Market Definition

The market encompasses the production and deployment of wind energy systems with a capacity of up to 50 kW, designed primarily for decentralized power generation.

These turbines utilize aerodynamic blades to convert wind energy into mechanical power, which is then transformed into electricity through a generator. Advanced manufacturing processes involve precision engineering, lightweight composite materials, and enhanced rotor designs to optimize energy capture.

Small wind turbines are widely used for residential, agricultural, and commercial applications, providing off-grid or supplemental power. They are also integrated into hybrid energy systems alongside solar panels and battery storage to enhance energy reliability.

Small Wind Turbine Market Overview

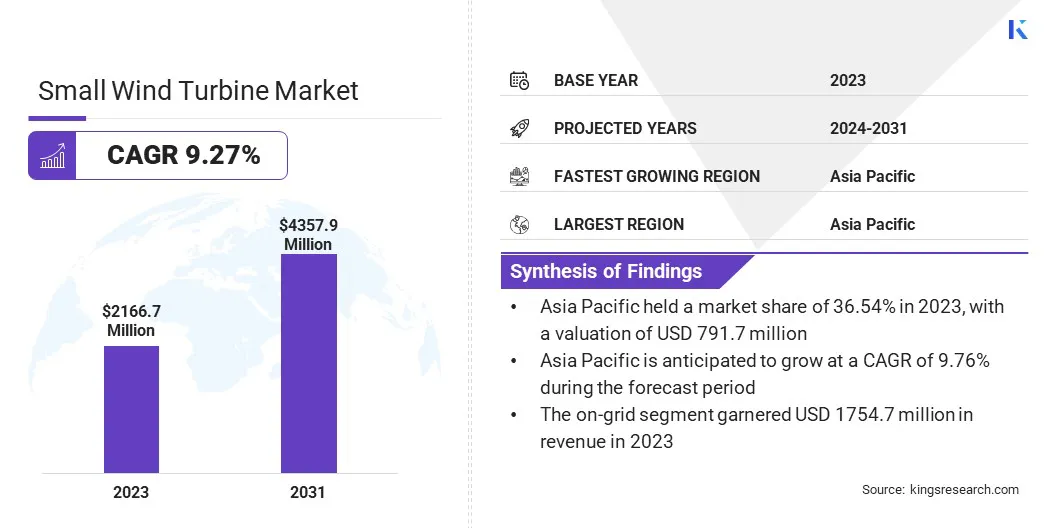

The global small wind turbine market size was valued at USD 2166.7 million in 2023 and is projected to grow from USD 2343.4 million in 2024 to USD 4357.9 million by 2031, exhibiting a CAGR of 9.27% during the forecast period.

The market is expanding, due to increasing reliance on decentralized power generation, enabling energy independence for remote areas and businesses seeking resilient off-grid solutions.

Additionally, the integration of small wind turbines with hybrid renewable energy systems, combining wind and solar power, enhances efficiency and reliability. Advancements in vertical-axis wind turbine technology are further driving adoption by offering compact, low-noise solutions suitable for urban and residential applications.

Major companies operating in the small wind turbine industry are Bergey Windpower Co., BORNAY.COM, ENESSERE S.r.l., Hi-VAWT Technology Corp., Ryse Energy, TUGE, Freen OÜ., Flower Turbines, Vergnet SA, Northern Power Systems, SD Wind Energy Limited., Aeolos Wind Energy Ltd., SENWEI ENERGY TECHNOLOGY INC., KESTREL RENEWABLE ENERGY, and EOCYCLE.

The growth of the market is supported by the increasing reliance on decentralized power generation. Businesses, agricultural operations, and residential users are investing in small wind turbines to generate electricity on-site, reducing reliance on centralized grids.

Distributed wind power enhances energy security, lowers transmission losses, and provides a cost-effective alternative to conventional energy sources. Governments are supporting distributed wind installations through incentives and regulatory frameworks promoting self-sufficiency.

- The Distributed Wind Market Report 2024 Edition, led by Pacific Northwest National Laboratory (PNNL), highlights that distributed wind projects secured approximately USD 12.4 million in funding during 2023. This funding came from state and federal incentives, tax credits, and support from the U.S. Department of Agriculture’s (USDA) Rural Energy for America Program, marking an increase of more than double compared to each of the previous two years. Additionally, distributed wind is expanding into new and remote areas, including Alaska’s northernmost regions, and entering emerging markets such as EV manufacturing.

Key Highlights:

- The small wind turbine industry size was valued at USD 2166.7 million in 2023.

- The market is projected to grow at a CAGR of 9.27% from 2024 to 2031.

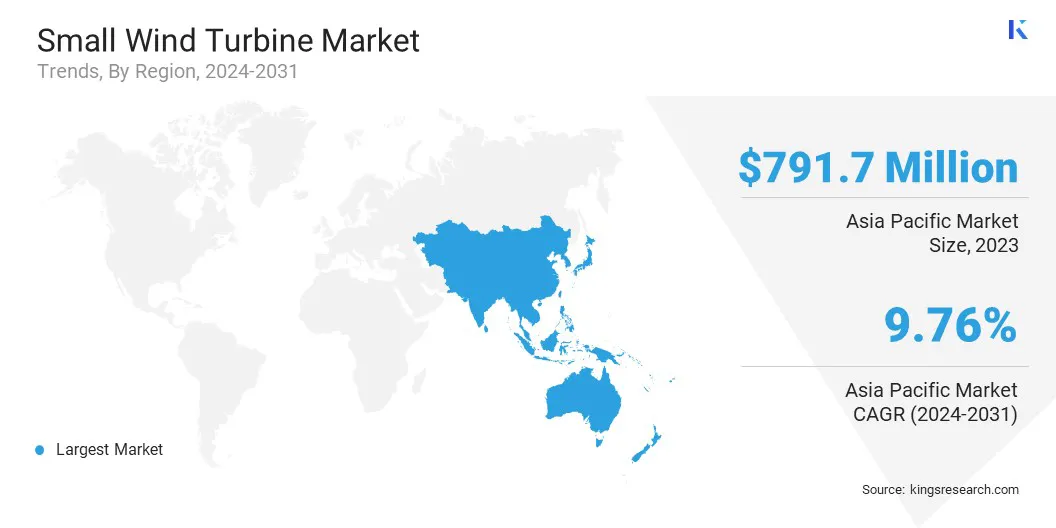

- Asia Pacific held a market share of 36.54% in 2023, with a valuation of USD 791.7 million.

- The horizontal axis wind turbines (HAWTs) segment garnered USD 1879.8 million in revenue in 2023.

- The 10–50 kW segment is expected to reach USD 2212.9 million by 2031.

- The on-grid segment secured the largest revenue share of 80.99% in 2023.

- The industrial segment is poised for a robust CAGR of 10.10% through the forecast period.

- The market in North America is anticipated to grow at a CAGR of 9.70% during the forecast period.

Market Driver

"Increasing Integration with Hybrid Renewable Energy Systems"

The small wind turbine market is registering significant growth, due to the increasing adoption of hybrid energy solutions. Combining small wind turbines with solar photovoltaics and battery storage is enhancing energy stability and optimizing power generation.

Businesses and households are investing in hybrid systems to maximize renewable energy utilization and reduce dependency on traditional power sources. Advancements in energy management systems are improving the efficiency of integrated solutions, making them more viable for remote and urban applications.

The expansion of hybrid energy infrastructure is strengthening the market presence of small wind turbines in global energy systems.

- In January 2024, French energy startup New World Wind introduced the WindTree, a tree-shaped turbine featuring Aeroleaf Hybrid micro-wind turbines. These uniquely designed leaves harness wind energy as they spin, while small solar panels integrated at the base of each leaf capture sunlight. This dual-function design enables the generation of power through wind and solar energy, ensuring continuous energy production.

- In May 2023, Blinkwater Village in Eastern Cape gained access to reliable electricity through a mini hybrid grid featuring six 3.5-kilowatt Kestrel wind turbines and 50 kilowatts of solar panels. This hybrid system generates sufficient power to support the 350-household community, enabling stable cellphone connectivity, facilitating education, supporting business activities, and enhancing daily life through television entertainment and cooking.

Market Challenge

"High Initial Investment and Cost Barriers"

The small wind turbine market faces challenges, due to high initial investment costs, including equipment, installation, and grid integration expenses. These financial barriers limit adoption, particularly for small businesses and residential users.

Companies are focusing on developing cost-effective turbine designs, leveraging advanced materials to enhance durability while reducing manufacturing costs.

Additionally, financing models such as leasing options, power purchase agreements, and government-backed subsidies are being introduced to make small wind systems more accessible. Innovations in modular and scalable turbine solutions are further driving affordability, ensuring wider adoption across diverse consumer segments.

Market Trend

"Advancements in Vertical-Axis Wind Turbine Technology"

The development of vertical-axis wind turbines (VAWTs) is expanding the application potential of small wind energy systems. VAWTs offer advantages such as low noise, compact design, and the ability to operate efficiently in turbulent wind conditions. Urban areas, commercial buildings, and industrial sites are increasingly adopting these systems to generate renewable energy in constrained spaces.

Innovations in aerodynamics and materials are improving the efficiency and durability of VAWTs, making them a viable option for distributed energy generation. Furthermore, advancements in turbine technology are driving the adoption of small wind turbines across diverse environments.

- In November 2024, Freen introduced advanced small wind turbines, marking the result of nearly a decade of research and development. These innovations set new benchmarks for global small-scale renewable energy solutions by leveraging VAWT) technology. Available in 3 kW, 20 kW, and 55 kW capacities, Freen’s turbines offer scalable and adaptable solutions suitable for both residential and commercial applications.

Small Wind Turbine Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Horizontal Axis Wind Turbines (HAWTs), Vertical Axis Wind Turbines (VAWTs)

|

|

By Capacity

|

Below 1 kW, 1–10 kW, 10–50 kW

|

|

By Grid Connectivity

|

On-grid, Off-grid

|

|

By Application

|

Residential, Commercial, Industrial, Agriculture

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Horizontal Axis Wind Turbines (HAWTs) and Vertical Axis Wind Turbines (VAWTs)): The horizontal axis wind turbines (HAWTs) segment earned USD 1879.8 million in 2023, due to its higher energy conversion efficiency, well-established technology, and proven reliability in diverse wind conditions, making it the preferred choice for residential, commercial, and agricultural applications.

- By Capacity (Below 1 kW, 1–10 kW and 10–50 kW): The 10–50 kW segment held 48.95% share of the market in 2023, due to its optimal balance between power output and installation feasibility, making it a preferred choice for agricultural operations, small businesses, and community-scale projects seeking reliable on-site energy generation with lower grid dependence.

- By Grid Connectivity (On-Grid and Off-Grid): The on-grid segment is projected to reach USD 3487.2 million by 2031, owing to its direct integration with existing power infrastructure, allowing users to offset electricity costs through net metering policies while ensuring a reliable energy supply without the need for extensive storage solutions.

- By Application (Residential, Commercial, Industrial, and Agriculture): The industrial segment is poised for significant growth at a CAGR of 10.10% through the forecast period, due to the rising demand for on-site renewable energy solutions that reduce operational costs, enhance energy security, and support sustainability goals, driving widespread adoption across manufacturing facilities, warehouses, and industrial complexes.

Small Wind Turbine Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific small wind turbine market accounted for a market share of around 36.54% in 2023, with a valuation of USD 791.7 million. Several countries in Asia Pacific are offering feed-in tariffs (FiTs), tax benefits, and capital subsidies to encourage the adoption of small wind turbines.

In Australia, state-level initiatives such as the Renewable Energy Target (RET) scheme are making small wind investments more attractive, further driving the market. Additionally, China's rapid advancement in renewable energy is significantly impacting the market.

- By mid-2024, China achieved its 2030 target of 1,200 gigawatts of installed solar and wind capacity, six years ahead of schedule. This acceleration is part of a broader strategy to reach peak carbon emissions by 2030 and achieve carbon neutrality by 2060.

- The government's substantial investments, including approximately USD 800 million earmarked for power grid modernization by 2030, are fostering an environment conducive to the adoption of small wind turbines, particularly in distributed energy systems.

The small wind turbine industry in North America is poised for significant growth at a robust CAGR of 9.70% over the forecast period. The market in North America is registering strong growth, due to its increased adoption in rural and agricultural areas.

Farmers and ranchers are integrating small wind turbines to power irrigation systems, storage facilities, and off-grid applications, reducing dependency on conventional power grids.

- The U.S. Department of Agriculture (USDA) supports distributed wind projects through initiatives like the Rural Energy for America Program (REAP), which provided over USD 12.4 million in funding in 2023. This financial backing is accelerating the deployment of small wind turbines across farms and remote communities, strengthening the market in the region.

Furthermore, the increasing frequency of extreme weather events and power outages in North America has intensified the demand for microgrids and resilient energy systems.

Small wind turbines are becoming a crucial component of decentralized energy networks, providing reliable power for communities vulnerable to grid disruptions, further fueling the market across the region.

Regulatory Frameworks

- In the U.S., the small wind turbine market is governed by regulations such as the Federal Aviation Administration (FAA) guidelines, which mandate aeronautical studies for turbines exceeding specific height limits. Compliance with the National Environmental Policy Act (NEPA) is required to assess environmental impacts before project approval. The industry also adheres to state-level renewable energy policies that offer incentives, tax credits, and net metering programs to promote distributed wind installations.

- The European Union (EU) enforces IEC 61400-1 design standards, which set engineering requirements for wind turbines, including mechanical, electrical, and structural components. Compliance with the Renewable Energy Directive (RED II) mandates the promotion of wind energy within member states, encouraging investments through subsidies and FITs. The EU’s environmental policies require wind projects to undergo impact assessments to minimize ecological disruptions.

- Japan enforces the Environmental Impact Assessment Act, requiring wind energy projects that exceed specified thresholds to conduct environmental impact assessments before development. The country’s FIT scheme guarantees fixed electricity purchase prices, ensuring financial viability for small wind turbine installations. Regulatory guidelines set by the Ministry of Economy, Trade and Industry (METI) establish grid connectivity standards and operational safety requirements.

- South Korea’s Renewable Portfolio Standards (RPS) mandate power producers to generate a minimum percentage of electricity from renewable sources, including wind. The Korean Agency for Technology and Standards (KATS) enforces rigorous safety and performance criteria for small wind turbines, ensuring technological reliability.

Competitive Landscape:

The small wind turbine industry is characterized by several market players, which are focusing on the development of scalable and hybrid advanced solutions to enhance the efficiency and adaptability of small wind turbines.

Companies are addressing diverse energy needs across urban and rural environments by integrating wind and solar technologies into modular systems. These innovations improve energy reliability, optimize rooftop installations, and reduce dependence on conventional grid systems.

Such strategic advancements are driving the adoption of small wind turbines, strengthening their role in the global transition to sustainable power solutions. The emphasis on hybrid and scalable designs is contributing to the expansion of the market, enabling broader deployment across residential, commercial, and industrial sectors.

- In November 2023, Flower Turbines introduced the Eco-Roof Energy Hub, an advanced solution for seamlessly integrating wind & solar systems on flat rooftops without the need for bolts. This design overcomes challenges linked to conventional mounting methods. Currently available in the EU, the company plans to expand its reach to additional markets soon.

List of Key Companies in Small Wind Turbine Market:

- Bergey Windpower Co.

- BORNAY.COM

- ENESSERE S.r.l.

- Hi-VAWT Technology Corp.

- Ryse Energy

- TUGE

- Freen OÜ.

- Flower Turbines

- Vergnet SA

- Northern Power Systems

- SD Wind Energy Limited.

- Aeolos Wind Energy Ltd.

- SENWEI ENERGY TECHNOLOGY INC.

- KESTREL RENEWABLE ENERGY

- EOCYCLE

Recent Developments (M&A/Agreements)

- In July 2024, Ecoways acquired Wind Energy Solutions (WES), a Dutch company recognized for its two-blade small wind turbines. This acquisition enables Ecoways to further expand its wind energy services, strengthening its capabilities in the small wind turbine sector.

- In July 2024, Bergey Windpower secured USD 500,000 in funding from the U.S. Department of Energy to enhance distributed wind turbine technology. The investment supports the implementation of advanced blade manufacturing processes, aiming to meet the rising demand while lowering production costs.

- In August 2023, Ryse Energy acquired Primus Wind Power, a well-established manufacturer of micro wind turbines. This acquisition strengthens Ryse Energy’s ability to deliver a broader range of high-performance wind turbines and hybrid renewable energy systems to international markets. The Primus Wind Power AIR turbines will be integrated into Ryse Energy’s small turbine portfolio, which spans capacities from 3 kW to 60 kW.