Market Definition

The market encompasses the global industry dedicated to the development, production, and deployment of imaging systems used in various space applications, including space exploration, Earth observation, and remote sensing.

This market includes a range of camera types, such as satellite cameras, CubeSat cameras, onboard spacecraft cameras, and other specialized imaging systems designed to operate in the extreme conditions of space.

These cameras leverage different imaging technologies, including electro-optical (EO) cameras, infrared (IR) cameras, multispectral cameras, and hyperspectral cameras, each serving distinct purposes such as high-resolution imaging, thermal monitoring, and spectral analysis.

Space Camera Market Overview

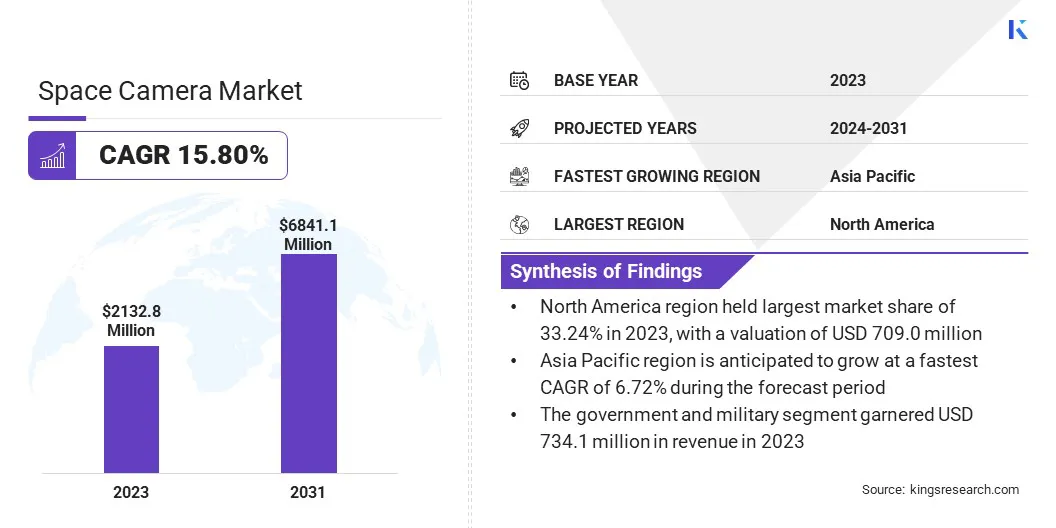

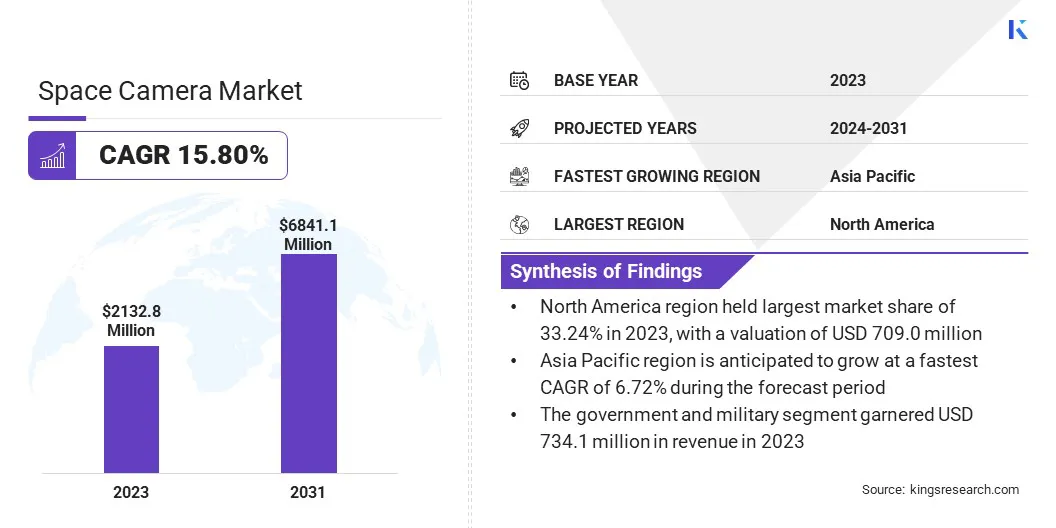

The global space camera market size was valued at USD 2132.8 million in 2023 and is projected to grow from USD 2450.6 million in 2024 to USD 6841.1 million by 2031, exhibiting a CAGR of 15.80% during the forecast period.

The market is driven by rising investments in satellite-based imaging, increasing demand for high-resolution Earth observation, and advancements in imaging technology. Governments, space agencies, and private companies are continuously expanding their satellite programs for applications, such as environmental monitoring, disaster management, defense, and space exploration.

Major companies operating in the space camera industry are Sodern, Northrop Grumman, Ball Corporation, Hasselblad, OHB SE, Safran Group, Teledyne Technologies Incorporated, Vision Research Inc., Canon Electronics Inc., L3Harris Technologies, Inc., Cavu Aerospace UK, Dragonfly Aerospace, AAC Clyde Space, 3D PLUS, and IMPERX, Inc.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) in image processing is revolutionizing space-based analytics, enabling faster and more precise insights.

Additionally, the commercialization of space activities, increasing partnerships between government agencies and private firms, and the emergence of cost-effective satellite launch solutions are expanding market opportunities.

- In November 2023, Sodern launched the Auricam range of space cameras suitable for MEO, LEO, GEO orbits. Designed to be delivered within a few weeks at a reduced cost, the versatile Auricam cameras available in two models, Auricam D80 and Auricam D35, are engineered to support missions such as space surveillance, scientific exploration in-orbit or rendezvous services, and navigation.

Key Highlights:

- The space camera industry size was valued at USD 2132.8 million in 2023.

- The market is projected to grow at a CAGR of 15.80% from 2024 to 2031.

- North America held a market share of 33.24% in 2023, with a valuation of USD 709.0 million.

- The satellite cameras segment garnered USD 617.8 million in revenue in 2023.

- The electro-optical (EO) cameras segment is expected to reach USD 1956.1 million by 2031.

- The space tourism & entertainment segment is expected to reach USD 1833.4 million by 2031.

- The government & military segment is expected to reach USD 2321.9 million by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 16.72% during the forecast period.

What are the major factors driving market growth?

The space camera market is driven by the increasing demand for high-resolution Earth observation and the growing investments in small satellite constellations and CubeSats.

Governments, defense agencies, and commercial entities are leveraging high-resolution satellite imaging for environmental monitoring, disaster management, surveillance, and urban planning, fueling the need for advanced space cameras with superior imaging capabilities.

Additionally, the rapid expansion of small satellite constellations and CubeSats is reshaping the market, as these cost-effective and compact systems enable frequent data collection for applications such as agriculture, climate monitoring, and geospatial analytics.

The rising affordability of satellite launches and advancements in miniaturized imaging technologies further accelerate market growth, making space-based imaging more accessible to a wide range of industries.

What are the major obstacles for this market?

The major challenges in the space camera market are data management and processing limitations, due to the massive volume of high-resolution images captured by satellites. Space cameras generate vast amounts of data that require efficient storage, transmission, and real-time processing, which can be constrained by bandwidth limitations and onboard computing capacity.

This challenge is particularly critical for applications like Earth observation, defense surveillance, and deep-space exploration, where timely data analysis is essential. A potential solution lies in the integration of edge computing and AI-driven onboard processing, enabling satellites to filter, compress, and analyze data before transmission to ground stations.

This reduces the burden on communication networks and enhances operational efficiency by delivering only the most relevant insights, improving the responsiveness of space-based imaging systems.

How is AI integration affecting the market?

The space camera market is increasingly shaped by advancements in AI-powered image processing, which is transforming the way satellite imagery is analyzed and utilized. AI-driven algorithms enhance image clarity, automate object detection, and enable real-time data processing, significantly improving the accuracy and efficiency of space-based imaging systems.

These technologies are particularly beneficial for applications such as Earth observation, defense surveillance, climate monitoring, and planetary exploration, where large volumes of data must be processed quickly and precisely.

Additionally, AI integration allows for predictive analytics and anomaly detection, enabling automated identification of environmental changes, infrastructure developments, and potential security threats.

Companies are investing in ML models and cloud-based AI platforms to provide real-time insights and optimize space camera performance as the demand for faster, more intelligent space imaging solutions grows.

- In September 2024, Ubotica, a leader in SPACE:AI, announced the launch of its revolutionary in-orbit camera, CogniSAT-NEI, designed for Non-Earth Imaging (NEI) applications. The camera, featuring real-time image capture and Edge-AI processing, has already demonstrated its capabilities during the Apex “Call to Adventure” mission on SpaceX’s Falcon 9 in March 2024 by capturing a stunning view of the Baja Peninsula from over 500 km above Earth.

Space Camera Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Satellite Cameras, CubeSat Cameras, Onboard Spacecraft Cameras, Others

|

|

By Technology

|

Electro-Optical (EO) Cameras, Infrared (IR) Cameras, Multispectral Cameras, Hyperspectral Cameras, Others

|

|

By Application

|

Space Exploration, Earth Observation & Remote Sensing, Astronomy & Cosmic Studies, Space Tourism & Entertainment, Others

|

|

By End Use

|

Government & Military, Commercial Enterprises, Space Agencies, Research Institutions

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Satellite Cameras, CubeSat Cameras, Onboard Spacecraft Cameras, Others): The satellite cameras segment earned USD 617.8 million in 2023, due to the increasing deployment of satellites for Earth observation, remote sensing, and defense applications.

- By Technology (Electro-Optical (EO) Cameras, Infrared (IR) Cameras, Multispectral Cameras, and Hyperspectral Cameras): The electro-optical (EO) cameras segment held 28.47% share of the market in 2023, due to their widespread use in high-resolution imaging for surveillance, mapping, and scientific research.

- By Application (Space Exploration, Earth Observation & Remote Sensing, Astronomy & Cosmic Studies, and Space Tourism & Entertainment, Others): The space tourism & entertainment segment is projected to reach USD 1833.4 million by 2031, owing to the growing investments in commercial space travel and immersive space-based media experiences.

- By End Use (Government & Military, Commercial Enterprises, Space Agencies, and Research Institutions): The government & military segment is projected to reach USD 2321.9 million by 2031, owing to the increased defense spending and the strategic importance of satellite-based intelligence and surveillance.

What is the market scenario in North America and Asia-Pacific region?

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for a space camera market share of around 33.24% in 2023, with a valuation of USD 709.0 million. This dominance is driven by the presence of leading space agencies such as NASA, well-established aerospace companies, and private sector giants like SpaceX.

The region benefits from substantial government funding, advanced research & development initiatives, and a high frequency of satellite launches for Earth observation, defense, and deep-space exploration.

Additionally, North America’s leadership in electro-optical (EO) and infrared (IR) imaging technologies, as well as strong collaborations between the public and private sectors, has significantly contributed to market expansion.

The space camera industry in Asia Pacific is poised to grow at a significant CAGR of 16.72% over the forecast period. This rapid growth is fueled by increasing investments in space programs by countries like China, India, and Japan, along with a surge in commercial satellite launches.

National space agencies such as China National Space Administration (CNSA) and the Indian Space Research Organization (ISRO) are actively developing advanced imaging technologies for remote sensing, space exploration, and defense applications.

The rising demand for CubeSats and small satellite constellations, coupled with growing private sector involvement in the region, is further accelerating market expansion. The cost-effective manufacturing capabilities and increasing government initiatives in Asia Pacific to enhance space infrastructure make it a key contributor to the market growth.

Regulatory Frameworks

- In the U.S., the Federal Communications Commission (FCC) regulates the use of radio frequencies for space-based imaging systems, ensuring that satellite cameras do not interfere with existing communication networks.

- In India, the Indian Space Research Organisation (ISRO) and the Department of Space (DoS) regulate satellite imaging activities and oversee private sector participation, ensuring compliance with national security guidelines and licensing requirements.

Competitive Landscape:

Companies are investing heavily in high-resolution imaging, multispectral and hyperspectral camera systems, and AI-powered image processing to enhance performance and data accuracy.

The adoption of miniaturized and lightweight cameras for CubeSats and small satellites has become a crucial strategy, enabling cost-effective solutions for Earth observation and deep-space exploration.

Strategic collaborations with government space agencies, defense organizations, and commercial satellite operators are a common approach to secure long-term contracts and funding. Market players are also expanding their manufacturing capabilities and R&D centers to accelerate innovation and maintain a competitive edge.

The market is registering a surge in mergers and acquisitions aimed at integrating advanced sensor technologies and AI-driven analytics into space imaging systems. Additionally, companies are focusing on customized imaging payloads for specialized applications such as planetary exploration, space tourism, and high-precision remote sensing.

Firms are actively engaging in multi-mission partnerships, expanding their satellite networks, and developing cloud-based data platforms for enhanced image accessibility and real-time analytics to strengthen market presence.

- In March 2024, Nikon Corporation announced that Nikon Inc. had entered into a Space Act agreement with NASA to support the Artemis campaign through the development of the Handheld Universal Lunar Camera. The collaboration integrates the Nikon Z 9 mirrorless full-frame flagship into the HULC system, serving as the handheld camera for the Artemis III mission to document the crew’s return to the lunar surface and facilitate scientific research.

Key Companies in Space Camera Market:

- Sodern

- Northrop Grumman

- Ball Corporation

- Hasselblad

- OHB SE

- Safran Group

- Teledyne Technologies Incorporated

- Vision Research Inc.

- Canon Electronics Inc.

- L3Harris Technologies, Inc.

- Cavu Aerospace UK

- Dragonfly Aerospace

- AAC Clyde Space

- 3D PLUS

- IMPERX, Inc

Recent Developments (Partnerships/Product Launchs)

- In February 2025, the Science and Technology Facilities Council’s RAL Space at Harwell Campus announced a strategic collaboration with NASA’s PUNCH (Polarimeter to Unify the Corona and Heliosphere) mission. Under this partnership, RAL Space will design, develop, and supply advanced visible-light camera systems for the mission’s four spacecraft, enabling unprecedented imaging of the solar wind’s evolution. Additionally, RAL Space will oversee in-flight calibration to ensure the accuracy and reliability of mission data.

- In February 2024, Redwire Corporation launched its flight-proven SentinelCam technology aboard Athena, Intuitive Machine’s Nova-C lunar lander on the IM-2 mission. The SentinelCam, part of Redwire’s Terrain Relative Navigation and Hazard Detection and Avoidance suite, is designed to deliver high-resolution, high dynamic range imaging to assist in landing analysis and track the lander’s movement, building on its success during IM-1 in detecting 9 safe landing sites.