Market Definition

The market focuses on manufacturing facilities that use advanced technologies to optimize production processes. It integrates systems such as industrial robots, control devices, sensors, industrial 3D printing, machine vision, and other intelligent solutions to enable automated, data-driven, and efficient operations.

The report examines critical driving factors, industry trends, regional developments, and regulatory frameworks impacting market growth through the projection period.

Smart Factory Market Overview

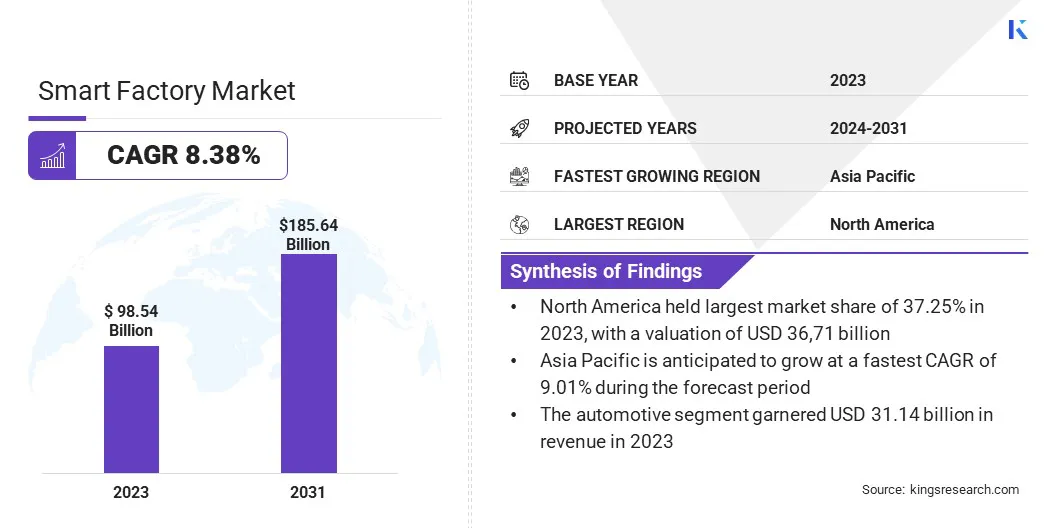

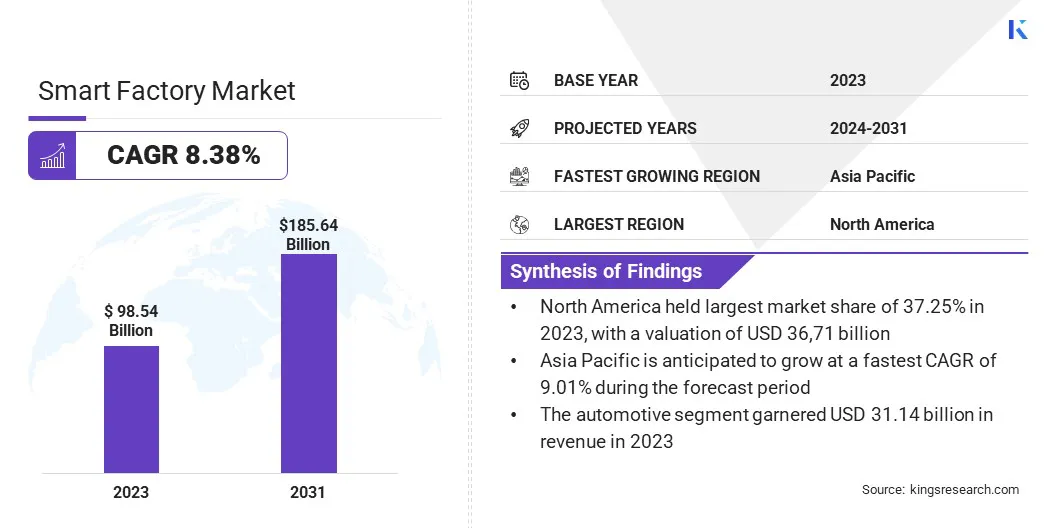

Global smart factory market size was USD 98.54 billion in 2023, which is estimated to be valued at USD 105.71 billion in 2024 and reach USD 185.64 billion by 2031, growing at a CAGR of 8.38% from 2024 to 2031.

The aerospace and automotive industries, as early adopters of smart factory technologies, boost demand for precision, scalability, and innovation. Their ongoing growth continues to support global expansion and investment in the market.

Major companies operating in the smart factory industry are ABB, Emerson Electric Co., Siemens, Schneider Electric, Mitsubishi Corporation, General Electric Company, Rockwell Automation, Honeywell International Inc, Yokogawa Electric Corporation, Omron Corporation, Endress+Hauser Group Services AG, FANUC CORPORATION, WIKA, Stratasys, 3D Systems, Inc., and others.

The = market is experiencing rapid growth, fueled by increasing demand for automation, data-driven decision-making, and enhanced operational efficiency. Advancements in IoT, AI, and cloud computing are enabling manufacturers to streamline processes, reduce downtime, and improve product quality.

With industries shifting toward Industry 4.0, there is a strong focus on real-time data analytics, predictive maintenance, and integrated systems. This transformation is creating opportunities for innovation and long-term value, as companies seek to remain competitive in an increasingly digital landscape.

- In February 2025, West-Bake adopted Rockwell Automation’s Plex Smart Manufacturing Platform, replacing paper records to enhance real-time inventory accuracy, decision-making, and scalability. This move supports European expansion and future-proof operations through the integration of MES, ERP, and QMS systems for digital transformation.

Key Highlights:

- The smart factory industry size was recorded at USD 98.54 billion in 2023.

- The market is projected to grow at a CAGR of 8.38% from 2024 to 2031.

- North America held a market share of 37.25% in 2023, with a valuation of USD 36.71 billion.

- The industrial robots segment garnered USD 29.07 billion in revenue in 2023.

- The manufacturing execution ystem (MES) segment is expected to reach USD 58.48 billion by 2031.

- The electronics & semiconductors segment is anticipated to witness the fastest CAGR of 10.26% over the forecast period

- Asia Pacific is anticipated to grow at a CAGR of 9.01% through the projection period.

Market Driver

"Growing Aerospace and Automotive Industries"

The expansion of the aerospace and automotive sectors are propelling the growth of the smart factory market. High-tech industries, with their complex manufacturing needs, demand precision, quality, and efficiency. Smart factories meet these needs through automation, robotics, and real-time data integration.

As both sectors continue to innovate and expand, particularly with trends such as electric vehicles and next-gen aircraft, they are investing heavily in digital transformation. This shift toward for modernization is significantly accelerating the adoption of smart factory solutions across the broader manufacturing landscape.

- In February 2024, GE Aerospace announced a USD 11 million investment to transform its aircraft engine repair facility in Singapore into a state-of-the-art smart factory. In partnership with the Singapore Economic Development Board (EDB), the initiative will integrate advanced automation, additive manufacturing, and digital technologies to enhance operational efficiency, workforce capabilities, and global competitiveness in maintenance, repair, and overhaul (MRO) of commercial aircraft engines.

Market Challenge

"Skilled Workforce Shortage"

The shortage of skilled workers in managing and operating advanced technologies present a major challenge to the development of the smart factory market. As industries adopt automation, AI, IoT, and robotics, there is a growing need for experts in these fields.

To mitigate this challenge, companies can invest in reskilling and upskilling programs, partner with educational institutions to create specialized courses, and leverage online learning platforms. Additionally, fostering a culture of continuous learning and collaboration can help address the talent gap and ensure the effective deployment of smart technologies.

- In June 2024, Purdue University, in collaboration with Accenture, launched an online Smart Manufacturing Academy aimed at upskilling employees in digital transformation. The self-paced programs covers smart manufacturing, IoT, automation, and business skills to prepare workers for the evolving manufacturing landscape.

Market Trend

"Advanced 3D Mapping and Visualization"

Advanced 3D mapping and visualization have emerged as a key trend in the smart factory market. By utilizing satellite imagery and artificial intelligence (AI), manufacturers are creating high-fidelity digital representations of factory environments.

This technology enables detailed, real-time insights into factory operations, enhancing efficiency and precision. It allows for better planning, monitoring, and predictive maintenance, leading to optimized production processes.

Additionally, the integration of 3D mapping offers an immersive, interactive experience for stakeholders, advancing digital transformation in manufacturing.

- In March 2024, VIZZIO Technologies and Foxconn Industrial Internet (FII) announced a collaboration to create the world’s first LIVE 3D Digital Twin of FII's global manufacturing sites. This partnership integrates satellite imaging, AI, and real-time analytics, enhancing precision, adaptability, and sustainability in smart manufacturing.

Smart Factory Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Industrial Robots, Control Devices, Sensors, Industrial 3D Printing, Machine Vision, Others

|

|

By Solution

|

Product Lifecycle Management (PLM), Manufacturing Execution System (MES), SCADA, ERP, Others

|

|

By End-Use Industry

|

Automotive, Electronics & Semiconductors, Food & Beverage, Aerospace & Defense, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Industrial Robots, Control Devices, Sensors, Industrial 3D Printing, Machine Vision,Others): The industrial robots segment earned USD 29.07 billion in 2023, due to increasing automation demand, improved precision, and labor cost reduction in manufacturing processes.

- By Solution [Product Lifecycle Management (PLM), Manufacturing Execution System (MES), SCADA, ERP, Others]: The product lifecycle management (PLM) segment held a share of 26.70% in 2023, attributed to its ability to streamline product design, enhance collaboration, and support efficient development processes in industries.

- By End-Use Industry (Automotive, Electronics & Semiconductors, Food & Beverage, Aerospace & Defense,Others): The automotive segment is projected to reach USD 58.01 billion by 2031, propelled by rising demand for autonomous vehicles, electric cars, and increased implementation of smart manufacturing technologies.

Smart Factory Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America smart factory market share stood at around 37.25% in 2023, valued at USD 36.71 billion. This dominance is reinforced by significant investments in advanced technologies such as AI, IoT, and automation.

The regional market further benefits from a well-established industrial base, high-tech infrastructure, and a strong focus on digital transformation across sectors, such as automotive, aerospace, and manufacturing.

Additionally, favorable government policies supporting innovation, along with the presence of major industry players, have fostered rapid adoption of smart manufacturing solutions, positioning North America as a key market for smart factories.

- In June 2024, Warmflow—a family-owned home heating technology company—implemented Plex’s Smart Manufacturing Platform by U.S.-based Rockwell Automation. This cloud-based solution integrates ERP, QMS, and MES systems to enhance operational efficiency, enable real-time forecasting, and support Warmflow’s digital transformation and future growth.

Asia Pacific smart factory industry is set to grow at a CAGR of 9.01% over the forecast period. This rapid growth is propelled by rapid industrialization, increasing adoption of automation, and government initiatives supporting digital transformation.

Countries such as China, Japan, and South Korea are investing heavily in advanced manufacturing technologies, including robotics, IoT, and AI, to enhance production efficiency.

The region's growing automotive, electronics, and consumer goods sectors further fuel demand for smart factories, making it a key hub for innovation and expansion in the smart factory space.

Regulatory Frameworks

- In the U.S., the NIST Cybersecurity Framework helps businesses of all sizes to better understand, manage, and reduce cybersecurity risks, while also protecting their networks and sensitive data.

- The General Data Protection Regulation (GDPR) underscores Europe's trong commitment to data privacy and security, particularly as reliance on cloud services grows and data breaches become more frequent..

- The EU Cybersecurity Act establishes a unified certification framework for ICT products, services and processes, allowing businesses to certify once and have their certifications recognized across all EU member states.

Competitive Landscape

Companies operating in the smart factory industry are increasingly adopting Industry 4.0 technologies to enhance production efficiency, optimize supply chain management, and reduce operational costs. They are integrating automation, artificial intelligence, robotics, and the Internet of Things (IoT) to improve manufacturing processes.

Additionally, companies are focusing on data-driven insights, predictive maintenance, and real-time monitoring to boost productivity and sustainability. This shift toward digitalization allows companies to enhance product quality, accelerate time-to-market, and achieve greater flexibility and scalability in their operations.

- In August 2024, Eaton announced the modernization of its manufacturing operations through the implementation of two smart factories in Juarez, Mexico, and Changzhou, China. Leveraging Industry 4.0 technologies, these facilities aim to enhance operational efficiency, reduce energy consumption, and achieve sustainability goals, reinforcing the company’s commitment to digital transformation in manufacturing.

List of Key Companies in Smart Factory Market:

- ABB

- Emerson Electric Co.

- Siemens

- Schneider Electric

- Mitsubishi Corporation

- General Electric Company

- Rockwell Automation

- Honeywell International Inc

- Yokogawa Electric Corporation

- Omron Corporation

- Endress+Hauser Group Services AG

- FANUC CORPORATION

- WIKA

- Stratasys

- 3D Systems, Inc.

Recent Developments (Partnerships/Adoption)

- In February 2025, Hyundai Motor and Samsung introcued a Private 5G RedCap solution for smart manufacturing, aimed at enhancing communication and reducing power consumption in industrial environments. Showcased at Mobile World Congress (MWC25) in Barcelona, the collaboration marks a key advancement in mobility manufacturing technologies.

- In September 2024, Cellares completed its first cGMP Cell Shuttle at the IDMO Smart Factory in Bridgewater, New Jersey. This achievement supports large-scale cell therapy manufacturing, with the production capacity of up to 40,000 CAR-T cell therapy doses annually and plans for global expansion.

- In July 2024, LG Electronics advanced its smart factory solutions by integrating artificial intelligence (AI) and digital transformation. The company offers a range of services, including production consulting, equipment development, and training. LG aims to expand its solutions across industries such as semiconductors, pharmaceuticals, and biotechnology by 2030.