Market Definition

The market refers to the industry focused on advanced irrigation technologies that optimize water use through automation, sensors, weather data, and IoT integration. These systems help conserve water, reduce costs, and improve crop yields.

The report outlines the primary drivers of market growth, along with an in-depth analysis of emerging trends and evolving regulatory frameworks shaping the industry's trajectory.

Smart Irrigation Market Overview

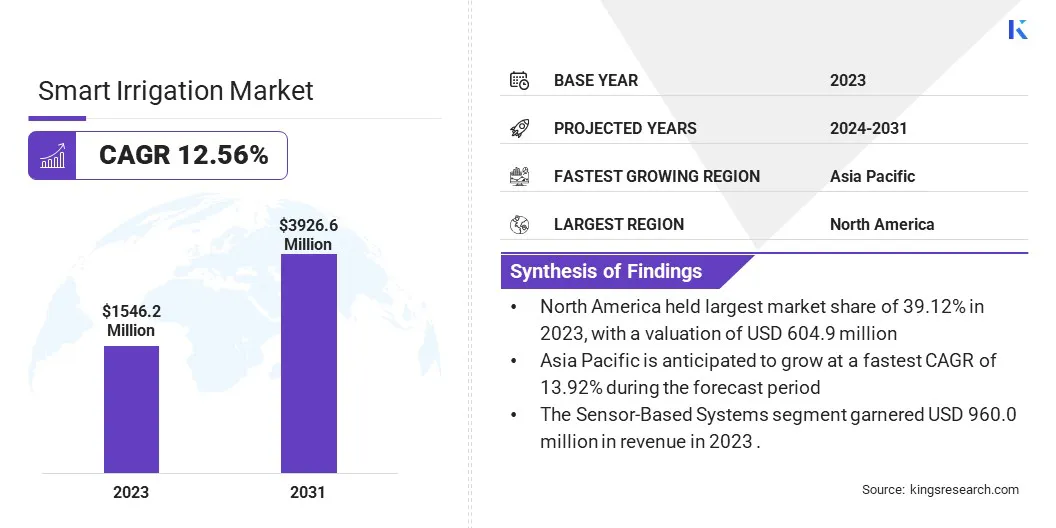

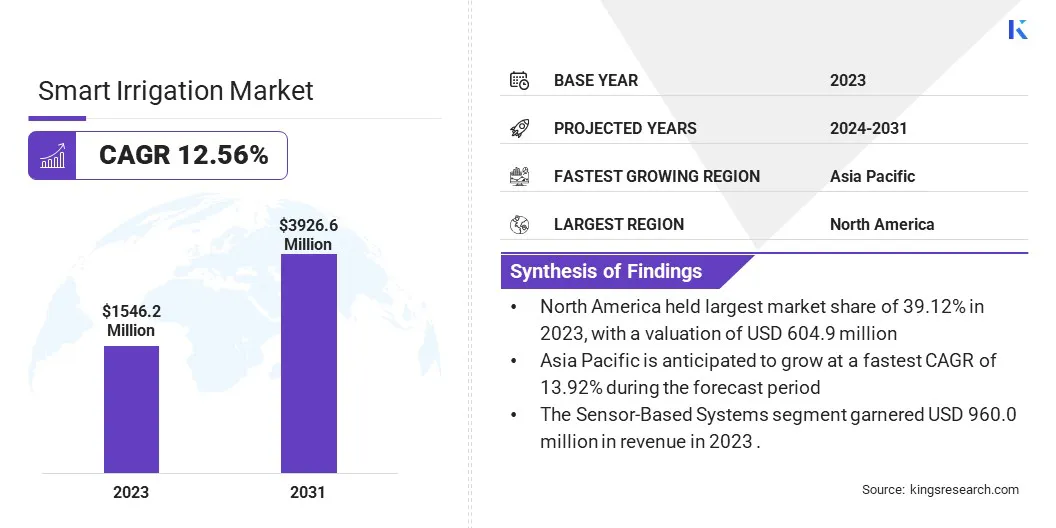

Global smart irrigation market size was valued at USD 1,546.2 million in 2023, which is estimated to be valued at USD 1,715.7 million in 2024 and reach USD 3,926.6 million by 2031, growing at a CAGR of 12.56% from 2024 to 2031.

Tailored smart irrigation solutions, developed with direct input from smallholder farmers, ensure that the technology is both user-friendly and affordable. By addressing the specific needs of farmers in water-stressed regions, these solutions promote widespread adoption and contribute to sustainable agricultural practices.

Major companies operating in the smart irrigation industry are The Toro Company, Rain Bird Corporation, Netafim, Hunter Industries Inc., WeatherTRAK, OtO Inc, Smart Rain Systems, LLC, Mobitech wireless solution private limited, Cultyvate, Galcon Bakarim Agricultural Cooperative Society Ltd., Rachio inc., Weathermatic, Irrigreen, Banyan Water, Inc, and RainMachine - Green Electronics LLC.

The market is expanding due to the increasing need for efficient water resource management driven by population growth, rising food demand, and climate change. The growing global population, projected by the United Nations to reach 8.5 billion by 2030 and 9.7 billion by 2050, increases food demand.

It leverages advanced technologies such as sensors, IoT, and automated systems to optimize water use in agriculture, landscaping, and urban applications. Moroever, increasing government incentives and policies promoting sustainable practices are further supporting the adoption of smart irrigation technologies globally.

Smart irrigation systems enhance productivity by reducing water wastage and improving resource efficiency, addressing critical challenges in modern agriculture and environmental conservation.

Key Highlights:

- The smart irrigation industry size was recorded at USD 1,546.2 million in 2023.

- The market is projected to grow at a CAGR of 12.56% from 2024 to 2031.

- North America held a market share of 39.12% in 2023, with a valuation of USD 604.9 million.

- The water flow meters & others segment garnered USD 599.5 million in revenue in 2023.

- The sensor-based systems segment is expected to reach USD 2,270.6 million by 2031.

- The agricultural segment had a market share of 65.91% in 2023.

- The distributors/dealers segment is anticipated to witness a CAGR of 14.52% during the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 13.92% during the forecast period.

Market Driver

"Empowering Smallholder Farmers"

By actively engaging smallholder farmers in the design and development of smart irrigation technologies, these solutions are better tailored to meet their practical needs and resource limitations.

This participatory approach leads to the creation of affordable, user-friendly systems that address the unique challenges faced by farmers in water-scarce and under-resourced regions. As a result, these innovations foster broader adoption, enhancing water efficiency, crop yields, and climate resilience, while driving growth in the mart irrigation market.

- In October 2023, MIT’s GEAR Lab introduced a low-cost, solar-powered precision irrigation controller, designed with input from smallholder farmers in Kenya, Morocco, and Jordan. This innovative system optimizes water and energy use, making advanced irrigation accessible to resource-constrained farmers globally.

Market Challenge

"Maintenance & Support"

A significant hurdle in the smart irrigation market is ensuring consistent maintenance and technical support, especially in remote areas with limited access to skilled technicians. To combat this, companies can offer remote diagnostics and troubleshooting tools, coupled with training programs.

Additionally, establishing partnerships with regional service providers can ensure timely support, boosting confidence and long-term adoption of smart irrigation technologies.

Market Trend

"Rising Adoption of Precision Irrigation Technologies"

The smart irrigation market is experiencing a surge in the adoption of precision irrigation systems. These technologies enable growers to remotely manage water usage, ensuring optimal hydration for crops.

This trend is driven by the need for resource efficiency, improved yields, and sustainable agricultural practices. By implementing precision irrigation, farmers aim to minimize water waste, reduce labor costs, and enhance overall productivity.

- In December 2024, Lumo and AvidWater partnered to bring Lumo's smart irrigation valves to California's Central Coast. This alliance combines Lumo's precision technology with AvidWater's service network, aiming to improve efficiency and sustainability for growers facing economic and environmental pressures in the region.

Smart Irrigation Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Controllers, Sensors, Water Flow Meters & Others

|

|

By System Type

|

Sensor-Based Systems, Weather-Based Systems

|

|

By Application

|

Non-Agricultural, Agricultural

|

|

By Distribution Channel

|

Direct Sales, Distributors/Dealers, Online Platforms

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Component (Controllers, Sensors, Water Flow Meters & Others): The water flow meters & others segment earned USD 599.5 million in 2023 driven by the increasing adoption of advanced irrigation technologies to optimize water usage and reduce wastage.

- By System Type (Sensor-Based Systems, Weather-Based Systems): The sensor-based systems segment held 62.09% of the market in 2023, owing to its ability to provide real-time data for precise water management and enhanced crop yields.

- By Application (Non-Agricultural, Agricultural): The agricultural segment is projected to reach USD 2,782.1 million by 2031, fueled by rising global food demand and the integration of IoT and AI technologies in farming practices.

- By Distribution Channel (Direct Sales, Distributors/Dealers, Online Platforms): The distributors/dealers segment is anticipated to have a CAGR of 14.52% during the forecast period, supported by increasing investments in supply chain optimization and the widespread adoption of smart irrigation system.

Smart Irrigation Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America smart irrigation market share stood around 39.12% in 2023 in the global market, with a valuation of USD 604.9 million. North America is dominating the market, driven by growing government initiatives for water conservation and sustainable agricultural practices.

Increasing government support the adoption of efficient irrigation technologies to address water scarcity and optimize resource use is driving the growth of the market.

Moreover, the presence of advanced technological infrastructure and widespread use of Internet of Things (IoT) devices enable precise monitoring and control of irrigation systems, enhancing water efficiency and crop productivity.

Asia Pacific smart irrigation industry is poised for significant growth at a robust CAGR of 13.92% over the forecast period. The Asia-Pacific region is experiencing rapid growth in the market due to increasing water scarcity and growing agricultural demands.

Rising population and expanding urbanization is driving the need for efficient water management in agriculture. Government initiatives promoting sustainable farming practices and investments in irrigation infrastructure is further driving the growth of the market.

- In November 2023, the Asian Development Bank (ADB) approved a USD 48 million loan for Georgia's Climate Smart Irrigation Sector Development Program. This initiative aims to modernize irrigation systems in the Kakheti region, benefiting around 1,000 farmers through water-efficient technologies and improved agricultural practices.

Regulatory Frameworks

- In the U.S., WaterSense is an Environmental Protection Agency (EPA)-sponsored program that labels water-efficient products and promotes smart irrigation, encouraging innovation, reducing water use by at least 20%, and supporting sustainability through partnerships with manufacturers, builders, and irrigation professionals.

- In EU, Regulation (EU) 2020/741 sets minimum water quality, monitoring, and risk management requirements to ensure safe, transparent use of reclaimed water for agricultural irrigation,

Competitive Landscape

Companies in the smart irrigation industry are focusing on developing innovative technologies that optimize water usage through data-driven systems. These efforts include integrating IoT sensors, AI, and weather-based analytics to automate irrigation schedules and improve precision.

Key players are aligning their products with environmental regulations goals, aiming to serve diverse sectors such as agriculture, landscaping, and urban infrastructure.

- In November 2024, Cisgenics launched its CisgenX smart irrigation system at the Irrigation Association Show in Long Beach, California, U.S. CisgenX enhances efficiency in sustainable irrigation across agriculture, landscaping, sports facilities, and urban environments.

List of Key Companies in Smart Irrigation Market:

- The Toro Company

- Rain Bird Corporation

- Netafim

- Hunter Industries Inc.

- WeatherTRAK

- OtO Inc

- Smart Rain Systems, LLC

- Mobitech wireless solution private limited

- Cultyvate

- Galcon Bakarim Agricultural Cooperative Society Ltd.

- Rachio inc.

- Weathermatic

- Irrigreen

- Banyan Water, Inc

- RainMachine - Green Electronics LLC

Recent Developments (Expansion/Product Launch)

- In June 2024, Netafim expanded its digital farming solutions in India. This includes data analytics, and automated systems for resource efficiency, climate resilience, and improved crop yields.

- In Jan 2024, Rain Bird introduced the ARC Series smart lawn irrigation timer, offering full app-based control with voice integration via Alexa or Google Home. The WiFi-enabled system supports up to 8 zones, features automatic seasonal adjustment, and qualifies for U.S. EPA WaterSense rebates.