Market Definition

A robotic total station (RTS) is an advanced surveying instrument that combines an electronic theodolite, electronic distance meter (EDM), and integrated software into a single system.

Unlike conventional total stations, which typically require two operators, robotic total stations employ motorized drives and automatic target recognition to continuously track the prism and perform measurements. This enables single-operator surveying, improving efficiency and reducing labor requirements.

Robotic Total Stations Market Overview

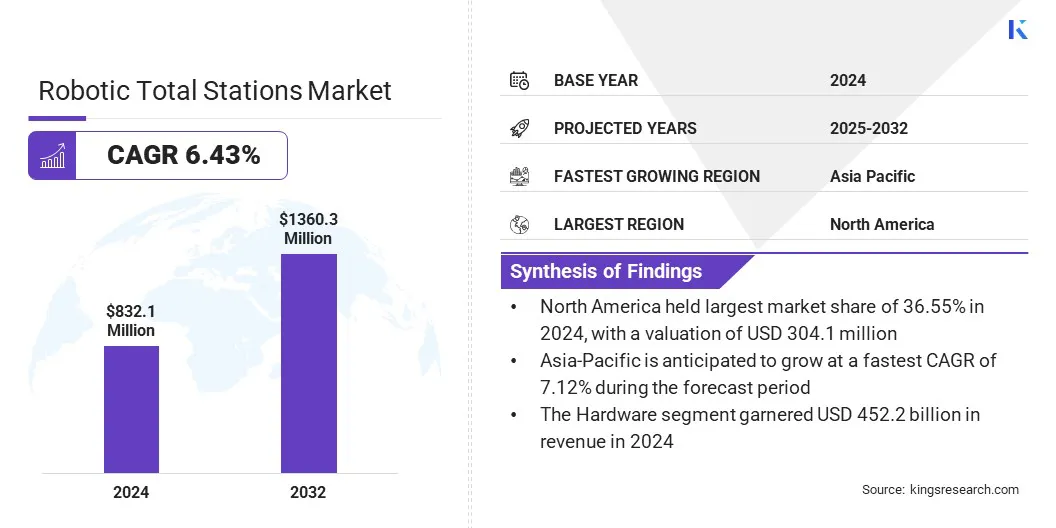

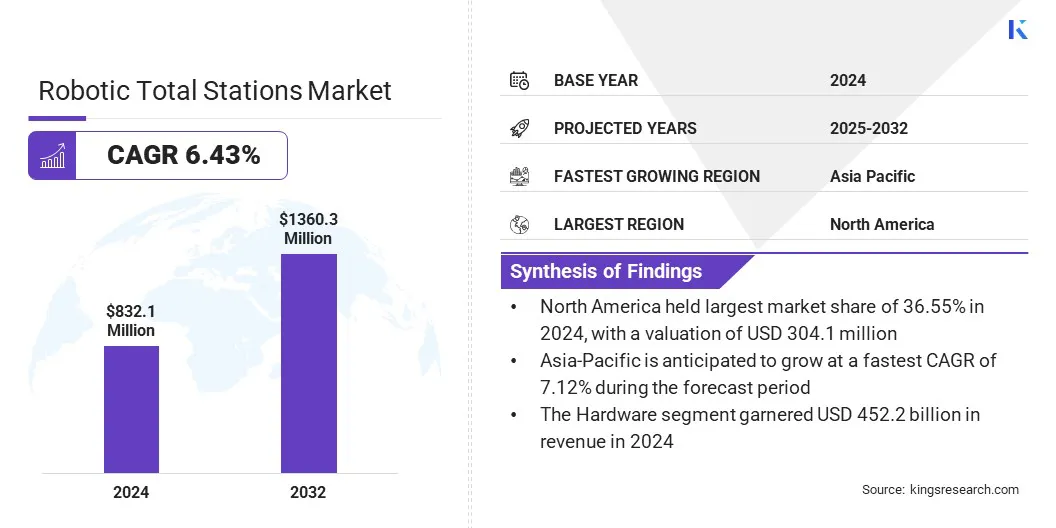

The global robotic total stations market size was valued at USD 832.1 million in 2024 and is projected to grow from USD 879.2 million in 2025 to USD 1,360.3 million by 2032, exhibiting a CAGR of 6.43% over the forecast period.

The market is experiencing steady growth driven by the rising demand for precision, automation, and efficiency in surveying and construction workflows. Adoption is supported by increasing infrastructure development, smart city projects, and the integration of RTS with Global Navigation Satellite System and Building Information Modeling technologies.

Key Highlights:

- The global robotic total stations market size was recorded at USD 832.1 million in 2024.

- The market is projected to grow at a CAGR of 6.43% from 2025 to 2032.

- North America held a market share of 36.55% in 2024, with a valuation of USD 304.1 million.

- The hardware segment garnered USD 452.2 million in revenue in 2024.

- The surveying & mapping segment is expected to reach USD 438.5 million by 2032.

- The construction segment is anticipated to witness the fastest CAGR of 6.32% during the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 7.12% over the forecast period.

Major companies operating in the global robotic total stations market are Carlson Software, Singoo, Changzhou Dadi Surveying Science & Technology Co., Ltd., GPS LANDS (SINGAPORE) PTE LTD, Hilti Corporation, South Surveying & Mapping Technology CO., LTD., STONEX Srl, April GUANGDONG KOLIDA INSTRUMENT CO., LTD., Hexagon AB, Topcon, Trimble Inc., GeoMax AG, Leica Geosystems AG, Nikon Corporation, and SOKKIA.

Rising demand for precision and productivity in construction and infrastructure projects is driving the demand for robotic total stations. These instruments enable single-operator surveying, reducing labor requirements while delivering high measurement accuracy and faster data collection.

Integration with digital platforms such as BIM and GIS supports seamless project planning, improves workflow efficiency, and minimizes errors. Advanced connectivity features further allow real-time data transfer and collaboration across teams, ensuring the timely execution of complex projects.

- In May 2023, GeoMax launched the Zoom95 robotic total station, designed to deliver higher speed, accuracy, and operational efficiency. The system is equipped with a larger WVGA display, upgraded processor, expanded storage capacity, and support for multiple software applications. It also integrates built-in Wi-Fi and a long-range Bluetooth handle, enabling reliable connectivity and smoother data transfer in the field.

Market Driver

Large-Scale Infrastructure Development and Construction Projects

The growth of the robotic total stations market is driven by large-scale infrastructure development and construction projects worldwide. Governments and private developers are increasingly adopting advanced surveying technologies to ensure precision, reduce project delays, and optimize labor costs.

Robotic total stations deliver single-operator efficiency and high measurement accuracy, establishing them as a critical tool in modern surveying operations for complex projects in transportation networks, smart city development, and industrial construction, where speed, reliability, and productivity are critical, thereby driving the market demand.

- In October 2024, the U.S. Department of Transportation provided more than USD 4.2 billion in funding. This was distributed through the Mega Grant and INFRA Grant programs. The funding is part of the Investing in America agenda and represents one of the largest investments under the Bipartisan Infrastructure Law.

Market Challenge

High Cost of Equipment Acquisition and Implementation

One of the primary challenges faced by the global robotic total stations market is the high upfront investment associated with advanced instruments and supporting software. Small and mid-sized contractors find the cost prohibitive, limiting wider adoption beyond large infrastructure projects.

Additionally, effective use of robotic total stations requires trained surveyors familiar with automation, data integration, and digital workflows. The shortage of skilled professionals in certain regions creates barriers to efficient deployment, slowing down market penetration despite the clear productivity benefits of the technology.

To address this challenge, manufacturers are introducing flexible financing models, subscription-based licensing, and rental options to reduce the financial burden for end users. Companies are also investing in user-friendly interfaces, automated calibration systems, and training programs to lower the skill barrier and encourage wider adoption across diverse segments of the construction and surveying industries.

Market Trend

Integration with Digital Construction Technologies

A key trend shaping the robotic total stations market is the growing integration of these instruments with digital construction technologies such as Building Information Modeling (BIM), Geographic Information Systems (GIS), and cloud-based collaboration platforms.

Manufacturers are embedding features like automated data synchronization, mixed reality visualization, and IoT connectivity, allowing real-time transfer of survey data to project teams. This trend is transforming robotic total stations from standalone measurement tools into connected solutions that support end-to-end construction workflows, improving accuracy, productivity, and decision-making across large infrastructure and smart city projects.

Robotic Total Stations Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Hardware, Software, Services

|

|

By Application

|

Surveying & Mapping, Construction & Infrastructure, Excavation

|

|

By End-Use Industry

|

Construction, Utilities, Mining, Transportation, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Component (Hardware, Software, Services): The hardware segment earned USD 452.2 million in 2024 due to rising adoption of advanced robotic total stations with enhanced accuracy, connectivity features, and automation capabilities that reduce labor dependency in large-scale surveying and construction projects.

- By Application (Surveying & Mapping, Construction & Infrastructure, Excavation): The construction & infrastructure held 45.20% of the market in 2024, due to increasing deployment of robotic total stations in large-scale projects for precise site layout, real-time data integration with BIM platforms, and improved efficiency in managing complex urban development and transportation networks.

- By End-Use Industry (Construction, Utilities, Mining, and Transportation, Others): The construction segment is projected to reach USD 659.0 million by 2032, owing to rising demand for high-precision surveying in large infrastructure projects and increased adoption of digital construction technologies.

Robotic Total Stations Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America robotic total stations market share stood at 36.55% in 2024, with a valuation of USD 304.1 million. This dominance is attributable to large-scale infrastructure development and construction modernization initiatives across North America.

Robotic total stations are increasingly deployed to support high-precision surveying requirements in transportation networks, smart city projects, and industrial facilities, where accuracy and efficiency are critical.

Moreover, contractors and engineering firms in the region are early adopters of advanced digital construction tools, integrating robotic total stations with Building Information Modeling (BIM) platforms and cloud-based project management systems. Increasing need for higher measurement accuracy, reduced labor dependency, and improved project productivity across construction and infrastructure projects is driving the adoption of robotic total stations in North America.

Asia-Pacific robotic total stations industry is poised for significant growth at a robust CAGR of 7.12% over the forecast period. The Asia-Pacific market is witnessing robust growth supported by rapid urbanization and large-scale infrastructure investments. Expanding transportation networks, smart city initiatives, and industrial development in countries such as China, India, and Japan are creating consistent demand for advanced surveying technologies.

Robotic total stations are increasingly adopted to manage complex construction environments, where they deliver precise measurements, accelerate project timelines, and reduce reliance on large field teams. Furthermore, the region’s construction sector is adopting automation and digitalization, with robotic total stations serving as a key tool for improving accuracy, productivity, and cost efficiency in diverse infrastructure and urban development projects.

- For instance,the Press Information Bureau (PIB) of India reported that the Union Budget 2023–24 allocated ₹10 lakh crore (approximately USD 122 billion) to infrastructure, encompassing transportation, urban development, and industrial corridors.

Regulatory Frameworks

- The U.S. regulates surveying instruments, including robotic total stations, through standards set by the National Geodetic Survey (NGS) and the American Society for Photogrammetry and Remote Sensing (ASPRS). Equipment must also comply with ISO 17123 (field procedures for geodetic instruments) and IEC safety standards for electronic measuring devices. State-level licensing boards oversee professional use in construction and land surveying.

- The EU mandates compliance with EN ISO standards for surveying accuracy and safety, alongside directives for digital construction integration through BIM mandates under EU public procurement regulations. Instruments used in construction projects must align with CE marking requirements to ensure interoperability and safety across member states.

- In APAC, the Survey of India guidelines regulate surveying practices, including the use of total stations in geospatial mapping and infrastructure projects. The Indian Government’s Geospatial Data Guidelines (2021) further govern data handling, requiring accuracy, secure data storage, and compliance with mapping permissions for infrastructure development.

- The International Organization for Standardization (ISO) provides global benchmarks, particularly the ISO 17123 series for field procedures of geodetic and surveying instruments, and ISO 9849/12858 for instrument accessories. These standards ensure uniform accuracy, calibration, and reliability of robotic total stations in global markets.

Competitive Landscape

The global robotic total stations industry is characterized by a large number of participants, including both established corporations and rising organizations. Major players in the robotic total station market are adopting strategies such as product innovation, continuous R&D, and strategic partnerships to enhance surveying accuracy and operational efficiency.

Advanced models with faster processors, integrated connectivity, and seamless BIM compatibility, companies are enabling contractors and surveyors to optimize workflows and reduce project delays.

Key Companies in Robotic Total Stations Market:

- Carlson Software

- Singoo

- Changzhou Dadi Surveying Science & Technology Co., Ltd.

- GPS LANDS (SINGAPORE) PTE LTD

- Hilti Corporation

- South Surveying & Mapping Technology CO., LTD.

- STONEX Srl

- April GUANGDONG KOLIDA INSTRUMENT CO., LTD.

- Hexagon AB

- Topcon

- Trimble Inc.

- GeoMax AG

- Leica Geosystems AG

- Nikon Corporation

- SOKKIA

Recent Developments

- In July 2024, Stonex introduced the R120 Robotic Android Total Station, designed to deliver high-precision performance for surveying and construction applications. The instrument provides 1″ angular accuracy (with an optional 2″ version), an EDM accuracy of 1 mm + 1 ppm, and a reflectorless operating range of up to 1000 meters.

- In July 2023, HP Inc. announced the full commercial availability of its HP SitePrint robotic total station solution across the U.S., Canada, the U.K., and Ireland. It is developed to deliver highly precise construction site layouts and enhance accuracy while improving productivity.

.