Market Definition

Subsea and offshore services encompass specialized operations that support the development, production, maintenance, and decommissioning of underwater and offshore infrastructure.

Key activities include subsea surveying, drilling support, inspection, repair and maintenance (IRM), subsea engineering, well intervention, decommissioning, and the installation of subsea equipment such as pipelines, umbilicals, and control systems. These services are essential for industries such as offshore oil & gas, offshore wind energy, telecommunications, and marine mining, ensuring safe, efficient, and reliable operations in complex marine environments.

Subsea and Offshore Services Market Overview

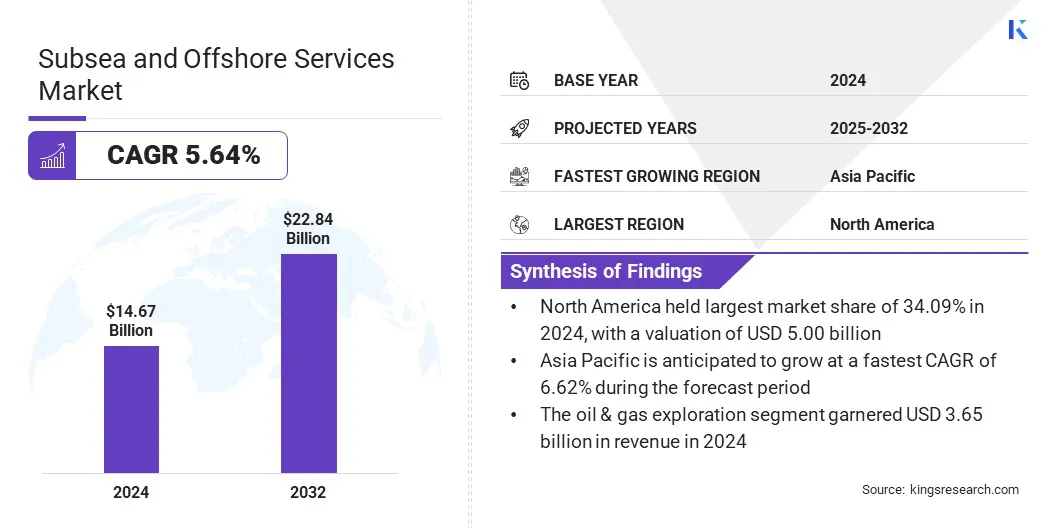

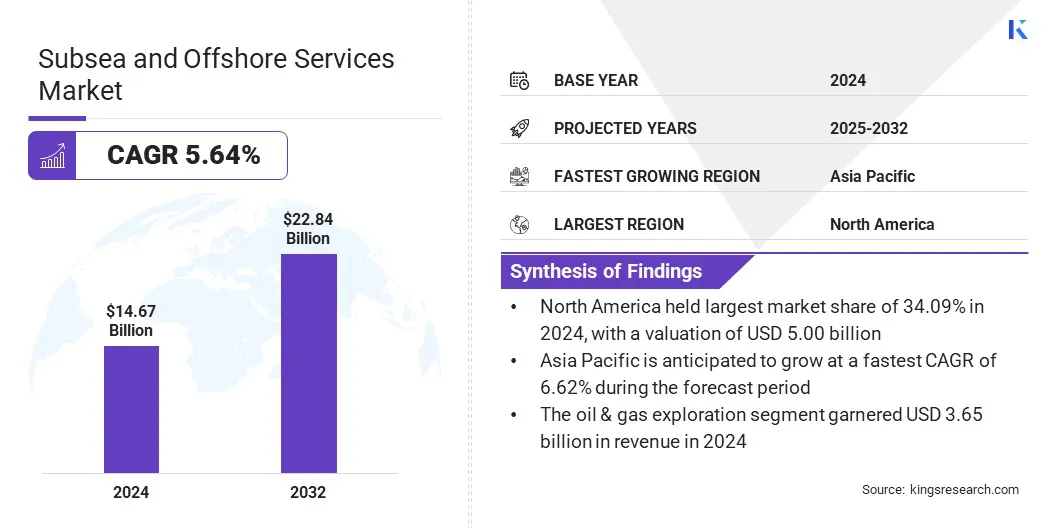

The global subsea and offshore services market size was valued at USD 14.67 billion in 2024 and is projected to grow from USD 15.46 billion in 2025 to USD 22.84 billion by 2032, exhibiting a CAGR of 5.64% during the forecast period. The increasing adoption of digital twin technology and remote monitoring systems is transforming the way offshore and subsea operations are managed.

Digital twins’ virtual replicas of physical assets such as offshore rigs, pipelines, and subsea equipment enable real-time data visualization, predictive maintenance, and performance optimization. This trend is driving the development of smart subsea assets and enabling service providers to offer value-added and data-driven solutions in the market.

Key Highlights:

- The subsea and offshore services industry size was recorded at USD 14.67 billion in 2024.

- The market is projected to grow at a CAGR of 5.64% from 2025 to 2032.

- North America held a share of 34.09% in 2024, valued at USD 5.00 billion.

- The inspection, maintenance, and repair segment garnered USD 4.39 billion in revenue in 2024.

- The ultra-deepwater segment is anticipated to witness the fastest CAGR of 5.76% over the forecast period.

- The oil & gas exploration segment generated USD 3.65 billion in revenue in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 6.62% through the projection period.

Major companies operating in the subsea and offshore services market are TechnipFMC plc, Subsea7, DEEPOCEAN, McDermott, Royal Boskalis B.V., Oceaneering International, Inc., Helix Energy, DOF Group ASA, Fugro, BOURBON, Aban Offshore Limited, Hornbeck Offshore, and Acteon Group Operations (UK) Limited.

The global shift toward decarbonization and sustainable energy solutions is driving significant growth in offshore renewable energy projects, particularly offshore wind farms. These projects require a wide range of subsea and offshore services across their lifecycle, including site surveys, seabed mapping, cable laying, foundation installation, and ongoing maintenance.

As countries set aggressive targets for renewable energy generation, particularly in Europe, Asia-Pacific, and the U.S., there is a growing demand for service providers with expertise in managing complex subsea operations in offshore wind environments.

This expansion presents a major opportunity for subsea and offshore service companies to diversify their portfolios beyond traditional oil and gas. Moreover, the integration of floating wind farms and advanced power cables at sea is expected to increase demand for innovative subsea engineering and support services, creating new revenue streams and supporting long-term market growth.

- In May 2025, Oceans of Energy, in collaboration with CrossWind and NKT, successfully delivered a dynamic subsea power export cable for the HKN1 offshore solar project, marking a key milestone in integrating solar energy into existing offshore wind infrastructure.

Market Driver

Growing Investments in Offshore Wind Farms

As global economies advance toward a net-zero future, investments in offshore wind farms have increased significantly, making them a key component of the clean energy transition. Governments in Europe, Asia-Pacific, and North America are introducing supportive policies, subsidies, and long-term energy targets to expand offshore wind capacity.

This has attracted substantial capital into new developments, including floating wind technologies for deeper waters. These projects rely on subsea and offshore services for site investigation, subsea cable installation, structural foundation placement, and ongoing maintenance.

- In December 2024, Nexans secured a major contract from ScottishPower Renewables (a part of Iberdrola) for the East Anglia TWO offshore wind project . The contract covers the supply and installation of 100 km of 275kV subsea export cables and 55 km of onshore cables for grid connection, strengthening Nexans’ position in Europe’s energy transition, strengthening Nexans’ position in Europe’s energy transition.

Increasing investments aligned with decarbonization goals are driving technological innovation in the subsea sector. As offshore wind scales globally, demand for experienced offshore service providers is rising, expanding their role beyond oil and gas to include renewable energy infrastructure development and lifecycle support.

Market Challenge

High Operational Costs and Harsh Environmental Conditions

A key challenge hindering the progress of the subsea and offshore services market is the high operational cost associated with executing underwater tasks in remote and hazardous marine environments.

Deep and ultra-deepwater projects require specialized vessels, advanced robotic systems, and a skilled workforce, increasing expenses. Unpredictable weather conditions, high-pressure environments, and limited accessibility further increase risks and delays, impacting profitability and discouraging investment in unexplored offshore areas..

To mitigate this challenge, companies are adopting autonomous systems, predictive maintenance using digital twins, and modular, cost-efficient engineering solutions to optimize resource allocation, reduce risk exposure, and enhance operational efficiency in harsh offshore environments.

Market Trend

Growing Integration of Autonomous Underwater Vehicles (AUVs)

The subsea and offshore services market is witnessing a rising integration of autonomous underwater vehicles (AUVs) to transform inspection, monitoring, and maintenance operations.

Equipped with advanced sensors, sonar, and imaging systems, AUVs can navigate complex subsea environments and collect high-resolution data with minimal human intervention. Their ability to operate in deep and ultra-deepwater conditions without support vessels reduces operational costs and enhances safety by limiting diver involvement.

As asset integrity and operational efficiency remain critical, AUVs provide a faster, more accurate, and cost-efficient method for inspecting pipelines, subsea structures, and underwater installations. With the industry's shift toward digitalization and sustainability, AUV deployment is enabling real-time decision-making and predictive maintenance in both oil & gas and emerging offshore renewable energy sectors.

- In March 2025, Nauticus acquired SeaTrepid International LLC to strengthen its subsea robotics capabilities and accelerate the deployment of its autonomy software, ToolKITT. This integration enhances interoperability between ROVs and Aquanaut vehicles, enabling greater operational efficiencies and expanding offshore service opportunities.

Subsea and Offshore Services Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Inspection, Maintenance, and Repair, Subsea Engineering, Decommissioning, Engineering, Procurement, Construction, & Installation, Subsea Survey, Others

|

|

By Depth

|

Shallow Water, Deepwater, Ultra-Deepwater

|

|

By Application

|

Oil & Gas Exploration, Offshore Wind Energy, Submarine Telecommunications, Environmental Monitoring, Defense & Surveillance, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Inspection, Maintenance, and Repair, Subsea Engineering, Decommissioning, Engineering, Procurement, Construction, & Installation, Subsea Survey, and Others): The inspection, maintenance, and repair (IMR) segment captured the largest share of 29.90% in 2024, mainly attributed to the increasing need to ensure asset integrity in aging offshore infrastructure, particularly in mature oil and gas fields.

- By Depth (Shallow Water, Deepwater, and Ultra-Deepwater): The ultra-deepwater segment is poised to record a CAGR of 5.76% through the forecast period, primarily due to rising investments in complex offshore oil and gas exploration projects beyond 1,500 meters in depth. Key regions include Brazil’s pre-salt basins, the U.S. Gulf of Mexico, and West Africa, as energy companies focus on meeting long-term global demand.

- By Application (Oil & Gas Exploration, Offshore Wind Energy, Submarine Telecommunications, Environmental Monitoring, Defense & Surveillance, and Others): The offshore wind energy segment is anticipated to grow at a CAGR of 5.83% over the forecast period, mainly due to increasing global efforts to reduce carbon emissions and transition to renewable energy.

Subsea and Offshore Services Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America subsea and offshore services market share stood at 34.09% in 2024, valued at USD 5.00 billion. This dominance is reinforced by extensive offshore oil and gas operations in the U.S. Gulf of Mexico.

The regional market further benefits from established infrastructure, a strong base of service providers, and significant investment in subsea asset maintenance, decommissioning, and enhanced oil recovery. Additionally, government support for offshore wind projects, particularly along the U.S. East Coast, is boosting demand for subsea surveying, cable laying, and underwater construction services.

- In December 2024, the U.S. action plan accelerating decarbonization of the maritime sector promotes low‑carbon fuels, zero‑emission energy solutions, and sustainable propulsion technologies. This evolution accelerates demand for subsea expertise in retrofitting offshore platforms, cable installation, and deployment of green services to support maritime transitions.

Major regional companies are increasingly adopting digital twin technologies, ROVs, and AI-based monitoring systems, positioning North America as a global hub for advanced subsea operations and offshore energy development.

The Asia-Pacific subsea and offshore services industry is set to grow at a CAGR of 6.62% over the forecast period. This rapid growth is bolstered by increasing offshore exploration and production (E&P) activities in countries such as China, Malaysia, India, and Australia. These nations are investing heavily in both oil and gas and offshore renewable energy to ensure energy security and reduce dependence on imports.

Moreover, the rapid development of offshore wind farms in China, Taiwan, South Korea, and Japan is creating substantial demand for subsea services, including foundation installation, subsea cable deployment, and underwater inspection and maintenance.

- In May 2025, ConocoPhillips China awarded Fluor Corporation the contract to develop the largest offshore oil production facility in Bohai Bay. With a projected capacity of 190,000 barrels per day, the project underscores the growing demand for advanced offshore engineering, installation, and project management services.

Government incentives, favorable policies, and growing private sector participation are further accelerating offshore infrastructure development. The regional market is also witnessing rising adoption of advanced technologies such as autonomous underwater vehicles (AUVs), predictive maintenance tools, and real-time data analytics to optimize operations and reduce risks.

Regulatory Frameworks

- In the U.S., the Outer Continental Shelf Lands Act (OCSLA, 1953) and Submerged Lands Act (1953) grant federal jurisdiction over offshore oil, gas, and mineral operations beyond state waters.

- In the UK, the Offshore Safety Directive (2013/30/EU) is implemented through Offshore Installations (Offshore Safety Directive) Regulations 2015, requiring operators to maintain comprehensive Safety Cases reviewed by HSE’s Offshore Energy division scrutiny.

- Germany enforces EU-wide standards for safety management, operator competence, chemical use, and environmental discharge under the OSPAR and REACH frameworks.

- In China, offshore wind and subsea cable projects must undergo environmental impact assessments and sovereign ocean permits from the State Oceanic Administration. Regulatory bodies also oversee standardization, localization, and certification of subsea technologies.

- In Japan, the Ministry of Economy, Trade and Industry (METI) and Japan Coast Guard regulate offshore petroleum under the Offshore Petroleum and Natural Gas Development Act, and wind energy under the Electricity Business Act, covering seabed installation safety, diving operations, and detailed EIA requirements.

Competitive Landscape

Key players operating in the subsea and offshore services industry are increasingly focusing on strengthening their portfolios through mergers, acquisitions, and joint ventures to tap into emerging offshore energy markets, particularly in Asia-Pacific and Europe.

- In May 2025, DOF, in collaboration with engineering firm Royal IHC, invested in a modular cable repair spread designed to transform offshore wind cable maintenance. This innovation aims to enable fleet-wide compatibility, faster deployment, reduced downtime, and improved logistical efficiency across offshore wind operations.

Additionally, a major imperative for market leaders is digital transformation, with substantial investment in remote monitoring systems, digital twins, AI-driven asset performance tools, and automation through ROVs and AUVs. These technologies are helping companies reduce operational risks and costs while maximizing uptime for clients.

Players are also diversifying service offerings to cater to both traditional oil & gas and renewable energy sectors, enabling long-term resilience in a fluctuating market environment.

- In July 2025, NKT partnered with Helix Robotics Solutions Limited to operate its upcoming T3600 subsea trencher, set to launch in 2027. This strategic collaboration strengthens NKT’s offshore trenching capabilities, enhancing subsea cable protection to support energy security and the renewable energy transition in offshore infrastructure projects.

Key Companies in Subsea and Offshore Services Market:

- TechnipFMC plc

- Subsea7

- DEEPOCEAN

- McDermott

- Royal Boskalis B.V.

- Oceaneering International, Inc.

- Helix Energy

- DOF Group ASA

- Fugro

- BOURBON

- Aban Offshore Limited

- Hornbeck Offshore

- Acteon Group Operations (UK) Limited

Recent Developments (Collaboration/Agreements)

- In June 2025, Oceaneering International’s Offshore Projects Group secured a vessel services agreement with a major operator for the MPSV Harvey Deep Sea, enhancing its subsea inspection, maintenance, and repair (IMR) and installation capabilities in the Gulf of Mexico.

- In May 2025, Cellula Robotics Limited signed an agreement with Subsea Europe Services GmbH (SES) to expand its footprint in Northern Europe. SES will promote Cellula’s full AUV portfolio, including Envoy, Porter, Guardian, Warden, and Sentinel systems, targeting academic research, offshore survey, and geophysical sectors in both commercial and scientific domains.

- In March 2025, TechnipFMC secured a major integrated Engineering, Procurement, Construction, and Installation (iEPCI) contract from Shell for the Gato do Mato greenfield development offshore Brazil. The project will leverage Subsea 2.0 configure-to-order production systems to enable integrated execution, streamline delivery , and accelerate time to first oil.

- In July 2024, Hornbeck Offshore Services received formal approval from the U.S. Navy’s small business programs office for a Mentor‑Protégé Agreement with Next Generation Logistics (NGL). This partnership strengthens Hornbeck’s position in subsea services and supports U.S. military subsea operations through modified offshore support vessels.