Market Definition

Data integration is the process of combining data from multiple sources into a unified, consistent view to ensure accuracy and usability. The market includes software, platforms, and services that support data management across cloud-based and on-premise systems.

These solutions are used for analytics, data warehousing, and operational workflows across sectors such as finance, healthcare, retail, and manufacturing. Key capabilities include data transformation, mapping, and synchronization for both real-time and batch processing in complex environments.

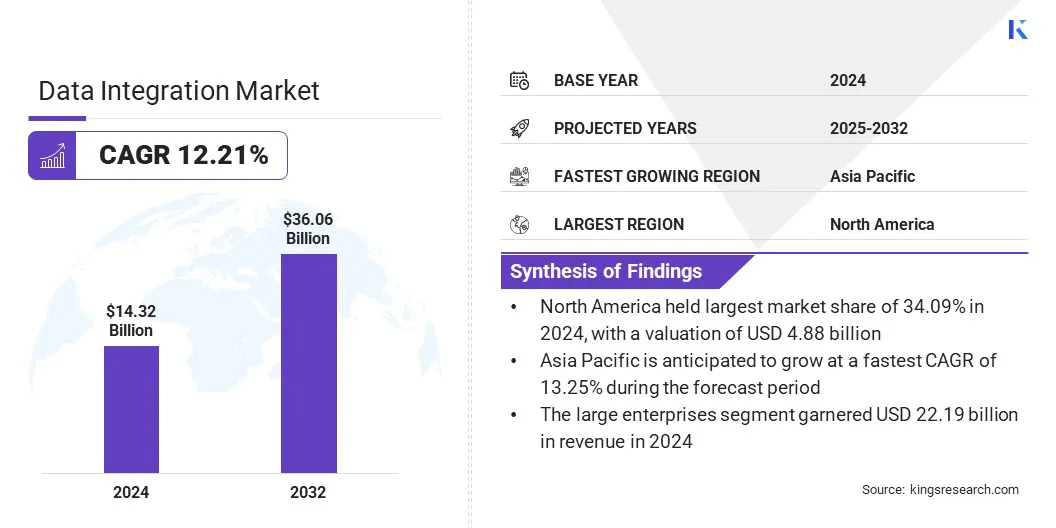

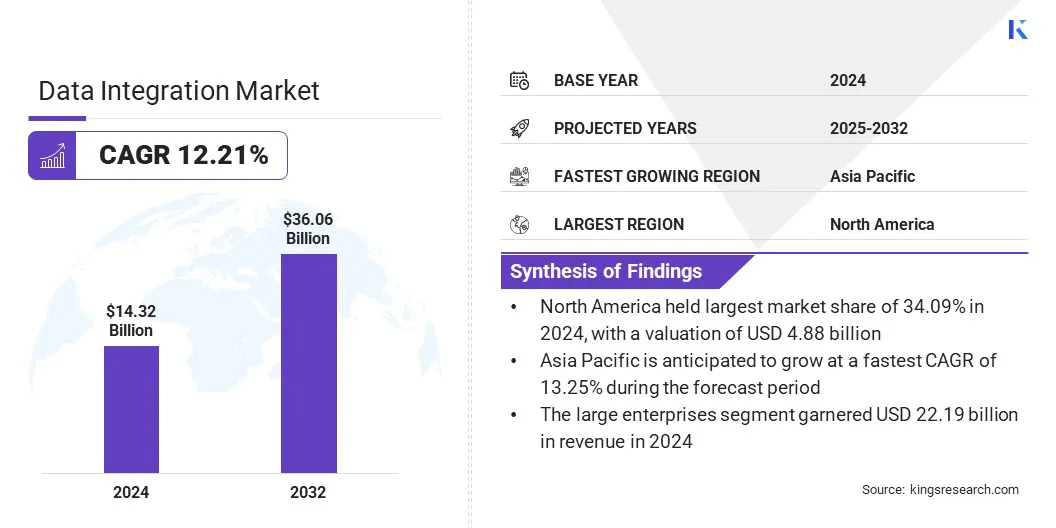

The global data integration market size was valued at USD 14.32 billion in 2024 and is projected to grow from USD 16.04 billion in 2025 to USD 36.06 billion by 2032, exhibiting a CAGR of 12.21% during the forecast period.

The market is experiencing growth as organizations adopt cloud infrastructure to improve scalability, flexibility, and data accessibility. Cloud systems generate large volumes of data from multiple sources, which creates a strong demand for integration tools that unify and manage this data effectively.

Key Highlights

- The data integration industry size was valued at USD 14.32 billion in 2024.

- The market is projected to grow at a CAGR of 12.21% from 2025 to 2032.

- North America held a market share of 34.09% in 2024, with a valuation of USD 4.88 billion.

- The tools segment garnered USD 8.26 billion in revenue in 2024.

- The on-premises segment is expected to reach USD 21.26 billion by 2032.

- The large enterprises segment is estimated to generate a valuation of USD 22.19 billion by 2032.

- The marketing segment is expected to reach USD 9.47 billion by 2032.

- The IT & telecommunications segment is likely to reach USD 8.30 billion by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 13.25% over the forecast period.

Major companies operating in the data integration industry are Informatica Inc., IBM, Oracle, SAP SE, Boomi, LP., SnapLogic Inc., Workato, Fivetran, Inc, Celigo, Inc., Jitterbit, Tray.ai, Inc., Amazon.com, Inc., Salesforce, Inc., Denodo Technologies, and QlikTech International AB.

Data Integration Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Tools, Services

|

|

By Deployment

|

Cloud-based, On-premises

|

|

By Organization

|

Large Enterprises, Small & Medium Enterprises

|

|

By Function

|

Marketing, Sales, Operations, Finance, HR

|

|

By Vertical

|

IT & Telecommunications, BFSI, Healthcare, Manufacturing, Retail & E-commerce, Media and Entertainment, Government, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Data Integration Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America data integration market accounted for a substantial share of 34.09% in 2024, valued at USD 4.88 billion. This dominance is fueled by the rapid adoption of AI solutions, which demand robust, scalable data integration platforms.

Companies in the U.S. and Canada are investing heavily in AI-powered applications for analytics, automation, and customer engagement. This shift has increased the demand for platforms that can unify and prepare high-quality data in real time across complex cloud and on-premise environments. A strong vendor presence and advanced IT infrastructure further support regional market expansion.

- In January 2025, Qlik partnered with TD SYNNEX to expand the distribution of its data integration, data quality, analytics, and AI solutions across North America and Europe. The collaboration leverages TD SYNNEX’s reseller network to fuel broader adoption of Qlik’s AI-driven data platforms and trusted data solutions.

The Asia-Pacific data integration industry is expected to register the fastest CAGR of 13.25% over the forecast period. This growth is fueled by the increasing establishment of data centers across the region. As organizations modernize their IT infrastructure, new data centers are being set up to handle the rising volume of digital information generated by businesses, government services, and consumers.

These facilities require efficient data integration platforms to unify data from multiple applications, ensure consistency, and support high-speed access across hybrid environments. The integration tools help manage structured and unstructured data, enabling real-time processing, secure data exchange, and reliable analytics. This growing data infrastructure is creating strong demand for scalable integration solutions, which is accelerating adoption across Asia Pacific.

- In December 2024, FPT established the FPT Data & AI Integration Center in Japan to strengthen its technology infrastructure and develop AI solutions tailored to the Japanese market. The center integrates FPT’s data and AI capabilities and supports its goal of reaching USD 1 billion revenue by 2027 through expanded partnerships and service deployment.

Data Integration Market Overview

The rise in digital transformation is prompting businesses to modernize their data environments. Companies are adopting integration platforms to support advanced analytics and streamline operations by ensuring consistent, accurate data across systems. Vendors are enhancing their offerings to support hybrid and multi-cloud setups, enabling better management of complex data.

- In June 2025, Nissin Foods Holdings implemented Qlik as a key component of its data integration and analytics platform. The solution enables real-time ERP data integration with Snowflake, improving decision-making and operational efficiency in logistics and sales. This initiative supports the company's goal of fostering a data-driven culture and enhancing supply chain and business performance

Market Driver

Rising Adoption of Cloud Computing

The data integration market is expanding, mainly due to the increasing adoption of cloud computing across industries. Organizations are shifting their data infrastructure to cloud platforms to improve flexibility, scalability, and cost efficiency. This transition is creating a strong demand for integration tools that can connect on-premises systems with cloud-based applications and third-party services.

Cloud environments also enable real-time data access and distributed processing, which further intensifies the need for seamless integration. This is prompting companies to deploy scalable and automated data integration frameworks to maintain consistent, secure, and uninterrupted data flow across hybrid IT environments.

- In May 2025, Informatica expanded its partnership with Databricks to help customers modernize on-premises Hadoop-based data lakes. The collaboration combines Informatica’s Intelligent Data Management Cloud with the Databricks Data Intelligence Platform and introduces the CLAIRE Modernization Agent to automate cloud migration and support AI and analytics workloads.

Market Challenge

Data Complexity Across Various Platforms and Systems

Handling data complexity across distributed and heterogeneous systems presents a major challenge to the expansion of the data integration market. Organizations often operate with a combination of cloud services, on-premises databases and third-party applications.

This leads to data stored in different formats, structures, and locations, making integration efforts time-consuming and error-prone. It becomes difficult to maintain data consistency, enforce governance, and enable accurate reporting.

To mitigate these risks, companies are adopting metadata-driven architectures that act as a unified layer across all systems. By defining the structure, meaning, and usage of data, metadata allows integration tools to connect sources more efficiently. This approach improves interoperability, simplifies data management, and enables scalable integration in complex enterprise environments.

- In August 2024, Hasura introduced a metadata-driven federated data access layer to enable unified access to distributed enterprise data. The solution includes modular metadata, multi-team Continuous Integration/Continuous Deployment (CI/CD) workflows, domain-level governance, and a schema registry, streamlining data access and compliance across systems while supporting AI and GenAI use cases through its supergraph architecture.

Market Trend

Growing Demand for Real-Time and Streaming Data Integration Solutions

The data integration market is witnessing a notable shift toward real-time and streaming data integration to meet the rising demand for faster insights and improved responsiveness. Organizations are increasingly prioritizing continuous data flows over traditional batch processing to support time-sensitive operations and dynamic decision-making. This shift enables organizations to handle large volumes of structured and unstructured data.

Real-time integration strengthens agility across business functions and enhances system efficiency. As digital transformation advances, enterprises increasingly seek low-latency and scalable integration tools, positioning real-time capabilities as a key component of data strategies.

- In May 2025, Incorta launched Incorta Connect, a modular solution for near-real-time, multi-source data integration. The platform enables low-code integration from ERP, CRM, and cloud systems into destinations such as BigQuery and Power BI. It supports fast deployment, live data updates, and scalable growth into analytics and AI use cases while reducing pipeline complexity and implementation time.

Market Segmentation

- By Component (Tools and Services): The tools segment earned USD 8.26 billion in 2024, mainly due to the rising demand for self-service data integration platforms that support real-time data processing and hybrid environments.

- By Deployment (Cloud-based and On-premises): The on-premises segment held a share of 59.94% in 2024, attributed to rising reliance on legacy systems and concerns over data security and compliance.

- By Organization (Large Enterprises and Small & Medium Enterprises): The large enterprises segment is projected to reach USD 22.19 billion by 2032, owing to their complex data infrastructure and higher adoption of scalable integration solutions to support global operations.

- By Function (Marketing, Sales, Operations, Finance, and HR): The marketing segment is estimated to reach USD 9.47 billion by 2032, fueled by the increasing demand for integrated customer data to run personalized marketing across multiple channels.

- By Vertical (IT & Telecommunications, BFSI, Healthcare, Manufacturing, Retail & E-commerce, Media and Entertainment, Government, and Others): The IT & telecommunications segment is anticipated to reach USD 8.30 billion by 2032, propelled by the growth in data volume and the need for seamless data synchronization across cloud and network systems

Regulatory Frameworks

- In the U.S., the Health Insurance Portability and Accountability Act (HIPAA) regulates the integration and management of data by healthcare organizations to ensure privacy and security during electronic data exchanges.

- In Europe, the General Data Protection Regulation (GDPR) regulates the collection, processing, and integration of personal data across systems. It establishes requirements for data controllers and processors to ensure transparency, data security, and accountability throughout data integration processes across both cloud-based and on-premise systems.

Competitive Landscape

The data integration industry is characterized by continuous innovation and collaborative strategies that address the growing complexity of enterprise data environments. Companies are focusing on product innovation, particularly through the development of low-code and no-code interfaces.

These solutions allow users with limited technical expertise to create and manage integration workflows, reducing implementation time and easing the burden on IT teams. This is leading to accelerated integration projects and improved responsiveness to evolving data requirements.

Companies are also forming strategic partnerships with cloud providers and system integrators to deliver end-to-end integration solutions across diverse IT ecosystems. These collaborations support seamless data exchange between legacy systems, cloud platforms, and modern applications, enhancing deployment flexibility and interoperability. These strategies are enabling companies to meet complex integration demands with greater speed, efficiency, and control.

- In November 2024, Zafin launched IO Canvas, a low-code builder designed to help financial institutions build and manage data pipelines. The solution enables faster integration of legacy and modern systems, reduces deployment time by up to 60%, and supports over 200 connectors to enhance scalability, flexibility, and data consistency across core banking operations.

- In February 2025, Cleo partnered with Saksoft to deliver real-time data, integration, and automation solutions to logistics companies. The collaboration leverages Cleo Integration Cloud to provide EDI and API automation, ERP and eCommerce connectivity, and real-time visibility, enhancing operational efficiency and supply chain control for Saksoft’s logistics clients.

Key Companies in Data Integration Market:

- Informatica Inc.

- IBM

- Oracle

- SAP SE

- Boomi, LP.

- SnapLogic Inc.

- Workato

- Fivetran, Inc

- Celigo, Inc.

- Jitterbit

- Tray.ai, Inc.

- Amazon.com, Inc.

- Salesforce, Inc.

- Denodo Technologies

- QlikTech International AB

Recent Developments (Partnership/Product Launches)

- In June 2025, Snowflake launched Snowflake Openflow, a multi-modal data ingestion service powered by Apache NiFi. The platform enables real-time, scalable data integration from various sources, supporting structured and unstructured data. It offers hundreds of pre-built connectors and supports AI-driven applications through unified, extensible, and interoperable data movement across cloud and on-premise systems.

- In May 2025, ServiceNow and AWS introduced bi-directional data integration and workflow orchestration solution that enables real-time data unification, advanced analytics, and automated workflows across platforms, allowing enterprises to act on insights instantly and enhance AI-driven decision-making.

- In February 2025, Novi partnered with NielsenIQ to integrate NIQ’s Label Insight data into its platform, enabling brands to streamline ingredient-level data access, automate claims verification, and qualify for sustainability certifications. The collaboration eliminates manual data entry and enhances Novi’s AI-driven tools, helping brands align with retailer programs and connect sustainability efforts to measurable outcomes.