Scintillator Market Size

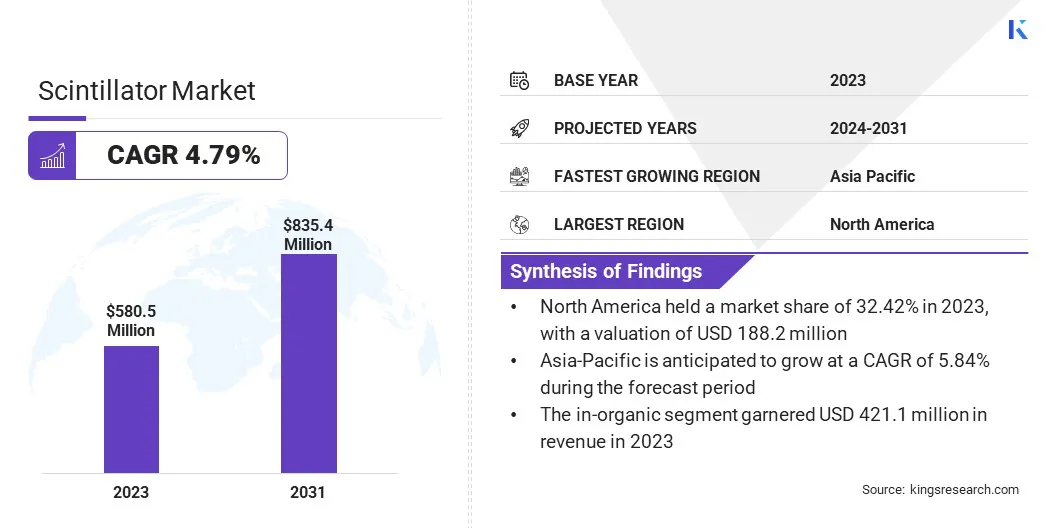

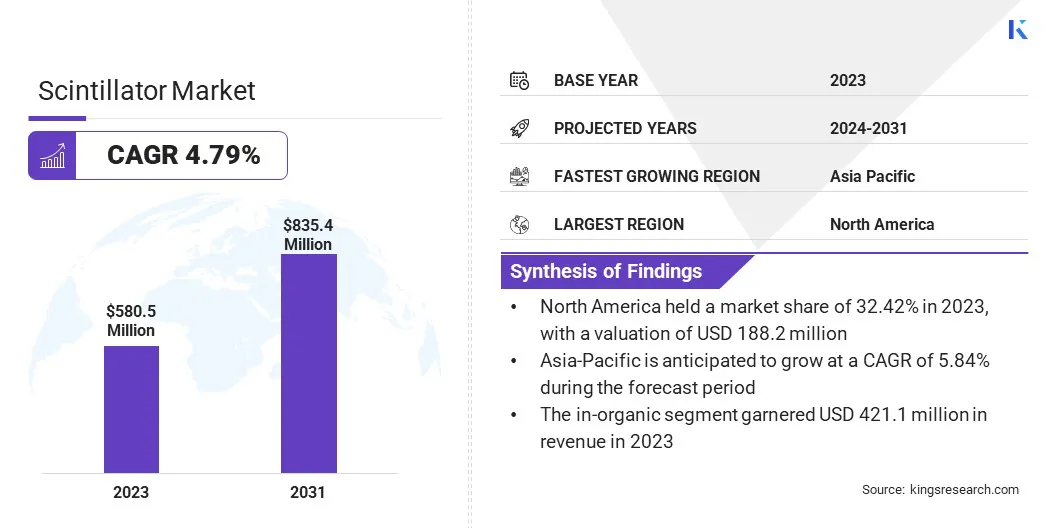

The global Scintillator Market size was valued at USD 580.5 million in 2023 and is projected to grow from USD 601.9 million in 2024 to USD 835.4 million by 2031, exhibiting a CAGR of 4.79% during the forecast period. The market is expanding rapidly, driven by increasing security concerns, advancements in radiation detection technology, and stringent safety regulations.

Rising healthcare applications, such as medical imaging, further fuel this demand. Innovations in material science are enhancing the efficiency and cost-effectiveness of scintillators, which is boosting their adoption across diverse sectors such as homeland security, nuclear power, and industrial inspection.

In the scope of work, the report includes solutions offered by companies such as Dynasil Corporation of America, Hamamatsu Photonics K.K., Proterial, Ltd., NIHON KESSHO KOGAKU CO., LTD., Rexon Components, Inc., Saint-Gobain S.A., Alpha Spectra, Inc., Toshiba Materials Co., Ltd., EPIC Crystal Co., Ltd., Amcrys, and others.

The scintillator market is experiencing robust growth, largely attributed to rising security concerns, rapid innovations in radiation detection technologies, and stringent government regulations. Scintillators, which are essential for detecting and measuring radiation, are increasingly being utilized across sectors such as healthcare, homeland security, and nuclear power.

The market is witnessing a notable shift toward inorganic scintillators due to their superior performance, including higher light output and enhanced radiation resistance. Additionally, significant investments in research and development are fostering innovations, making these materials more efficient and cost-effective. These factors collectively contribute to the expansion of the market, positioning scintillators as critical components in modern radiation detection and safety applications.

A scintillator is a material that emits light when it absorbs ionizing radiation, a process known as scintillation. When high-energy particles or photons strike a scintillator, the material absorbs the energy and re-emits it as visible or ultraviolet light. This light can then be detected and measured by various devices, such as photomultiplier tubes or photodiodes, to determine the presence and intensity of the radiation.

Scintillators are widely used in applications that require radiation detection and measurement, including medical imaging, nuclear security, high-energy physics, and industrial inspection. They are available in various forms, including crystals, liquids, and plastics, each tailored to specific applications and detection requirements.

Analyst’s Review

The scintillator market is experiencing robust growth, primarily fueled by expanding healthcare applications and continual technological advancements.

- Recent data from the NHS in England highlights a significant increase in imaging tests conducted in 2022, emphasizing the crucial role of scintillators in X-ray, CT scans, and MRI diagnostics.

- In addition, in May 2023, scientists from Florida State University, under the leadership of Professor Biwu Ma, unveiled organic-inorganic hybrid materials that hold the potential to enhance CT scan and X-ray image quality through improved scintillation properties.

These materials emit light when exposed to high-energy radiation, marking a potential breakthrough in radiation detection and medical imaging. Market players are capitalizing on these innovations by prioritizing R&D to introduce advanced technologies, thereby enhancing product capabilities and ensuring sustained market expansion through improved imaging precision and competitive advantage.

Scintillator Market Growth Factors

The increased demand for scintillator-based detectors, supported by growing concerns regarding nuclear threats and the need for stringent border security, is significantly propelling market growth. As governments and security agencies prioritize the detection and prevention of unauthorized radioactive material movement, investments in advanced radiation detection technologies are increasing.

Scintillators, known for their high sensitivity and accuracy, are becoming essential components of radiation detection systems used in homeland security. This surge in demand is prompting manufacturers to innovate and enhance scintillator technologies, thereby expanding their applications and market reach.

The scintillator market faces significant challenges, primarily due to high production costs and the complexity involved in manufacturing these materials. Producing high-quality scintillators requires expensive raw materials and intricate processes, leading to increased overall costs.

Additionally, the manufacturing process is complex, demanding precise control and advanced technology to ensure the desired performance and reliability of the scintillators. However, key market players are addressing these challenges by investing heavily in research and development to discover more cost-effective materials and innovative production techniques.

By optimizing manufacturing processes and exploring alternative raw materials, they aim to reduce costs without compromising quality. Furthermore, companies are forming strategic partnerships and collaborations to pool resources and expertise, enabling them to overcome production complexities more efficiently. These efforts are helping key players maintain competitiveness and continue to advance in the market.

Scintillator Market Trends

Government regulations mandating stricter radiation safety standards, coupled with increased funding for research projects in radiation detection technologies, are key factors bolstering the expansion of the scintillator market.

Regulatory frameworks that mandate rigorous radiation monitoring and safety protocols compel various industries, including healthcare, nuclear power, and homeland security, to adopt advanced detection solutions. Moreover, the demand for scintillator-based detectors is rising due to their effectiveness in meeting these stringent safety standards.

Additionally, increased government funding for research and development in radiation detection technologies fosters innovation, leading to the creation of more efficient and sophisticated scintillators. These advancements improve detection capabilities and expand the potential applications of scintillators, thereby boosting market growth.

The growing preference for inorganic scintillators is supporting the development of the market. Industries such as healthcare, nuclear power, and homeland security are increasingly adopting these advanced materials owing to their higher light output, superior radiation resistance, and longer operational lifetimes.

These benefits result in enhanced reliability and accuracy in radiation detection, which are essential for meeting stringent safety standards and addressing critical applications. Additionally, recent advancements in material science have led to the development of more efficient and cost-effective inorganic scintillators, making them a more attractive option for various sectors.

This increased adoption and continuous innovation are propelling market expansion, solidifying inorganic scintillators' position as the preferred choice in radiation detection technologies.

Segmentation Analysis

The global market is segmented based on material, application, and geography.

By Material

Based on material, the scintillator market is categorized into in-organic and organic. The in-organic segment garnered the highest revenue of USD 421.1 million in 2023, mainly due to its superior performance characteristics compared to organic scintillators. Inorganic scintillators, such as sodium iodide (NaI), cesium iodide (CsI), and bismuth germanate (BGO), offer higher light output, better radiation resistance, and longer operational lifetimes.

These properties render them particularly suitable for high-precision applications in medical imaging, nuclear security, and high-energy physics. Recent advancements in material science have led to the development of more efficient and cost-effective inorganic scintillators, further enhancing their appeal. The increasing demand for reliable and accurate radiation detection solutions in critical sectors is propelling the expansion of the segment.

By Application

Based on application, the market is divided into healthcare, nuclear power plants, research institutes, and others. The healthcare segment captured the largest scintillator market share of 42.70% in 2023, largely attributed to the increasing demand for advanced medical imaging technologies.

Scintillators, which are essential components in systems such as PET, SPECT, and gamma cameras, enable precise detection and visualization of radioactive tracers used in diagnosing conditions such as cancer and cardiovascular diseases. Technological advancements have enhanced scintillator sensitivity and imaging resolution, thereby improving diagnostic accuracy and patient care.

With a growing global prevalence of chronic diseases and an aging population, the need for reliable and high-performance medical imaging solutions is rising. This trend underscores the importance of scintillators as essential components in modern healthcare diagnostics.

Scintillator Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America scintillator market share stood around 32.42% in 2023 in the global market, with a valuation of USD 188.2 million. This notable expansion is stimulated by ongoing legislative reforms aimed at enhancing risk mitigation strategies in the region. These measures are spurring the adoption of advanced scintillator technologies, particularly in medical applications such as cancer treatment.

Increased awareness among healthcare providers and organizations such as the American Cancer Society is fueling regional market growth. Collaborations between academia, healthcare, and technology sectors are ostering innovation and improving device efficacy. With ongoing advancements and supportive regulatory frameworks, North America remains a pivotal hub for scintillator development, positioned to improve diagnostic precision and improve patient outcomes across the healthcare landscape.

Asia-Pacific is anticipated to witness substantial growth at a CAGR of 5.84% over the forecast period. Increased investments in healthcare infrastructure are enhancing the regional market potential by promoting wider adoption of advanced medical technologies, including scintillators.

Technological advancements in scintillator materials and manufacturing processes are significantly enhancing their performance, particularly in critical applications such as cancer diagnosis and radiation therapy, thereby boosting demand. Increased awareness among healthcare stakeholders regarding the benefits associated with scintillator technology is further supporting regional market expansion.

Competitive Landscape

The global scintillator market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Scintillator Market

- Dynasil Corporation of America

- Hamamatsu Photonics K.K.

- Proterial, Ltd.

- NIHON KESSHO KOGAKU CO., LTD.

- Rexon Components, Inc.

- Saint-Gobain S.A.

- Alpha Spectra, Inc.

- Toshiba Materials Co., Ltd.

- EPIC Crystal Co., Ltd.

- Amcrys

Key Industry Development

- November 2022 (Product Launch): Canon Medical Systems Corporation (Canon Medical), a subsidiary of Canon Inc., introduced its first photon-counting CT system in the United States, incorporating advanced scintillator technology. This system, which features Redlen's sophisticated scintillators, was installed at Japan's National Cancer Centre Exploratory Oncology Research & Clinical Trial Centre for the purpose of studying the clinical applications of PCCT.

The global scintillator market is segmented as:

By Material

By Application

- Healthcare

- Nuclear Power Plants

- Research Institutes

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America