Market Definition

Stem cell manufacturing involves the large-scale production of stem cells through controlled laboratory processes to ensure purity, viability, and consistency. These cells are derived from various sources, including bone marrow, adipose tissue, and induced pluripotent stem cells, and are expanded for clinical and research purposes.

The field supports applications in regenerative medicine, drug discovery, and toxicity testing. It is widely used in treating degenerative diseases, advancing personalized therapies, and supporting biomedical research across academic, clinical, and commercial settings.

Stem Cell Manufacturing Market Overview

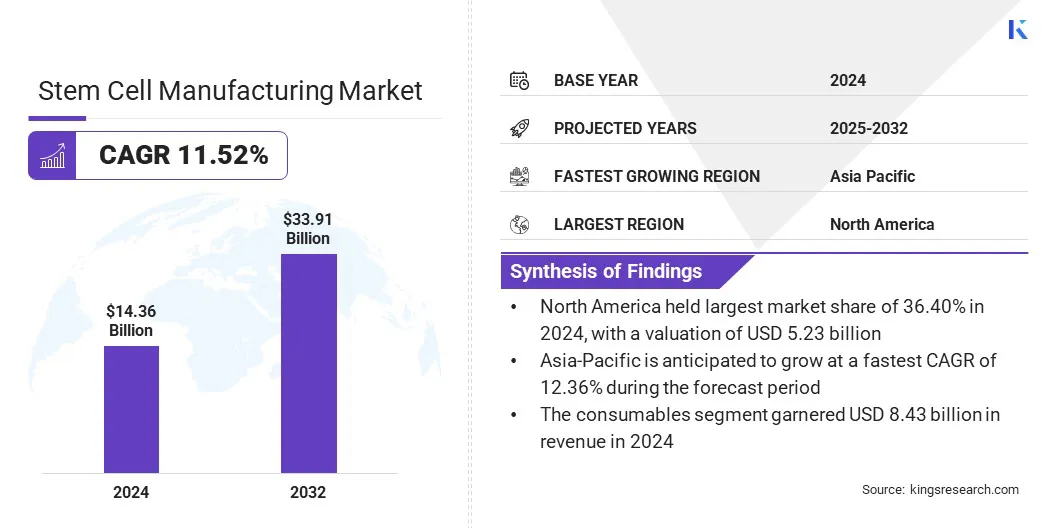

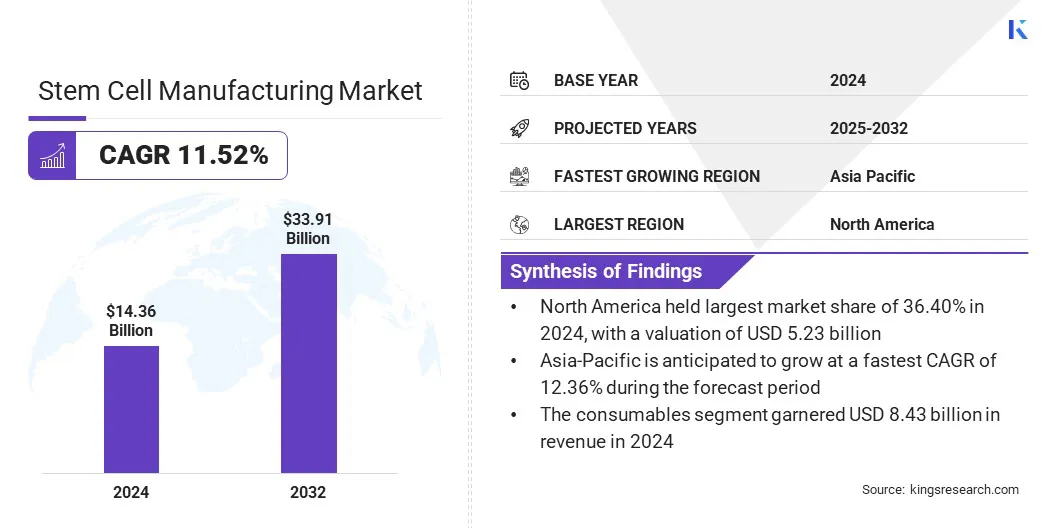

The global stem cell manufacturing market size was valued at USD 14.36 billion in 2024 and is projected to grow from USD 15.80 billion in 2025 to USD 33.91 billion by 2032, exhibiting a CAGR of 11.52% over the forecast period.

This growth is attributed to the increasing investments in regenerative medicine and rising adoption of stem cell therapies aimed at addressing chronic diseases and tissue repair. The expanding use of advanced manufacturing technologies, including automated bioreactors and scalable cell processing systems, is further fueling market expansion.

Key Market Highlights:

- The stem cell manufacturing industry size was valued at USD 14.36 billion in 2024.

- The market is projected to grow at a CAGR of 11.52% from 2025 to 2032.

- North America held a market share of 36.40% in 2024, valued at USD 5.23 billion.

- The consumables segment garnered USD 8.43 billion in revenue in 2024.

- The clinical application segment is expected to reach USD 17.80 billion by 2032.

- The pharmaceutical and biotechnology companies segment is anticipated to witness the fastest CAGR of 12.02% during the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 12.36% through the projection period.

Major companies operating in the stem cell manufacturing market are Thermo Fisher Scientific Inc., Lonza Group Ltd., Takara Bio Inc., Merck KGaA, Sartorius AG, Corning Incorporated, BD., FUJIFILM Holdings America Corporation, Terumo Corporation, HiMedia Laboratories, Miltenyi Biotec, PromoCell, Sartorius CellGenix GmbH, Pluri Biotech Ltd., and Vericel.

Growing emphasis on personalized medicine, coupled with supportive regulatory frameworks and rising demand for high-quality stem cell products, is accelerating the development and commercialization of stem cell-based treatments.

Additionally, continuous innovation in cell line development, biobanking capabilities, and global collaborations among pharmaceutical and biotechnology companies are contributing to the market’s robust growth trajectory.

- In June 2023, Vertex Pharmaceuticals and Lonza initiated the development of a 130,000-square-foot cell therapy manufacturing facility in Portsmouth, New Hampshire. This facility aims to support the production of Vertex’s type 1 diabetes therapies, including VX-880 and VX-264. The partnership focuses on expanding manufacturing capabilities for stem cell-derived islet cell treatments.

Market Driver

Growing Adoption in Clinical Applications

The growth of the stem cell manufacturing market is fueled by the increasing adoption of advanced therapies to treat complex and chronic diseases. Rising incidences of conditions such as neurodegenerative disorders, autoimmune diseases, and cancer are creating the demand for innovative treatment options.

More healthcare providers are integrating stem cell therapies into patient care to improve treatment outcomes while reducing adverse effects associated with traditional methods.

According to the Government of the UK, clinical-grade stem cell line requests accounted for 54% of total demand in 2022, reflecting the rising need for high-quality stem cells in medical applications.

This shift toward clinical adoption is further supported by expanding regulatory approvals, growing patient awareness, and increased investment in personalized medicine. The rising demand for effective and targeted therapeutic solutions is fueling market expansion.

Market Challenge

Limitations in Scalability and Standardization

Limitations in scalability and standardization pose significant obstacles to the growth of the stem cell manufacturing market. The complex and variable nature of biological materials challenges the consistent production of large cell volumes with critical quality attributes such as viability and potency.

Differences in cell sourcing, culture conditions, and processing protocols contribute to variability that complicates regulatory approvals and clinical adoption.

Inconsistent manufacturing standards and difficulties in scaling up processes lead to increased costs, extended development timelines, and risks of contamination or batch failure. These factors limit the ability to meet growing demand and hinder the widespread commercialization of stem cell therapies.

To overcome these issues, industry stakeholders are investing in advanced automation, rigorous quality control measures, and the development of standardized manufacturing protocols.

Collaborative efforts aim to improve reproducibility, ensure regulatory compliance, and enable efficient large-scale production to support market expansion.

Market Trend

Advancements in Stem Cell Manufacturing Technologies

Advancements in stem cell manufacturing technologies are transforming the market by enabling efficient, scalable, and high-quality production processes. Automated bioreactors, closed-system processing, and optimized culture media formulations reduce contamination risks and improve reproducibility, enhancing product consistency.

Unlike traditional manual methods, these technologies allow precise control over critical parameters, ensuring enhanced cell viability and therapeutic potential.

Moreover, Next-generation platforms such as 3D bioprinting and microcarrier-based cultures support higher cell yields and better mimic natural tissue environments. These developments accelerate commercialization timelines and meet the increasing demand for stem c ell therapies in both research and clinical applications.

- In September 2024, Evotec SE and Novo Nordisk formed a partnership to develop next-generation off-the-shelf stem cell therapies. Novo Nordisk will fund technology development at Evotec’s R&D and manufacturing sites, with exclusive rights in specific therapeutic areas. The collaboration aims to boost clinical and commercial manufacturing capabilities.

Stem Cell Manufacturing Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Consumables, Instruments, and Stem Cell Lines

|

|

By Application

|

Research Application and Clinical Application

|

|

By End User

|

Pharmaceutical and Biotechnology Companies, Academic and Research Institutes, and Cell and Tissue Banks

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product (Consumables, Instruments, and Stem Cell Lines): The consumables segment earned USD 8.43 billion in 2024 due to strong demand for reagents and culture media essential for stem cell manufacturing.

- By Application (Research Application and Clinical Application): The clinical application held 54.70% of the market in 2024, due to increasing adoption of advanced therapies for treating chronic and degenerative diseases.

- By End User (Pharmaceutical and Biotechnology Companies, Academic and Research Institutes, and Cell and Tissue Banks): The pharmaceutical and biotechnology companies segment is projected to reach USD 20.14 billion by 2032, owing to their growing investments in regenerative medicine and stem cell–based therapeutic development.

Stem Cell Manufacturing Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America stem cell manufacturing market share stood at 36.40% in 2024, valued at USD 5.23 billion. This dominance is reinforced by the presence of world-leading pharmaceutical and biotechnology companies, extensive research funding, and cutting-edge healthcare infrastructure.

The region’s proactive regulatory environment and rapid adoption of automated manufacturing technologies are driving efficiency and product innovation.

Additionally, strategic collaborations between academia, industry, and government agencies are accelerating stem cell research and clinical translation. Growing emphasis by healthcare providers, researchers, and pharmaceutical companies on personalized medicine and regenerative therapies is further propelling market growth.

Moreover, advancements in bioprocess automation, quality control, and scalable production platforms are boosting continuous innovation, improving manufacturing consistency, and supporting long-term market growth.

- In May 2024, REPROCELL USA opened its GMP Biomanufacturing Facility in Beltsville, Maryland, producing off-the-shelf GMP-grade human induced pluripotent and mesenchymal stem cells. The closed-system technology ensures consistent quality and reduced contamination risks.

Asia-Pacific is poised for significant growth at a CAGR of 12.36% over the forecast period. This growth is attributed to increasing healthcare investments, rising awareness of regenerative medicine, and expanding biotechnology research across the region.

The region’s large patient population, growing prevalence of chronic diseases, and improving medical infrastructure are driving demand for advanced stem cell manufacturing solutions.

Government initiatives aimed at promoting innovation in healthcare and supporting clinical trials are accelerating technology adoption. along with advancements in automated manufacturing and quality control, are enhancing scalability and product consistency, supporting regional market expansion.

- In July 2024, BioServe India introduced a new portfolio of advanced stem cell products to support research and drug development efforts in the country. The range includes cell culture media, growth factors, reprogramming kits, 3D culture systems, and drug discovery services aimed at advancing regenerative medicine.

Regulatory Frameworks

- In the U.S., the FDA’s 21 CFR Part 1271 regulates human cells, tissues, and cellular and tissue-based products. It ensures the safety, quality, and prevention of communicable disease transmission in the manufacturing and distribution of stem cell products.

- In the European Union, the EMA Advanced Therapy Medicinal Products (ATMP) Regulation (EC) No 1394/2007 regulates advanced therapy medicinal products. It establishes requirements for quality, safety, and efficacy in the development and authorization of stem cell–based therapies.

- In Japan, the Pharmaceuticals and Medical Devices Act (PMD Act) regulates regenerative medicine products. It provides expedited approval pathways and mandates post-market safety monitoring for stem cell manufacturing and therapies.

Competitive Landscape

Companies operating in the stem cell manufacturing market are actively expanding their market presence through technological innovation, diversifying their product portfolios, and forming strategic partnerships.

Key players are heavily investing in research and development to enhance automation, scalability, process consistency, and quality control, with a focus on creating efficient and cost-effective manufacturing solutions.

They are also developing advanced bioprocessing technologies, closed-system manufacturing platforms, and real-time monitoring systems to address the complexities of large-scale cell production.

Additionally, firms are forming collaborations with pharmaceutical companies, research institutions, and regulatory bodies to accelerate product commercialization, expand geographic reach, and strengthen their positions in both established and emerging markets.

- In December 2023, Fujifilm announced a USD 200 million investment to expand its cell therapy development and manufacturing capabilities. The funding supports FUJIFILM Cellular Dynamics and FUJIFILM Diosynth Biotechnologies, enhancing production of induced pluripotent stem cell therapies and other advanced cell-based treatments. This includes a new 175,000 sq. ft. facility in Wisconsin, and clean rooms in California, U.S. The investment aims to meet the growing demand and accelerate advancements in regenerative medicine.

Key Companies in Stem Cell Manufacturing Market:

- Thermo Fisher Scientific Inc.

- Lonza Group Ltd.

- Takara Bio Inc

- Merck KGaA

- Sartorius AG

- Corning Incorporated

- BD

- FUJIFILM Holdings America Corporation

- Terumo Corporation

- HiMedia Laboratories

- Miltenyi Biotec

- PromoCell

- Sartorius CellGenix GmbH

- Pluri Biotech Ltd.

- Vericel

Recent Developments (Partnerships/ Expansion)

- In May 2025, Astraveus entered a strategic partnership with NecstGen to assess the Lakhesys Benchtop Cell Factory for CAR-T therapy production. NecstGen will leverage Astraveus' technology to enhance manufacturing efficiency and support R&D by producing lentiviral vectors at its Leiden site.

- In October 2024, Aspen Neuroscience announced the expansion of its autologous cell therapy manufacturing facility in San Diego. The expansion aims to increase production capacity to meet growing demand for personalized therapies targeting neurodegenerative diseases. This move supports the company’s goal to accelerate clinical development and commercialization of its cell therapy products.