Market Definition

Silicone elastomers are high-performance synthetic rubbers made of crosslinked polysiloxane chains, offering flexibility, thermal stability, chemical resistance, and electrical insulation. They include liquid silicone rubber (LSR), high-consistency rubber (HCR), and room-temperature vulcanizing (RTV) silicone.

Widely used in automotive components, medical devices, electronics insulation, cookware, adhesives, and personal care products, they serve as a critical material for durable and reliable applications.

Silicone Elastomers Market Overview

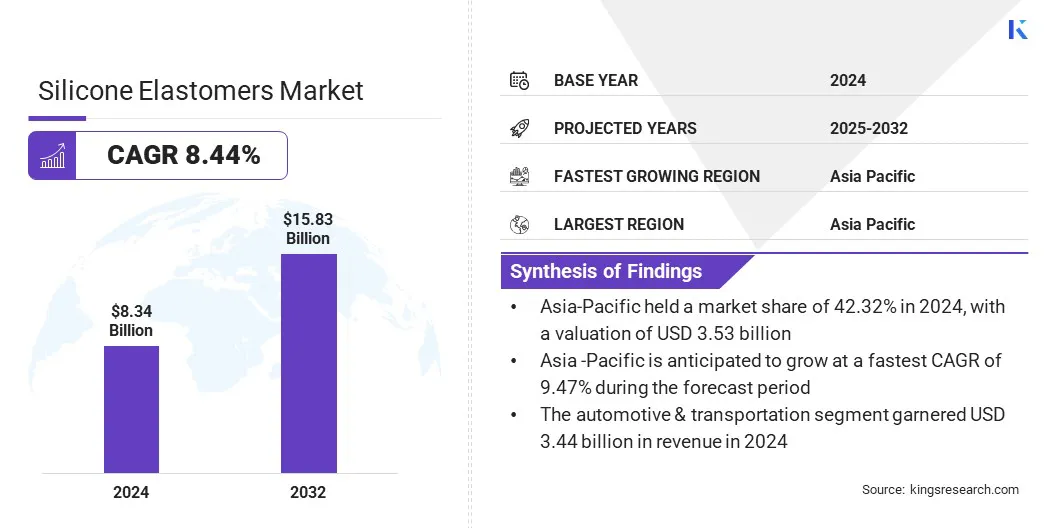

The global silicone elastomers market was valued at USD 8.34 billion in 2024 and is projected to grow from USD 8.97 billion in 2025 to USD 15.83 billion by 2032, exhibiting a CAGR of 8.44% during the forecast period.

This growth is driven by the rising demand for high-performance materials in automotive, electronics, and healthcare applications, where silicone elastomers offer thermal stability, chemical resistance, and durability. Additionally, expansion in construction and infrastructure is boosting the use of silicone-based sealants, gaskets, glazing, and insulation for reliable and long-lasting performance.

Key Highlights:

- The silicone elastomers industry was recorded at USD 8.34 billion in 2024.

- The market is projected to grow at a CAGR of 8.44% from 2025 to 2032.

- Asia Pacific held a share of 42.32% in 2024, valued at USD 3.53 billion.

- The high-temperature vulcanized segment garnered USD 4.53 billion in revenue in 2024.

- The liquid injection molding segment is expected to reach USD 6.14 billion by 2032.

- The healthcare & medical devices segment is anticipated to witness the fastest CAGR of 10.32% through the projection period.

- North America is anticipated to grow at a CAGR of 8.90% over the forecast period.

Major companies operating in the silicone elastomers market are Dow, Wacker Chemie AG, Elkem ASA, MESGO S.p.A, Specialty Silicone Products, Inc, Reiss Manufacturing, Inc, Rogers Corporation, Evonik Industries AG, Stockwell Elastomerics, CHT Germany GmbH, Zhejiang Xin'an Chemical Industry Group Co., Ltd, KCC SILICONE CORPORATION, Avantor, Inc., Nano Tech Chemical Brothers Pvt. Ltd., and Silicone Engineering Limited.

The expansion of production capacity is fueling market growth, supporting wider adoption of specialty silicones. Increasing manufacturing capacity supports the rising demand for room-temperature and high-temperature vulcanizing silicones, which are widely used in electromobility, renewable energy, and electronics sectors.

- In January 2024, WACKER Chemie AG announced plans to establish a new production facility in Karlovy Vary, Czech Republic, to expand its specialty silicone business, with a focus on room-temperature and high-temperature vulcanizing silicones for electromobility, renewable energy, and electronics applications.

Market Driver

Expansion of Construction Sector

A key factor propelling the progress of the silicone elastomers market is the expansion of the construction sector. Increasing investments in commercial, residential, and infrastructure projects are creating a strong demand for durable and flexible materials.

Silicone elastomers are widely used in sealants, gaskets, glazing, and insulation, providing weather resistance, thermal stability, and long-term performance. This is leading to the widespread adoption of silicone elastomers in the construction sector, fostering market growth.

- In July 2025, the American Institute of Architects (AIA) projected U.S. construction spending to grow by 33% in 2025, fueled by increased investments in commercial, institutional, and infrastructure projects, including data centers. This growth is expected to boost demand for building materials, propelling he adoption of silicone elastomers in applications such as sealants, gaskets, glazing, and insulation.

Market Challenge

High Production Costs

A major challenge hindering the expansion of the silicone elastomers market is the high production costs associated with manufacturing these materials. Producing silicone elastomers requires specialized raw materials and involves complex chemical processes that demand precise control and advanced equipment. Additionally, stringent quality control measures and energy-intensive operations increase the production expenses of silicone elastomer products.

To address this challenge, market players are investing in process optimization and automation to reduce labor and energy expenses. They are exploring alternative, cost-effective raw materials without compromising the performance of silicone elastomer products. Additionally, manufacturers are implementing efficient quality control systems to minimize waste and improve the production yield of silicone elastomer products.

Market Trend

Development of Eco-Friendly Silicone Elastomers for Sustainable Personal Care

A notable trend influencing the silicone elastomers market is the development of eco-friendly solutions for sustainable personal care. Manufacturers are introducing carbon-neutral silicone elastomers designed to reduce environmental impact while maintaining high performance in skincare, haircare, and cosmetic formulations.

These innovations provide smooth texture, durability, and stability, meeting both functional and sustainability demands. This trend is prompting brands to shift toward greener product portfolios, enhancing their appeal to eco-conscious consumers and supporting long-term growth in the personal care sector.

- In June 2025, Dow introduced carbon-neutral silicone elastomer blends at New York SCC Suppliers’ Day to expand its sustainable product portfolio and reduce the carbon footprint in personal care applications.

Silicone Elastomers Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Liquid Silicone Rubber, High-Temperature Vulcanized, Room-Temperature Vulcanized

|

|

By Processing Method

|

Liquid Injection Molding, Compression Molding, Injection Molding, Extrusion, Others

|

|

By End-Use Industry

|

Automotive & Transportation, Construction, Healthcare & Medical Devices, Consumer Goods, Electronics & Electrical, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product Type (Liquid Silicone Rubber, High-Temperature Vulcanized, and Room-Temperature Vulcanized): The high-temperature vulcanized segment earned USD 4.53 billion in 2024, largely due to its superior thermal stability and durability in demanding applications.

- By Processing Method (Liquid Injection Molding, Compression Molding, Injection Molding, Extrusion, and Others): The liquid injection molding segment held a share of 35.43% in 2024, attributed to its high precision, efficiency, and suitability for mass production.

- By End-Use Industry (Automotive & Transportation, Construction, Healthcare & Medical Devices, Consumer Goods, Electronics & Electrical, and Others): The automotive & transportation segment is projected to reach USD 6.27 billion by 2032, owing to rising demand for high-performance seals, gaskets, and components.

Silicone Elastomers Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific silicone elastomers market share stood at 42.35% in 2024, valued at USD 3.53 billion. This dominance is reinforced by rapid industrialization and infrastructure development, which are creating strong demand for silicone elastomers in construction, transportation, and industrial machinery across emerging economies.

The expanding consumer goods and personal care industries are further supporting adoption in cosmetics, skincare, and household products. The growing focus on renewable energy and the rising adoption of electric vehicles are boosting the use of silicone elastomers for high-voltage insulation, sealing, and thermal management solutions.

Moreover, strategic acquisitions by regional players to expand liquid silicone rubber capabilities and strengthen partnerships in medical technology are fueling regional market expansion.

- In February 2024, Trelleborg acquired Baron Group to expand its liquid silicone rubber capabilities and strengthen its position as a global partner in medical technology products.

North America silicone elastomers industry is set to grow at a CAGR of 8.90% over the forecast period. This growth is attributed to the rising demand from the healthcare sector, where silicone elastomers are used in medical devices and implants due to their biocompatibility and ability to withstand sterilization.

The expanding automotive industry is leading to the increased use of silicone elastomers for high-performance seals, gaskets, and components that endure extreme conditions.

Growth in electronics and telecommunication applications is further boosting demand, as silicone elastomers provide reliable insulation, flexibility, and durability for advanced devices and network infrastructure. Additionally, strategic mergers and acquisitions in the silicones industry are expanding production capabilities, thereby contributing to domestic market growth.

- In May 2024, KCC Corporation acquired Momentive Performance Materials Group to strengthen its global leadership in silicones and expand long-term growth opportunities.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) regulates silicone elastomers under the Toxic Substances Control Act (TSCA). It oversees their manufacture, import, use, and disposal to ensure environmental protection, workplace safety, and compliance with chemical reporting and risk assessment standards.

- In the U.K., the Health and Safety Executive (HSE) regulates silicone elastomers under the Control of Substances Hazardous to Health (COSHH) regulations, ensuring safe handling, storage, and workplace exposure limits, and compliance with risk assessment requirements.

- In China, the Ministry of Ecology and Environment (MEE) regulates the production, import, and use of silicone elastomers under national environmental laws. It monitors chemical safety, pollution control, and emissions during manufacturing while enforcing compliance with environmental standards and proper waste management.

- In India, the Central Pollution Control Board (CPCB) regulates silicone elastomers under the Environment Protection Act. It monitors emissions, effluent discharge, and hazardous waste management while enforcing compliance with air, water, and chemical handling standards to prevent pollution and safeguard public health.

Competitive Landscape

Major players in the silicone elastomers industry are expanding their capabilities in silicone rubber mixing to deliver improved formulations for diverse applications such as aerospace components, food and beverage processing equipment, and power transmission systems. Manufacturers are strengthening their presence in aerospace by offering silicone solutions that meet stringent safety and durability standards.

In the food and beverage sector, they focus on hygienic elastomers compliant with regulatory requirements. Additionally, players are targeting the power transmission industry with specialized silicone components that ensure insulation, reliability, and long-term performance under demanding conditions.

- In March 2024, The Rubber Group acquired Silicone Rubber Right Products (SRRP) and TEAM Products to expand its silicone rubber mixing, molding, and extrusion capabilities.

Key Companies in Silicone Elastomers Market:

- Dow

- Wacker Chemie AG

- Elkem ASA

- MESGO S.p.A

- Specialty Silicone Products, Inc

- Reiss Manufacturing, Inc

- Rogers Corporation

- Evonik Industries AG

- Stockwell Elastomerics

- CHT Germany GmbH

- Zhejiang Xin'an Chemical Industry Group Co., Ltd

- KCC SILICONE CORPORATION

- Avantor, Inc.

- Nano Tech Chemical Brothers Pvt. Ltd.

- Silicone Engineering Limited

Recent Developments (M&A)

- In May 2025, Trelleborg acquired Sico Gesellschaft für Siliconverarbeitung mbH and Sico Silicone s.r.o. to strengthen its silicone capabilities and broaden its product offerings in Europe.

- In July 2024, DuPont acquired Donatelle Plastics to enhance its healthcare portfolio with advanced injection molding, liquid silicone rubber processing, and medical device manufacturing capabilities.

- In January 2024, Elastofirm acquired a majority stake in Silam Siliconas S.A. to enhance its high consistency rubber (HCR) silicone portfolio and strengthen its European market presence.