Specialty Paper Market Size

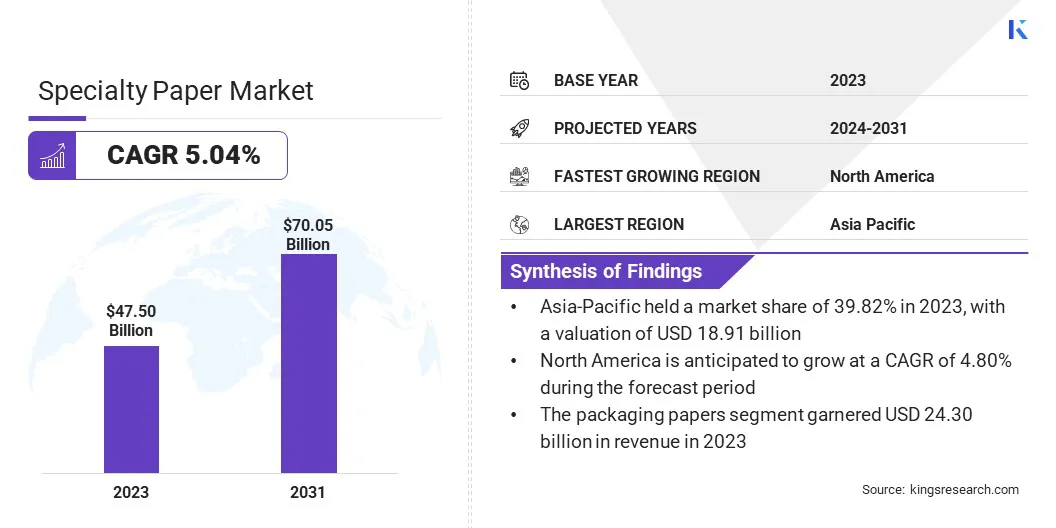

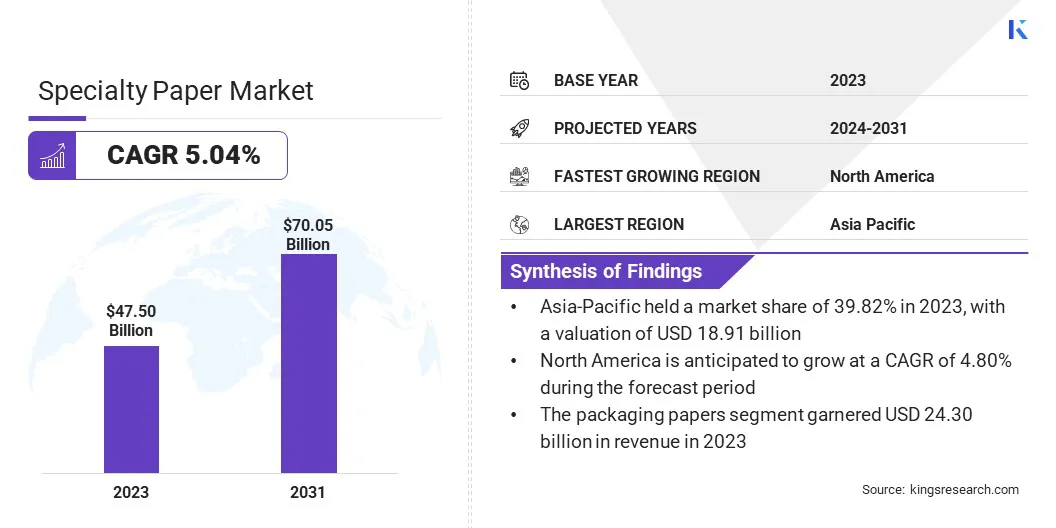

The global Specialty Paper Market size was valued at USD 47.50 billion in 2023 and is projected to grow from USD 49.66 billion in 2024 to USD 70.05 billion by 2031, exhibiting a CAGR of 5.04% during the forecast period. The market is expanding rapidly due to advancements in production technologies and increased consumer demand for customized and functional packaging.

The sector is experiencing notable growth, mainly driven by innovations in paper properties, such as enhanced strength, moisture resistance, and printability. Additionally, regulatory pressures and corporate sustainability goals are prompting industries to adopt specialty papers that offer both performance and environmental benefits.

In the scope of work, the report includes solutions offered by companies such as Stora Enso Oyj, Nippon Paper Industries Co. Ltd, Mondi, ITC Limited, Domtar Corporation, Nordic Paper AS, Twin Rivers Paper Company, LINTEC Corporation, Sappi Limited, BillerudKorsns AB, and others.

The specialty paper market is witnessing substantial growth as a result of the increasing demand for sustainable and high-performance materials. With rising environmental concerns, there is a notable shift toward the use of eco-friendly papers, including those made from recycled and biodegradable sources. Advances in paper technology, such as the incorporation of nanomaterials and innovations in molecular structures, are enhancing product functionality and customization.

Additionally, the growing emphasis on hygiene and environmental performance is spurring the demand for specialty papers that offer both protection and sustainability. These trends are fueling market expansion as industries actively seek versatile and environmentally friendly packaging solutions.

- In May 2023, Billerud launched a new wrapping solution designed for toilet and kitchen paper rolls. This machine-glazed kraft paper has been specifically adapted and validated for its application, achieving an optimal balance between sustainability and durability. It is renewable, recyclable, and biodegradable, and possesses the durability to withstand tough handling comparable to polyethylene plastic. This innovative solution represents a significant advancement in the development of eco-friendly packaging for everyday household products.

Specialty paper refers to paper products engineered for specific applications, offering unique properties that distinguish them from standard paper. Designed with enhanced features such as durability, strength, moisture resistance, or chemical resistance, specialty papers cater to diverse industrial and commercial needs.

They often include specialized coatings or treatments and may incorporate advanced materials such as nanomaterials to improve performance. Commonly used in packaging, labeling, security documents, and technical applications, specialty papers provide tailored solutions for to meet specific requirements. These paper address the need for both functionality and versatility across various sectors.

Analyst’s Review

The growth of the specialty paper market is fueled by the increasing demand for sustainable packaging solutions. As industries and consumers increasingly prioritize sustainability, there is a pressing need for adhesive solutions that reduce environmental impact and CO2 emissions.

- For instance, in January 2023, LINTEC announced the expansion of its labelstock lineup with the development of a permanent general-purpose hot-melt adhesive, which was featured in a new series named HVT. Launched on February 1, this series includes three new products: two based on synthetic paper and one water-resistant paper-based labelstock. Designed for diverse applications, including various display labels, these new products are intended to lower environmental impact and contribute to reducing CO2 emissions by incorporating eco-friendly adhesives. This innovation reflects LINTEC's commitment to advancing sustainable solutions in labeling.

This trend is prompting companies to innovate with eco-friendly materials and technologies, aligning with broader environmental goals and meeting customer preferences for sustainability. As the demand for greener products rises, businesses are adopting solutions that reduce their environmental impact and CO2 emissions, thereby supporting a shift toward more sustainable practices.

Specialty Paper Market Growth Factors

The expansion of the specialty paper market is majorly fueled by the rising awareness regarding environmental issues and the global transition toward sustainable practices. As consumers and businesses are becoming more conscious of their ecological impact, the demand for specialty papers made from recycled and biodegradable materials is surging.

These eco-friendly papers are reducing the reliance on virgin pulp, conserving forests, and enhancing recyclablility, thereby effectively addressing waste management issues. Brands across various industries are increasingly adopting sustainable specialty papers for their packaging.

This shift is boosted by the rising consumer demand for greener products, as well as the need to comply with environmental regulations and corporate social responsibility goals. This widespread adoption is propelling market growth, as the need for sustainable packaging solutions is becoming integral to business strategies and consumer preferences.

- In July 2023, Mondi, a global leader in packaging and paper, invested USD 17.3867 million in new technology to develop an innovative packaging range called Functional Barrier Paper Ultimate. This ultra-high barrier paper-based solution is designed to meet the increasing customer demand for sustainable packaging. It contributes to a circular economy by offering an eco-friendly alternative to traditional packaging materials, thus aligning with the growing emphasis on environmental responsibility and resource efficiency in the packaging industry.

However, the specialty paper market is facing challenges due to high production costs and limited raw material availability, which are constraining market growth. Additionally, integrating advanced technologies and maintaining consistent quality standards are posing significant financial and resource challenges.

To address these issues, key players are focusing on research and development to create more cost-effective production methods and improve raw material sourcing. Investments in automation and advanced technologies are further enhancing efficiency and reducing costs. These strategies are contributing to ensuring consistent quality and supporting market expansion despite existing constraints.

Specialty Paper Market Trends

The molecular structure of specialty paper is increasingly being utilized to develop new product variants tailored to user requirements, including biodegradable options. The integration of nanomaterials in specialty papers is enhancing their suitability for various by-products, thereby expanding their application range.

These advanced properties are making specialty papers a preferred choice for numerous end users, reflecting a significant market trend toward customization and innovation in specialty paper products. This trend is propelling market growth by boosting the adoption of specialty papers across diverse industries, highlighting their versatility and the ongoing demand for high-performance, sustainable materials. As industries seek innovative and eco-friendly solutions, the unique properties of specialty papers are meeting these needs, thereby propelling market expansion.

- In October 2022, Mondi and Reckitt introduced an innovative paper-based packaging solution for Finish dishwasher tablets, achieving a 75% reduction in plastic use. This new packaging is set to eliminate over 2,000 tonnes of plastic annually upon full rollout. The initiative supports Reckitt's goal of reducing its use of virgin plastic in packaging by 2030, reflecting a significant step toward more sustainable packaging practices.

The use of specialty papers in packaging is evolving, particularly in industries where parts are being covered in protective oil before being wrapped in paper. Kraft paper is used to protect these parts, preventing the dispersion of oil and maintaining the cleanliness of the packaging.

- For instance, BIOCARBON LAMINATES offers the UK's first carbon-neutral laminate. Their BioCarbon Laminates range has received an Environmental Product Declaration (EPD) and has demonstrated strong environmental performance through a Life Cycle Analysis (LCA). Additionally, these decorative laminates provide antimicrobial protection, making them ideal for hygiene-sensitive areas across industries such as hospitality, locker rooms, healthcare washrooms, commercial interiors, leisure facilities, and education and retail.

This trend is propelling market growth by fueling the demand for environmentally friendly and hygienic packaging solutions, thus meeting industry needs for sustainability and hygiene.

Segmentation Analysis

The global market is segmented based product type, material, distribution channel, and geography.

By Product Type

Based on product type, the market is categorized into packaging papers, décor papers, labelling papers, office papers, and others. The packaging papers segment garnered the highest revenue of USD 24.30 billion in 2023. The increasing focus on sustainability is leading to increased demand for packaging papers that are recyclable, biodegradable, and made from renewable resources.

Innovations in packaging paper technologies, such as enhanced barrier properties and improved durability, are further fueling segmental growth by offering solutions that meet the evolving needs of various industries. Additionally, the proliferation of e-commerce and the surging demand for premium packaging are contributing to the expansion of the segment. As industries increasingly seek eco-friendly and high-performance packaging solutions, the packaging papers segment is experiencing robust growth.

By Material

Based on material, the market is categorized into natural and recycled. The recycled segment captured the largest specialty paper market share of 56.88% in 2023. As consumers and businesses prioritize eco-friendly practices, the demand for recycled paper products is surging. This segment benefits from lower environmental impact by reducing waste and conserving natural resources compared to virgin paper.

Advances in recycling technologies and improved quality of recycled paper are enhancing its appeal and functionality, making it highly suitable for a wider range of applications. The regulatory emphasis on reducing carbon footprints and waste management further boosts the progress of the segment, leading to the widespread adoption across various industries.

- For instance, in September 2023, at Labelexpo Europe, Lintec Europe introduced a new labelstock material aimed at improving the recyclability of PET bottles. This innovative material, along with direct thermal paper, provides a sustainable alternative to traditional synthetic paper products.

By Distribution Channel

Based on distribution channel, the specialty paper market is categorized into offline and online. The offline segment is expected to garner the highest revenue of USD 47.67 billion by 2031. Increased consumer demand for tangible, high-quality printed materials such as brochures, catalogs, and direct mail is fueling the expansion of the segment.

Despite the rise of digital media, businesses continue to invest in offline marketing and communication strategies, recognizing the value of the tangible and personalized nature of physical documents. Innovations in paper technology, such as enhanced printability and durability, are improving the quality and functionality of offline materials. Additionally, the growing trend toward personalized and premium printed products is further boosting the growth of the segment.

Specialty Paper Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia-Pacific specialty paper market share stood around 39.82% in 2023 in the global market, with a valuation of USD 18.91 billion. The surge in demand for advanced packaging solutions across various sectors such as food and beverage, pharmaceuticals, and e-commerce is contributing significantly to regional market growth.

Additionally, increased environmental awareness is leading to the widespread adoption of eco-friendly specialty papers, including recycled and biodegradable options, as governments implement stricter waste management regulations. Technological advancements in paper production are enhancing the quality and versatility of specialty papers. The region's major paper producers and expanding manufacturing facilities, particularly in China, India, and Japan, are further fueling domestic market growth.

North America is anticipated to witness significant growth at a CAGR of 4.80% over the forecast period. The region's significant investment in research and development is leading to the creation of new specialty paper products with enhanced features and expanded applications.

The strong presence of major end-use industries, including automotive and healthcare, is fostering the demand for specialized papers with high-performance characteristics. Additionally, there is a growing trend toward personalization and customization in packaging and promotional materials, which is fueling market growth. The increasing focus on improving supply chain efficiencies and reducing operational costs is further promoting the widespread adoption of innovative specialty paper solutions, thereby augmenting regional market growth.

Competitive Landscape

The global specialty paper market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Specialty Paper Market

- Stora Enso Oyj

- Nippon Paper Industries Co. Ltd

- Mondi

- ITC Limited

- Domtar Corporation

- Nordic Paper AS

- Twin Rivers Paper Company

- LINTEC Corporation

- Sappi Limited

- BillerudKorsns AB

Key Industry Development

- August 2023 Partnership): Sappi, a leading global manufacturer of flexible packaging papers featuring integrated barriers and heat-seal capabilities, entered into a developmental partnership with digital printing innovator Xeikon. This collaboration seeks to advance the integration of digital printing technology with specialty packaging solutions, enhancing product performance and versatility.

The global specialty paper market is segmented as:

By Product Type

- Packaging Papers

- Décor Papers

- Labelling Papers

- Office Papers

- Others

By Material

By Distribution Channel

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America