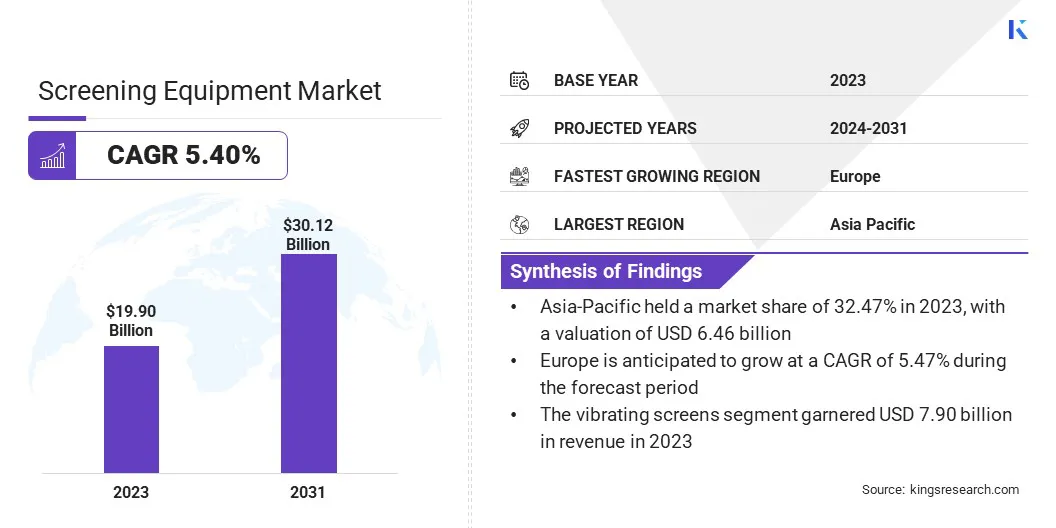

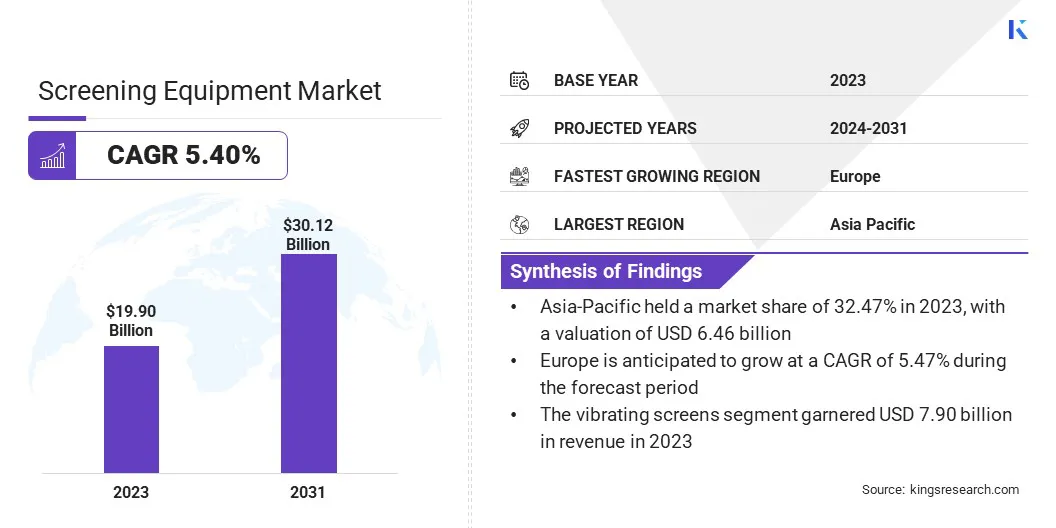

Screening Equipment Market Size

The global Screening Equipment Market size was valued at USD 19.90 billion in 2023 and is projected to grow from USD 20.85 billion in 2024 to USD 30.12 billion by 2031, exhibiting a CAGR of 5.40% during the forecast period.

The surging global demand for natural resources such as metals, minerals, and aggregates for infrastructure development is highlighting the need for efficient screening equipment in mining and construction.

Key Market Highlights:

- Market Value (2023): USD 19.90 Billion.

- Forecasted Value (2031): USD 30.12 Billion.

- CAGR (2024-2031): 5.40%.

- Largest & Fastest Growing Region (2024-2031): Asia-Pacific market held a notable share of around 32.47% in 2023, with a valuation of USD 6.46 billion.

- The dry screening segment secured the largest revenue share of 61.95% in 2023.

- The vibrating screens segment led the market in 2023, reaching a valuation of USD 7.90 billion.

In the scope of work, the report includes products offered by companies such as Terex Corporation, Sandvik AB, Metso Outotec Oyj, Astec Industries, Inc., Deister Machine Company, Inc., McCloskey International Limited, SMICO Manufacturing Co. Inc., Weir Group PLC, CDE Global Limited, Haver & Boecker OHG, and others.

Moreover, emerging markets, particularly in Asia-Pacific, Africa, and Latin America, are experiencing rapid urbanization, creating a strong demand for construction materials such as sand, gravel, and cement. his growth is further supported by government initiatives to modernize cities, underscoring the need for efficient material processing.

- A January 2024 report by Our World in Data indicates that 56.6% of the global population resided in urbanized areas by the end of 2023.

Additionally, the pharmaceutical industry’s expansion, fueled by increasing healthcare needs, is creating significant demand for precision screening equipment. Pharmaceutical companies rely on this equipment to sift and separate powders, granules, and liquids used in the production of medications.

Ensuring that these materials meet strict quality and safety standards is critical for maintaining product efficacy and safety. Compliance with regulatory standards further promotes the use of high-performance screening technologies in the pharmaceutical sector.

Screening equipment is machinery used across various industries to separate, classify, and sort materials by size, shape, or other criteria. It is vital in sectors such as mining, construction, recycling, agriculture, and manufacturing, where precise material sorting is essential for processing and production.

Screening equipment typically includes vibrating screens, trommel screens, and rotary sifters, designed to handle bulk materials such as aggregates, minerals, and waste. These machines ensure operational efficiency by improving material quality, enhancing production throughput, and reducing waste. Advanced models often incorporate automation and energy-efficient technologies.

Analyst’s Review

The screening equipment market is witnessing strong growth, largely due to stricter government regulations and environmental policies addressing e-waste management. Governments are implementing rigorous guidelines for the disposal, recycling, and treatment of e-waste, prompting industries to adopt advanced screening technologies to ensure compliance.

- The Indian Government has issued the E-Waste (Management) Second Amendment Rules, 2023, designed to promote secure, responsible, and sustainable e-waste management. These regulations specifically target the handling of refrigerants produced during the manufacturing and disposal of refrigeration and air-conditioning equipment.

Additionally, companies are investing in increased production capacity and advanced manufacturing technologies to meet rising global demand. This expansion enables faster production, greater scalability, and more tailored screening solutions across key industries such as mining, construction, and waste management.

- In April 2023, Metso Outotec inaugurated its expanded manufacturing facility for large screening equipment in Sorocaba, Brazil. This expansion aims to increase the site's production capacity from 250 to 500 units annually. The upgraded facility is expected to produce high-performance, energy- and water-efficient UFS Series and BSE Series banana screens, which are key components of the Planet Positive offering. Additionally, the company has invested in new fabrication capabilities for producing screening components and parts at the same location.

Screening Equipment Market Growth Factors

The industrialization of emerging markets is fueling the growth of the screening equipment market. Industries such as manufacturing, mining, and construction are expanding operations to meet both domestic and international demand.

Screening equipment plays a pivotal role in these industries by ensuring the efficient sorting and grading of materials for further processing or distribution. The need for quality control and compliance with global standards further boosts the adoption of advanced screening solutions in rapidly industrializing economies.

- The UN's 29th edition of the International Yearbook of Industrial Statistics, published in December 2023, reports a 2.3% growth in the global industrial sectors, including manufacturing, mining, electricity, water supply, waste management, and other utilities.

Moreover, the rising demand for mobile screening solutions, particularly in industries such as mining, construction, and agriculture, is fostering the growth of market.

Mobile screening equipment provides operational flexibility by allowing on-site material processing, reducing transportation costs, and improving efficiency. These portable systems are easy to deploy, which makes them ideal for remote or temporary work sites.

The growing need for flexibility, combined with advancements in mobile equipment design, fosters the adoption of portable screening solutions that enhance convenience and productivity.

However, the substantial capital required for purchasing and installing advanced screening equipment presents a significant challenge to market growth. This initial investment encompasses costs related to the machinery itself, installation, and integration with existing systems.

The financial burden associated with these expenses may deter potential buyers and hinder market expansion. To address this challenge, manufacturers are providing tailored solutions that integrate seamlessly with existing systems, minimizing the need for extensive modifications and reducing overall costs.

Enhanced value propositions, including long-term cost savings through increased efficiency and lower maintenance requirements, are emphasized to demonstrate the return on investment.

By implementing these approaches, companies aim to make advanced screening technologies more accessible and appealing to a broader range of customers, thus supporting sustained market growth.

Screening Equipment Industry Trends

The increasing global waste generation influences the screening equipment market, particularly in waste management, recycling, and environmental sustainability. As urbanization and industrialization progress, the volume of municipal solid waste, e-waste, and industrial waste rises.

This trend increases the demand for advanced screening equipment that can efficiently separate and process waste materials for recycling, disposal, or energy recovery.

- According to a February 2024 report from the UN Environment Programme, global municipal solid waste generation is anticipated to rise from 2.1 billion tonnes in 2023 to 3.8 billion tonnes by 2050.

Moreover, the ongoing digital transformation across diverse industries is fostering innovation in screening equipment. Technologies such as artificial intelligence (AI), the Internet of Things (IoT), and machine learning are being integrated into screening systems to enhance automation, monitoring, and predictive maintenance.

These advancements enable higher precision, reduce downtime, and lower operational costs. Companies are investing in cutting-edge screening solutions to maintain competitiveness and improve operational efficiency.

Segmentation Analysis

The global market has been segmented based on product type, technology, mobility, and geography.

By Product Type

Based on product type, the market has been segmented into vibrating screens, trommel screens, gyratory screens, and rotary screens. The vibrating screens segment led the screening equipment market in 2023, reaching a valuation of USD 7.90 billion.

Their ability to handle large volumes of material and effectively separate particles based on size makes them essential across multiple industries, including mining, construction, and recycling.

The design of vibrating screens, which utilizes vibration for material movement and separation, ensures high throughput and consistent performance. Additionally, their adaptability to various applications and easy integration into existing systems enhances their appeal, thereby stimulating the expansion of the segment.

By Technology

Based on technology, the market has been bifurcated into dry screening and wet screening. The dry screening segment secured the largest revenue share of 61.95% in 2023. Unlike wet screening, which requires additional water and handling of slurry, dry screening processes materials without liquid, making it more efficient and cost-effective.

This method is particularly advantageous in applications where moisture content is minimal or water usage is restricted.

Dry screening further offers lower operational costs by eliminating complex and costly water management and disposal issues. Additionally, the technology is suitable for handling granular and bulk materials across various industries, including mining, construction, and recycling.

By Mobility

Based on mobility, the market has been divided into stationary screening equipment and mobile screening equipment. The mobile screening equipment segment is poised to witness significant growth at a robust CAGR of 5.94% through the forecast period.

Mobile units can be transported easily between locations, adapting to different material handling needs without the need for permanent installations. This mobility is particularly advantageous for industries such as construction and mining, where projects often involve changing locations.

Additionally, the growing emphasis on cost-effectiveness boosts demand for mobile equipment, which reduces the need for multiple fixed installations and lowers overall capital expenditure.

Screening Equipment Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia-Pacific screening equipment market held a notable share of around 32.47% in 2023, with a valuation of USD 6.46 billion. The growing production of metals and minerals, including gold, along with extensive mining activities, is fostering this growth.

The global demand for essential resources such as gold, copper, and iron ore is prompting mining companies in the region to enhance their operations. This increased mining activity requires advanced screening technologies to efficiently process and ensure the quality and consistency of materials for production or export.

- As reported by the World Gold Council in June 2024, China emerged as the world's leading gold producer in 2023, with a production volume of 378.2 tonnes, representing approximately 10% of global output.

Europe is estimated to experience significant growth at a robust CAGR of 5.47% over the forecast period. In Europe, significant investments from governments and the private sector in large-scale construction projects are fueling regional market growth.

Projects such as smart cities, transportation networks, and residential developments are on the rise, creating a substantial demand for high-quality construction materials.

- In July 2024, the European Commission approved 134 transport projects to receive more than USD 7.78 billion in grants from the Connecting Europe Facility (CEF), the EU's strategic infrastructure investment tool. This allocation marks the largest funding round under the current CEF Transport program. Approximately 83% of the funds are directed toward projects that advance the EU’s climate goals by enhancing and modernizing the network of railways, inland waterways, and maritime routes within the trans-European transport (TEN-T) network.

Screening equipment plays a critical role in processing aggregates used in these developments, ensuring material consistency and quality. As urban expansion progresses, the need for efficient and reliable material screening solutions increases, supporting the growth of the Europe market across the region.

Competitive Landscape

The screening equipment industry report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for the market growth.

List of Key Companies in Screening Equipment Market:

- Terex Corporation

- Sandvik AB

- Metso

- Astec Industries, Inc.

- Deister Machine Company, Inc.

- McCloskey International

- SMICO Manufacturing Co. Inc.

- The Weir Group PLC

- CDE Group

- HAVER & BOECKER OHG

Key Industry Developments

- July 2024 (Product Launch): Weir introduced its Enduron Orbital Vibrating Screens, designed to enhance efficiency and performance in demanding applications, including mineral processing and aggregate production. These screens feature a unique orbital motion to optimize material stratification, improving separation and reducing component wear.

- June 2024 (Product Launch): Terex launched MAGNA, a new line of large-scale crushing and screening equipment for quarrying and mining operations. This equipment offers increased power, improved material throughput efficiently, and enhanced productivity and cost-effectiveness for customers.

The global screening equipment market has been segmented as:

By Product Type

- Vibrating Screens

- Trommel Screens

- Gyratory Screens

- Rotary Screens

By Technology

- Dry Screening

- Wet Screening

By Mobility

- Stationary Screening Equipment

- Mobile Screening Equipment

By End-User

- Construction & Building Materials

- Mining & Mineral Processing

- Recycling

- Agriculture

- Food & Beverage

- Oil & Gas

- Healthcare & Pharmaceuticals

- Other

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America