Enquire Now

SIEM Market Size, Share, Growth & Industry Analysis, By Component (Solution, Services), By Deployment (On-premises, Cloud-based, Hybrid), By Organization (Small & Medium Enterprises, Large Enterprises), By Vertical (BFSI, Healthcare, IT and Telecommunications, Manufacturing, Retail, Government & Defense, Others), and Regional Analysis, 2022-2032 2025-2032

Pages: 180 | Base Year: 2024 | Release: September 2025 | Author: Antriksh P.

Key strategic points

Security Information and Event Management (SIEM) is a cybersecurity solution that aggregates and analyzes data from various sources like networks, servers, and applications. It collects and correlates data from multiple sources, detects potential threats, ensures compliance with regulatory standards, and supports incident response. SIEM enables centralized visibility, improved threat detection, and enhanced security management for enterprises.

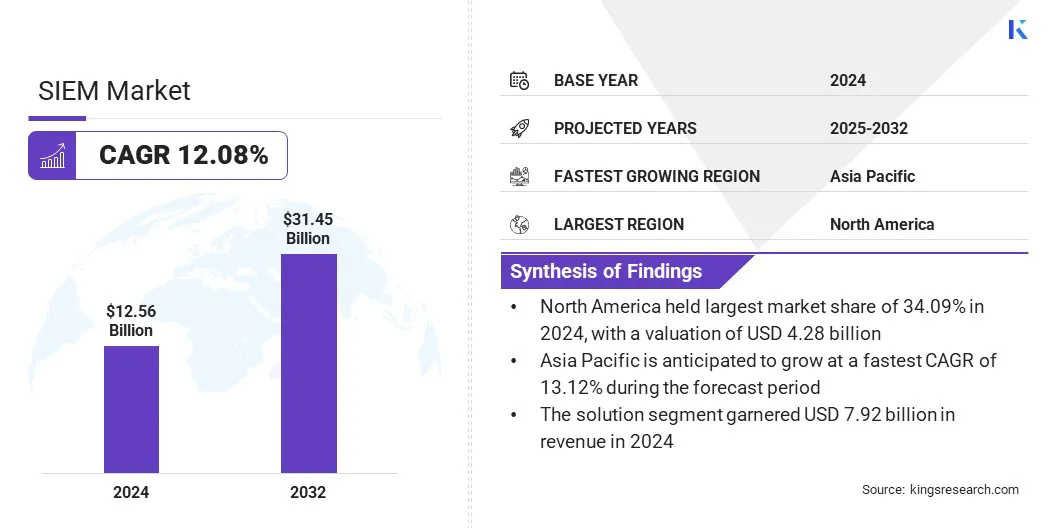

The global SIEM market size was valued at USD 12.56 billion in 2024 and is projected to grow from USD 14.03 billion in 2025 to USD 31.45 billion by 2032, exhibiting a CAGR of 12.08% over the forecast period. This growth is driven by enterprises adopting cloud-based SIEM for scalability and cost efficiency. It enables centralized monitoring, rapid threat detection, and compliance support across expanding cloud and hybrid environments.

Major companies operating in the SIEM market are IBM Corporation, Microsoft, Cisco Systems, Inc., Sophos Ltd., SolarWinds Worldwide, LLC, Securonix, Exabeam, Fortinet, Inc., Rapid7, Sumo Logic, Check Point Software Technologies Ltd., CrowdStrike Inc., LevelBlue, BlueVoyant, and Open Text Corporation.

The growing demand for centralized security monitoring and incident response is driving the expansion of the market. Organizations increasingly require unified platforms to collect, correlate, and analyze security events across diverse environments.

This driver is gaining importance as enterprises manage complex hybrid infrastructures that integrate on-premises, cloud, and virtual environments. The growing cyber threats further amplifies the need for unified monitoring, advanced analytics, and coordinated incident response to maintain security effectiveness.

Escalating Cybersecurity Threats and Data Breaches

A key factor propelling the growth of the SIEM market is the escalation of cybersecurity threats and data breaches across industries such as BFSI, healthcare, and e-commerce. Enterprises face frequent ransomware attacks, phishing campaigns, and insider risks that compromise sensitive data. These evolving threats have increased the need for real-time detection and response capabilities offered by SIEM platforms.

SIEM solutions enable enterprises to strengthen threat intelligence, enhance forensic analysis, and protect business-critical assets in increasingly hostile cyber environments. Moreover, several companies have faced data breaches that exposed sensitive customer information, underscoring the growing cybersecurity vulnerabilities across enterprises.

Integration Issues with Legacy Systems and Diverse IT Environments

A major challenge hindering the expansion of the SIEM market is integration issues with legacy systems and diverse IT infrastructures. Many organizations are struggling with compatibility gaps, scalability constraints, and high integration costs that reduce SIEM efficiency. Such complexities are creating delays in deployment and limiting the ability to achieve unified threat visibility.

To address this challenge, vendors are introducing flexible APIs, cloud-native SIEM architectures, and pre-built integration tools that simplify deployment, improve interoperability, and enhance adaptability across traditional, cloud, and hybrid infrastructures.

Increasing Integration of AI and Machine Learning for Threat Detection

A key trend influencing the SIEM market is the growing integration of artificial intelligence and machine learning in SIEM platforms to strengthen threat detection. AI-driven analytics enable SIEM platforms to identify anomalies, detect advanced threats, and minimize false positives.

Machine learning models enhance adaptability by continuously learning from evolving attack patterns and historical data. This trend allows security teams to accelerate incident response and reduce manual workloads.

|

Segmentation |

Details |

|

By Component |

Solution, Services |

|

By Deployment |

On-premises, Cloud-based, Hybrid |

|

By Organization |

Small & Medium Enterprises, Large Enterprises |

|

By Vertical |

BFSI, Healthcare, IT and Telecommunications, Manufacturing, Retail, Government & Defense, Energy & Utilities, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America SIEM market held 34.09% share in 2024, valued at USD 4.28 billion. The region’s growth is driven by the widespread adoption of advanced security analytics and demand for real-time incident monitoring. Organizations are focusing on unified platforms that strengthen threat detection, compliance management, and response capabilities.

Continuous enhancements in automation, scalability, and integration with existing security frameworks position SIEM solutions as critical tools for enterprises in the region.

The Asia-Pacific SIEM industry is projected to grow at a CAGR of 13.12% over the forecast period. This growth is driven by the rising cybersecurity challenges, rapid digital transformation, and expansion of enterprise IT ecosystems. Enterprises in the region are prioritizing real-time visibility, automated incident response, and security compliance management. The growing reliance on hybrid infrastructures is further increasing the need for SIEM deployment.

Key players operating in the SIEM industry are adopting strategies to expand product portfolios, enhance threat intelligence capabilities, and integrate AI and machine learning into their platforms. They are enhancing cloud-native offerings, emphasizing interoperability with diverse IT environments, and building flexible deployment models.

Companies are also aligning growth with partnerships, acquisitions, and product launches designed to consolidate market presence and address evolving enterprise requirements.

Frequently Asked Questions