Market Definition

Second generation biofuels are advanced renewable fuels derived from non-food biomass sources, including agricultural residues, forestry waste, municipal solid waste, and dedicated energy crops such as switchgrass and miscanthus. These biofuels encompass technologies such as cellulosic ethanol production, biomass-to-liquid conversion, and biochemical and thermochemical processing.

They are applied to reduce greenhouse gas emissions, enhance energy security, and provide sustainable alternatives for transportation, aviation, and industrial energy needs.

Second Generation Biofuels Market Overview

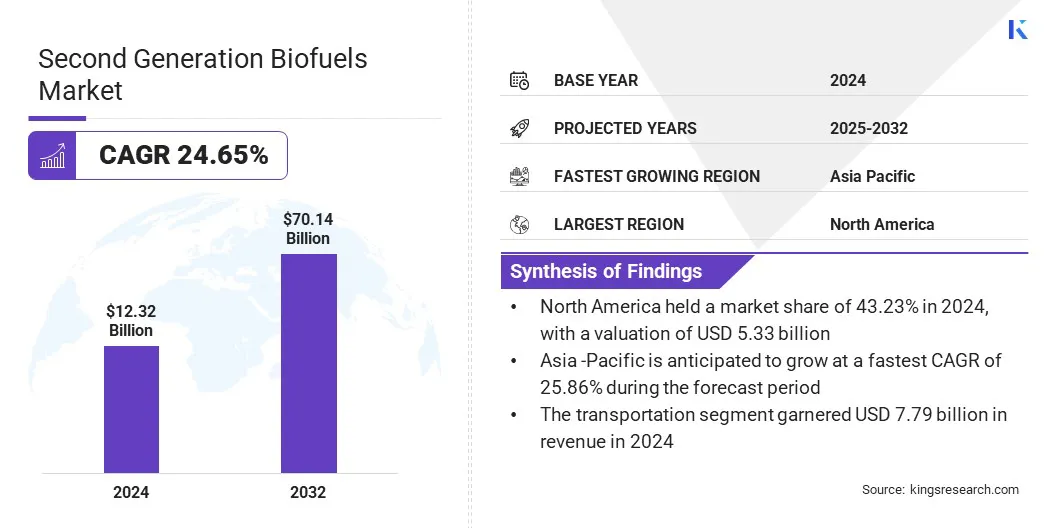

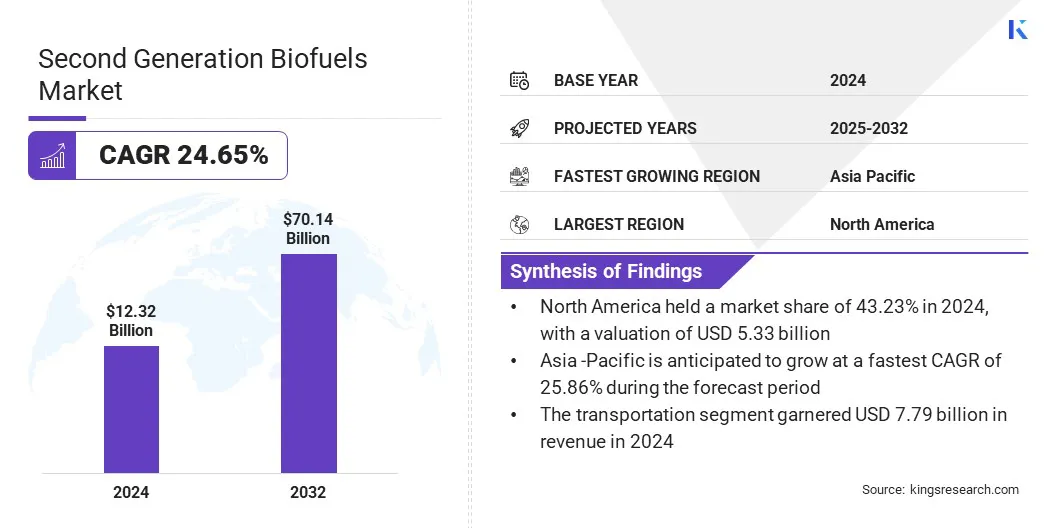

The global second generation biofuels market size was valued at USD 12.32 billion in 2024 and is projected to grow from USD 15.00 billion in 2025 to USD 70.14 billion by 2032, exhibiting a CAGR of 24.65% during the forecast period.

The market is driven by the growing demand for sustainable aviation fuel as airlines and transport sectors seek low-carbon alternatives to reduce greenhouse gas emissions and meet environmental regulations.

The market is further growing due to the increasing investments by market players in advanced biofuel production technologies and large-scale facilities that enhance capacity, improve efficiency, and support the adoption of second generation biofuels.

Key Market Highlights:

- The second generation biofuels industry was recorded at USD 12.32 billion in 2024.

- The market is projected to grow at a CAGR of 24.65% from 2024 to 2032.

- North America held a market share of 43.23% in 2024, with a valuation of USD 5.33 billion.

- The lignocellulosic biomass segment garnered USD 6.31 billion in revenue in 2024.

- The cellulosic ethanol segment is expected to reach USD 47.69 billion by 2032.

- The transportation segment is anticipated to witness the fastest CAGR of 25.89% during the forecast period.

- The thermochemical segment held a market share of 58.22% in 2024

- Asia Pacific is anticipated to grow at a CAGR of 25.86% during the forecast period.

Major companies operating in the second generation biofuels market are Valero Energy Corporation, ADM, Bunge, Clariant, Moeve, LanzaTech, ORLEN, INEOS AG, Cargill, Incorporated, GranBio, Fulcrum BioEnergy, Eni S.p.A, Verbio SE, New Energy Blue, and PureField.

Additionally, advancements in large-scale second generation ethanol production are driving the market by boosting low-carbon fuel availability for aviation and maritime sectors. The use of sugarcane residues as feedstock promotes sustainable production and reduces environmental impact.

These initiatives are driving investments in advanced biofuel technologies, supporting circular economy practices, and increasing the adoption of second generation biofuel across industrial and transportation applications.

- In May 2024, Raízen launched the world’s largest second generation ethanol plant at Bonfim Bioenergy Park, Brazil. This new plant will produce 82 million liters of second generation ethanol per year from sugarcane residues for low-carbon fuel applications in aviation and maritime sectors.

Market Driver

Rising Global Demand for Biofuel

A major factor driving the growth of the second generation biofuels market is the rising global demand for cleaner and sustainable energy alternatives. Governments, industries, and airlines are increasingly adopting low-carbon fuels to meet environmental targets and reduce greenhouse gas emissions.

This growing focus on sustainable energy is encouraging investment in advanced biofuel production technologies, expanding manufacturing capacities, and improving commercialization processes, thereby supporting broader adoption of second generation biofuels.

- In January 2024, the International Energy Agency (IEA) reported that global biofuel demand is set to rise by 38 billion litres between 2023 and 2028, a nearly 30% increase from the previous five years, driving production and investment in the global market.

Market Challenge

High Production Costs

A key challenge in the market is the high production costs associated with converting lignocellulosic biomass and waste into ethanol or biodiesel.

Advanced technologies, pre-treatment processes, and specialized enzymes increase operational expenses and reduce competitiveness against conventional fossil fuels. These high costs limit large-scale adoption and create financial barriers for producers, slowing investment and growth in the second generation biofuels market.

To address this challenge, market players are implementing advanced technologies and integrated processes that streamline biomass conversion and reduce energy and enzyme requirements. They are forming strategic partnerships and joint ventures to share infrastructure, expertise, and resources, lowering overall operational expenses.

Market Trend

Development of Drop-in Biofuels

A key trend in the market is the development of drop-in biofuels that are chemically identical to conventional petroleum products. This allows seamless integration into existing engines and fuel infrastructure, thereby increasing the adoption of low-carbon diesel and sustainable aviation fuels.

Producers are increasingly converting waste oils and agricultural residues into low-carbon fuels that can be immediately blended or substituted. Moreover, growing environmental regulations and rising demand from the aviation and transport sectors are accelerating investment and deployment of drop-in biofuels.

- In October 2024, the ORLEN Group launched sales of HVO100, a second generation biofuel made from vegetable oils and waste oils, at two service stations in Germany. The company is expanding retail and wholesale sales across Europe and constructing a production plant in Płock, Poland, with a capacity of 300,000 tonnes per year to support low-carbon diesel and sustainable aviation fuel production.

Second Generation Biofuels Market Report Snapshot

|

Segmentation

|

Details

|

|

By Feedstock

|

Lignocellulosic Biomass, Waste-based, Algae, Others

|

|

By Fuel Type

|

Cellulosic Ethanol, Biodiesel, Bio-Butanol, Others

|

|

By Application

|

Transportation, Power Generation, Industrial Heating, Others

|

|

By Production Process

|

Thermochemical, Biochemical, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Feedstock (Lignocellulosic Biomass, Waste-based, Algae, and Others): The lignocellulosic biomass segment earned USD 6.31 billion in 2024 due to its wide availability and efficiency in producing high-yield cellulosic ethanol.

- By Fuel Type (Cellulosic Ethanol, Biodiesel, Bio-Butanol, and Others): The cellulosic ethanol segment held 57.32% of the market in 2024, due to its compatibility with existing fuel infrastructure and growing demand in transportation.

- By Application (Transportation, Power Generation, Industrial Heating, and Others): The transportation segment is projected to reach USD 47.90 billion by 2032, owing to the increased adoption of low-carbon fuels in aviation, marine, and road transport.

- By Production Process (Thermochemical, Biochemical, and Others): The thermochemical segment is anticipated to grow at a CAGR of 26.27% over the forecast period, due to its ability to convert diverse biomass efficiently into high-quality biofuels.

Second Generation Biofuels Market Regional Analysis

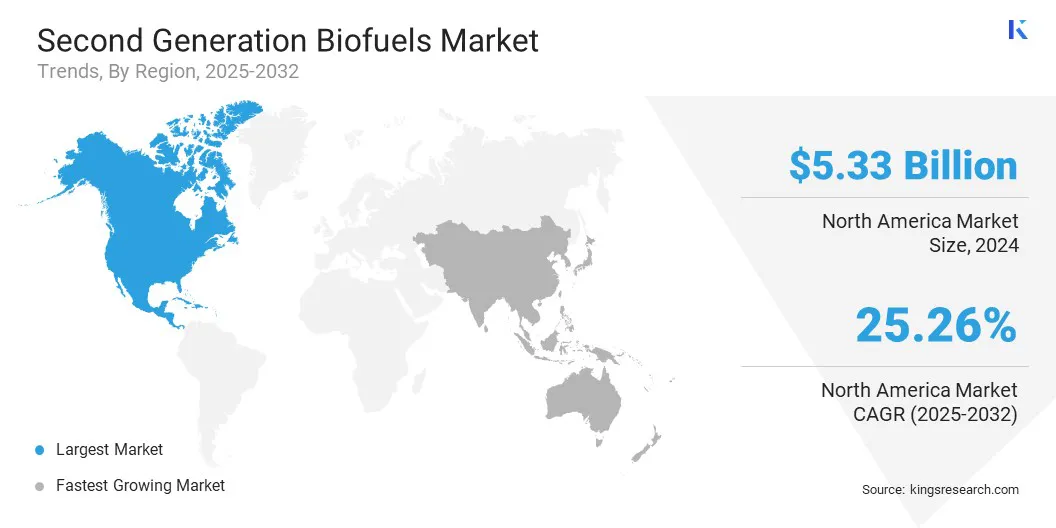

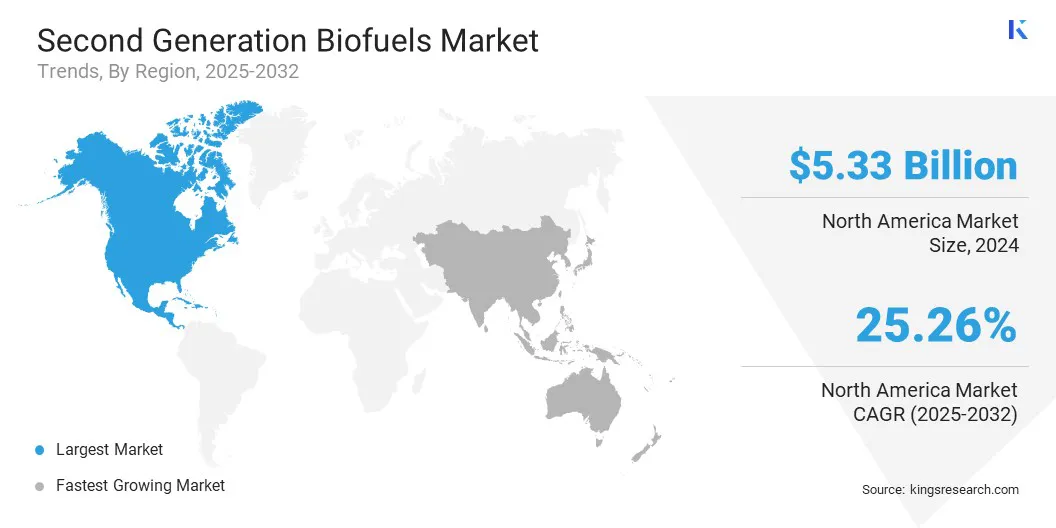

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America second generation biofuels market share stood at 43.23% in 2024 in the global market, with a valuation of USD 5.33 billion. This dominance is attributed to the increasing investment in innovative consolidated bioprocessing production technologies and active efforts by government to advance the commercialization of cellulosic ethanol.

Increasing government funding and private sector investments in R&D and the commercialization of cellulosic ethanol are driving the region’s market expansion.

The market expansion is also supported by abundant agricultural residues and non-food biomass feedstocks that provide a sustainable and cost-effective supply chain in the region.

Moreover, strategic partnerships with established biofuel producers are enabling broader technology deployment and facilitating entry into large-scale cellulosic ethanol production. These factors are strengthening regional capacity to supply advanced biofuels and supporting the market growth in this region.

- In March 2024, Terragia Biofuel raised USD 6 million in a seed round led by Engine Ventures and Energy Impact Partners to commercialize its biology-based process for converting cellulosic biomass into ethanol and other products across North America. The funding supports scaling operations, expanding the team, and forming partnerships with major biofuel producers.

Asia Pacific is set to grow at a robust CAGR of 25.86% over the forecast period. This growth is attributed to rising investments in advanced biofuel facilities and increasing adoption of non-food biomass for ethanol production. The region is witnessing strong government initiatives and policy support promoting the use of second-generation biofuels to reduce reliance on fossil fuels and cut carbon emissions.

Additionally, strategic acquisitions by key players are accelerating the adoption of efficient production processes and enhancing local manufacturing capabilities. Increasing focus of government to reduce emissions and growing investments by key players in advanced biofuel technologies are further accelerating market growth across the region.

- In July 2024, AM Green planned to invest USD 1 billion in the second generation biofuels sector, including establishing two bioethanol plants in India. The investment aims to produce cellulosic ethanol from bamboo and expand advanced biofuel production capacity.

Regulatory Frameworks

- In the U.S., the U.S. Environmental Protection Agency oversees the Renewable Fuel Standard (RFS), setting annual blending mandates for advanced biofuels, including cellulosic ethanol. It regulates lifecycle greenhouse gas emission thresholds, approves new biofuel pathways, and monitors compliance through Renewable Identification Numbers (RINs).

- In the UK, the Department for Energy Security and Net Zero administers the Renewable Transport Fuel Obligation (RTFO), setting sustainability and greenhouse gas savings criteria for advanced biofuels. It ensures second generation biofuels contribute to the UK’s net-zero emissions and clean energy targets.

- In China, the National Energy Administration regulates biofuel production under national energy strategies by establishing targets for advanced biofuels in the renewable energy mix. It oversees project approvals, feedstock sustainability requirements, and integration with national energy security goals. It ensures second generation biofuels support carbon neutrality, rural economic development, and the diversification of China’s transportation energy sources.

Competitive Landscape

Major players in the second generation biofuels market are initiating construction of large-scale plants to increase production capacity for sustainable aviation fuel and renewable diesel. They are utilizing agricultural waste and used cooking oils as primary feedstocks to reduce reliance on conventional raw materials.

Producers are integrating advanced processing technologies such as cellulosic ethanol conversion, renewable hydrogen use, energy recovery systems, and heat integration methods to enhance efficiency and minimize environmental impact during operations.

Additionally, they are incorporating digital tools such as artificial intelligence, the Internet of Things, and data analytics to optimize production processes and maintain safety standards.

- In February 2024, Apical, through its renewable energy subsidiary Bio-Oils, commenced construction of Southern Europe’s largest second generation biofuels plant in partnership with Moeve. This USD 1.28 billion facility is scheduled to start production in 2026, and it is expected to produce 500,000 tons of sustainable aviation fuel and renewable diesel using agricultural waste and used cooking oils as feedstock.

Top Key Companies in Second Generation Biofuels Market:

- Valero Energy Corporation

- ADM

- Bunge

- Clariant

- Moeve

- LanzaTech

- ORLEN

- INEOS AG

- Cargill, Incorporated

- GranBio

- Fulcrum BioEnergy

- Eni S.p.A

- Verbio SE

- New Energy Blue

- PureField

Recent Developments (Product Launch)

- In May 2024, Fermbox Bio launched EN3ZYME, a cellulosic enzyme cocktail designed to convert pretreated agricultural residues into fermentable sugars for second-generation ethanol production.

Additionally, companies are exploring alternative, cost-effective feedstocks such as agricultural residues and waste oils to maintain sustainable, economically viable second generation biofuel production