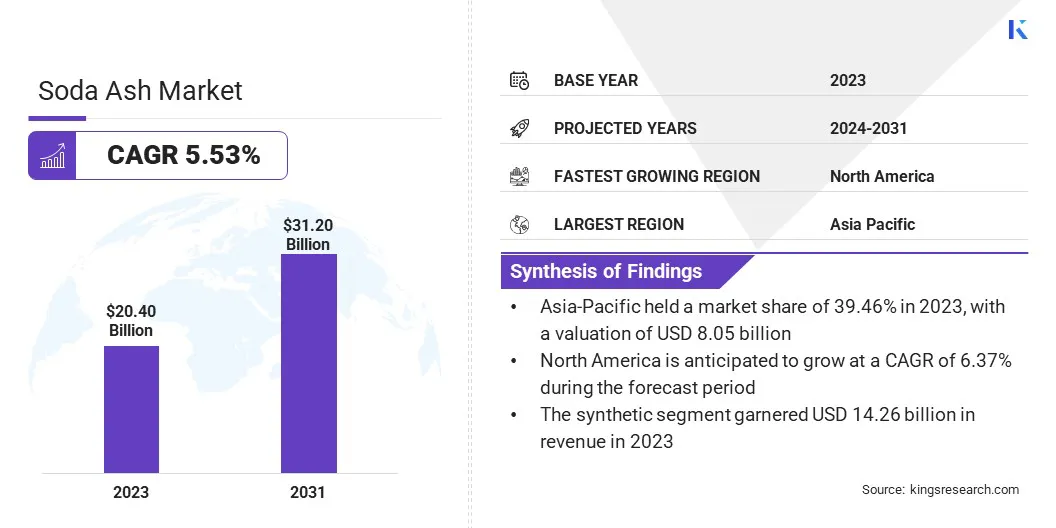

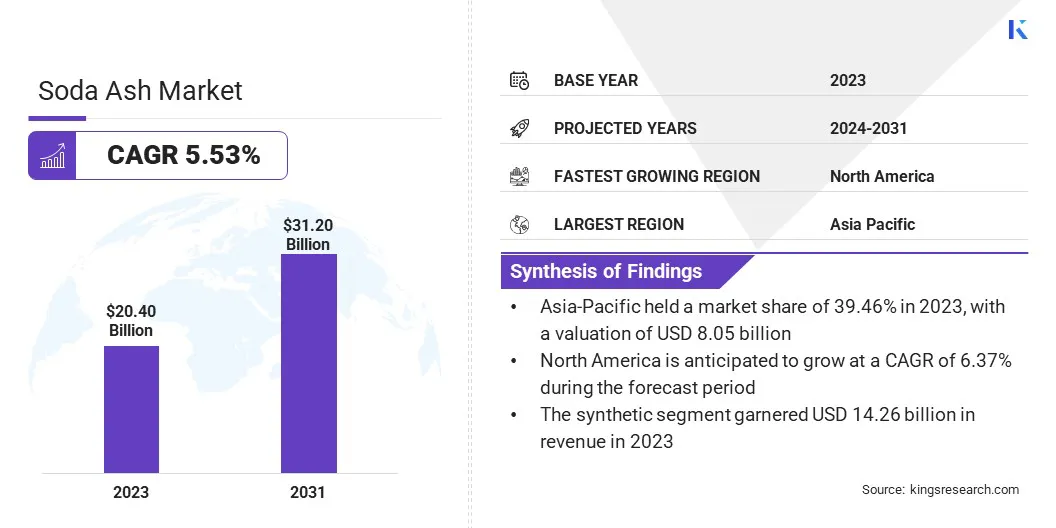

Soda Ash Market Size

Global Soda Ash Market size was recorded at USD 20.40 billion in 2023, which is estimated to be at USD 21.41 billion in 2024 and projected to reach USD 31.20 billion by 2031, growing at a CAGR of 5.53% from 2024 to 2031. In the scope of work, the report includes products offered by companies such as Ciner Group, Genesis Energy, L.P., GHCL Limited, HUBEI YIHUA CHEMICAL INDUSTRY CO., LTD., Sahand Industrial Group, Şişecam, Solvay SA, Tata Chemicals Ltd., CIECH S.A., and DCW Ltd. and others.

The growth of the market is driven by increasing demand from the glass manufacturing, detergent, and chemical industries, technological advancements in production, and a growing emphasis on environmental sustainability. The rising demand from the glass manufacturing industry significantly propels market growth, as soda ash is a critical component in glass production. Additionally, the expansion of the detergent and soap industries boosts demand for soda ash due to its growing use as a cleaning agent.

The expansion of the chemical industry further leads to the surging need for soda ash as a result of its pivotal role in various chemical processes. Moreover, environmental regulations promoting the use of soda ash in water treatment to reduce pollutants stimulate demand. Moreover, technological advancements in soda ash production and the increasing application of soda ash in the food industry enhance its market prospects.

The soda ash market is characterized by robust growth, driven by its extensive application across various industries. The Asia-Pacific region dominates the market, with China being a major producer and consumer due to its large manufacturing base. North America and Europe both hold significant market shares, supported by steady industrial activities and stringent environmental regulations.

- Major players in the market include large multinational corporations, as well as small and medium enterprises, collectively shaping a fragmented competitive landscape.

Despite facing challenges such as fluctuating raw material prices and rising environmental concerns, the market is expected to maintain steady growth due to sustained demand for soda ash.

Soda ash, also known as sodium carbonate, is a white, water-soluble salt commonly used in manufacturing and industrial processes. It serves as a vital raw material in the production of glass, detergents, and chemicals.

Soda ash is obtained through the mining of trona ore or through the Solvay process, which involves the chemical reaction of sodium chloride, ammonia, and carbon dioxide. Its applications extend to water treatment, where it helps neutralize acidity, and in food processing, where it acts as a pH regulator. Due to its versatile properties, soda ash is a fundamental substance in various industrial applications.

Analyst’s Review

Manufacturers are constantly focusing on efforts to capitalize on emerging opportunities in the market. Significant investments in research and development have led to the introduction of innovative production technologies, thus enhancing efficiency and sustainability. Moreover, manufacturers are diversifying their product portfolios to meet evolving consumer demands, with a particular emphasis on eco-friendly and high-purity soda ash variants.

The introduction of new products tailored to specific end-use industries, such as glass manufacturing and detergents, is resulting in market expansion. To stay competitive, companies should continue investing in technological advancements and sustainable practices. Additionally, strategic collaborations and market expansion efforts in emerging economies are recommended to seize untapped growth potential in the global soda ash market.

Soda Ash Market Growth Factors

Technological advancements play a pivotal role in driving the growth of the soda ash market. Continuous innovation in production processes enhances efficiency and reduces costs, thereby improving market competitiveness. Technological advancements, such as energy-efficient manufacturing techniques and the widespread adoption of automation streamline operations, leading to higher productivity and lower environmental impact.

Moreover, research and development efforts focus on developing eco-friendly production methods, thus addressing sustainability concerns and stringent regulatory requirements. By adopting technological innovations, companies in the market are conentrating on gaining competitive edge, in order to meet evolving consumer demands, and capitalize on emerging growth opportunities.

- Tuticorin Alkali Chemicals & Fertilisers Limited (TFL), which is a part of AM International, Singapore, started the commercial production of green soda ash using advanced carbon-capture technology. TFL established a Carbon Dioxide Recovery Plant to convert carbon from coal into biomass fuel, thereby eliminating fossil-fuel use. Additionally, they have used green ammonium from Egypt to produce near-zero soda ash, marking a significant milestone in carbon-neutral manufacturing.

The stringent environmental regulations governing manufacturing processes present a major challenge to market development. These regulations aim to minimize pollution and mitigate environmental impact, requiring companies to invest in costly upgrades to comply with standards. To overcome this challenge, industry players are prioritizing sustainability initiatives and implementing cleaner production methods.

Investments in green technologies, such as carbon capture and utilization, are helping reduce carbon emissions and mitigate environmental concerns associated with soda ash production. Collaborating with regulatory bodies and adopting best practices in environmental management help ensure long-term sustainability and foster positive relationships with stakeholders.

Soda Ash Market Trends

A significant trend impacting the market is the increasing emphasis on recycling and the focus on circular economy models. The growing awareness regarding environmental sustainability is resulting in industries increasingly adopting circular practices to minimize waste and resource consumption. In the soda ash sector, recycling initiatives focus on reclaiming and reusing soda ash from waste streams, such as glass manufacturing and water treatment processes.

Companies are investing heavily in innovative technologies to facilitate the recycling of soda ash, thereby reducing the need for virgin production and mitigating environmental impact. This aligns with concerted global efforts toward creating a more sustainable and resource-efficient economy, thus stimulating market growth and fostering a greener future.

Another significant trend in the soda ash market is the increased penetration into emerging economies. Rapid industrialization and urbanization in countries such as India, Brazil, and Indonesia have created substantial demand for soda ash across various industries. Rising disposable incomes and changing consumer lifestyles further fuel market growth in these regions.

Market players are capitalizing on opportunities in emerging economies by investing in production facilities and establishing strategic partnerships with local businesses. Additionally, governments in these regions are implementing favorable policies to attract foreign investments and promote industrial development, resulting in the expansion of the market.

Segmentation Analysis

The global market is segmented based on type, density, end-use industry, and geography.

By Type

Based on type, the market is categorized into synthetic and natural. The synthetic segment led the soda ash market in 2023, reaching a valuation of USD 14.26 million. This dominance is primarily attributed to the widespread availability and cost-effectiveness of synthetic soda ash compared to its natural counterpart. Synthetic soda ash is produced through the Solvay process, which offers consistent quality and higher purity levels, making it a highly preferred choice for various industrial applications.

Additionally, synthetic soda ash production is easier to scale up to meet growing demand, contributing to its market dominance. Moreover, technological advancements in synthetic soda ash production processes continue to enhance efficiency and reduce production costs, thereby bolstering segmental growth.

By Density

Based on density, the market is classified into light and dense. The dense segment is poised to witness significant growth, registering a CAGR of 5.59% through the forecast period (2024-2031). This growth is mainly fueled by the increasing demand for dense soda ash in the glass manufacturing industry.

Dense soda ash, also known as soda ash dense or soda ash light, is increasingly favored for its higher purity and greater alkalinity, making it ideal for glassmaking processes. Additionally, the rising usage of dense soda ash in water treatment applications fuels segmental growth. Furthermore, advancements in production technologies and logistics infrastructure contribute to the expansion of the dense soda ash segment.

By End-Use Industry

Based on end-use industry, the market is segmented into glass industry, soaps & detergents, chemical industry, pulp & paper, and others. The glass industry segment secured the largest soda ash market share of 44.34% in 2023. This dominance is primarily propelled by the extensive use of soda ash as a key raw material in glass production.

Soda ash facilitates the melting process, improves the transparency and durability of glass, and helps control the pH level of glass melts. The booming construction and automotive industries worldwide have led to increased demand for glass products, thereby propelling the growth of the glass industry segment. Additionally, innovations in glass formulations and manufacturing processes continue to drive demand for soda ash in this segment.

Soda Ash Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The Asia-Pacific Soda Ash Market share stood around 39.46% in 2023 in the global market, with a valuation of USD 8.05 billion. This dominance is largely facilitated by the region's thriving manufacturing industries, particularly in China and India. These countries boast large-scale production facilities and robust demand for soda ash across diverse sectors such as glass manufacturing, detergents, and chemicals.

Additionally, favorable government policies and increased investments in infrastructure support domestic market growth. Moreover, Asia-Pacific's expanding population and rapid urbanization boost consumption of consumer goods, resulting in a strong demand for soda ash across various applications, consolidating its dominance in the market.

North America is poised to experience the fastest growth, recording a CAGR of 6.31% through the estimated timeframe. This growth is primarily augmented by increasing demand from various end-use industries such as glass manufacturing, detergents, and chemicals. The region benefits from ongoing technological advancements and innovation, leading to improved production processes and product quality, thereby stimulating regional market growth.

Additionally, stringent environmental regulations in North America stimulate the widespread adoption of eco-friendly manufacturing practices, including the use of soda ash in cleaner production methods. Moreover, the region's stable economy and surging consumer preferences for sustainable products propel the North America soda ash market progress.

Competitive Landscape

The global soda ash market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Soda Ash Market

- Ciner Group

- Genesis Energy, L.P.

- GHCL Limited

- HUBEI YIHUA CHEMICAL INDUSTRY CO., LTD.

- Sahand Industrial Group

- Şişecam

- Solvay SA

- Tata Chemicals Ltd.

- CIECH S.A.

- DCW Ltd.

Key Industry Developments

- December 2023 (Technology): Solvay SA announced the implementation of its e.Solvay process for the production of soda ash, a proprietary technology developed with an investment of USD 43.18 million. This has helped the company, achieve significant improvements in environmental and resource efficiency. This new technology reduced carbon dioxide emissions by 50%, energy, water, and salt consumption by 20%, and limestone usage by 30%. The electrochemical process, powered by renewable energy, lowered operational costs, thereby enhancing sustainability and competitiveness in soda ash production.

- July 2023 (Launch): Inner Mongolia Berun Group located in China began production at a new natural soda ash factory in Alxa Right Banner, Inner Mongolia. The facility is projected to reach a capacity of 5 million metric tons by year-end (2023), representing 13.8% of China's total production. The company invested USD 2 billion and plans to invest an additional USD 3 billion to expand capacity to 7.8 million metric tons.

The global soda ash market is segmented as:

By Type

By Density

By End-Use Industry

- Glass Industry

- Soaps & Detergents

- Chemical Industry

- Pulp & Paper

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America