Market Definition

The market includes a range of products and technologies applied to seeds before planting to improve crop performance. This market encompasses synthetic chemicals and biologicals, which are used individually or in combination. These treatments serve key functions such as protection and enhancement.

Protection focuses on shielding seeds from pests, diseases, and environmental stress. The market covers various application methods, including coating, dressing, and pelleting. The report identifies the principal factors contributing to market expansion, along with an analysis of the competitive landscape influencing its growth trajectory.

Seed Treatment Market Overview

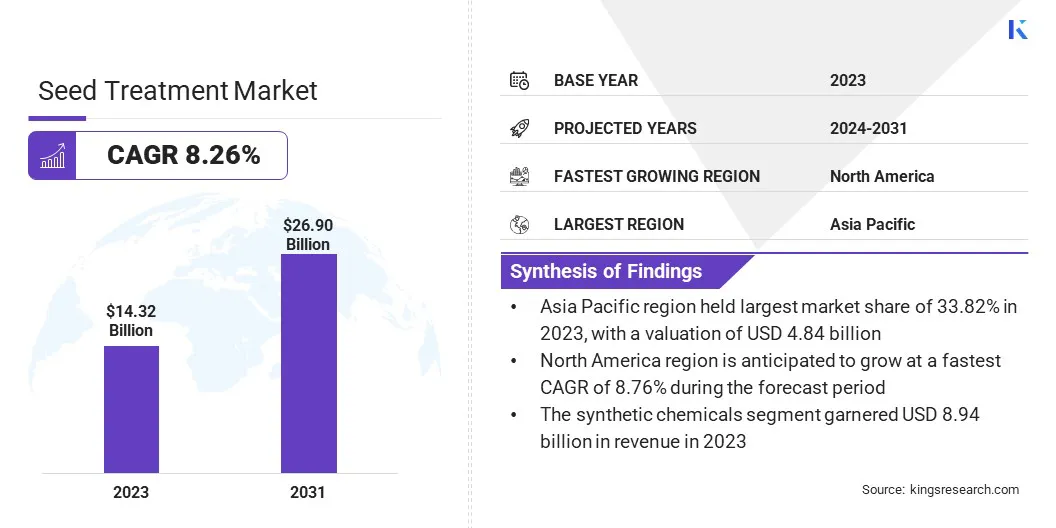

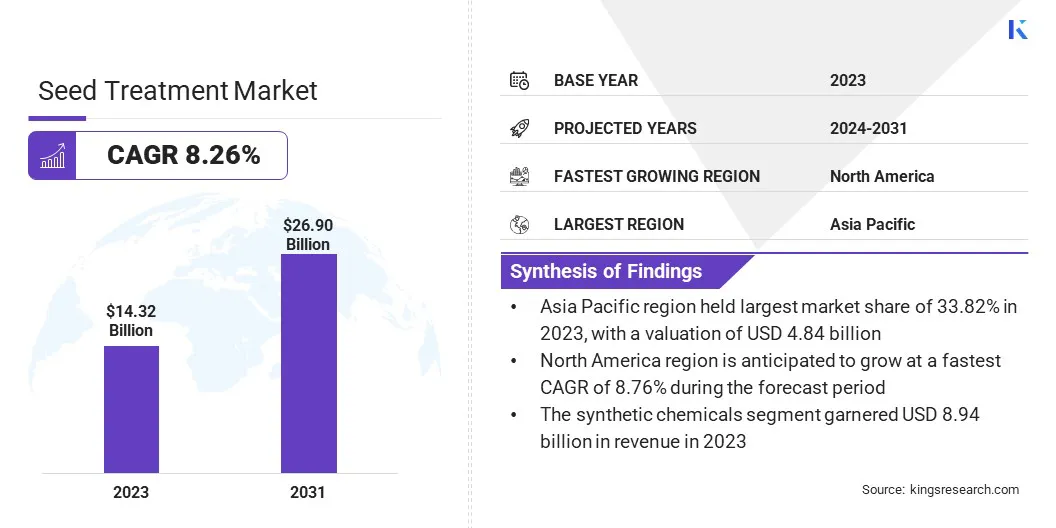

The global seed treatment market size was valued at USD 14.32 billion in 2023 and is projected to grow from USD 15.43 billion in 2024 to USD 26.90 billion by 2031, exhibiting a CAGR of 8.26% during the forecast period.

This growth is supported by the rising global demand for high-yielding and disease-resistant crops, coupled with increasing awareness among farmers about crop protection and productivity enhancement. Advancements in biological seed treatment formulations and integrated pest management strategies are driving adoption, especially in regions with intensive agriculture.

Major companies operating in the seed treatment industry are AMVAC Chemical Corporation, Sumitomo Chemical Co., Ltd., Verdesian, BASF, Koppert, Nufarm Global, Bayer AG, Precision Laboratories, UPL, Croda Agriculture, Syngenta, Germains Seed Technology, FMC Corporation, Novonesis Group, and Cortevaxx.

Moreover, sustainability has become a key focus, encouraging the development of environmentally friendly seed treatment solutions that minimize chemical usage while maintaining effectiveness. This shift is aligned with global agricultural policies promoting sustainable farming practices.

- In February 2024, Locus Agriculture unveiled six new biological in-furrow and seed treatments as part of the Rhizolizer Duo line expansion. The new additions cater to various crops, including corn, cotton, legumes, soybeans, and wheat, offering versatile solutions for on-farm, upstream, and downstream seed applications. This launch addresses the growing demand for sustainable and cost-effective biologicals, providing row crop farmers with advantages for higher yields.

Key Highlights:

- The seed treatment industry size was valued at USD 14.32 billion in 2023.

- The market is projected to grow at a CAGR of 8.26% from 2024 to 2031.

- Asia Pacific held a market share of 33.82% in 2023, with a valuation of USD 4.84 billion.

- The synthetic chemicals segment garnered USD 8.94 billion in revenue in 2023.

- The protection segment is expected to reach USD 13.46 billion by 2031.

- The coating segment is expected to reach USD 10.36 billion by 2031.

- The cereals segment is expected to reach USD 9.96 billion by 2031.

- The market in North America is anticipated to grow at a CAGR of 8.76% during the forecast period.

Market Driver

"Rising Demand for High-yield Crops"

The seed treatment market is being significantly driven by the rising demand for high-yield crops. As the global population grows, so does the need for increased food production. Expanding farmland is not always a viable option, due to urbanization and environmental concerns.

Seed treatment provides a practical solution by enhancing seed quality and performance. It helps improve germination rates, strengthens early plant vigor, and protects against soil-borne diseases, pests, and environmental stress.

Seed treatments are especially effective in preventing damage from pests like nematodes and insects, which can severely impact crop yields if not controlled. Seed treatments contribute to stronger plant establishment, healthier crops, and ultimately higher yields by offering protection against these early-stage threats.

- In December 2024, UPL Corp announced the registration of NIMAXXA bionematicide by the U.S. Environmental Protection Agency (EPA). The triple-strain biological seed treatment offers season-long protection against nematodes in corn and soybeans. Two strains act as bionematicides to attack nematode eggs and juveniles, while the third delivers bio stimulant activity to enhance root growth and crop resilience.

Market Challenge

"High Cost of Advanced Seed Treatment Technologies"

A major challenge in the seed treatment market is the high cost of advanced seed treatment technologies. The development and production of innovative, high-performance treatments often require substantial investment in research, development, and regulatory approval.

This can make these solutions expensive, which may limit adoption, particularly in cost-sensitive markets or among smaller-scale farmers. A potential solution lies in the adoption of cost-effective formulations and application techniques. Companies can reduce costs by focusing on optimizing product efficacy at lower dosages or exploring more efficient application methods.

Market Trend

"Shift Toward Sustainable Solutions"

The seed treatment market is registering a significant shift toward sustainable solutions, driven by increasing environmental awareness and regulatory pressures. Companies are focusing on developing seed treatment products that have minimal environmental impact while maintaining high efficacy.

These solutions prioritize low toxicity, precise application, and compatibility with soil health and biodiversity. This trend is evident as more treatments are being formulated to reduce the use of harmful chemicals, ensure better control of pests and diseases, and improve soil quality.

As the agricultural industry strives to meet sustainability targets, these eco-friendly innovations are becoming crucial in promoting long-term soil productivity and supporting sustainable farming practices.

- In June 2023, Syngenta introduced EQUENTO. The novel seed treatment, powered by PLINAZOLIN technology, offers a new mode of action to control soil pests across crops like cereals and canola. EQUENTO enhances sustainability by enabling precise pest control at low dose rates, maintaining seed and plant safety, and supporting soil health and biodiversity.

Seed Treatment Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Synthetic Chemicals, Biologicals

|

|

By Function

|

Protection, Enhancement

|

|

By Application

|

Coating, Dressing, Pelleting

|

|

By Crop

|

Cereals, Oilseeds, Fruits & Vegetables, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Synthetic Chemicals, Biologicals): The synthetic chemicals segment earned USD 8.94 billion in 2023, due to their broad-spectrum efficacy and widespread use in large-scale farming.

- By Function (Protection, Enhancement): The enhancement segment held 51.34% share of the market in 2023, due to the rising demand for improved seed vigor, nutrient efficiency, and crop uniformity.

- By Application (Coating, Dressing, Pelleting): The coating segment is projected to reach USD 10.36 billion by 2031, owing to its precise application, reduced chemical usage, and compatibility with advanced seed technologies.

- By Crop (Cereals, Oilseeds, Fruits & Vegetables, and Others): The cereals segment is projected to reach USD 9.96 billion by 2031, owing to high global production volumes and the critical need for early-stage protection.

Seed Treatment Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific seed treatment market share stood at around 33.82% in 2023, with a valuation of USD 4.84 billion. This dominance is driven by the rapid expansion of agricultural activities across countries like China, India, and Southeast Asia.

Growing demand, due to high population, has increased the pressure on food production. Farmers are adopting advanced agricultural inputs, including seed treatments, to boost yield and reduce crop losses.

Government initiatives supporting modern farming practices and rising awareness about seed health have contributed to the market growth in this region. Awareness among farmers about the economic benefits of seed protection and enhancement is growing.

Expanding agribusiness investments, rising use of hybrid seeds, and the increasing presence of global and regional agrochemical companies are strengthening the market in this region.

The seed treatment industry in North America is poised to grow at a significant CAGR of 8.76% over the forecast period. This is attributed to the strong adoption of precision agriculture, high R&D investment, and early uptake of biological seed treatment technologies.

The U.S. and Canada lead in commercial farming practices. These countries have a well-established seed industry and strong distribution networks. Growing interest in sustainable farming is also pushing the demand for innovative seed treatment solutions.

- In February 2024, Syngenta announced the upcoming addition of Victrato to its seed treatment portfolio. The new solution is designed to protect cotton and soybeans against nematodes and key diseases such as Sudden Death Syndrome and Cotton Root Rot (CRR), while also providing early-season suppression of foliar soybean diseases.

Regulatory Frameworks

- In the U.S., seed treatment products are regulated by the EPA under the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA). Products must be registered with the EPA, and treated seeds must comply with labeling and safety standards outlined in 40 CFR Part 152.

- In Europe, seed treatment substances are governed by Regulation (EC) No 1107/2009, which evaluates active substances and sets approval procedures. Treated seeds must also follow the EU Seed Marketing Directives and REACH regulation for chemical safety.

Competitive Landscape:

Companies are actively investing in Research and Development (R&D) to create advanced formulations, including bio-based and combination products that offer both protection and enhancement benefits.

Many companies are entering into strategic collaborations and partnerships with seed producers, agri-tech firms, and biotechnology companies to expand their reach and integrate innovative technologies into seed treatment solutions.

To address the growing demand across diverse crop types and regions, players are also focusing on geographic expansion, especially into emerging markets where modern agricultural practices are gaining traction.

Portfolio diversification remains a key strategy, with firms introducing customized solutions tailored to specific crops, climates, and farming systems. Some companies are leveraging digital platforms and precision agriculture tools to deliver data-driven insights and improve the effectiveness of seed treatment applications.

- In December 2024, BioConsortia, Inc. and H&T entered a commercial agreement to launch the FixiN 33 nitrogen-fixing microbial seed treatment in New Zealand. The partnership aims to enhance crop yields and reduce fertilizer use through advanced microbial solutions. The product offers a shelf life of over two years, supports multiple crops like corn and cereals, and minimizes environmental impact through improved nitrogen use efficiency.

List of Key Companies in Seed treatment market:

- AMVAC Chemical Corporation

- Sumitomo Chemical Co., Ltd.

- Verdesian

- BASF

- Koppert

- Nufarm Global

- Bayer AG

- Precision Laboratories

- UPL

- Croda Agriculture

- Syngenta

- Germains Seed Technology

- FMC Corporation

- Novonesis Group

- Corteva

Recent Developments

- In January 2025, UPL Corp announced the U.S. EPA registration of ATROFORCE bionematicide seed solution for use in cotton. The new biosolution utilizes a patented strain of Trichoderma atroviride as its active ingredient to minimize nematode impact, reduce egg lay, and protect yield potential. Designed to grow along with the plant’s roots, ATROFORCE delivers extended protection and promotes healthier plant development under nematode pressure.