Market Definition

A Distributed Antenna System (DAS) is a network of strategically placed antennas connected to a central signal source that improves wireless coverage and capacity in areas with poor reception, such as large buildings, stadiums, or underground facilities. The market is focused on developing, deploying, and maintaining DAS networks.

Distributed Antenna System Market Overview

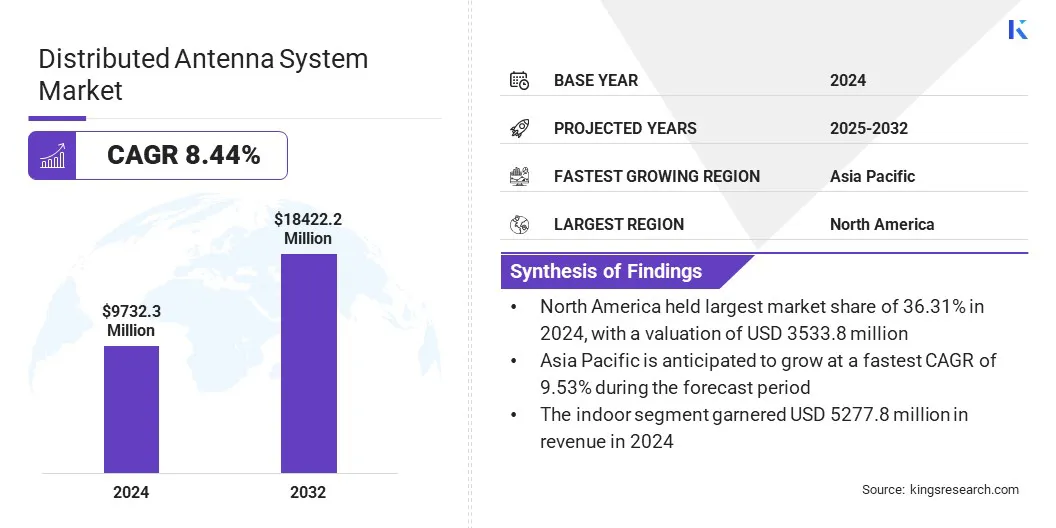

The global distributed antenna system market size was valued at USD 9,732.3 million in 2024, which is estimated to be valued at USD 10,446.4 million in 2025 and reach USD 18,422.2 million by 2032, growing at a CAGR of 8.44% from 2025 to 2032.

This growth is driven by the rising enterprise demand for private 5G networks, as organizations seek secure, high-speed, and customizable connectivity solutions. These networks enable greater control, reduced latency, and improved operational efficiency across various industry verticals.

Major companies operating in the distributed antenna system industry are American Tower Corporation, AT&T, Boingo Wireless, Inc., BTI Wireless, Comba Telecom Network Systems Limited., Amphenol Procom, KATHREIN Digital Systems GmbH, ADRF, Baylin Technologies Inc., Rosenberger Hochfrequenztechnik GmbH & Co. KG, JMA Wireless, PBE Group, SOLiD, TE Connectivity, and Westell Technologies, Inc.

The market is experiencing strong growth, driven by the rising demand for uninterrupted indoor and outdoor wireless connectivity, increasing mobile data traffic, and the global rollout of 5G networks. With growing adoption across sectors such as transportation, healthcare, and commercial infrastructure, DAS solutions are becoming essential for enhancing network coverage and capacity.

- In November 2024, Frog Cellsat secured a major contract to deploy its OneDAS MIMO 2×2 system at the new Guwahati Airport terminal in India, ensuring robust 4G and 5G coverage across eight frequency bands. The deployment aims to enhance in-building wireless connectivity for passengers and airport operations, supporting seamless communication and improved network performance in high-traffic zones.

Advancements in MIMO (Multiple Input Multiple Output) technology, which leverages multiple antennas at both transmitter and receiver ends to improve speed, capacity, and reliability, are accelerating market growth. Combined with multi-band support, these innovations are addressing evolving connectivity demands across dense urban environments, transport hubs, and large commercial facilities.

Key Highlights:

- The distributed antenna system industry size was valued at USD 9,732.3 million in 2024.

- The market is projected to grow at a CAGR of 8.44% from 2025 to 2032.

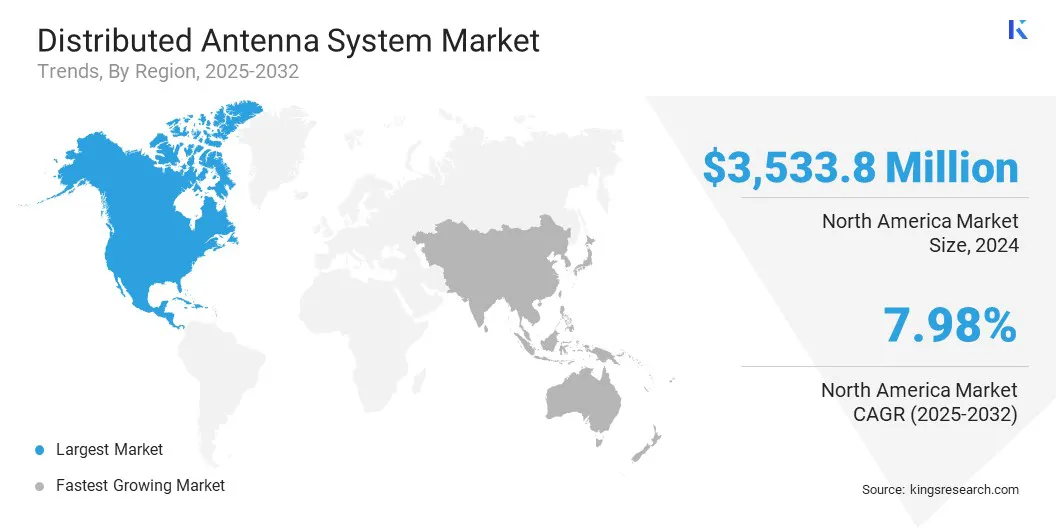

- North America held a market share of 36.31% in 2024, with a valuation of USD 3,533.8 million.

- The components segment garnered USD 5,568.8 million in revenue in 2024.

- The indoor segment is expected to reach USD 10,500.5 million by 2032.

- The neutral-host segment held a market of 47.33% in 2024.

- The transportation segment is anticipated to have a CAGR of 10.27% during the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 9.53% during the forecast period.

Market Driver

Enterprise Demand for Private 5G Networks

The growth of the distributed antenna system market is driven by the increasing demand for private 5G networks among enterprises aiming to modernize their communication infrastructure. Private 5G networks offer enhanced security, ultra-low latency, and dedicated bandwidth, necessary for mission-critical applications, real-time data exchange, and automation.

Industries such as manufacturing, healthcare, logistics, and retail are adopting private 5G networks to support IoT, robotics, and AI-driven processes. As a result, businesses are integrating DAS solutions to ensure strong and reliable in-building coverage essential for private 5G network performance.

- In December 2024, Nextivity collaborated with LG Electronics to accelerate the enterprise adoption of 5G and IoT solutions. By integrating LG’s Private 5G UltraSlim system with Nextivity’s CEL-FI DAS technology, the collaboration aims to deliver scalable and in-building 5G connectivity and advanced IoT applications across sectors like healthcare, education, retail, and warehousing.

Market Challenge

High Initial Deployment Costs

A key challenge limiting the growth of the distributed antenna system market is the high initial deployment cost, as infrastructure setup demands substantial investment in equipment, cabling, and skilled labor, which poses a barrier for smaller enterprises. To address this challenge, companies are increasingly offering scalable and modular DAS solutions, allowing phased implementation based on budget and need.

Additionally, leasing models, shared infrastructure, and partnerships with telecom operators can help reduce upfront costs and make DAS deployment more accessible to a broader range of businesses.

Market Trend

Multi-Vendor Ecosystem Integration

A key trend influencing the distributed antenna system market is the growing adoption of multi-vendor ecosystems. Telecom operators are increasingly combining best-in-class components from multiple vendors to build more flexible and efficient DAS networks.

This approach fosters innovation, enhances performance by using specialized technologies, and reduces reliance on single suppliers, thereby mitigating supply chain risks. As a result, operators can create cost-effective, interoperable, and scalable solutions that meet the evolving demands of next-generation wireless connectivity.

- In October 2024, Verizon deployed the world’s first interoperable multi-vendor O-RAN-based Distributed Antenna System (DAS) at the University of Texas Moody Center and Austin Convention Center. It showcased enhanced 5G performance, cost efficiency, and flexibility by integrating components from Samsung and Commscope through open and standardized interfaces.

Distributed Antenna System Market Report Snapshot

|

Segmentation

|

Details

|

|

By Offering

|

Components [Antenna Nodes/Radio Nodes, Bidirectional Amplifiers (BDAs), Donor Antennas, Others], Services (Design and Consulting Services, Installation Services, Maintenance and Support Services, Others)

|

|

By Coverage Type

|

Indoor, Outdoor

|

|

By Ownership Model

|

Carrier, Neutral-Host, Enterprise

|

|

By Industry Vertical

|

Commercial, Public Safety, Transportation, Healthcare, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Offering (Components and Services): The components segment earned USD 5,568.8 million in 2024, due to the rising demand for advanced antennas, repeaters, and radio units supporting seamless 4G and 5G in-building wireless coverage.

- By Coverage Type (Indoor and Outdoor): The indoor segment held 54.23% of the market in 2024, attributed to increased DAS deployment in commercial buildings, hospitals, and airports to address poor signal reception and enhance user connectivity.

- By Ownership Model (Carrier, Neutral-Host, and Enterprise): The neutral-host segment is projected to reach USD 9,458.2 million by 2032, owing to cost-sharing advantages and the rising demand for shared infrastructure among multiple mobile network operators.

- By Industry Vertical (Commercial, Public Safety, Transportation, Healthcare, and Others): The transportation segment is anticipated to have a CAGR of 10.27% during the forecast period, driven by the need for uninterrupted connectivity in railways, subways, airports, and road tunnels.

Distributed Antenna System Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America distributed antenna system market share stood at 36.31% in 2024, with a valuation of USD 3,533.8 million. North America is the dominating region in the market, driven by early adoption of advanced communication technologies, widespread 5G rollout, and strong investments in smart infrastructure.

- According to the 5G Americas organization, the region is expected to have approximately 420 million 5G users in 2025, highlighting massive adoption of 5G across consumer and enterprise segments.

The presence of major telecom operators, supportive regulatory policies, and the high demand for in-building wireless solutions across sectors like transportation, healthcare, and commercial real estate contribute significantly to market growth. Additionally, initiatives promoting Open RAN and private 5G networks further strengthen North America’s position as a key hub for DAS innovation and deployment.

Asia Pacific distributed antenna system industry is poised for significant growth at a CAGR of 9.53% over the forecast period. Asia Pacific is the fastest growing region in the market, fueled by rapid urbanization, increasing mobile data usage, and expanding digital infrastructure.

- According to a March 2025 statement by the Indian Ministry of Communications, over 25 crore mobile subscribers in India are now using 5G services, supported by the installation of 4.69 lakh 5G Base Transceiver Stations (BTSs) nationwide.

Asia Pacific’s proactive adoption of 5G, rising enterprise digitization, and significant government support for advanced connectivity solutions are creating a fertile environment for accelerated DAS deployment across urban and semi-urban areas.

Regulatory Frameworks

- In India, the Department of Telecommunications (DoT) oversees spectrum allocation through auctions, with key 5G bands like 3300–3670 MHz and 700 MHz playing a vital role in expanding nationwide connectivity.

- In the United States, the Federal Communications Commission (FCC) manages the licensed spectrum through structured auctions, particularly for mid-band and mmWave frequencies essential for high-capacity 5G.

- In the European Union, the General Data Protection Regulation (GDPR) governs privacy and data protection. While it does not regulate DAS infrastructure directly, it enforces strict compliance on data handling through connected devices and networks, influencing how DAS solutions are designed, especially those supporting IoT and user data analytics.

Competitive Landscape

Companies in the distributed antenna system industry are actively innovating to deliver more integrated, cost-efficient, and future-ready solutions. Many firms are developing converged systems that support commercial and public safety networks to reduce infrastructure complexity. There is also a strong focus on modular and scalable architectures that adapt to diverse venue requirements.

Firms are enhancing compliance with global safety and performance standards while forming strategic partnerships to expand their ecosystem and accelerate the adoption of 5G-ready, in-building wireless connectivity solutions across industries.

- In March 2024, ADRF launched its industry-leading converged wireless network solution through the ADXV DAS, enabling building owners to support commercial and public safety frequency bands in a single system. This innovation delivers at least 30% cost savings, reduces equipment and installation complexity, and meets strict compliance standards, making wireless connectivity more accessible and efficient for modern infrastructure.

List of Key Companies in Distributed Antenna System Market:

- American Tower Corporation

- AT&T

- Boingo Wireless, Inc.

- BTI Wireless

- Comba Telecom Network Systems Limited.

- Amphenol Procom

- KATHREIN Digital Systems GmbH

- ADRF

- Baylin Technologies Inc.

- Rosenberger Hochfrequenztechnik GmbH & Co. KG

- JMA Wireless

- PBE Group

- SOLiD

- TE Connectivity

- Westell Technologies, Inc.

Recent Developments (M&A/Product Launch)

- In April 2025, Airspan acquired Corning’s wireless business, gaining control of its 6000 and 6200 DAS systems and SpiderCloud small cell portfolio. This acquisition enhances Airspan’s in-building wireless capabilities and unifies trusted DAS solutions with its existing Open RAN expertise to deliver next-generation indoor connectivity solutions worldwide.

- In February 2025, Sumitomo Electric showcased its high-speed and high-capacity millimeter-wave Distributed Antenna System (DAS) for 5G and 6G at the Mobile World Congress. The compact DAS remote unit supports advanced indoor coverage, enabling efficient data transmission in dense environments while contributing to next-generation network evolution through real-time demonstrations and cutting-edge industrial 5G solutions.

- In January 2025, Telstra and ISPT introduced the next-generation 5G Distributed Antenna System (DAS) technology in Sydney’s Tech Central precinct, delivering seamless indoor connectivity in lifts, basements, and offices. Their Low-Power Active DAS supports high-speed and low-latency applications, enabling future-ready infrastructure for advanced use cases like AI, robotics, and augmented reality across commercial buildings.