Market Definition

The market refers to systems and technologies that enable real-time adjustment of electricity consumption based on supply conditions, grid demands, or pricing signals. It includes hardware, software platforms, and communication infrastructure used by utilities, grid operators, commercial buildings, and residential users to manage and optimize energy usage.

The market is segmented by mechanism into price-based programs, where consumers voluntarily shift usage in response to time-based pricing, and incentive-based programs, where users are financially rewarded for predefined load reductions. The report highlights key market drivers, major trends, regulatory frameworks, and the competitive landscape shaping the industry’s growth.

Smart Demand Response Market Overview

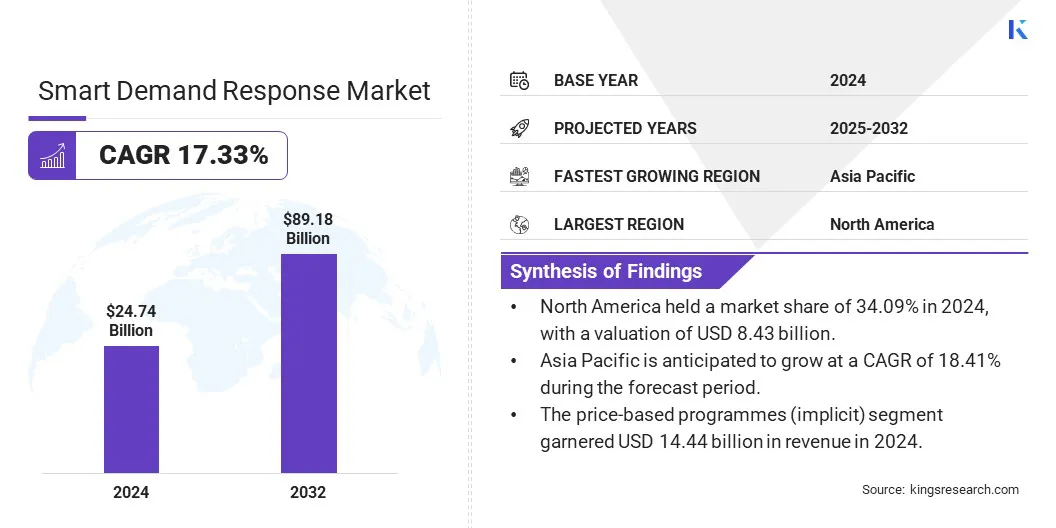

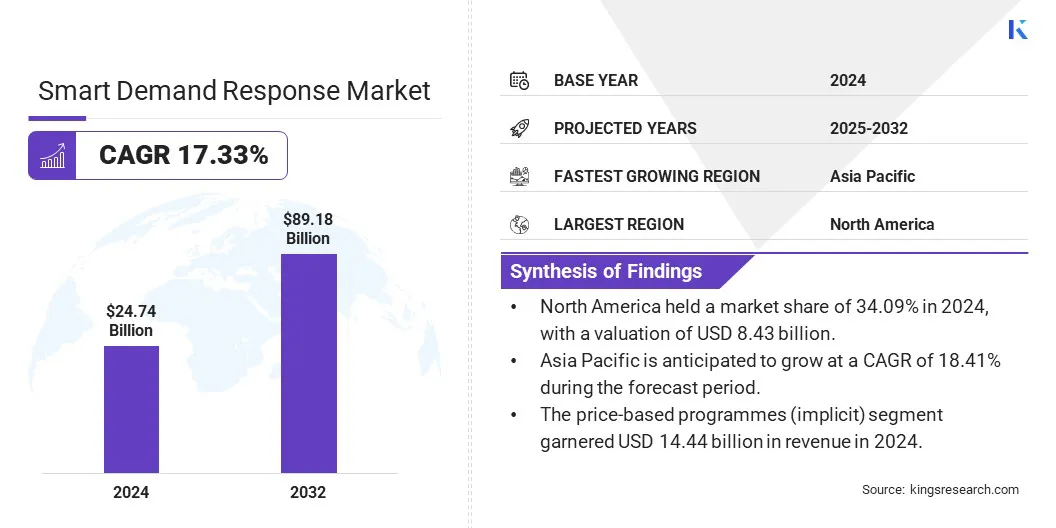

The global smart demand response market size was valued at USD 24.74 billion in 2024 and is projected to grow from USD 28.95 billion in 2025 to USD 89.18 billion by 2032, exhibiting a CAGR of 17.33% during the forecast period.

This growth is driven by the increasing need for effective energy management solutions and greater grid flexibility. With rising electricity consumption and growing emphasis on energy efficiency by the governments, utilities and end-users are adopting smart demand response to optimize load patterns and reduce peak demand.

Major companies operating in the smart demand response industry are Johnson Controls Inc., Enel Spa, VIOTAS, Schneider Electric, Mitsubishi Electric Corporation, Sympower, ABB, Itron Inc., GridPoint Inc., General Electric Company, Alarm.com, Siemens AG, Hitachi, Ltd., Eaton, and Honeywell International Inc.

Integration of artificial intelligence (AI) with demand response solutions is transforming the market by enabling more accurate load forecasting, real-time response optimization, and predictive control. AI-driven platforms are utlised to analyze large volumes of consumption data, identify usage patterns without manual intervention.

- In March 2025, Samsung expanded its SmartThings Flex Connect program into the PJM Interconnection LLC. Samsung’s SmartThings platform supports a wide range of connected devices, providing flexible options for consumers to engage in energy-saving initiatives through automated controls.

Key Highlights:

- The smart demand response market size was recorded at USD 24.74 billion in 2024.

- The market is projected to grow at a CAGR of 17.33% from 2025 to 2032.

- North America held a market share of 34.09% in 2024, with a valuation of USD 8.43 billion.

- The price-based programmes (implicit) segment garnered USD 14.44 billion in revenue in 2024.

- The residential segment is expected to reach USD 37.21 billion by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 18.41% during the forecast period.

Market Driver

Rising Demand for Energy Management Solutions

The market is driven by the increasing adoption of energy management solutions across residential, commercial, and industrial sectors. The increasing cost of electricity and growing emphasis on environmental responsibility are driving the adoption of intelligent energy management systems.

Consumers and businesses across residential, commercial, and industrial sectors are turning to smart demand response solutions to monitor, control, and reduce energy usage more efficiently. These systems enable real-time consumption tracking and automated load adjustments, helping users optimize energy use and reduce operational costs.

- In June 2024, ABB launched the ReliaHome Smart Panel energy management solution in the U.S. and Canada. Developed in collaboration with Lumin, the platform offers homeowners enhanced control over electricity use and savings through a user-friendly app. The panel supports on- and off-grid energy optimization and is universally compatible with third-party devices such as batteries, solar inverters, and electric vehicle chargers.

Market Challenge

Interoperability Issues Among Devices and Platforms

The growth of the smart demand response market is hindered by interoperability issues among devices and platforms. Many demand response programs rely on a wide range of technologies, including smart meters, thermostats, energy management systems, and utility platforms.

Incompatible communication protocols and lack of standardization make integration difficult, reducing efficiency and scalability. To overcome this, market players are adopting open standards and promoting collaboration through alliances and regulatory support.

Initiatives focused on developing interoperable frameworks and unified communication protocols are helping streamline integration, enabling seamless coordination across devices and systems within the demand response ecosystem.

Market Trend

Integration of Artificial Intelligence

The market is witnessing a shift toward the integration of artificial intelligence (AI) into energy management platforms. AI enhances the performance of demand response systems by enabling accurate load forecasting, real-time data analysis, and automated control decisions.

This allows utilities and operators to respond more efficiently to grid fluctuations and price signals. AI-driven platforms also support personalized energy recommendations for users, improving participation and energy savings. As energy systems become more complex and decentralized, the role of AI in optimizing demand response operations is becoming increasingly critical.

- In April 2024, 75F introduced a smart OpenADR-compliant solution featuring real-time occupancy prioritization and optimized air quality for utility programs aimed at reducing energy costs in commercial buildings. The automated demand response system uses AI-enabled smart devices to manage HVAC equipment across various commercial properties, prioritizing occupied zones and fresh air during load shed events without compromising comfort.

Smart Demand Response Market Report Snapshot

|

Segmentation

|

Details

|

|

By Mechanism

|

Price-based programmes (Implicit), Incentive-based programmes (Explicit)

|

|

By Application

|

Residential, Commercial, Industrial

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Mechanism (Price-based Programmes (Implicit), Incentive-based Programmes (Explicit)): The price-based programmes (Implicit) segment earned USD 14.44 billion in 2024 due to increased adoption of time-of-use tariffs and dynamic pricing models that encouraged consumer participation in peak load reduction.

- By Application (Residential, Commercial, Industrial): The residential segment held 42.17% of the market in 2024, owing to the rising smart meter installations and growing awareness among households about cost savings through energy consumption management.

Smart Demand Response Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America smart demand response market share stood at around 34.09% in 2024 in the global market, with a valuation of USD 8.43 billion. This dominance is driven by strong regulatory support, high penetration of smart meters, and well-established utility infrastructures.

Significant investments in grid modernization and early adoption of dynamic pricing models is further driving market growth. Additionally, the presence of major technology providers and favorable energy efficiency mandates are also contributing to the market growth in this region.

- In July 2024, Samsung launched SmartThings Energy Flex Connect, a demand response program in California and New York that enables users to earn rewards by automating energy-saving actions during peak demand events. The program allows eligible users to enroll supported devices like thermostats, plugs, air conditioners, lights, TVs, and appliances through the SmartThings app to participate in energy conservation efforts.

Asia Pacific is poised to grow at a significant CAGR of 18.41% over the forecast period. This growth is fueled by rapid urbanization, rising electricity demand, and increasing investments in smart grid infrastructure.

Government initiatives across China, India, Japan, and South Korea are promoting energy efficiency and grid stability. Expansion of renewable energy sources and supportive policy frameworks are encouraging the adoption of smart demand response solutions.

Regulatory Frameworks

- In the U.S., the Federal Energy Regulatory Commission (FERC) provides the regulatory framework for smart demand response. FERC Order 745 mandates that demand response resources participating inenergy markets must be compensated at the same rate as electricity generation, provided they meet cost-effectiveness criteria.

- In Europe, the Electricity Directive (EU) 2019/944 regulates the integration of demand response by requiring member states to ensure non-discriminatory market access, dynamic pricing, and support independent aggregators.

- In India, the Central Electricity Regulatory Commission (CERC) and the Bureau of Energy Efficiency (BEE) regulate demand response through pilot programs and policy initiatives under the Smart Grid Vision and Roadmap, promoting energy efficiency and load management.

Competitive Landscape

The key players in the smart demand response market are focusing on enhancing software platforms to support real-time load monitoring, dynamic pricing integration, and interoperability with distributed energy resources. Market players are investing in advanced analytics and AI-based demand forecasting to improve grid responsiveness and operational efficiency.

Strategic alliances with utilities, technology providers, and grid operators are pursued to scale solutions and expand customer reach. Additionally, companies are diversifying service portfolios by integrating demand response with energy storage, smart home technologies, and electric vehicle charging infrastructure to create comprehensive energy management solutions.

- In October 2023, the Energy Market Authority (EMA) and SP Group announced a pilot Residential Demand Response (R-DR) programme in Singapore. The initiative aims to empower households with smart meters to reduce electricity consumption during peak demand periods. This pilot is the first of its kind in Singapore to encourage demand-side participation for a more resilient and sustainable energy future.

List of Key Companies in Smart Demand Response Market:

- Johnson Controls Inc.

- Enel Spa

- VIOTAS

- Schneider Electric

- Mitsubishi Electric Corporation

- Sympower

- ABB

- Itron Inc.

- GridPoint Inc.

- General Electric Company

- Alarm.com

- Siemens AG

- Hitachi, Ltd.

- Eaton

- Honeywell International Inc.

Recent Developments (Product Launch)

- In March 2025, SPAN expanded its product suite by launching SPAN Edge, an Intelligent Service Point device designed for utilities to manage the distribution grid and support home electrification. This new at-the-meter technology delivers real-time, autonomous power controls, helping utilities save on planned infrastructure upgrades while improving reliability and affordability for customers.