Market Definition

Specialty oleochemicals are high-value compounds derived from natural fats and oils, tailored for specific functional properties. Key products include specialty esters, fatty amines, glycerol esters, and alkoxylates, used across personal care, pharmaceuticals, food additives, and industrial formulations. They provide benefits such as emulsification, lubrication, and conditioning, while supporting sustainable product development through renewable feedstocks.

Specialty Oleochemicals Market Overview

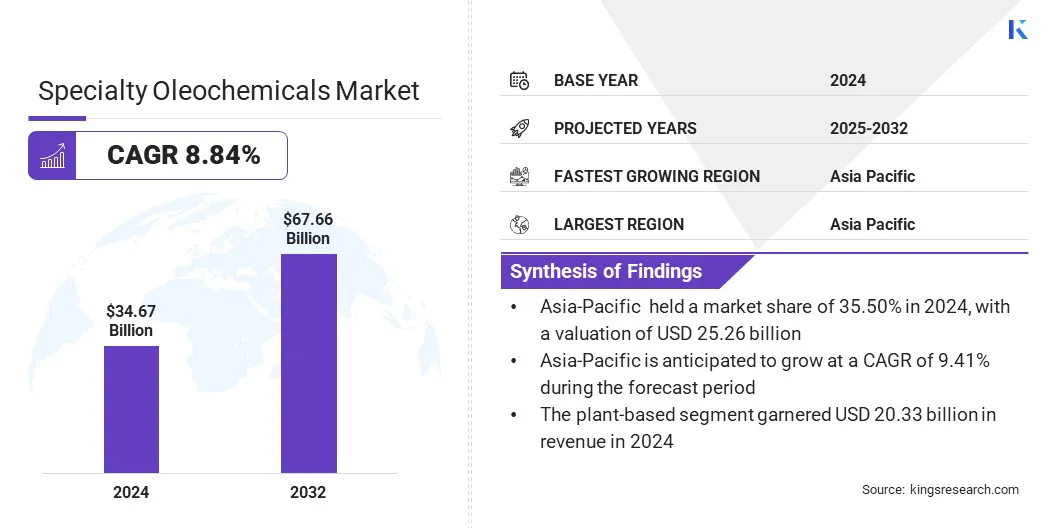

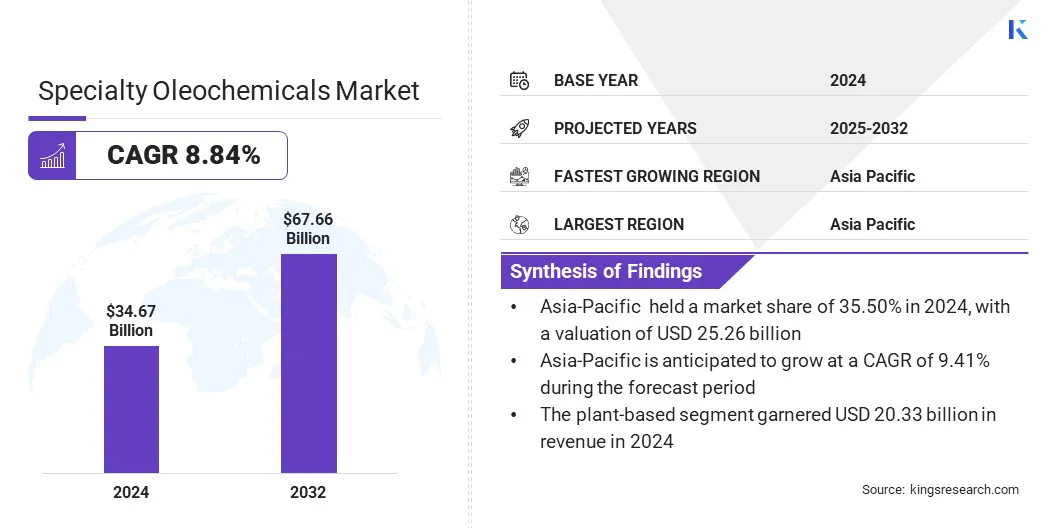

According to Kings Research, the global specialty oleochemicals market size was valued at USD 34.67 billion in 2024 and is projected to grow from USD 37.40 billion in 2025 to USD 67.66 billion by 2032, exhibiting a CAGR of 8.84% during the forecast period.

This growth is attributed to the rising demand for bio-based and sustainable chemical solutions in personal care, pharmaceuticals, food and beverage, and industrial applications. Increasing consumer preference for natural ingredients and regulatory initiatives promoting eco-friendly alternatives are further boosting market expansion.

Key Highlights

- The specialty oleochemicals industry size was USD 34.67 billion in 2024.

- The market is projected to grow at a CAGR of 8.84% from 2025 to 2032.

- Asia-Pacific held a share of 35.50% in 2024, valued at USD 12.31 billion.

- The glycerol esters segment garnered USD 10.83 billion in revenue in 2024.

- The plant-based segment is expected to reach USD 40.07 billion by 2032.

- The personal care & cosmetics segment is anticipated to witness the fastest CAGR of 9.36% over the forecast period.

- Europe is anticipated to grow at a CAGR of 8.56% through the projection period.

Major companies operating in the specialty oleochemicals market are BASF, Evonik, Emery Oleochemicals, Wilmar International Ltd, KLK OLEO, Oleon NV, IOI Oleochemical, Kao Corporation, Baerlocher GmbH, Kraton Corporation, PT. Ecogreen Oleochemicals, VVF Group, Godrej Industries Limited, Musim Mas Group, and TWIN RIVERS TECHNOLOGIES

The emphasis on performance enhancement, formulation efficiency, and sustainability is boosting adoption across diverse sectors. Additionally, advancements in feedstock processing, product innovation, and investment in renewable raw materials are accelerating market expansion.

Market Driver

Increasing Demand for Sustainable & Bio-Based Chemical Solutions

The growth of the specialty oleochemicals market is propelled by the global shift toward renewable and environmentally responsible alternatives to petroleum-based chemicals. Rising consumer awareness of sustainability, coupled with the preference for natural and biodegradable ingredients in personal care, food, and pharmaceutical products, is fueling adoption.

Specialty oleochemicals offer functional benefits such as emulsificationpersonal care, lubrication, and conditioning while aligning with eco-friendly product development. Regulatory initiatives promoting green chemistry and stricter environmental standards are further reinforcing this transition. Industries are investing in bio-based innovations to enhance performance and reduce environmental footprint, positioning specialty oleochemicals as essential inputs across diverse applications.

Market Challenge

Fluctuations in Raw Material Availability and Pricing

Fluctuations in raw material availability and pricing create a significant barrier to the growth of the specialty oleochemicals market. The industry relies heavily on feedstocks such as palm oil, coconut oil, and soybean oil, which are vulnerable to climate variability, agricultural yield fluctuations, and geopolitical factors. These uncertainties directly increase production costs, reduce profit margins, and complicate long-term supply planning for manufacturers.

The challenge is particularly pronounced in regions dependent on imports, where global price shifts and trade restrictions increase supply risks. Growing pressure to secure sustainably sourced and certified feedstocks further adds to cost burdens and narrows procurement options. Price-sensitive industries often find it difficult to absorb cost fluctuations, limiting the broader adoption of specialty oleochemicals in certain applications.

To mitigate these risks, producers are adopting diversified sourcing strategies, expanding into alternative feedstocks, and investing in technologies to enhance resource efficiency. Ongoing research into microbial and waste-based raw materials offers opportunities to reduce reliance on volatile agricultural sources and strengthen long-term supply stability.

Market Trend

Technological Advancements in Bio-Based Innovations

The specialty oleochemicals market is experiencing a notable trend toward technological advancements in bio-based innovations, fueled by the need for alternative and sustainable raw material sources.

Emerging methods such as microbial fermentation, enzymatic processing, and waste-to-chemical conversion are improving efficiency while diversifying feedstock options beyond traditional vegetable oils. These innovations are particularly valuable in regions facing feedstock volatility, as they provide more reliable and environmentally responsible production pathways.

Manufacturers are increasingly investing in advanced biotechnologies and pilot-scale facilities to accelerate commercialization. Development of high-performance formulations tailored for pharmaceuticals, personal care, and industrial applications is expanding the scope of bio-based oleochemicals, thereby supporting market expansion.

- In October 2024, Emery Oleochemicals expanded its 100% USDA BioPreferred certified biobased portfolio with four pelargonic acid products. The addition includes three EMERION W 90 PA variants for residue-free weed control and EMERY 1202 pelargonic acid for applications in lubricants, metalworking, fragrances, animal feed, and industrial cleaning, highlighting the company’s commitment to sustainable solutions.

Specialty Oleochemicals Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Specialty Esters, Glycerol Esters, Alkoxylates, Fatty Amines, and Others

|

|

By Source

|

Plant-Based, Animal-Based, and Microbial-Based

|

|

By Application

|

Personal Care & Cosmetics, Food Processing, Industrial, Healthcare & Pharmaceuticals, Consumer Goods, Textiles, Paints & Inks, Polymer & Plastics Additives, and Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Specialty Esters, Glycerol Esters, Alkoxylates, Fatty Amines, and Others): The glycerol esters segment earned USD 10.83 billion in 2024, mainly due to their extensive use as emulsifiers, stabilizers, and additives in food, personal care, and pharmaceutical applications.

- By Source (Plant-Based, Animal-Based, and Microbial-Based): The plant-based segment held a share of 58.65% in 2024, fueled by abundant feedstock availability and strong demand for renewable, sustainable chemical alternatives.

- By Application (Personal Care & Cosmetics, Food Processing, Industrial, Healthcare & Pharmaceuticals, Consumer Goods, Textiles, Paints & Inks, Polymer & Plastics Additives, and Others): The personal care & cosmetics segment is projected to reach USD 19.22 billion by 2032, owing to rising consumer preference for natural ingredients and increasing use of specialty oleochemicals in skincare, haircare, and hygiene products.

Specialty Oleochemicals Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific specialty oleochemicals market share stood at 35.50% in 2024, valued at USD 12.31 billion. This dominance is reinforced by rapid industrialization, expanding personal care and food processing sectors, and growing consumer demand for sustainable and bio-based products.

The regional market further benefits from increasing investments in renewable feedstocks and the adoption of advanced oleochemical formulations across pharmaceuticals, cosmetics, and industrial applications.

Government initiatives promoting eco-friendly chemicals, combined with technological advancements and partnerships with global manufacturers, are propelling regional market growth. Rising urbanization, industrial modernization, and enhanced production capabilities further position Asia Pacific as a key hub for specialty oleochemical production and consumption.

- In 2023, Apical Oleochemicals (Taixing) produced its first batch of lauric acid (acid LA1299), completing the pilot run of its Oleochemicals Integration Complex. The facility, with an annual capacity of 577,000 tons and supplies lauric acid for daily chemicals, food, medicine, and lubricants, supporting a sustainable and energy-efficient industry cluster.

The Europe specialty oleochemicals industry is poised to grow at a CAGR of 8.56% over the forecast period. This growth is fueled by rising demand for sustainable and high-quality specialty oleochemicals in personal care, pharmaceuticals, and food processing applications. Stringent environmental regulations and government incentives for renewable and bio-based chemicals are promoting wider adoption across industries.

Furthermore, advancements in production technologies, strategic collaborations between manufacturers and research institutions, and increasing focus on eco-friendly formulations are supporting domestic market expansion. The region’s strong R&D capabilities, industrial modernization, and consumer preference for natural ingredients are positioning Europe as a key market for specialty oleochemical development and consumption.

- In June 2023, BASF expanded its alkoxylation capacity with additional production at its Antwerp, Belgium, and Ludwigshafen, Germany sites. The expansion adds over 150,000 metric tons per year to meet rising demand in detergents, automotive, and construction, and includes a second ethylene oxide production line in Antwerp to enhance overall production capabilities.

Regulatory Frameworks

- In the U.S., the Toxic Substances Control Act regulates the manufacturing, import, processing, and distribution of chemical substances. It ensures that specialty oleochemicals are assessed for health and environmental risks, requiring testing, reporting, and recordkeeping to support safe commercialization.

- In the European Union, the Registration, Evaluation, Authorization and Restriction of Chemicals regulates chemical substances. It requires specialty oleochemicals to provide comprehensive safety data, ensuring their safe use in manufacturing, personal care, and industrial applications.

Competitive Landscape

Companies operating in the specialty oleochemicals industry are maintaining competitiveness through investments in sustainable production processes, bio-based product innovations, and strategic mergers and acquisitions. They are developing high-performance oleochemicals with improved functionality, purity, and application-specific performance to meet rising demand across personal care, food, pharmaceutical, and industrial sectors.

Companies are also expanding their product portfolios to include specialty esters, glycerol esters, fatty amines, and alkoxylates, catering to diverse applications and regulatory standards. Focus is placed on establishing regional production facilities, collaborating with research institutions, and enhancing supply chain resilience.

Additionally, firms are emphasizing customer-centric solutions, technical support, and tailored formulations while leveraging process optimization and digital tools to improve efficiency, sustainability, and long-term competitiveness.

- In April 2023, KLK OLEO acquired a controlling stake in Temix Oleo SpA to expand its renewable feedstock-based ester portfolio. This initiative strengthens KLK OLEO's position in the European market, particularly in the lubricant, cosmetics, and coatings sectors, and supports its long-term growth strategy of product diversification and broader customer access.

Key Companies in Specialty Oleochemicals Market:

- BASF

- Evonik

- Emery Oleochemicals

- Wilmar International Ltd

- KLK OLEO

- Oleon NV

- IOI Oleochemical

- Kao Corporation

- Baerlocher GmbH

- Kraton Corporation

- Ecogreen Oleochemicals

- VVF Group

- Godrej Industries Limited

- Musim Mas Group

- TWIN RIVERS TECHNOLOGIES

Recent Developments (Agreements)

- In April 2023, Musim Mas, an oleochemicals company, announced that its subsidiary Masurf Inc. acquired a manufacturing facility in Bauang, Batangas, Philippines, from Stepan Philippines Quaternaries, Inc. The acquisition strengthens surfactant production, expands applications in personal care, home care, and industrial sectors, and supports the company’s commitment to sustainable growth.