Market Definition

Structured cabling is a standardized system that organizes and manages the wiring infrastructure used to transmit data, voice, and video signals within a building or across multiple locations. It enables seamless communication between devices and systems while allowing easy upgrades, maintenance, and scalability for network expansions.

Structured Cabling Market Overview

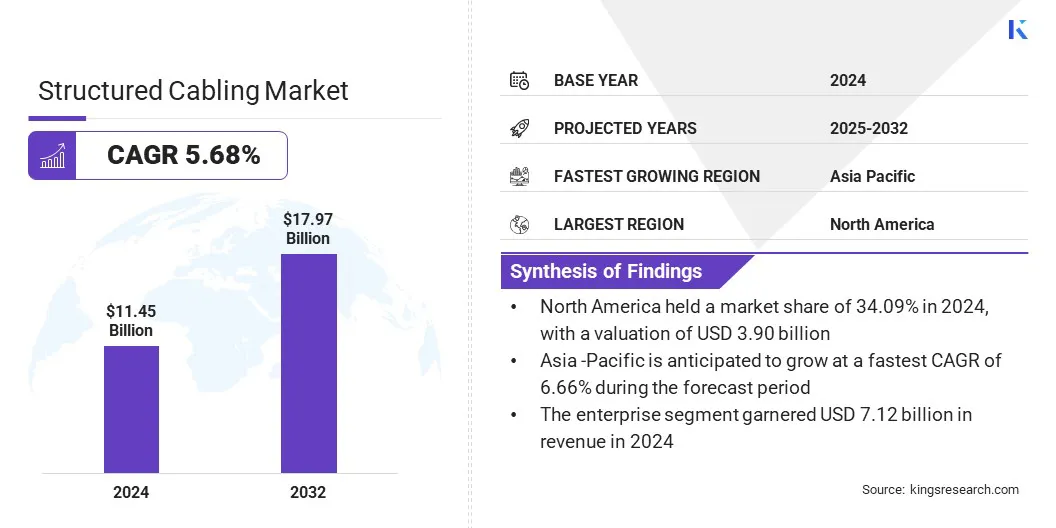

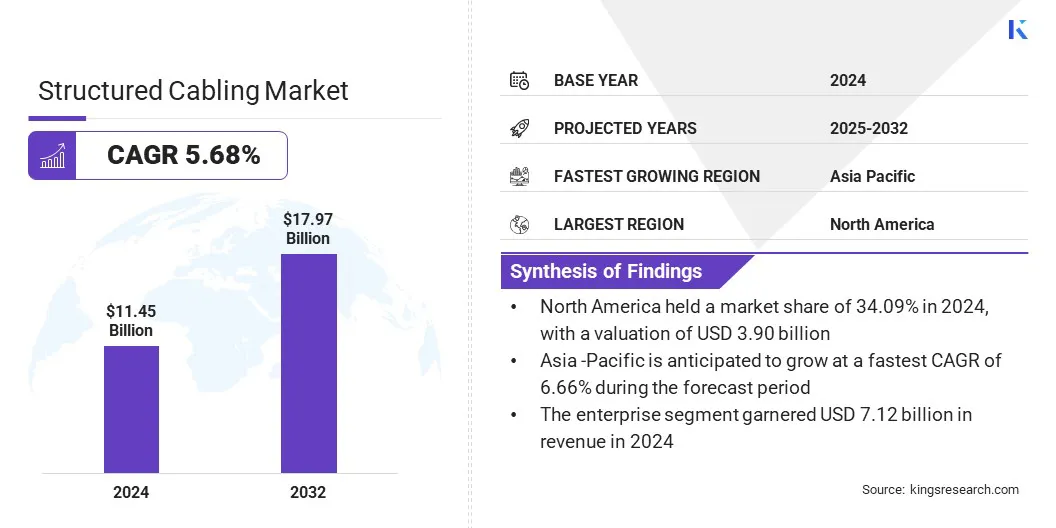

The global structured cabling market size was valued at USD 11.45 billion in 2024 and is projected to grow from USD 12.04 billion in 2025 to USD 17.97 billion by 2032, exhibiting a CAGR of 5.68% during the forecast period.

This growth is mainly attributed to the expansion of 5G networks, leading to increased demand for high-performance cabling systems to support faster data transmission and low-latency connectivity across commercial and industrial infrastructure.

The market is further witnessing expansion as organizations are integrating intelligent cabling systems that enable real-time network monitoring, performance optimization, and automated management, enhancing efficiency and scalability in structured cabling deployments.

Major companies operating in the structured cabling industry are Panduit Corp, Belden Inc, Corning Incorporated, Nexans, CommScope Inc, Furukawa Electric Co., Ltd, Legrand, Siemon, Schneider Electric, Leviton Manufacturing Co., Inc, Paige Electric Co., R&M, Hubbell, TE Connectivity, and Sumitomo Electric Lightwave, Inc.

Government investments in digital infrastructure are fueling market growth by supporting nationwide efforts to expand broadband networks and high-speed internet access. These initiatives are enabling the deployment of high-speed internet across urban and rural areas to increase the need for reliable and scalable cabling systems.

As public funding focuses on digital inclusion and smart infrastructure, the need for organized, technologically sustainable cabling solutions continues to rise across sectors.

- In June 2023, according to the National Telecommunications and Information Administration (NTIA) Biden-Harris Administration allocated USD 42.45 billion under the BEAD program to expand high-speed internet across all U.S. states and territories. This is creating a strong demand for structured cabling to support reliable and high-capacity broadband infrastructure.

Key Highlights:

- The structured cabling industry size was recorded at USD 11.45 billion in 2024.

- The market is projected to grow at a CAGR of 5.68% from 2025 to 2032.

- North America held a share of 34.09%% in 2024, valued at USD 3.90 billion.

- The copper segment garnered USD 4.40 billion in revenue in 2024.

- The cat 5E segment is expected to reach USD 5.05 billion by 2032.

- The data center segment is anticipated to grow at a CAGR of 5.89% over the forecast period.

- The residential segment held a share of 40.47% in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 6.66% through the projection period.

Market Driver

Expansion of 5G Networks

The expansion of 5G networks is propelling the growth of the structured cabling market by increasing the need for high-capacity and low-latency communication infrastructure. To support edge computing and enhanced backhaul systems, telecom providers are investing in advanced cabling solutions that ensure fast and reliable data transmission.

Structured cabling is crucial for connecting 5G base stations, data centers, and distributed antenna systems, enabling seamless connectivity and supporting the rapid rollout of next-generation mobile networks across both urban and rural areas.

- As of February 2024, the Federal Register reported that 5G coverage in the U.S. reached approximately 34% in in-vehicle mobile environments (7/1) and 46% in outdoor stationary environments. This coverage gap is boosting demand for structured cabling solutions, as telecom providers seek to strengthen backhaul infrastructure and high-speed connectivity across diverse geographic conditions.

Market Challenge

High Initial Installation Costs

High initial installation costs and design complexity are hindering the progress of the structured cabling market, limiting adoption among small and medium enterprises (SMEs). These businesses often operate with constrained budgets and may find it challenging to justify the upfront investment required for professional-grade cabling infrastructure.

Additionally, the complexity involved in planning, designing and integrating structured cabling within existing spaces can require specialized expertise and cause operational disruptions. This is prompting SMEs to opt for less organized, short-term solutions, affecting scalability and performance.

To address this challenge, market players are offering cost-effective and modular cabling solutions tailored for small and medium enterprises. They are developing simplified design frameworks and plug-and-play systems that reduce installation time and technical complexity.

Vendors are also providing flexible financing options, including leasing and subscription-based models, to ease the financial burden on SMEs. Additionally, manufacturers are investing in training programs and support services to enable in-house IT teams and SMEs to deploy and maintain structured cabling systems more efficiently.

Market Trend

Integration of Intelligent Cabling Systems

Integration of intelligent cabling systems is transforming the structured cabling market by enabling real-time monitoring, automated alerts, and advanced infrastructure management. These systems use embedded sensors and software to track port activity, detect unauthorized connections, and streamline troubleshooting processes.

By reducing manual intervention and improving operational visibility, intelligent cabling solutions enhance network reliability and efficiency across large-scale, high-density and dynamic IT environments. Enterprises are increasingly prioritizing automation and data-driven decision-making, which is boosting the adoption of smart cabling systems across data centers, commercial buildings, and mission-critical environments.

- In January 2024, CommScope expanded its structured cabling portfolio with the launch of SYSTIMAX 2.0, featuring advanced technologies to meet evolving network infrastructure demands. The upgraded solutions support multigigabit thernet and real-time port monitoring, addressing performance, automation, and scalability requirements across data centers, buildings, and campus networks.

Structured Cabling Market Report Snapshot

|

Segmentation

|

Details

|

|

By Material

|

Copper, Fiber Optic, Others

|

|

By Cable

|

Cat 5E, Cat 6, Cat 6A, Cat 7/7A, Others

|

|

By Application

|

Enterprise, Data Center

|

|

By End Use Industry

|

Residential, Commercial, Industrial

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Material (Copper, Fiber Optic, and Others): The copper segment earned USD 4.40 billion in 2024, mainly due to its cost-effectiveness and widespread use in short-distance data transmission.

- By Cable (Cat 5E, Cat 6, Cat 6A, and Cat 7/7A): The cat 5E segment held a share of 28.08% in 2024, bolstered by its affordability and sufficient performance for standard Ethernet applications.

- By Application (Enterprise and Data Center): The enterprise segment is projected to reach USD 11.06 billion by 2032, owing to increasing demand for structured cabling in office networks and smart buildings.

- By End Use Industry (Residential, Commercial, and Industrial): The commercial segment is anticipated to grow at a CAGR of 5.79% over the forecast period, attributed to rising investments in IT infrastructure and connectivity.

Structured Cabling Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America structured cabling market accounted for the largest share of 34.09% in 2024, valued at USD 3.90 billion. This dominance is reinforced by the strong presence of established infrastructure and consistent investments by key players in data communication systems across the region.

The regional market is expanding as enterprises are actively upgrading networks to support high-speed internet and cloud-based services, which is boosting demand for reliable and scalable structured cabling. This growth is further stimulated by the rising demand for the widespread implementation of smart buildings and digital systems across commercial and industrial spaces, which is reinforcing the need for advanced connectivity solutions.

Moreover, the market is benefiting from strategic acquisitions to enhance supply chains and broaden low voltage cable offerings. This is addressing growing connectivity needs in the electrical and audiovisual sectors, supporting regional market expansion.

- In March 2025, Eleconnex, a portfolio company of Dunes Point Capital acquired Structured Cable Products, Inc. and SIMPLY45 LLC to expand its offerings in low voltage cable and connectivity solutions. The acquisition aims to strengthen Eleconnex’s position in the electrical infrastructure market by enhancing its supply capabilities for the Audio/Visual (A/V), electrical, and specialty distribution sectors across the U.S.

The Asia-Pacific structured cabling industry is set to grow at a robust CAGR of 6.66% over the forecast period. This growth is fueled by rapid digital transformation and increasing investments by private players in fiber infrastructure. This growth is further supported by broadband expansion and smart city initiatives, aligning with growing connectivity demands.

Enterprises in the region are upgrading infrastructure to support cloud adoption, automation, and high-speed data transfer across both commercial and industrial sectors.

Additionally, the expansion of manufacturing and technology operations in countries such as India and China is fostering this growth. Market players are strengthening fiber connectivity capabilities to support telecom infrastructure and manage rising regional data traffic, contributing significantly to regional market expansion.

- In December 2024, Prysmian Group acquired Warren & Brown Technologies to enhance its portfolio of fiber connectivity solutions. This move aims to expand its fiber optic management capabilities and global manufacturing footprint. The acquisition seeks to support innovation and scalability in telecom infrastructure, particularly across Australia, Southeast Asia, and other growing digital markets.

Regulatory Frameworks

- In the U.S., the Telecommunications Industry Association (TIA) oversees structured cabling standards in the U.S., primarily through its ANSI/TIA-568 series. It regulates technical guidelines for cable performance, design, and installation in commercial buildings.

- In China, the Ministry of Industry and Information Technology (MIIT) governs structured cabling by setting standards for network infrastructure under national codes such as GB/T 50311. MIIT regulates cable quality, safety compliance, and electromagnetic compatibility. It ensures structured cabling systems align with national digitalization goals, particularly in smart city and data center development.

- In India, the Telecommunications Engineering Centre (TEC) under the Department of Telecommunications regulates structured cabling through specifications such as GR and IR documents. TEC oversees performance standards, testing protocols, and environmental compliance.

Competitive Landscape

Major players in the structured cabling industry are strengthening their infrastructure capabilities and forming strategic alliances to meet growing demand in sectors such as healthcare and hospitality.

They are expanding fiber and IT infrastructure to support seamless connectivity and enhanced digital experiences. Additionally, investments in partnerships are also focused on delivering scalable cabling solutions that cater to evolving infrastructure needs and support long-term digital transformation across various sectors.

- In July 2024, WorldVue acquired a minority stake in Cabling Solutions, LLC to expand its infrastructure capabilities in the hospitality sector. This partnership aims to accelerate the deployment of fiber and IT infrastructure in hotels and guest-focused environments.

List of Key Companies in Structured Cabling Market:

- Panduit Corp

- Belden Inc

- Corning Incorporated

- Nexans

- CommScope, Inc

- Furukawa Electric Co., Ltd

- Legrand

- Siemon

- Schneider Electric

- Leviton Manufacturing Co., Inc

- Paige Electric Co,

- R&M

- Hubbell

- TE Connectivity

- Sumitomo Electric Lightwave, Inc.

Recent Developments (M&A /New Product Launch)

- In February 2025, Leviton extended its FLX-1 advanced polymer technology to include LANMARK-6 Category 6 plenum cables, enhancing flexibility and ease of installation. The reduced-diameter design minimizes cable memory and stress marks, making deployment more efficient in enterprise, commercial, and intelligent building networks.

- In December 2024, ABB acquired Solutions Industry & Building (SIB) to strengthen its portfolio of cable protection systems and electrification solutions. The acquisition expands ABB’s presence in the North American, European, and Middle Eastern markets, particularly in cable glands, couplings, and certified accessories for industrial, railway, and hazardous environments. applications.