Market Definition

Smart warehousing involves the use of advanced technologies such as automation, robotics, IoT, and AI-driven software to streamline core warehouse functions, including inventory control, order processing, and real-time asset monitoring.

The market includes a comprehensive range of solutions such as warehouse management systems (WMS), autonomous mobile robots (AMRs), automated storage and retrieval systems (AS/RS), RFID, sensors, and cloud-based analytics. It supports key sectors like retail, e-commerce, manufacturing, logistics, and healthcare by enhancing operational accuracy, increasing storage efficiency, and enabling data-driven supply chain decisions through connected, intelligent infrastructure.

Smart Warehousing Market Overview

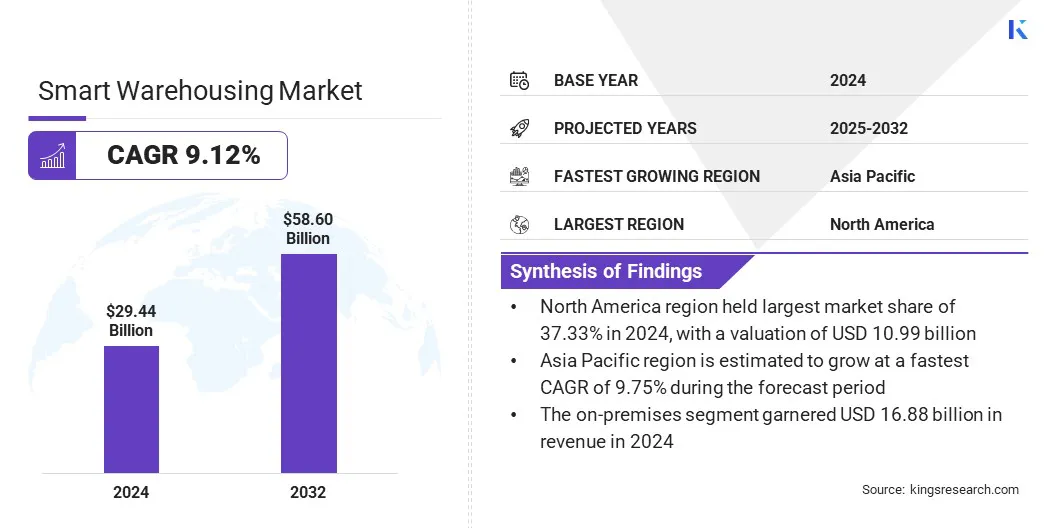

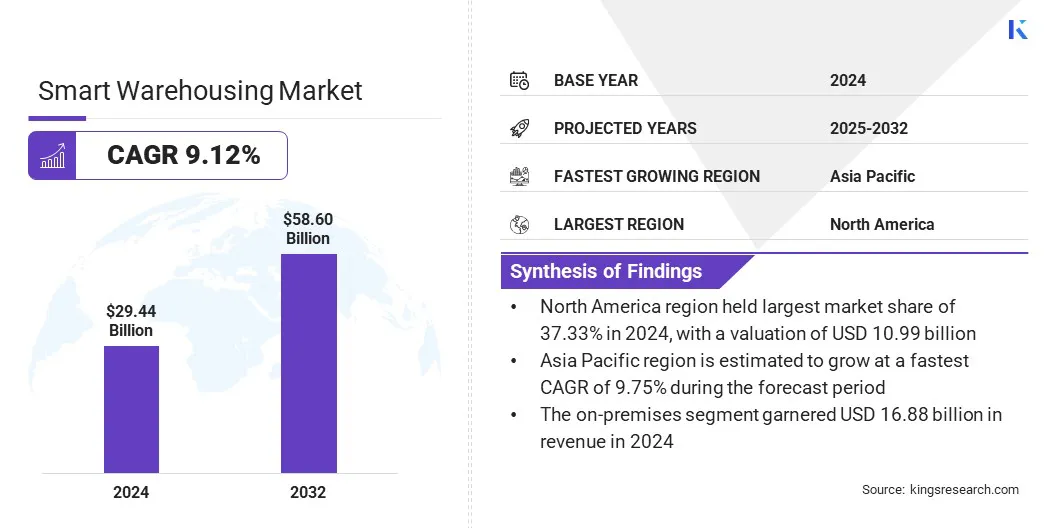

The global smart warehousing market size was valued at USD 29.44 billion in 2024 and is projected to grow from USD 31.80 billion in 2025 to USD 58.60 billion by 2032, exhibiting a CAGR of 9.12% during the forecast period. The market growth is attributed to the increasing need for real-time operational transparency & process automation and rising use of AMRs to enhance material handling, navigation, and task execution.

Major companies operating in the smart warehousing industry are Manhattan Associates, Oracle, SAP SE, Tecsys, PSI Software SE, Reply, Infor, IBM, Blue Yonder Group, Inc., Generix Group, WiseTech Global group, ABB, Microsoft, Foysonis, and NextSCM Solutions Private Limited.

The expansion of global trade and cross-border e-commerce logistics is driving the market, as it increases the need for intelligent, high-speed, and coordinated warehouse operations. This includes the steady rise in international parcel volumes, broader global consumer access, and the requirement for accurate inventory tracking across borders.

Technology providers and warehouse solution manufacturers are responding by deploying these integrated solutions across global supply chain infrastructures. They are developing scalable systems that support cross-border inventory control, customs compliance, and last-mile delivery through centralized operational frameworks. This alignment with expanding global logistics networks continues to accelerate the adoption of smart warehousing technologies.

- In June 2025, Logistics Reply partnered with KIKO Milano to enhance its UK e-commerce operations by deploying the LEA Reply Warehouse Management System (WMS) in London. This collaboration reflects a growing trend in the smart warehouse market, where brands leverage automation and data-driven solutions to build agile, scalable, and fulfillment-optimized logistics infrastructure for online retail.

Key Highlights:

- The smart warehousing industry size was valued at USD 29.44 billion in 2024.

- The market is projected to grow at a CAGR of 9.12% from 2025 to 2032.

- North America held a market share of 37.33% in 2024, with a valuation of USD 10.99 billion.

- The hardware segment garnered USD 13.93 billion in revenue in 2024.

- The on-premises segment is expected to reach USD 32.75 billion by 2032.

- The order fulfillment segment secured the largest revenue share of 35.51% in 2024.

- The retail & e-commerce segment is poised for a robust CAGR of 10.93% through the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 9.75% during the forecast period.

Market Driver

Rising Demand for Real-time Visibility and Automation

Rising operational complexity and the increasing requirement for real-time inventory visibility are driving the adoption of IoT and automation technologies, contributing to the growth of the smart warehousing market. These technologies facilitate continuous data capture, real-time tracking, and coordinated warehouse operations. They address inefficiencies in inventory management, enhance order accuracy, and enable agile responses to dynamic supply chain demands.

Solution providers and warehouse technology manufacturers are actively developing integrated platforms that utilize sensors, autonomous systems, and real-time analytics. Moreover, companies are embedding AI-powered capabilities and connected infrastructure to ensure operational transparency and predictive control. This strategic focus on automated, data-centric operations is strengthening the smart warehousing ecosystem and accelerating overall market expansion.

- In October 2024, the National Institute of Standards and Technology (NIST) highlighted that IoT-enabled asset tracking systems now provide real-time visibility into an item’s location, status, and condition, enabling more precise inventory control.

Market Challenge

High Capital Investment Requirements Limiting Adoption

A key challenge in the smart warehousing market is the high initial investment required for implementing advanced technologies such as IoT, automation systems, and AI-powered platforms. This capital-intensive deployment restricts adoption among small and mid-sized enterprises and limits market penetration across cost-sensitive regions. The substantial upfront cost impacts the pace of digital transformation and delays the realization of operational efficiency gains in many facilities.

Solution providers are offering modular automation tools, cloud-based platforms, and subscription-based pricing models that reduce financial strain on end users. Manufacturers are focusing on scalable systems that allow phased implementation, enabling gradual integration based on operational priorities.

This approach supports broader adoption by aligning capital requirements with measurable returns, which helps mitigate investment-related constraints and sustain market advancement.

Market Trend

Adoption of Autonomous Mobile Robots

The deployment of AMRs for material handling and order fulfillment is a significant trend in the smart warehousing market. AMRs enable flexible navigation, automated transport, and real-time coordination across storage zones without fixed infrastructure. This enhances operational speed, reduces manual labor, and improves picking accuracy in high-volume warehouse environments.

The transition toward AMR-based workflows is improving warehouse responsiveness and contributing to the overall efficiency & scalability of smart warehousing operations.

- In February 2025, Brightpick unveiled Brightpick Giraffe, a robot capable of reaching 20 feet to triple storage density versus manual operations. Working with Autopickers, it retrieves totes from upper levels for order picking and replenishment. This innovation aligns with the trend of adopting AMRs for material handling and fulfillment.

Smart Warehousing Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Hardware (Sensors & Detectors, Automation Devices, Automated Storage & Retrieval Systems (AS/RS)), Software (Warehouse Management Systems (WMS), Inventory Management Systems, Transportation Management Systems (TMS)), Services (System Integration & Implementation, Consulting Services, Support & Maintenance Services, Managed Services, Training Services)

|

|

By Deployment Model

|

On-Premises, Cloud-Based

|

|

By Application

|

Inventory Management, Order Fulfillment, Asset Tracking, Predictive Analytics

|

|

By Industry Vertical

|

Transportation & Logistics, Retail & E-commerce, Healthcare & Life Sciences, Food & Beverages, Automotive

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Component (Hardware, Software, and Services): The hardware segment earned USD 13.93 billion in 2024, due to the high demand for automation equipment such as autonomous mobile robots, sensors, and RFID systems that enable real-time operations and efficient material handling.

- By Deployment Model (On-Premises, and Cloud-Based): The on-premises segment held 57.32% share of the market in 2024, due to its ability to offer enhanced data security, system customization, and seamless integration with existing infrastructure for large-scale warehouse operations.

- By Application (Inventory Management, Order Fulfillment, Asset Tracking, and Predictive Analytics): The order fulfillment segment is projected to reach USD 20.65 billion by 2032, owing to increasing e-commerce demand, which requires fast, accurate, and automated processing of high-volume orders across distribution centers.

- By Industry Vertical (Transportation & Logistics, Retail & E-commerce, Healthcare & Life Sciences, Food & Beverages, and Automotive): The retail & e-commerce segment earned USD 9.65 billion in 2024, due to the rising need for real-time inventory visibility, rapid order processing, and scalable automation to manage high-volume consumer demand.

Smart Warehousing Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America smart warehousing market share stood at around 37.33% in 2024, with a valuation of USD 10.99 billion. This market dominance is attributed to the accelerated growth in e-commerce, which is driving the demand for automated and real-time fulfillment solutions such as autonomous mobile robots, intelligent picking systems, and cloud-based warehouse management platforms in the region.

Rapid digitalization of retail and rising consumer expectations for faster deliveries are pushing warehouses to adopt advanced technologies. Moreover, companies are deploying AI-powered WMS, and sensor-based systems to improve operational speed and accuracy. This continued emphasis on automation and optimization strengthens North America’s leadership in the market.

- In December 2024, GEODIS surpassed 10 million robot-assisted picks at its Pennsylvania facility using Locus Robotics, highlighting how surging e-commerce demand is accelerating automation in warehousing in North America.

The smart warehousing industry in Asia Pacific is poised for a CAGR of 9.75% over the forecast period. This growth is attributed to the integration of Artificial Intelligence (AI), Internet of Things (IoT), and robotics to optimize warehouse operations and enhance real-time visibility across logistics networks. AI enables predictive analytics and demand forecasting, while IoT sensors provide continuous tracking of goods, equipment, and environmental conditions.

Additionally, robotics streamline repetitive tasks such as picking, sorting, and internal transport. As a result, this coordinated use of advanced technologies is driving efficiency, accuracy, and scalability, positioning Asia Pacific as the leading region in the market. The regional market is fueled by robust company investments in these technologies to strengthen operational performance and meet growing regional demand.

Regulatory Frameworks

- In the U.S., the Occupational Safety and Health Administration (OSHA) regulates the market by enforcing safety standards for automation systems and ensuring secure human-machine interaction & operational compliance across automated warehouse environments.

- In China, the Ministry of Industry and Information Technology (MIIT) regulates the market by enforcing IoT and automation standards, advancing warehouse digitization through the “Made in China 2025” initiative.

Competitive Landscape

The smart warehousing industry is witnessing innovations through the launch of advanced automation solutions, cloud-based warehouse management systems, and AI-powered robotics. Market participants are introducing integrated platforms that enhance real-time visibility, inventory control, and order fulfillment efficiency.

Moreover, several companies are deploying autonomous technologies and scalable infrastructure to support high-volume operations. These developments reflect a strategic focus on improving warehouse productivity and meeting evolving logistics demands across industries.

- In July 2024, Cart.com, Inc. launched Constellation Warehouse Management System (WMS) and Transportation Management System (TMS) to optimize inventory, shipping, returns, and labor operations for scalable, cost-efficient logistics.

List of Key Companies in Smart Warehousing Market:

- Manhattan Associates

- Oracle

- SAP SE

- Tecsys

- PSI Software SE

- Reply

- Infor

- IBM

- Blue Yonder Group, Inc.

- Generix Group

- WiseTech Global group

- ABB

- Microsoft

- Foysonis

- NextSCM Solutions Private Limited

Recent Developments (Partnerships/ Product Launches)

- In April 2025, Gorilla Technology Group Inc. partnered with Toyota material handling warehouse solutions to co-develop AI-powered warehouse automation, addressing inefficiencies, part errors, and delays through intelligent, accurate, and efficient smart warehousing systems.

- In June 2024, Scanco Software, LLC launched its advanced automated WMS, delivering a feature-rich, cost-effective solution fully integrated with Acumatica Enterprise Resource Planning (ERP) for optimized warehouse operations.

- In November 2023, Tecsys Inc. launched Elite WMS for healthcare distribution with embedded serialized DSCSA support to ensure efficient and continuous compliance with the Drug Supply Chain Security Act regulations by the U.S. Food and Drug Administration (FDA).