size was valued at USD 8.37 billion in 2024 and is projected to grow from USD 8.93 billion in 2025 to USD 14.76 billion by 2032, exhibiting a CAGR of 7.44% during the forecast period.

This growth is attributed to the rising deployment of high-speed communication networks across diverse end-use sectors such as telecommunications, data centers, healthcare, and industrial automation. Increasing demand for reliable, high-bandwidth connectivity to support cloud computing, video streaming, and IoT applications is driving the adoption of fiber optic solutions.

Major companies operating in the fiber optics industry are STL Tech, Optical Cable Corporation, Corning Incorporated, Sumitomo Electric Industries, Ltd., OFS Fitel, LLC, TE Connectivity, Prysmian S.p.A, CommScope, AFL, Coherent Corp, BIRLA FURUKAWA FIBRE OPTICS PRIVATE LIMITED, Molex, Fujikura Ltd., Nexans, and Proterial Cable America, Inc.

The growing emphasis on 5G infrastructure, smart city development, and digital transformation initiatives, along with advancements in fiber optic cable design and transmission efficiency, is further driving the growth of the market.

In addition, ongoing innovations in optical components, cost-effective manufacturing, and enhanced signal integrity, combined with expanding applications in defense systems, remote sensing, and intelligent transport networks, are accelerating the development of the market.

- In February 2025, Hexatronic Group, a Swedish fiber optic solutions provider, announced plans to start manufacturing fiber-optic cables in the U.S. This aims to strengthen local production, meet rising demand, and improve supply chain resilience across North America's telecommunications and broadband infrastructure sector.

Key Highlights

- The fiber optics industry size was valued at USD 8.37 billion in 2024.

- The market is projected to grow at a CAGR of 7.44% from 2025 to 2032.

- Asia-Pacific held a market share of 36.33% in 2024, with a valuation of USD 3.04 billion.

- The single-mode fiber (SMF) segment garnered USD 3.89 billion in revenue in 2024.

- The aerial segment is expected to reach USD 6.79 billion by 2032.

- The telecom segment is anticipated to witness the fastest CAGR of 7.86% during the forecast period

- The market in Europe is anticipated to grow at a CAGR of 7.62% during the forecast period.

Market Driver

Rapid Growth and Deployment of 5G Networks

The market is propelled by the rapid growth and deployment of 5G networks worldwide. As demand for faster data speeds and lower latency intensifies, telecom operators are aggressively expanding their network infrastructure to support next-generation connectivity.

This expansion requires extensive fiber optic cabling to connect 5G cell towers, small cells, and data centers, enabling high-capacity and reliable data transmission essential for 5G performance. This is further supported by the increasing adoption of emerging technologies such as augmented reality (AR), autonomous vehicles, and smart city applications, all of which rely on the robust communication capabilities provided by fiber optics.

The growing need for seamless, high-speed wireless communication is driving network providers and governments to invest heavily in fiber optic infrastructure, thereby accelerating the growth of the global fiber optics market.

- In May 2024, Reichle & De-Massari AG (R&M) opened its largest manufacturing plant in Bengaluru, India, focused on fiber optic solutions for data centers and FTTx applications. Built in accordance with Switzerland’s renowned standards for precision, reliability, and sustainability, the plant aims to meet the rising demand for broadband, 5G, and data center infrastructure across India and the Asia-Pacific region.

Market Challenge

Technical Issues Related to Fiber Fragility

The inherent fragility of optical fibers poses a significant challenge to the deployment and maintenance of fiber optic networks, particularly in telecommunications, data centers, and industrial applications. Fiber optic cables are extremely sensitive to bending, stretching, and physical stress, which can cause signal attenuation or complete failure.

Environmental factors such as temperature fluctuations, vibrations, and accidental impacts further increase the risk of damage, compromising network reliability and increasing maintenance costs.

To overcome these challenges, manufacturers are developing bend-insensitive fibers and armored cables that offer greater durability and protection against physical stress. Installation protocols have also been enhanced with specialized tools and training to minimize handling damage.

Additionally, ongoing monitoring and predictive maintenance technologies help detect faults early, ensuring prompt repairs and reducing network downtime. These innovations collectively improve the resilience and longevity of fiber optic infrastructure.

Market Trend

Advancements in Fiber Optic Technology

Advancements in fiber optic technology are significantly transforming the fiber optics market by enhancing network performance, flexibility, and application scope. Modern fiber optics incorporate ultra-low loss fibers, bend-insensitive designs, and improved optical amplifiers, which increase signal strength, reduce attenuation, and enable more efficient data transmission over longer distances.

These technological breakthroughs allow for higher bandwidth and more reliable connectivity, even in challenging installation environments, making fiber optics ideal for applications ranging from telecommunications to data centers and industrial automation. Improved integration with advanced network protocols and edge computing further optimizes data processing by reducing latency and power consumption, supporting real-time communication demands.

Moreover, the miniaturization and enhanced durability of fiber optic components are facilitating easier deployment in compact and complex infrastructure, expanding their use in smart cities, 5G networks, and IoT ecosystems.

- In February 2025, OFS unveiled the AccuRoll DC TL Rollable Ribbon (RR) Cable, a cutting-edge fiber optic cable engineered to improve efficiency, flexibility, and performance across various network applications. With its rollable ribbon technology and gel-free, riser-rated design, the cable enables high-density installations and smooth transitions between indoor and outdoor environments without the need for splicing.

Fiber Optics Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Single-Mode Fiber (SMF), Multi-Mode Fiber (MMF), and Plastic Optical Fiber (POF)

|

|

By Deployment

|

Underground, Underwater, and Aerial

|

|

By End Use Industry

|

Telecom, Oil & Gas, Military & Aerospace, BFSI, and Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Single-Mode Fiber (SMF), Multi-Mode Fiber (MMF), and Plastic Optical Fiber (POF)): The single-mode fiber (SMF) segment earned USD 3.89 billion in 2024 due to its superior long-distance transmission capabilities and higher bandwidth efficiency compared to other fiber types.

- By Deployment (Underground, Underwater, and Aerial): The aerial segment held 45.87% of the market in 2024, due to its lower installation costs and faster deployment compared to underground and underwater alternatives.

- By End Use Industry (Telecom, Oil & Gas, Military & Aerospace, BFSI, and Others): The telecom segment is projected to reach USD 5.76 billion by 2032, owing to the increasing demand for high-speed internet, 5G network expansion, and growing data traffic worldwide.

Fiber Optics Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific fiber optics market share stood at around 36.33% in 2024, with a valuation of USD 3.04 billion. This dominance is attributed to rapid urbanization, extensive investments in telecommunications infrastructure, and the accelerating rollout of 5G networks across the region.

Additionally, the increasing demand for high-speed internet connectivity across urban and rural areas, along with the growing adoption of Internet of Things (IoT) technologies in smart city projects is driving market growth in this region. Favorable government policies aimed at improving digital infrastructure, coupled with the presence of key industry players in fiber optic manufacturing and deployment are further driving the market growth in Asia Pacific.

Furthermore, ongoing advancements in network technologies and increasing collaborations between public and private sectors are enhancing the region’s fiber optic capabilities, thereby accelerating market growth.

- In March 2025, the Press Information Bureau (PIB) of India published guidelines issued by the Central Electricity Authority (CEA) on sharing fiber cores within Optical Ground Wire (OPGW) and Underground Fiber Optic (UGFO) cables utilized in power transmission. These guidelines prioritize the communication needs of the power grid while permitting the commercial leasing of spare fiber cores, provided there is an 18-month termination notice. Additionally, they advise the installation of cables with increased fiber capacity to meet future demand.

The fiber optics industry in Europe is poised for significant growth at a robust CAGR of 7.62% over the forecast period. This growth is attributed to the increasing investments in high-speed broadband infrastructure and the accelerated rollout of fiber-to-the-home (FTTH) and 5G networks across the region.

The region’s strong regulatory framework promotes digital connectivity, drives infrastructure modernization, and facilitates the broad deployment of fiber optic technologies. Rising demand from industries such as healthcare, defense, and automotive for secure, high-capacity communication networks is also driving market expansion.

Additionally, ongoing innovations in fiber optic components, along with collaborations between government bodies and private enterprises, are enhancing network performance and scalability, thereby propelling market growth in this region.

- In April 2025, European technology company ZF introduced optical multi-gigabit Ethernet in its ProAI system, advancing fiber optic use in vehicles. Supporting data transmission up to 40 meters under the IEEE 802.3cz-2023 standard, this innovation enables high-speed, robust communication for next-generation, software-defined vehicles.

Regulatory Frameworks

- In the U.S., the Federal Communications Commission (FCC) regulates the market. It oversees telecommunications infrastructure deployment, promotes competition, innovation, and broadband expansion, and ensures a robust and competitive market by setting standards for network access and interoperability.

- In the European Union, the European Electronic Communications Code (EECC) regulates the market. It aims to foster investment in high-speed broadband infrastructure, simplify the permitting process for network deployment, ensure fair competition among service providers, and enhance consumer protection across member states.

- In India, the Telecommunications Act, 2023 regulates the market by providing guidelines for the deployment and operation of fiber optic networks. It supports infrastructure sharing, Right of Way approvals, and promotes broadband expansion through the National Broadband Mission.

Competitive Landscape

The fiber optics industry is characterized by a diverse mix of well-established global corporations and innovative regional firms, each focusing on expanding their product portfolios and market reach through technological innovation, geographic expansion, and strategic partnerships.

Leading companies are heavily investing in research and development to enhance fiber optic performance, durability, and cost-efficiency, with an emphasis on advancing next-generation technologies such as bend-insensitive fibers and integrated photonics. They are also developing scalable and customized solutions to meet the increasing demand across telecommunications, healthcare, and industrial sectors.

Additionally, firms are forming alliances with key stakeholders in network infrastructure, data centers, and government bodies to accelerate the deployment of fiber optic technologies across a wider range of applications.

- In April 2025, Nortech Systems was granted a patent for its non-magnetic expanded beam fiber optic cable technology. Constructed from non-magnetic materials such as aluminum and titanium, these cables provide exceptional durability with more than 100,000 mating cycles and maintain reliable operation in magnetic environments like MRI systems. This advancement is designed for use in medical imaging, aerospace, defense, and industrial sectors, improving cable longevity and minimizing maintenance requirements.

- In May 2023, Air Water Inc. in collaboration with Keio University created the world’s first needle-sized disposable endoscope utilizing graded-index plastic optical fiber technology. Featuring a lens tip measuring between 0.1 and 0.5 mm, this minimally invasive device allows outpatient joint examinations under local anesthesia, providing an affordable and hygienic option.

List of Key Companies in Fiber Optics Market:

- STL Tech

- Optical Cable Corporation

- Corning Incorporated

- Sumitomo Electric Industries, Ltd.

- OFS Fitel, LLC

- TE Connectivity

- Prysmian S.p.A

- CommScope

- AFL

- Coherent Corp

- BIRLA FURUKAWA FIBRE OPTICS PRIVATE LIMITED

- Molex

- Fujikura Ltd.

- Nexans

- Proterial Cable America, Inc.

Recent Developments (M&A/Partnerships/Agreements/Product Launch)

- In March 2025, Prysmian Group partnered with U.S.-based Relativity Networks to co-produce next-generation hollow-core fiber optic cables for data centers. This technology enables data to travel nearly 50% faster and farther than traditional cables, reducing latency. This collaboration aims to meet the rising demand for high-speed data transmission in AI-driven applications.

- In November 2024, Omni Fiber and Lit Fiber, both owned by Oak Hill Capital, announced a merger to speed up fiber-to-the-home (FTTH) expansion in underserved areas. The merger aims to improve efficiency and customer service, with Lit Fiber customers expected to access speeds up to 10 Gbps by 2025.

- In July 2024, Deutsche Telekom AG and O₂ Telefónica expanded their cooperation, allowing O₂ to offer Deutsche Telekom’s fiber-optic connections with speeds up to 1 Gbps. This partnership supports broader broadband access as Deutsche Telekom aims to reach 25 million households by 2030.

- In March 2024, AFL, a subsidiary of Japan’s Fujikura Ltd., announced a USD 50 million investment to expand its fiber optic cable manufacturing in Duncan, South Carolina, U.S. This expansion aims to boost production capacity, support U.S. broadband deployment, and modernize the power grid.

- In November 2023, Prysmian Group introduced its plan to roll out 16-fiber single-mode and multi-mode FlexRibbon 2.0 mm cables in North America, which were released in early 2024. Designed for high-density use, these cables accommodate data center speeds up to 1.6 Tbps and are compatible with ultra-compact connectors, addressing the growing needs of AI-focused infrastructure.

- In March 2023, CommScope announced a USD 47 million investment to expand fiber optic cable production in the U.S., aiming to accelerate broadband rollout in underserved communities. New production lines in North Carolina will manufacture the smaller, lighter, and cost-effective HeliARC cable, designed for rural deployments. This initiative aligns with U.S. government policies to boost domestic manufacturing and broadband access.