Market Definition

Scale inhibitors are specialized chemical solutions designed to prevent mineral scale build up in industrial systems such as pipelines, boilers, and cooling towers. By disrupting the crystallization process, these inhibitors enhance operational efficiency, minimize maintenance costs, and extend equipment lifespan.

Widely utilized in sectors such as oil and gas, water treatment, and power generation, they are essential for optimizing system performance and ensuring uninterrupted operations.

Scale Inhibitors Market Overview

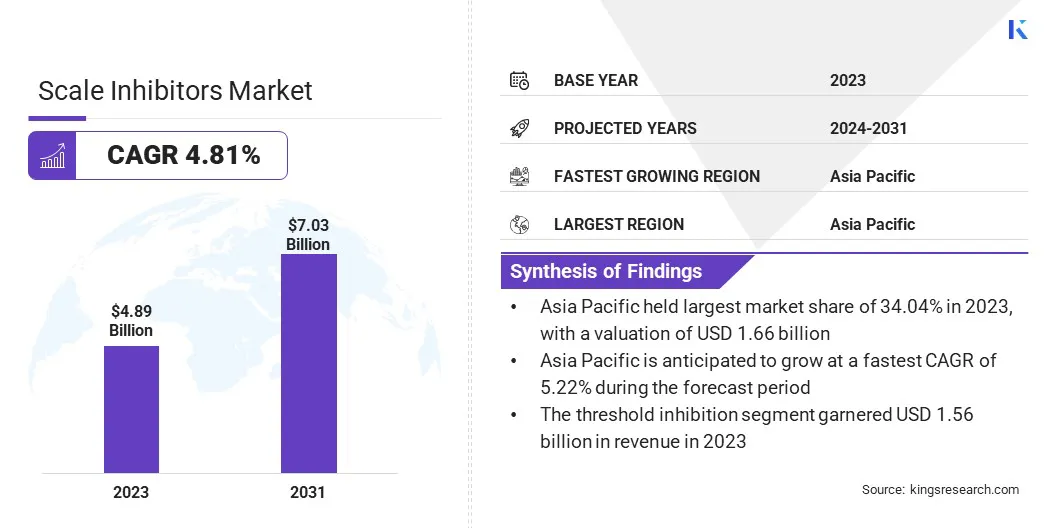

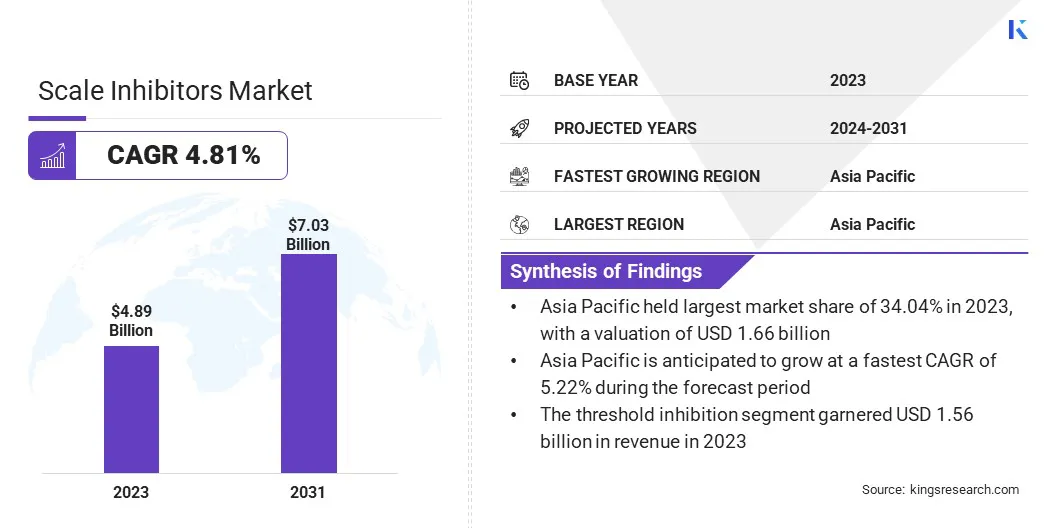

The global scale inhibitors market size was valued at USD 4.89 billion in 2023 and is projected to grow from USD 5.06 billion in 2024 to USD 7.03 billion by 2031, exhibiting a CAGR of 4.81% during the forecast period.

The market is experiencing steady growth, driven by increasing demand across industries such as oil and gas, water treatment, power generation, and manufacturing.

Rapid industrialization, expanding energy production activities, and the need for efficient water management solutions are fueling market expansion. Advancements in chemical formulations and eco-friendly scale inhibitors are further fueling product adoption.

Major companies operating in the global scale inhibitors industry are BASF, The Dow Chemical Company, Kemira Oyj, Solenis, Ecolab Inc., CLARIANT, Cortec Corporation, AkzoNobel N.V., Henkel AG & Co. KGaA, Baker Hughes Company, Innospec, DuPont de Nemours, Inc., Eastman Chemical Company, SUEZ Group, and Veolia Water Solutions & Technologies.

Additionally, rapid advancements in scale prevention technologies, including biodegradable and environmentally friendly inhibitors, are boosting product adoption. Increasing investments in infrastructure development, particularly in emerging economies, and the rising utilization of desalination technologies to meet global water demands are contributing significantly to market growth.

Furthermore, Industries are increasingly adopting advanced scale inhibitors to enhance cost efficiency, energy savings, and equipment longevity. The development of multifunctional inhibitors with corrosion resistance and biofouling control is fostering innovation and market expansion.

Key Highlights:

- The global scale inhibitors market size was valued at USD 4.89 billion in 2023.

- The market is projected to grow at a CAGR of 4.81% from 2024 to 2031.

- Asia Pacific held a share of 34.04% in 2023, valued at USD 1.66 billion.

- The phosphonates segment garnered USD 1.56 billion in revenue in 2023.

- The threshold inhibition segment is expected to reach USD 2.25 billion by 2031.

- The oil & gas segment is projected to generate a revenue of USD 1.92 billion by 2031.

- Europe is anticipated to grow at a CAGR of 4.83% over the forecast period.

Market Driver

"Rising Industrialization and Energy Demand"

The scale inhibitors market is witnessing substantial growth, primarily fueled by the increasing demand for efficient water treatment solutions and the rapid expansion of the oil and gas industry.

With accelerating industrialization and urbanization, efficient water management is crucial across sectors, including power generation, manufacturing, and municipal water treatment.

Scale inhibitors prevent mineral scale buildup in critical systems such as pipelines, boilers, and cooling towers, extending equipment life and reducing maintenance costs. The growing focus on sustainability and water conservation is fostering the adoption of advanced scale inhibition solutions to improve system efficiency and reduce water wastage.

Additionally, the expansion of the oil and gas sector fosters market expansion, with increasing exploration, drilling, and production activities across the globe. Scale formation in oil wells, refineries, and pipelines can lead to operational inefficiencies, increased energy consumption, and costly downtime.

To mitigate these challenges, scale inhibitors are widely used to prevent mineral deposits from accumulating in extraction and refining processes, thereby optimizing performance and extending the lifespan of infrastructure.

Market Challenge

"Rising Environmental Concerns and Volatality in Raw Material Prices"

The scale inhibitors market faces challenges as industries demand more efficient, long-lasting, and environmentally friendly solutions. Manufacturers must continuously invest in research and development to enhance product performance while complying with evolving regulatory and industry standards.

Traditional scale inhibitors often contain chemicals that may raise environmental concerns, prompting the need for more sustainable solutions. This shift requires significant investments in advanced chemical formulations, nanotechnology, and biotechnology to develop next-generation scale inhibitors with superior performance, biodegradability, and lower environmental impact.

A key challenge impeding market expansion is the volatility in raw material prices, which impacts production costs, supply chain stability, and pricing strategies for scale inhibitors.

The availability and cost of essential chemical ingredients are influenced by factors such as global supply chain disruptions, trade restrictions, geopolitical tensions, and fluctuating industry demand. These price fluctuations can create uncertainty for manufacturers, making it difficult to maintain consistent production costs and profit margins.

To mitigate this challenge, companies are adopting supply chain diversification strategies by sourcing raw materials from multiple regions, reducing reliance on a single supplier, and optimizing procurement processes.

Market Trend

"Shift Toward Sustainable Solutions and Adoption of Smart Technologies"

The scale inhibitors market is evolving rapidly, driven by emerging trends such as the shift toward eco-friendly and biodegradable scale inhibitors and the adoption of smart chemical dosing and digital monitoring technologies.

With increasing environmental regulations and sustainability initiatives, industries are prioritizing the development and use of green scale inhibitors that minimize ecological impact while maintaining high-performance efficiency.

Biodegradable and non-toxic formulations are increasingly adopted in water treatment, oil and gas, and power generation to reduce carbon footprints and meet stringent environmental standards.

Additionally, the integration of IoT (Internet of Things) and AI-driven monitoring systems is revolutionizing scale inhibitor application in industrial processes. Advanced digital solutions enable real-time scale tracking, automated chemical dosing, and predictive maintenance, optimizing efficiency while reducing operational costs.

By enhancing process control and resource utilization while preventing equipment failures, smart scale inhibition solutions are becoming essential for operational excellence. As industries increasingly accelerate digitalization and automation, the demand for intelligent scale inhibition solutions is expected to rise, fiostering innovation and market expansion.

Scale Inhibitors Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Phosphonates, Carboxylate/Acrylate, Sulfonates, Others

|

|

By Method

|

Threshold Inhibition, Crystal Modification, Dispersion, Others

|

|

By End-Use Industry

|

Oil & Gas, Mining, Water and Wastewater Treatment, Petrochemicals, Pulp and Paper, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Phosphonates, Carboxylate/Acrylate, Sulfonates, and Others): The phosphonates segment earned USD 1.56 billion in 2023 due to its strong chelating properties and widespread use in industrial water treatment and oilfield applications.

- By Method (Threshold Inhibition, Crystal Modification, Dispersion, and Others): The threshold inhibition held a share of 31.90% in 2023, attributed to its effectiveness in preventing scale formation at low concentrations, making it a preferred choice in various industries.

- By End-Use Industry (Oil & Gas, Mining, Water and Wastewater Treatment, Petrochemicals,and Others): The oil & gas segment is projected to reach USD 1.92 billion by 2031, owing to increasing drilling activities and the need for scale prevention in pipelines and refining operations.

Scale Inhibitors Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for a substantial scale inhibitors market share of 34.04% in 2023, valued at USD 1.66 billion. This dominance is reinforced by rapid industrialization, increasing demand for water treatment solutions, and the expansion of industries such as oil & gas, power generation, and manufacturing in key economies, including China, India, and Japan.

Additionally, rapid urbanization is leading to higher water consumption, highlighting the need for effective water treatment technologies in residential, commercial, and industrial applications.

The expanding oil & gas sector is is leading to increasing drilling and refining activities, requiring efficient scale control solutions to maintain equipment efficiency. The expanding chemical and petrochemical industries are increasing the use of scale inhibitors to prevent scaling in processing units and cooling systems.

Europe scale inhibitors industry is expected to register a CAGR of 4.83% over the forecast period. This growth is primarily attributed to strict environmental regulations, prompting industries to adopt eco-friendly and biodegradable scale inhibitors.

Additionally, increasing investments in sustainable water management, coupled with the strong presence of industries such as petrochemicals, power generation, and municipal water treatment, are creating demand.

Moreover, the growing emphasis on reducing industrial water consumption and enhancing energy efficiency is promoting the adoption of advanced scale inhibition solutions across various industries.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) regulates the use of scale inhibitors in industrial water treatment to ensure environmental safety, while the Food and Drug Administration (FDA) oversees their use in food and pharmaceutical applications.

- In Europe, the European Chemicals Agency (ECHA) enforces the Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH) regulation, ensuring the safe use of scale inhibitors. The European Environment Agency (EEA) monitors their environmental impact.

- In Japan, the Ministry of Economy, Trade and Industry (METI) oversees the production and application of scale inhibitors in industrial processes, while the Ministry of the Environment (MOE) enforces environmental safety regulations.

- In India, the Central Pollution Control Board (CPCB) under the Ministry of Environment, Forest and Climate Change (MoEFCC) regulates the discharge of scale inhibitors into water bodies, while the Bureau of Indian Standards (BIS) sets quality and safety standards.

Competitive Landscape

The global scale inhibitors market is characterized by a large number of participants, including both established corporations and emerging players. Market participants are focusing on innovation, product differentiation, and strategic partnerships to strengthen their market position.

They are further investing in research and development to formulate advanced and environmentally friendly scale inhibitors that align with stringent regulatory standards and sustainability goals.

Market players are expanding through mergers, acquisitions, and collaborations to gain a competitive position. The growing demand for customized and application-specific scale inhibitors has led to the development of specialized formulations catering to industries such as oil and gas, power generation, water treatment, and manufacturing.

Pricing strategies and supply chain optimization remain critical, with companies striving to offer cost-effective solutions without compromising performance. The adoption of bio-based and hybrid scale inhibitors is further driving innovation, supported by industry's shift toward sustainable alternatives.

List of Key Companies in Scale Inhibitors Market:

- BASF

- The Dow Chemical Company

- Kemira Oyj

- Solenis

- Ecolab Inc.

- CLARIANT

- Cortec Corporation

- AkzoNobel N.V.

- Henkel AG & Co. KGaA

- Baker Hughes Company

- Innospec

- DuPont de Nemours, Inc.

- Eastman Chemical Company

- SUEZ Group

- Veolia Water Solutions & Technologies